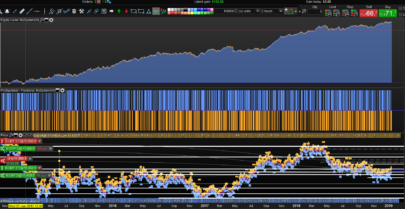

This is a really simple system in its base form. It has no filters or money management. I submit it only to show what can be done with VERY simple entry & exit rules. I’m pretty sure this could be developed further into an implementable system.

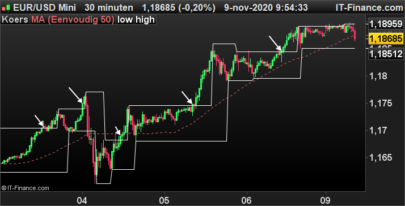

The basis is EUR/USD on 2h timeframe. It might work on other assets, I haven’t tried yet.

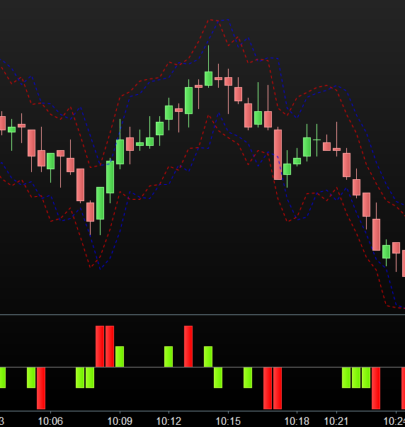

The system will initiate a long if there is a green body exceeding ATR(20)*2. It will exit the long on another green body exceeding ATR(20)*2, or on the 9th bar after entry, or if a short position is initiated.

The system will initiate a short if there is a red body exceeding ATR(20)*2. It will exit the short on another red body exceeding ATR(20))*2, or on the 9th bar after entry, or if a long position is initiated.

There you go, as simple as that. Good luck with your adaptations!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 |

ATR = AverageTrueRange[14](close) LongEntry = close - open > ATR * 2 LongExit = close - open > ATR * 2 OR BarIndex = TradeIndex + 8 ShortEntry = open - close > ATR * 2 ShortExit = open - close > ATR * 2 OR BarIndex = TradeIndex + 8 Maxpos = 1 // Conditions to enter long positions IF CountOfLongShares < MaxPos AND LongEntry THEN BUY 1 CONTRACTS AT MARKET ENDIF // Conditions to exit long positions If LongOnMarket AND LongExit THEN SELL AT MARKET ENDIF // Conditions to enter short positions IF CountOfShortShares < MaxPos AND ShortEntry THEN SELLSHORT 1 CONTRACTS AT MARKET ENDIF // Conditions to exit short positions IF ShortOnMarket AND ShortExit THEN EXITSHORT AT MARKET ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Just a quick note. The first line should read AverageTrueRange[20](close), not [14]

How does the backtest change with AverageTrueRange[14](close)? Better, worse, unchanged?

If I remember correctly, best backtest results were achieved with ATR(21). Slightly worse with 14, but not materially

Thanks!

Great system, I love its simplicity. Thank you.

Enjoy!

Hy, thank-you for share-it…

Ex-cuse me for the trivial question,

I understood the condition LognEntry ,but why the condition “close -open>ATR*2 ” is also in the condition “LongExit” ?

thank-you

Close – Open is the thame as LognEntry?

Hi Sam,

Thank you for the comment. I ageee completely and do not find your question trivial. Please allow me to check the code and come back with an answer. I can spontaneously say that this is not the same as codes I have implemented (yes, I do run variations on this idea live on several markets). Let me have a look and revert with an explanation.

Kind regards,

Fredrik

There is no SL to this system, right?

If I want to add one, how would I add it?

In the IF-clause containing the BUY or SELLSHORT instruction you could add a line containing SET STOP….. etc.

In answer to SAM: The Logic of the cover clause containing the same logic as the entry-clause is simply to hold the position until such time that another impulse (=1-bar movement larger than the ATR-hurdle) causes the system to exit. This idea came from watching the charts.

Tried the code, nice concept, seems to work quit well for US/EUR 2hrs, Other markets seems not to fit very well, at least to what I tried.

Simple and nice code , congrats !!!

Seems work well with TIme frame 1 h

Hi all,

Sorry revisiting an old post. This algo is simple, and simplicity is the ultimate sophistication. I am wondering if anyone has any adaptation of this strategy? I tried putting a bid on retracement instead of buying straight away at the next candle’s opening. But because this strategy is momentum, pull back is shallow and missing key opportunities. If anyone has more thoughts on this, will appreciate if you can share. Tks.