Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Mother of Dragons trading strategy…

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Mother of Dragons trading strategy…

-

AuthorPosts

-

Does anyone know of any reason why one shouldn’t trade with this enabled?

Maybe the reason is, that the profit/equity curve for a longer period is not better than without cumulation. Other reason could be a higher DD,but I can´check it, because my longest period in 5m TF is only 15 month.

Does anyone know of any reason why one shouldn’t trade with this enabled?

Would be scary if one morning you woke up and the System had accumulated 20 trades (position size is 20) and you were close to or on a margin call??

Thank you VinzentVega and GraHal for your feedback. Whilst the extensive parameters required to generate a signal mean that there don’t appear to be many triggered, the point of waking up to 20 positions on at once remains a reality.

I found this post by Vonasi which I shall incorporate into the latest version to negate the risk and set a max position allowed;

https://www.prorealcode.com/topic/using-true-cumulating-positions/#post-97661

Thanks again everyone, much appreciated.

I’m recently new to this thread and have read over all the content and quite impressed on what has been put together in this strategy. I ran a few versions (as below) on my IG demo account and am pleased with the results so far, 6 wins and 2 losses. The two losses were also quite minimal especially in comparison to the gains made on the winning trades. I wanted to ask you all of which charts each of these should be getting loaded into. Have I loaded these to the correct charts?

DAX MoD V2.2a Loaded On 5 Min Germany 30 Cash (5 EURO) i.e. not the futures.

DOW MoD V4.7 Loaded On 5 Min DJI Wall Street Cash ($10) DOW Main

DJ MoD V4.7a Loaded On 5 Min DJI Wall Street Cash ($10) DOW Main

I noticed there is also a NAS Version of NAS MoD V3. Is this to be loaded onto the USTech 100 ($1) NASDAQ Futures?

Hello, do you have the same thing as me?

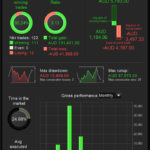

No, I have had mine on Wall Street Cash A$1 with these results. I have been quite impressed. This backtest was done with 10 x $1 contracts and 1 pip spread but the number of contracts is up to your own risk plan/management.

I have been testing these MoD algos with a few colleagues, with some other commercial algorithms we had headaches regarding time zone settings needing to be set in a particular country/time zone or they would not work. The procedure when loading could not use the individual exchange time zones but we needed to change the time zone for PRT completely whilst loading the algorithm.

When using the DAX V2.2a, DJI V4.7a and NAS V3 algorithms, which time zone settings are required?

@nonetheless @dowjones Am tagging you guys as you had posted the versions of the strategy that I am using.DAX V2.2a, DJI V4.7a and NAS V3 algorithms, which time zone settings are required?

DAX V2.2a = UTC + 2

DJI V4.7.2a = UTC + 8

I didn’t use NAS, so I’m not sure…

scoot3r83 thanked this postHi all,

Iv’e tried to use the Mother of Dragons for setting up a system for Brent. Im wondering if anyone else have a system running that isn’t stopped on a regular basis?

The error message is:

“The trading system was stopped due to a division by zero during the evaluation of the last candlestick. You can add protections to your code to prevent divisions by zero then backtest the system to check the correction.”Found a old post about this regarding one or two value RSI and ghost bars but can’t seem to figure out what would cause it since the RSI is above

After a lot of trial and error im not 100% who to credit for the code and there for the header misses correct credits. Sorry for that but a lot of thanks for the work everybody put in to this and thanks for sharing!

