demo test since April 22. no loss on CAC40.

On 3 trades only Bertrand 😉 But it’s a beginning …

Hi Guys,

Don’t know if someone mentioned it but there is an error in the code

For me it’s not

//VECTEUR = CALCUL DE LA PENTE ET SA MOYENNE MOBILE

MMB = Exponentialaverage[PeriodeB](close)

pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB

trigger = Exponentialaverage[PeriodeB+lag](pente)

But

MMA = exponentialaverage[PeriodeA](customclose)

ADJASUROPPO = ((MMA-MMA[nbchandelierA])/pipsize) / nbChandelierA

ANGLE = (ATAN(ADJASUROPPO))

trigger = exponentialaverage[PeriodeA+lag](ANGLE)

Because in the first code the code is always positive and not positive/negative depends on the angle

Have a nice day

Zilliq

Paul

PaulParticipant

Master

hi zilliq

can you post some results or code using your change?

Thanks

I had assumed he meant only to redefine ‘trigger’

//STRATEGIE

//VECTEUR = CALCUL DE L'ANGLE

ONCE PeriodeA = 10

ONCE nbChandelierA= 14

MMA = Exponentialaverage[PeriodeA](customclose)

ADJASUROPPO = (MMA-MMA[nbchandelierA]*pipsize) / nbChandelierA

ANGLE = (ATAN(ADJASUROPPO)) //FONCTION ARC TANGENTE

CondBuy1 = ANGLE >= 45

CondSell1 = ANGLE <= - 34

//VECTEUR = CALCUL DE LA PENTE ET SA MOYENNE MOBILE

ONCE PeriodeB = 22

ONCE nbChandelierB= 34

lag = 4

MMB = Exponentialaverage[PeriodeB](close)

pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB

trigger = exponentialaverage[PeriodeA+lag](ANGLE)

but the results are dire. Something else then?

First, the code in the actual vectorial dax code was

//VECTEUR = CALCUL DE LA PENTE ET SA MOYENNE MOBILE

ONCE PeriodeB = 22

ONCE nbChandelierB= 34

lag = 4

MMB = Exponentialaverage[PeriodeB](close)

pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB

trigger = Exponentialaverage[PeriodeB+lag](pente)

// modifier par fifi743

// ajout d'un filtre pour achat

filtre,weekpivot,pivot,filt =call"FILTRE_Prise_Position"(close)

//===================== ajouter par fifi743

donchianP = 20

hh=highest[donchianP](high)

ll=lowest[donchianP](low)

MA=Average[4](close)

Myrsi=RSI[2](close)

CondBuy2 = (pente > trigger) AND (pente < 0) and high>MA and coeff>0.9

CondSell2 = (pente CROSSES UNDER trigger) AND (pente > -1)

If you use the actual vectorial dax code you can NEVER have a negative pente and so you can NEVER have a CondBuy2 and the pente is ALWAYS>-1

PeriodeB = 22

nbChandelierB= 34

lag = 4

MMB = Exponentialaverage[PeriodeB](close)

pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB

Return pente

And now if you correct the code, you have positive/negative pente and Good Condbuy

PeriodeB = 22

nbChandelierB= 34

lag = 4

MMB = Exponentialaverage[PeriodeB](close)

pente = ((MMB-MMB[nbchandelierB])/pipsize) / nbchandelierB

Return pente

So the correction it’s just the “/” in the pente calculation?

Paul

PaulParticipant

Master

Thanks zilliq for the explaining.

I tested your conclusion

pente is ALWAYS>-1

so I checked with this

if pente<=-1 then

test=1

else

test=0

endif

graph test

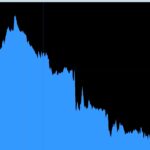

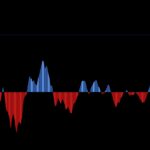

and got the result in the pic

I’am taking another look with your modification.

Hi Paul, use the actual code not the correction and as you see on my picture (the blue) the pente is always positive and it’s normal because of the code

With the actual “mistake” code

PeriodeB = 22

nbChandelierB= 34

lag = 4

MMB = Exponentialaverage[PeriodeB](close)

pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB

if pente<=-1 then

test=1

else

test=0

endif

return test

Always 0 = mistake

Paul

PaulParticipant

Master

I cannot reach the same conclusion, even as indicator on the dax 5min timeframe. Maybe have a look at my latest version. I will release it in the next post.

HI @paul

Take the actual code

PeriodeB = 22

nbChandelierB= 34

lag = 4

MMB = Exponentialaverage[PeriodeB](close)

pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB

And you will see you can’t have negative value as pipsize is on MMB[nbchandelierB] and not (MMB-MMB[nbchandelierB])

See U