Hi Nicolas,

The attached code produces results with modest profit on the DAX but if I run in live mode on IG it fails to raise an order and stops running. It says to view reason for rejection but cannot see any failed orders on the report. Any suggestions please?

John

<br>// Definition of code parameters

DEFPARAM CumulateOrders = False // Cumulating positions deactivated

DEFPARAM FLATBEFORE = 070000 // Flat before this time

DEFPARAM FLATAFTER = 205000 // Flat after this time

//reset a at start of day

once a = 0

//resetting variables when no trades are on market

if not onmarket then

MAXPRICE = 0

MINPRICE = close

priceexit = 0

endif

//prices to enter trades

BuyPrice = High[0]+2*PointSize

SellPrice = Low[0]-2*PointSize

// Conditions to enter long positions

indicator1 = Stochastic[14,5](close)

c1 = (indicator1 < 25)

indicator2 = Average[20](close)

indicator3 = Average[50](close)

c2 = (indicator2 > indicator3)

c6 = (a<=0)

IF NOT ONMARKET AND c1 AND c2 AND c6 THEN

BUY 1 PERPOINT AT BuyPrice STOP

a=1//trade is a buy order

ENDIF

// Conditions to enter short positions

indicator5 = Stochastic[14,5](close)

c4 = (indicator5 > 75)

indicator6 = Average[50](close)

indicator7 = Average[20](close)

c5 = (indicator6 > indicator7)

c7 = (a>=0)

IF NOT ONMARKET AND c4 AND c5 AND c7 THEN

SELLSHORT 1 PERPOINT AT SellPrice STOP

a=-1//trade is a sell order

ENDIF

trailingstop = 20

//resetting variables when no trades are on market

if not onmarket then

MAXPRICE = 0

MINPRICE = close

priceexit = 0

endif

//case SHORT order

if shortonmarket then

MINPRICE = MIN(MINPRICE,low) //saving the MFE of the current trade

if tradeprice(1)-MINPRICE>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexit = MINPRICE+trailingstop*pointsize //set the exit price at the MFE + trailing stop price level

endif

endif

//case LONG order

if longonmarket then

MAXPRICE = MAX(MAXPRICE,high) //saving the MFE of the current trade

if MAXPRICE-tradeprice(1)>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexit = MAXPRICE-trailingstop*pointsize //set the exit price at the MFE - trailing stop price level

endif

endif

//exit on trailing stop price levels

if onmarket and priceexit>0 then

EXITSHORT AT priceexit STOP

SELL AT priceexit STOP

endif

// stop and target

SET STOP PLOSS 25

SET TARGET PPROFIT 80

Hi. If you look in the Order list, under Cancelled/Rejected tab- find the order you ask about, and hover the mouse pointer over the yellow ! mark. it should give some more information.

\Elsborgtrading

Hi Elsborgtrading

The Cancelled/Rejected list is empty in fact the whole report is empty. When it fell over and having found no transactions I deleted the strategy from auto trading. I’m just going to reload and wait for it to fall over again. The pity was it tried to place the trade when I expected it to.

Thanks for your consideration of this problem.

Strange. My guess is that you didn’t have enough margin in you account to cover the trade- I ofcause could be wrong, but I know that happened for me a couple of times- or your code tried to enter the market at 1 position when you needed at least 2 for that instrument or something like that.There is a setting for Pro Order that is should stop or continue when encounter an error. hope that helps 🙂

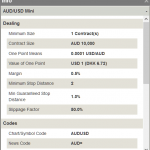

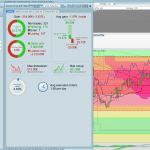

I didn’t find anywhere in PRT to dispay the INFO of the instrument where you can see these settings, so I use the web trader instead to see this. see scrndump. Perhaps someone else knows where to see INFO in PRT?

Hi Elsborgtrading

I’m trading a spreadbet account but have more than enough in my account to open 3 points. My only question mark on this have I written the code correctly. On ititiation of the strategy I entered 3 as the quantity, is this consistent with the way I wrote the code i.e.

<pre class=”line-numbers language-prorealtime”><code class=” language-prorealtime”><span class=”token keyword”>SELLSHORT</span> <span class=”token number”>1</span> PERPOINT <span class=”token keyword”>AT</span> SellPrice <span class=”token keyword”>STOP

</span>or

<pre class=”line-numbers language-prorealtime”><code class=” language-prorealtime”><span class=”token keyword”>BUY</span> <span class=”token number”>1</span> PERPOINT <span class=”token keyword”>AT</span> BuyPrice <span class=”token keyword”>STOP

</span>The minimum bet on DAX is 2 points.

Regards

dymjohn

Hi again. I’m not that experienced in coding, so I actually don’t know the one you just posted? Is that PRT code? anyway the first code you put in the initial post here, I tried to enter in Pro order and it backtest with no error, but I guess that you already knew that 🙂 But what DAX time frame are you using? I can’t back test any that actually makes a profit with the code?

Br. Elsborgtrading

Hi Elsborgtrading

You need to use the 5 minute timeframe and test over say 10000 bars.

Regards

dymjohn

Hi. Maybe I’m doing something wrong here, because I don’t see any profit- even with no spread setting?

Eric

EricParticipant

Master

In the code you have 1 per point and minimum spreadbetting is 2 per point?

try with 2 in the code (in backtest it works with 1)

Hi Elsborgtrading

The problem was quantity so now looking to improve. I did say it was only a modest profit but thanks for your attention.

regards

dymjohn

Hi Eric

Yes it was a quantity problem they always confuse me.

Thanks

dymjohn