// Definition of code parameters DEFPARAM CumulateOrders = false // Cumulating positions deactivated DEFPARAM preloadbars = 10000 //Money Management MM = 0 // = 0 for optimization if MM = 0 then positionsize = 1 ENDIF //code re-invest Capital = 1000 // initial capital Equity = Capital + StrategyProfit if MM = 1 then positionsize = Max(1, Equity * (1/Capital)) positionsize = Round(positionsize*100) positionsize = positionsize/100 // change from "1" to "position" in buy/sell conditions to use re-invest //******************** ENDIF //code quit strategy maxequity = max(equity,maxequity) DrawdownNeededToQuit = 20 // percent drawdown from max equity to stop strategy if equity < maxequity * (1 - (DrawdownNeededToQuit/100)) then quit endif // Time management Ctime = not (time >= 205959 or time < 070000) // Friday 22:00 Close ALL operations. IF DayOfWeek = 5 AND time = 220000 THEN SELL AT MARKET EXITSHORT AT MARKET ENDIF // Settings //Timeframe 2h //Period weightedaverage Q1 = 44 // 1-600 //Supertrend q2 = 6 // 1 - 10 q3 = 6 // 1- 10 // MA average q4 = 7 // 1- 100 q5 = 4 // 0-6 // RSI q6 = 20 q7 = 10 q8 = 6 q9 = 2 // 30 min // Average q10 = 2 // 1- 10 q11 = 5 // 1- 10 // 15 min // Average q12 = 3 // 1- 10 q13 = 4 // 1- 10 // Periodc q14 = 42 // 10 min // supertrend q15 = 2 //na q16 = 7 // na // 5 min //RSI q17 = 8 q18 = 3 q19 = 12 q20 = 11 //ma average q21 = 17 q22 = 5 //Periodb q23 = 17 //Long SL q24 = 7 //Long TP q25 = 9 //Short SL q26 = 7 //Short TP q27 = 9 TIMEFRAME(2 hours,updateonclose) Period= Q1 inner = 2*weightedaverage[round( Period/2)](typicalprice)-weightedaverage[Period](typicalprice) HULLa = weightedaverage[round(sqrt(Period))](inner) c1 = HULLa > HULLa[1] c2 = HULLa < HULLa[1] indicator1 = SuperTrend[q2,q3] c3 = (close > indicator1) c4 = (close < indicator1) ma = average[q4,q5](close) c11 = ma > ma[1] c12 = ma < ma[1] //Stochastic RSI | indicator lengthRSI = q6 //RSI period lengthStoch = q7 //Stochastic period smoothK = q8 //Smooth signal of stochastic RSI smoothD = q9 //Smooth signal of smoothed stochastic RSI myRSI = RSI[lengthRSI](close) MinRSI = lowest[lengthStoch](myrsi) MaxRSI = highest[lengthStoch](myrsi) StochRSI = (myRSI-MinRSI) / (MaxRSI-MinRSI) K = average[smoothK](stochrsi)*100 D = average[smoothD](K) c13 = K>D c14 = K<D TIMEFRAME(30 minutes,updateonclose) indicator5 = Average[q10](typicalPrice) indicator6 = Average[q11](typicalPrice) c15 = (indicator5 > indicator6) c16 = (indicator5 < indicator6) TIMEFRAME(15 minutes,updateonclose) indicator2 = Average[q12](typicalPrice) indicator3 = Average[q13](typicalPrice) c7 = (indicator2 > indicator3) c8 = (indicator2 < indicator3) Periodc= q14 innerc = 2*weightedaverage[round( Periodc/2)](typicalprice)-weightedaverage[Periodc](typicalprice) HULLc = weightedaverage[round(sqrt(Periodc))](innerc) c9 = HULLc > HULLc[1] c10 = HULLc < HULLc[1] TIMEFRAME(10 minutes) indicator1a = SuperTrend[q15,q16] c19 = (close > indicator1a) c20 = (close < indicator1a) TIMEFRAME(5 minutes) //Stochastic RSI | indicator lengthRSIa = q17 //RSI period lengthStocha = q18 //Stochastic period smoothKa = q19 //Smooth signal of stochastic RSI smoothDa = q20 //Smooth signal of smoothed stochastic RSI myRSIa = RSI[lengthRSIa](close) MinRSIa = lowest[lengthStocha](myrsia) MaxRSIa = highest[lengthStocha](myrsia) StochRSIa = (myRSIa-MinRSIa) / (MaxRSIa-MinRSIa) Ka = average[smoothKa](stochrsia)*100 Da = average[smoothDa](Ka) c23 = Ka>Da c24 = Ka<Da ma3 = average[q21,q22](close) c21 = ma3 > ma3[1] c22 = ma3 < ma3[1] Periodb= q23 innerb = 2*weightedaverage[round( Periodb/2)](typicalprice)-weightedaverage[Periodb](typicalprice) HULLb = weightedaverage[round(sqrt(Periodb))](innerb) c5 = HULLb > HULLb[1]and HULLb[1]<HULLb[2] c6 = HULLb < HULLb[1]and HULLb[1]>HULLb[2] //Long target and stoploss LSL = Q24 /10 LTP = Q25 /10 // Conditions to enter long positions IF Ctime and dhigh(0)-high<250 and c1 AND C3 AND C5 and c7 and c9 and c11 and c13 and c15 and c19 and c21 and c23 THEN BUY positionsize CONTRACT AT MARKET SET STOP %LOSS LSL SET TARGET %PROFIT LTP ENDIF //Short target and stoploss SSL = Q26/10 STP = Q27/10 // Conditions to enter short positions IF Ctime and low-dlow(0)<700 and c2 AND C4 AND C6 and c8 and c10 and c12 and c14 and c16 and c20 and c22 and c24 THEN SELLSHORT positionsize CONTRACT AT MARKET SET STOP %LOSS SSL SET TARGET %PROFIT STP ENDIF //================== exit in profit if longonmarket and C6 and c8 and close>positionprice then sell at market endif If shortonmarket and C5 and c7 and close<positionprice then exitshort at market endif //==============exit at loss if longonmarket AND c2 