When I look at the strategies that were published here 2, 3 or even 4 years ago, I wonder if it might be worthwhile to re-examine and improve them.

Our knowledge has grown, but the strategies back then had their reasons.

We could try to re-evaluate these strategies of that time with the knowledge of today.

a random example

RSI FX KISS h1 AUDUSD AUDSGD EURUSD

As to the one at your link, I think it’s really basic and was not so good. As it is I don’t think it may perform any better now.

You cannot write a strategy based only on RSI, or MA’s or whatever else. KISS (Keep It Simple and Stupid) is a nice acronym, were it only written KIS!

A solution would be to add some price action patterns or further indicators. But, in the end, it’s far easier to code a new one when you have an idea.

i Think grahal has a file with systems from this forum and performance if im not wrong.

Would recomend making your own systems tho.

i Think grahal has a file with systems from this forum and performance if im not wrong.

I have tried to encourage use of a Log, but hardly anybody contributes by entering performance stats etc.

- One Year After got more entries initially, but then stopped.

I then thought maybe folks can’t be bothered if it takes more than 10 seconds of their time to enter data so I came up with a much simplified version

- Forward Test – Sys Perf but that went down like a lead balloon! 🙂

At any stage I am open to suggestions to amend columns / data required in the log to make a Log what the Community wants to see and use?

One Year After – Library

Forward Test – Sys Perf

GraHal

Which of the strategies in the library do you think works best?

There are a lot of strategies, some should be pretty ok anyway 🙂

This code was made 2017 October. Since then it has made € 300 in profits.

Yes – but before we jump in and just trade it perhaps we should analyse it?

Let’s start with the exit conditions. There are two – get out if there is another big green or red body or get out if a certain amount of time has passed by. Alarm bells are already ringing with time based exits! The best way to examine each is to remove one at a time.

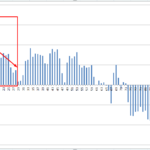

The first image shown is the results with both exit conditions.

The second image is the results with just the body size condition.

The third image is the results with just the time based condition.

mmmm……. me thinks that this strategy might just be a bit of time based data mining but we’ll keep testing.

The fourth image is with all exit conditions removed so that we just reverse position based on entry conditions.

Let’s do one final check.

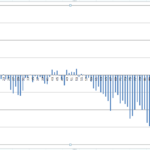

Another test we can do to see how exit condition biased a strategy is by adding 1 to a flag every time an exit condition is hit and GRAPH the results. Like this:

ATR = average[p](tr)//AverageTrueRange[p](close)

LongEntry = close - open > ATR * 2

LongExit1 = close - open > ATR * 2

LongExit2 = BarIndex = TradeIndex + 8

ShortEntry = open - close > ATR * 2

ShortExit1 = open - close > ATR * 2

ShortExit2 = BarIndex = TradeIndex + 8

Maxpos = 1

// Conditions to enter long positions

IF CountOfLongShares < MaxPos AND LongEntry THEN

BUY 1 CONTRACTS AT MARKET

if shortonmarket then

shortexit3flag = shortexit3flag + 1

endif

ENDIF

// Conditions to exit long positions

If LongOnMarket AND LongExit1 THEN

SELL AT MARKET

longexit1flag = longexit1flag +1

ENDIF

If LongOnMarket AND LongExit2 THEN

SELL AT MARKET

longexit2flag = longexit2flag +1

ENDIF

// Conditions to enter short positions

IF CountOfShortShares < MaxPos AND ShortEntry THEN

SELLSHORT 1 CONTRACTS AT MARKET

if longonmarket then

longexit3flag = longexit3flag + 1

endif

ENDIF

// Conditions to exit short positions

IF ShortOnMarket AND ShortExit1 THEN

EXITSHORT AT MARKET

shortexit1flag = shortexit1flag + 1

ENDIF

IF ShortOnMarket AND ShortExit2 THEN

EXITSHORT AT MARKET

shortexit2flag = shortexit2flag + 1

ENDIF

graph shortexit1flag

graph longexit1flag

graph shortexit2flag

graph longexit2flag

graph shortexit3flag

graph longexit3flag

exit 1 flags are ATR based exits

exit 2 flags are time based exits.

exit 3 flags are reversal exits.

The results are shown in the last image.

It seems pretty conclusive that this strategy is purely time based data mining from these tests even if it has made a few hundred pips in forward testing.

All is not totally lost for the strategy though as it does help us analyse how long it is wise to hold on to a position after one of these entries. If you remove all other exit conditions and then run a optimisation back test and then put the results in an Excel graph then we can see that there is definitely a range where holding is profitable but hold too long and watch any potential profits disappear.

Sorry – I just realised that the image in the last post is incorrect. I was testing with a different value for ATR. Average[p](tr) instead of AverageTrueRange[p](close). The correct image is attached.

We can see that the need to get out of a trade happens much sooner. So at least we have learned something else – Average[p](tr) is a better entry condition than AverageTrueRange[p](close)!

Hi Vonasi, nice analysis, it is really eye-opening. Regarding your analysis by excel graph, isn’t it a good sign for the strategy? as profit appears shortly after entry (most of them within 10 bar), so the next step is to include some trailing stop. (on smaller TF perhaps?)

Yes fatlung that is correct – even if the strategy as a whole is basically purely timed exit based the Excel charts show that the entry points are pretty good entry points.

It looks like Average[p](tr) is a better filter than AverageTrueRange[p](close) but I have only tested them with a value of 20 and so they still need further testing and graphing to check for curve fitting.

Certainly it should be possible to find a better exit method than the current ones – maybe also body size compared to the average true range? Perhaps we should be exiting when the market runs out of momentum and has small candles and or small bodies.

I’ve personally never had much joy with trailing stops but why not try them too?! They always seem a little curve fitted and seem to take away profit whenever I try them out.

I think we should keep the time based exits but maybe make them longer to give the trade a little more time to come good but not so long that the market has moved miles away from what we once thought was a good entry point.

Modified the code with a different stop and different timeframe.

Optimized until 2014 as you should do 🙂

ATR = average[14](tr)//AverageTrueRange[p](close)

LongEntry = close - open > ATR * 2

ShortEntry = open - close > ATR * 2

Maxpos = 1

// Conditions to enter long positions

IF CountOfLongShares < MaxPos AND LongEntry THEN

BUY 1 CONTRACTS AT MARKET

ENDIF

// Conditions to enter short positions

IF CountOfShortShares < MaxPos AND ShortEntry THEN

SELLSHORT 1 CONTRACTS AT MARKET

ENDIF

myATRLL = 1* averagetruerange[5](close)//8,1

myATRPL = 1* averagetruerange[10](close)//6,9

SET stop loss myATRLL

SET target profit myATRPL

Hello, dear ones.

I was not here for a while and so I am happy to see that the topic was well received.

I will read your comments this weekend in peace.

Many thanks for the input.

until then

blue

hi everyone, it has been a while since the strategy was last updated.

Is anyone running this strategy live? any modification on take profit? Has anyone tried it on different markets?

I personally added a small percentage stoploss and it works well.

it seems to be a potentially universal strategy as the idea behind it is very simple.