ok. thanks you but backtest 5 pertes=1000 euros demo 1 perte=55euros

put the mouse on it and you have the operation number

The values for AC vary between 0 and 16. Should AC be >0 ?

NO

It gives you where the problem is.

I couldn’t see anything unusual on the graph. Maybe it was just a blip? It has been working fine since that one rejection, taking trades.

Actually, for now it’s outperforming both the DAX v8, and the NAS v6 but much too early to judge. Thanks for your help!

Can you upload the .itf file with which you get that backtest? I have tried with the different V6 and none gives me those results and there is one that gives an error.

Thank you.

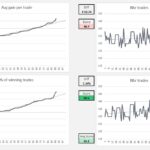

The DAX 5m version I was running went a bit flat from Nov so I refreshed the numbers and it’s looking better than ever. Image on the left is (I think) the last version posted with mods by Paul and Fifi. I didn’t touch any of their work, just re-optimized the vectorial settings @ 60k. So the image on the right is effectively a 30-70 walk back. Mostly improved, especially over the last 6 months.

So once I did that, I figured I’d better do the NAS 5M as well. Made a few small changes and re-optimized over the full 200k. Robustness looks acceptable, but could probably be further improved.

Thanks again to Balmora for this exceptional algo, and to everyone else who contributed.

The DAX 5m version I was running went a bit flat from Nov so I refreshed the numbers and it’s looking better than ever. Image on the left is (I think) the last version posted with mods by Paul and Fifi. I didn’t touch any of their work, just re-optimized the vectorial settings @ 60k. So the image on the right is effectively a 30-70 walk back. Mostly improved, especially over the last 6 months.

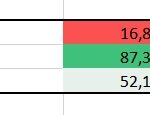

Robustness went worse with this version

another version that i have tested about DAx vectorial. an MTF version of it.

lower gain but less ddmax and more consecutive gains

i had noticed during the big period of volatility that parameters had a positive impact between february and april.

it might be interesting to store the value of these parameters in several variables, a variable per digit, to count the parameter used during the profit or not, and as soon as there is a loss or a gain depending of strategyprofit, to apply a weight of the parameter, then, 2 possibilities, average of the number stored following the best weights or average to take the parameter with the best weight.. a possible evolution of machine learning

@Francesco here’s the results i got. I didn’t bother posting it because I’m not at all confident that I got all the tradeons in the right places — there are an unholy number of entry points.

The way I see it though, you’re looking at a 140k OOS back test with a better curve, better profit, more trades, much lower DD and a correction to the recent months when it has frankly been quite dead … where would you rather put your money? The robustness score would have to be utterly disastrous to change my mind.

@MAKSIDE what TF did you add and what did you put there?

I also tried experimenting with MTF, here’s one that might be interesting — doubling the vectorial component at the 15m TF. Very few trades, as you would expect, but 100% wins. I’m sure it can be improved if someone wants to take it on…

@nonetheless

thx for sharing ! nice. if 100% wins, we can play with the positionsize.. 😉

about my version, pls see below.. cbuy and sell added to the current conditions

timeframe(4hours,updateonclose)

indicator1 = SuperTrend[6,2]

cbuy= (close > indicator1)

csell = (close < indicator1)

I got those results..i’m pretty sure i put tradeon on every single entry condition

I got those results..i’m pretty sure i put tradeon on every single entry condition

is it the nonetheless’s version ?

Just a test of upload of a picture.