Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Machine Learning in ProOrder ProRealTime

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Machine Learning in ProOrder ProRealTime

-

AuthorPosts

-

@Paul … comment out Line 144. Also then … 1 less endif should be needed?

My ‘sweating over it’ time may be a benefit to others as I tried just about every conceivable thing possible to get mine to work. Then – when I got it working – I went back over some things I tried to see what difference they should have made! 🙂

Let us know if it works?

Also you need the initialisation below to be inserted in your code at Line 10 …

once HeuristicsCycle = 0 once HeuristicsAlgo1 = 1 once HeuristicsAlgo2 = 0@Paul I got your code to run after making the changes above, but Valuex and ValueY are not changing.

More sweating now! 🙂

Success … see attached!

I looked at my working System and the only way I got mine to fully spark into life (with ValueX and ValueY changing) … was to NOT include the code below … so there must be something wrong with below or the concept of below does not work??

I guess JuanJ will have to help us with below?

HeuristicsCycleLimit = 2 once HeuristicsCycle = 0 once HeuristicsAlgo1 = 1 once HeuristicsAlgo2 = 0 If HeuristicsCycle >= HeuristicsCycleLimit Then If HeuristicsAlgo1 = 1 Then HeuristicsAlgo2 = 1 HeuristicsAlgo1 = 0 ElsIf HeuristicsAlgo2 = 1 Then HeuristicsAlgo1 = 1 HeuristicsAlgo2 = 0 EndIf HeuristicsCycle = 0 EndIf If HeuristicsAlgo1 = 1 ThenAha … I just looked at my other fully working working System including the above code … but we do NOT need either lines of code below …

So that’s saved JuanJ a bit more time! 🙂

If HeuristicsAlgo1 = 1 Then If HeuristicsAlgo2 = 1 ThenEDIT / PS

Comparing results of both my 2 fully functional Systems and Paul’s System with and without the HeuristicsCycle Code above … the results are the same both with and without!

Maybe there could be instances where the HeuristicsCycle Code makes a difference?

Thoughts:

JuanJ noted cross-errors when he tried 2 x Algos together (some time ago) so he kindly provided the HeuristicsCycle Code as a solution.These cross-errors may have been due to the cross-use (between the 2 x Algos) of certain settings due to the missing ‘2’ from certain settings (of Algo2) which I highlighted and corrected in an earlier post.

we do NOT need either lines of code below …

Away from the screen my brain cleared! 🙂

Without the lines of code below, we have nothing that is controlling / defining Algo1 and Algo2 and so the HeuristicsCycle code is not doing anything? (This is why both sets of results are the same!).

So I am now back to my earlier assertion that HeuristicsCycle code is not working for some reason?

If HeuristicsAlgo1 = 1 Then If HeuristicsAlgo2 = 1 ThenFrancesco did it before ….. he had two different results, but without code we don’t know how he did it.

he had two different results, but without code we don’t know how he did it.

Francesco results were before (without JuanJ code) and after (with JunanJ code).

I have my Systems (and Paul’s) working – with the JuanJ Algo1 and Algo2 – but seemingly not using the code below.

HeuristicsCycleLimit = 2 once HeuristicsCycle = 0 once HeuristicsAlgo1 = 1 once HeuristicsAlgo2 = 0 If HeuristicsCycle >= HeuristicsCycleLimit Then If HeuristicsAlgo1 = 1 Then HeuristicsAlgo2 = 1 HeuristicsAlgo1 = 0 ElsIf HeuristicsAlgo2 = 1 Then HeuristicsAlgo1 = 1 HeuristicsAlgo2 = 0 EndIf HeuristicsCycle = 0 EndIf If HeuristicsAlgo1 = 1 ThenIf you remove this part of code, I seem to have understood that the results will not change you …. so there is something else different ….

Either …

- The Cycle code above is not working and therefore achieving no change in the results?

This scenario means that Algo1 and Algo2 are both working at the same time (on the same bar).

OR

2. The Cycle code above is working as designed to do, but the results are the same as without the Cycle code above.

This scenario means that Algo1 and Algo2 are working separately every 2 Cycles (on different bars).

Item 2. is why I think that the Cycle code is not working as the results would not be identical??

Item 2. is why I think that the Cycle code is not working as the results would not be identical as without the Cycle code.

A lot of idea’s but i’am stuck at the moment.

@GraHal, I tried many combinations, but to result. Also tried fifi’s idea.

If someone got it to a working version, then please post the whole code.

If someone got it to a working version, then please post the whole code.

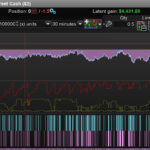

Below is your code working and the results attached … you can see Valuex and ValueY as variables changing … under the equity curve.

