Well, I had to call it something, right?

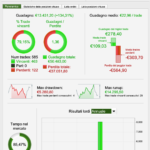

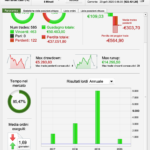

Attached is the first code I’ve put together that ‘seems to work’. Survives all manner of WF tests: 70-30, 50-50, 30-70 – however you want to chop it.

Also does well in Vonasi’s robustness tester, Random 10-10. I tried hitting it with a very big hammer but still performs well.

Uses a combination of HullMA and Supertrend on the 2h TF to define the primary trend, then another HullMA + trailing stop on a 5m TF to control entry and exit.

The 5m TF doesn’t give us much in the backtest but it does well in clear uptrends and downtrends. Just that choppy bit in March 2019 where it couldn’t cope. I hate to see whole month where a strategy doesn’t come good, but one out of 16 is not too shabby.

It runs around the clock so I’ve allowed for a spread of 3.3, calculated for IG as: (6.5 x 2.4 + 6.5 x 1.6 + 2 x 9.8 + 9 x 3.8)/24

All backtesting was done with MM disabled but I ran the final optimization with it turned on just to demonstrate the boost it gives. Starts with position size = 1 and by the end of the run when equity has trebled, it’s placing position size of ~3.4, so more or less in keeping with standard practise. Also reduces position size in bad patches.

Credit where credit is due: Vonasi wrote the Money Management part and coded the HullMA for me. The trailing stop I believe is Nicolas’ work – big thanks to both!

But the really cool thing about this strategy is that the equity graph draws a perfect profile of Daenerys Targaryen! You might have to squint a bit, but if you can’t see Daenerys then you haven’t optimized correctly.

All comments, suggestions, mods etc welcome!

// DJI 5m

DEFPARAM CumulateOrders = False // Cumulating positions deactivated

DEFPARAM preloadbars = 5000

Capital = 10000

MinSize = 1 //The minimum position size allowed for the instrument.

MM1stType = 0 //Starting type of moneymanagement. Set to 0 for level stakes. Set to 1 for increasing stake size as profits increase and decreasing stake size as profits decrease. Set to 2 for increasing stake size as profits increase with stake size never being decreased.

MM2ndType = 1 //Type of money management to switch to after TradesQtyForSwitch number of trades and ProfitNeededForSwitch profit has occurred

TradesQtyForSwitch = 15 //Quantity of trades required before switching to second money management choice.

ProfitNeededForSwitch = 2 //% profit needed before allowing a money management type change to MM2ndType.

DrawdownNeededToSwitch = 8 //% draw down from max equity needed before money management type is changed back to MM1stType.

DrawdownNeededToQuit = 25 //% draw down from max equity needed to stop strategy

Once MoneyManagement = MM1stType

Equity = Capital + StrategyProfit

maxequity = max(equity,maxequity)

if equity < maxequity * (1 - (DrawdownNeededToSwitch/100)) then

enoughtrades = 0

tradecount = 0

moneymanagement = MM1stType

endif

if equity < maxequity * (1 - (DrawdownNeededToQuit/100)) then

quit

endif

if not EnoughTrades then

if abs(countofposition) > abs(countofposition[1]) then

tradecount = tradecount + 1

endif

if tradecount > TradesQtyForSwitch and maxequity >= Capital * (1 + (ProfitNeededForSwitch/100)) then

EnoughTrades = 1

MoneyManagement = MM2ndType

endif

endif

IF MoneyManagement = 1 THEN

PositionSize = Max(MinSize, Equity * (MinSize/Capital))

ENDIF

IF MoneyManagement = 2 THEN

PositionSize = Max(LastSize, Equity * (MinSize/Capital))

LastSize = PositionSize

ENDIF

IF MoneyManagement <> 1 and MoneyManagement <> 2 THEN

PositionSize = MinSize

ENDIF

PositionSize = Round(PositionSize*100)

PositionSize = PositionSize/100

// Size of POSITIONS

PositionSizeLong = 1 * positionsize

PositionSizeShort = 1 * positionsize

TIMEFRAME(120 minutes)

Period= 520

inner = 2*weightedaverage[round( Period/2)](typicalprice)-weightedaverage[Period](typicalprice)

HULLa = weightedaverage[round(sqrt(Period))](inner)

c1 = HULLa > HULLa[1]

c2 = HULLa < HULLa[1]

indicator1 = SuperTrend[5,21]

c3 = (close > indicator1)

c4 = (close < indicator1)

TIMEFRAME(5 minutes)

Periodb= 60

innerb = 2*weightedaverage[round( Periodb/2)](typicalprice)-weightedaverage[Periodb](typicalprice)

HULLb = weightedaverage[round(sqrt(Periodb))](innerb)

c5 = HULLb > HULLb[1]

c6 = HULLb < HULLb[1]

// Conditions to enter long positions

IF c1 AND C3 AND C5 THEN

BUY PositionSizeLong CONTRACT AT MARKET

SET STOP %LOSS 2.1

SET TARGET %PROFIT 1

ENDIF

// Conditions to enter short positions

IF c2 AND C4 AND C6 THEN

SELLSHORT PositionSizeShort CONTRACT AT MARKET

SET STOP %LOSS 1.2

SET TARGET %PROFIT 1

ENDIF

//trailing stop function

trailingstart = 84 //trailing will start @trailinstart points profit

trailingstep = 3 //trailing step to move the "stoploss"

//reset the stoploss value

IF NOT ONMARKET THEN

newSL=0

ENDIF

//manage long positions

IF LONGONMARKET THEN

//first move (breakeven)

IF newSL=0 AND close-tradeprice(1)>=trailingstart*pipsize THEN

newSL = tradeprice(1)+trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND close-newSL>=trailingstep*pipsize THEN

newSL = newSL+trailingstep*pipsize

ENDIF

ENDIF

//manage short positions

IF SHORTONMARKET THEN

//first move (breakeven)

IF newSL=0 AND tradeprice(1)-close>=trailingstart*pipsize THEN

newSL = tradeprice(1)-trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND newSL-close>=trailingstep*pipsize THEN

newSL = newSL-trailingstep*pipsize

ENDIF

ENDIF

//stop order to exit the positions

IF newSL>0 THEN

SELL AT newSL STOP

EXITSHORT AT newSL STOP

ENDIF

//************************************************************************