GraHal

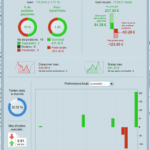

With your settings it looks like this.

As you say, manual exit requires you to be at the computer all the time.

You need to test on 3 min TF as that System I posted is a 3 min TF System … may as well now just so we have it all correctly compared?? 🙂

PS

Just noticed drawdown is less by a factor of 10 (42 manual exit vs 420) … so that is a big benefit.

You don’t have to be at the screen 100% of the time … but I guess you have to keep looking at progress regular but I often do this on my phone while I am outside working on the car or garden etc.

Correction: above should have read (31 manual exit vs 412)

haha, my fault.

Are so used to using 5 min TF

Spread=4

Now it should be better..

Wow yeah that looks better … any of us would be happy with that??

Love the Gain / Loss ratio (8.16) and also the total loss of £-132 but this makes a mockery of the computed Max Drawdown figure of £546??

total loss of £-132 but this makes a mockery of the computed Max Drawdown figure of £546??

On reflection it doesn’t make a mockery as we would have to look at the MAE (max adverse excursion) that the losing trades made to end up at a total loss of £-132??

haha, my fault.

Are so used to using 5 min TF

Spread=4

Now it should be better..

What changes did you make to get to your numbers? can you copy your lines please?

//-------------------------------------------------------------------------

// Main code : Vectorial DJI 3M v6.0 +entFilt

//-------------------------------------------------------------------------

//-------------------------------------------------------------------------

// Main code : Vectorial DJI 3M v6.0

//-------------------------------------------------------------------------

//-------------------------------------------------------------------------

// Main code : _Vectorial Dax V3

//-------------------------------------------------------------------------

// ROBOT VECTORIAL DAX

// M5

// SPREAD 1.5

// by BALMORA 74 - FEBRUARY 2019

DEFPARAM CumulateOrders = false

DEFPARAM Preloadbars = 50000

T1 = 6

p1 = average[t1](close)

p2 = average[t1*2](close)

p3 = average[t1*6](close)

p4 = average[t1*3](close)

a1 = p1 > p2 and p2 > p3 and p3 > p4

a2 = p1 < p2 and p2 < p3 and p3 < p4

//VARIABLES

CtimeA = time >= 080000 and time <= 180000

CtimeB = time >= 080000 and time <= 180000

// TAILLE DES POSITIONS

PositionSizeLong = 1

PositionSizeShort = 1

//STRATEGIE

//VECTEUR = CALCUL DE L'ANGLE

ONCE PeriodeA = 10

ONCE nbChandelierA= 15

MMA = Exponentialaverage[PeriodeA](close)

ADJASUROPPO = (MMA-MMA[nbchandelierA]*pipsize) / nbChandelierA

ANGLE = (ATAN(ADJASUROPPO)) //FONCTION ARC TANGENTE

CondBuy1 = ANGLE >= 35

CondSell1 = ANGLE <= - 40

//VECTEUR = CALCUL DE LA PENTE ET SA MOYENNE MOBILE

ONCE PeriodeB = 20

ONCE nbChandelierB= 35

lag = 1.5

MMB = Exponentialaverage[PeriodeB](close)

pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB

trigger = Exponentialaverage[PeriodeB+lag](pente)

CondBuy2 = (pente > trigger) AND (pente < 0)

CondSell2 = (pente CROSSES UNDER trigger) AND (pente > -1)

//ENTREES EN POSITION

CONDBUY = CondBuy1 and CondBuy2 and CTimeA

CONDSELL = CondSell1 and CondSell2 and CtimeB

//POSITION LONGUE

IF CONDBUY and A1 THEN

buy PositionSizeLong contract at market

//SET Target %PROFIT 1

//SET STOP %LOSS 0.7

ENDIF

//POSITION COURTE

IF CONDSELL and a2 THEN

Sellshort PositionSizeShort contract at market

//SET Target %PROFIT 1.2

//SET STOP %LOSS 1

ENDIF

//VARIABLES STOP SUIVEUR

ONCE trailingStopType = 1 // Trailing Stop - 0 OFF, 1 ON

ONCE trailingstoplong = 9 // Trailing Stop Atr Relative Distance

ONCE trailingstopshort = 8 // Trailing Stop Atr Relative Distance

ONCE atrtrailingperiod = 14 // Atr parameter Value

ONCE minstop = 0 // Minimum Trailing Stop Distance

// TRAILINGSTOP

//----------------------------------------------

atrtrail = AverageTrueRange[atrtrailingperiod]((close/10)*pipsize)/1000

trailingstartl = round(atrtrail*trailingstoplong)

trailingstartS = round(atrtrail*trailingstopshort)

if trailingStopType = 1 THEN

TGL =trailingstartl

TGS=trailingstarts

if not onmarket then

MAXPRICE = 0

MINPRICE = close

PREZZOUSCITA = 0

ENDIF

if longonmarket then

MAXPRICE = MAX(MAXPRICE,close)

if MAXPRICE-tradeprice(1)>=TGL*pointsize then

if MAXPRICE-tradeprice(1)>=MINSTOP then

PREZZOUSCITA = MAXPRICE-TGL*pointsize

ELSE

PREZZOUSCITA = MAXPRICE - MINSTOP*pointsize

ENDIF

ENDIF

ENDIF

if shortonmarket then

MINPRICE = MIN(MINPRICE,close)

if tradeprice(1)-MINPRICE>=TGS*pointsize then

if tradeprice(1)-MINPRICE>=MINSTOP then

PREZZOUSCITA = MINPRICE+TGS*pointsize

ELSE

PREZZOUSCITA = MINPRICE + MINSTOP*pointsize

ENDIF

ENDIF

ENDIF

if onmarket and PREZZOUSCITA>0 then

EXITSHORT AT PREZZOUSCITA STOP

SELL AT PREZZOUSCITA STOP

ENDIF

ENDIF

Hi.

I do not arrive at the same numbers as you.

I don’t get the same benefits either. It gives me a profit of 231 euros

I do not arrive at the same numbers as you.

Your 2nd image is not using the same Auto-System as the 1st image … you show results for EUR/USD 15M AYM(1) … don’t worry it happens to the best of us!!! 🙂 🙂

It gives me a profit of 231 euros

For what period?? The figs bullbear showed are for about 1 month only.

Best you post a screen shot of your results??

I do not arrive at the same numbers as you.

Your 2nd image is not using the same Auto-System as the 1st image … you show results for EUR/USD 15M AYM(1) … don’t worry it happens to the best of us!!! 🙂 🙂

Just mistake of title 🙂 > same results 🙂

It gives me a profit of 231 euros

For what period?? The figs bullbear showed are for about 1 month only.

Best you post a screen shot of your results??

Just mistake of title :)> same results.