and c6 and close<positionprice then sell at market endif If shortonmarket and c1 and c5 and close>positionprice then exitshort at market endif //%trailing stop function trailingPercent = .26 stepPercent = .014 if onmarket then trailingstart = tradeprice(1)*(trailingpercent/100) //trailing will start @trailingstart points profit trailingstep = tradeprice(1)*(stepPercent/100) //% step to move the stoploss endif //reset the stoploss value IF NOT ONMARKET THEN newSL=0 ENDIF //manage long positions IF LONGONMARKET THEN //first move (breakeven) IF newSL=0 AND close-tradeprice(1)>=trailingstart THEN newSL = tradeprice(1)+trailingstep ENDIF //next moves IF newSL>0 AND close-newSL>trailingstep THEN newSL = newSL+trailingstep ENDIF ENDIF //manage short positions IF SHORTONMARKET THEN //first move (breakeven) IF newSL=0 AND tradeprice(1)-close>=trailingstart THEN newSL = tradeprice(1)-trailingstep ENDIF //next moves IF newSL>0 AND newSL-close>trailingstep THEN newSL = newSL-trailingstep ENDIF ENDIF //stop order to exit the positions IF newSL>0 THEN SELL AT newSL STOP EXITSHORT AT newSL STOP ENDIF //************************************************************************ IF longonmarket and barindex-tradeindex>1800 and close<positionprice then sell at market endif IF shortonmarket and barindex-tradeindex>610 and close>positionprice then exitshort at market endif //============================================= if longonmarket and abs(open-close)<1 and high[1]>high and close>positionprice and high-close>10then sell at market endif if shortonmarket and abs(open-close)<1 and low[1]>low and close-low>13 and close<positionprice then exitshort at market endif //=================================== myrsiM5=rsi[14](close) // if myrsiM5<30 and barindex-tradeindex>1 and longonmarket and close>positionprice then sell at market endif if myrsiM5>70 and barindex-tradeindex>1 and shortonmarket and close<positionprice then exitshort at market endif // --------- US DAY LIGHT SAVINGS MONTHS ---------------- // mar = month = 3 // MONTH START nov = month = 11 // MONTH END IF (month > 3 AND month < 11) OR (mar AND day>14) OR (mar AND day-dayofweek>7) OR (nov AND day<=dayofweek AND day<7) THEN USDLS=010000 ELSE USDLS=0 ENDIF once openStrongLong = 0 once openStrongShort = 0 if (time <= 223000 - USDLS and time >= 050000 - USDLS) then openStrongLong = 0 openStrongShort = 0 endif //detect strong direction for market open once rangeOK = 40 once tradeMin = 1500 IF (time >= 223500 - USDLS) AND (time <= 223500 + tradeMin - USDLS) AND ABS(close - open) > rangeOK THEN IF close > open and close > open[1] THEN openStrongLong = 1 openStrongShort = 0 ENDIF IF close < open and close < open[1] THEN openStrongLong = 0 openStrongShort = 1 ENDIF ENDIF once bollperiod = 20 once bollMAType = 1 once s = 2 bollMA = average[bollperiod, bollMAType](close) STDDEV = STD[bollperiod] bollUP = bollMA + s * STDDEV bollDOWN = bollMA - s * STDDEV IF bollUP = bollDOWN THEN bollPercent = 50 ELSE bollPercent = 100 * (close - bollDOWN) / (bollUP - bollDOWN) ENDIF once trendPeriod = 70 once trendPeriodResume = 30 once trendGap = 3 once trendResumeGap = 6 if not onmarket then fullySupported = 0 fullyResisteded = 0 endif //Market supported in the wrong direction IF shortonmarket AND fullySupported = 0 AND summation[trendPeriod](bollPercent > 50) >= trendPeriod - trendGap THEN fullySupported = 1 ENDIF //Market pull back but continue to be supported IF shortonmarket AND fullySupported = 1 AND bollPercent[trendPeriodResume + 1] < 0 AND summation[trendPeriodResume](bollPercent > 50) >= trendPeriodResume - trendResumeGap THEN exitshort at market ENDIF //Market resisted in wrong direction IF longonmarket AND fullyResisteded = 0 AND summation[trendPeriod](bollPercent < 50) >= trendPeriod - trendGap THEN fullyResisteded = 1 ENDIF //Market pull back but continue to be resisted IF longonmarket AND fullyResisteded = 1 AND bollPercent[trendPeriodResume + 1] > 100 AND summation[trendPeriodResume](bollPercent < 50) >= trendPeriodResume - trendResumeGap THEN sell at market ENDIF // //Started real wrong direction once strongTrend = 60 once strongPeriod = 8 once strongTrendGap = 2 IF shortonmarket and openStrongLong and barindex - tradeindex < 12 and summation[strongPeriod](bollPercent > strongTrend) = strongPeriod - strongTrendGap then exitshort at market ENDIF IF longonmarket and openStrongShort and barindex - tradeindex < 12 and summation[strongPeriod](bollPercent < 100 - strongTrend) = strongPeriod - strongTrendGap then sell at market ENDIFanyone else have a system running that isn’t stopped on a regular basis

I have run both MoD DAX and DJI for many months, no such issue for me.

For your issue, in my experience, to debug the issue, better to take note when the issue reported, so you can build indicator or GRAPH the suspected division method to check. The problem is Probacktest doesn’t report issue with zero division, I did a dummy test before to purposely divide by zero and backtest still can complete successfully.

I have run both MoD DAX and DJI for many months, no such issue for me.

Yes it works great for with all indexes but can’t get it to run on Brent Crude oil. Tried several setups and always get the zero division error message or the suggestion of preloading bars (can’t remember the error message on top of my head)

I worked with a strategy on Brent but realized I had to scrap it because of constant zero division error. You can forget about oil for automated trading.

Dow Jones thanked this postOut of curiosity… what are the values you use for you 5M RSI calculations?

Out of curiosity… what are the values you use for you 5M RSI calculations?

This test (have done a few) 8, 3, 12, 11I worked with a strategy on Brent but realized I had to scrap it because of constant zero division error. You can forget about oil for automated trading.

Thanks for confirming that i’m not mad

-

AuthorPosts

- You must be logged in to reply to this topic.

Mother of Dragons trading strategy…

ProOrder: Automated Strategies & Backtesting

Author

Summary

This topic contains 522 replies,

has 50 voices, and was last updated by LaurentBZH35

4 years, 10 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 01/21/2020 |

| Status: | Active |

| Attachments: | 195 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.