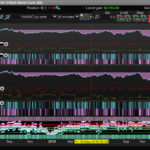

defparam cumulateorders = false defparam preloadbars = 10000 defparam flatbefore = 080000 defparam flatafter = 220000 //period1=7 //period2=14 HeuristicsCycleLimit = 2 once HeuristicsCycle = 0 once HeuristicsAlgo1 = 1 once HeuristicsAlgo2 = 0 If HeuristicsCycle >= HeuristicsCycleLimit Then If HeuristicsAlgo1 = 1 Then HeuristicsAlgo2 = 1 HeuristicsAlgo1 = 0 ElsIf HeuristicsAlgo2 = 1 Then HeuristicsAlgo1 = 1 HeuristicsAlgo2 = 0 EndIf HeuristicsCycle = 0 EndIf // //If HeuristicsAlgo1 = 1 Then //Heuristics Algorithm 1 Start If (onmarket[1] = 1 and onmarket = 0) or (longonmarket[1] = 1 and longonmarket and countoflongshares < countoflongshares[1]) or (longonmarket[1] = 1 and longonmarket and countoflongshares > countoflongshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares < countofshortshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares > countofshortshares[1]) or (longonmarket[1] and shortonmarket) or (shortonmarket[1] and longonmarket) Then optimize = optimize + 1 EndIf StartingValue = 6 ResetPeriod = 3 //Specify no of months after which to reset optimization Increment = 1 MaxIncrement = 7 //Limit of no of increments either up or down Reps = 3 //Number of trades to use for analysis MinValue = 1 //Minimum allowed value MaxValue = 12 //Maximum allowed value If monthinit = 1 or monthinit = 3 or monthinit = 5 or monthinit = 7 or monthinit = 8 or monthinit = 10 or monthinit = 12 Then MonthDays = 31 ElsIf monthinit = 4 or monthinit = 6 or monthinit = 9 or monthinit = 11 Then MonthDays = 30 ElsIf monthinit = 2 Then If (yearinit/4 = round(yearinit/4)) or (yearinit/400 = round(yearinit/400)) Then //haha not sure how exactly to do this MonthDays = 29 //leap year Else MonthDays = 28 EndIf EndIf If (month = monthinit and day = dayinit + ResetPeriod) or (month = monthinit + 1 and (day + (MonthDays - dayinit)) >= ResetPeriod) Then ValueX = StartingValue WinCountB = 0 StratAvgB = 0 BestA = 0 BestB = 0 dayinit = day monthinit = month yearinit = year EndIf once ValueX = StartingValue once PIncPos = 1 //Positive Increment Position once NIncPos = 1 //Neative Increment Position once Optimize = 0 ////Initialize Heuristicks Engine Counter (Must be Incremented at Position Start or Exit) once Mode = 1 //Switches between negative and positive increments //once WinCountB = 3 //Initialize Best Win Count //GRAPH WinCountB coloured (0,0,0) AS "WinCountB" //once StratAvgB = 4353 //Initialize Best Avg Strategy Profit //GRAPH StratAvgB coloured (0,0,0) AS "StratAvgB" If Optimize = Reps Then WinCountA = 0 //Initialize current Win Count StratAvgA = 0 //Initialize current Avg Strategy Profit HeuristicsCycle = HeuristicsCycle + 1 For i = 1 to Reps Do If positionperf(i) > 0 Then WinCountA = WinCountA + 1 //Increment Current WinCount EndIf StratAvgA = StratAvgA + (((PositionPerf(i)*countofposition[i]*100000)*-1)*-1) Next StratAvgA = StratAvgA/Reps //Calculate Current Avg Strategy Profit //Graph (PositionPerf(1)*countofposition[1]*100000)*-1 as "PosPerf1" //Graph (PositionPerf(2)*countofposition[2]*100000)*-1 as "PosPerf2" //Graph StratAvgA*-1 as "StratAvgA" //once BestA = 300 //GRAPH BestA coloured (0,0,0) AS "BestA" If StratAvgA >= StratAvgB Then StratAvgB = StratAvgA //Update Best Strategy Profit BestA = ValueX EndIf //once BestB = 300 //GRAPH BestB coloured (0,0,0) AS "BestB" If WinCountA >= WinCountB Then WinCountB = WinCountA //Update Best Win Count BestB = ValueX EndIf If WinCountA > WinCountB and StratAvgA > StratAvgB Then Mode = 0 ElsIf WinCountA < WinCountB and StratAvgA < StratAvgB and Mode = 1 Then ValueX = ValueX - (Increment*NIncPos) NIncPos = NIncPos + 1 Mode = 2 ElsIf WinCountA >= WinCountB or StratAvgA >= StratAvgB and Mode = 1 Then ValueX = ValueX + (Increment*PIncPos) PIncPos = PIncPos + 1 Mode = 1 ElsIf WinCountA < WinCountB and StratAvgA < StratAvgB and Mode = 2 Then ValueX = ValueX + (Increment*PIncPos) PIncPos = PIncPos + 1 Mode = 1 ElsIf WinCountA >= WinCountB or StratAvgA >= StratAvgB and Mode = 2 Then ValueX = ValueX - (Increment*NIncPos) NIncPos = NIncPos + 1 Mode = 2 EndIf If NIncPos > MaxIncrement or PIncPos > MaxIncrement Then If BestA = BestB Then ValueX = BestA Else If reps >= 10 Then WeightedScore = 10 Else WeightedScore = round((reps/100)*100) EndIf ValueX = round(((BestA*(20-WeightedScore)) + (BestB*WeightedScore))/20) //Lower Reps = Less weight assigned to Win% EndIf NIncPos = 1 PIncPos = 1 ElsIf ValueX > MaxValue Then ValueX = MaxValue ElsIf ValueX < MinValue Then ValueX = MinValue EndIF Optimize = 0 EndIf // Heuristics Algorithm 1 End //ElsIf HeuristicsAlgo2 = 1 Then //Heuristics Algorithm 2 Start If (onmarket[1] = 1 and onmarket = 0) or (longonmarket[1] = 1 and longonmarket and countoflongshares < countoflongshares[1]) or (longonmarket[1] = 1 and longonmarket and countoflongshares > countoflongshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares < countofshortshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares > countofshortshares[1]) or (longonmarket[1] and shortonmarket) or (shortonmarket[1] and longonmarket) Then optimize2 = optimize2 + 1 EndIf StartingValue2 = 16 ResetPeriod2 = 3 //Specify no of months after which to reset optimization Increment2 = 1 MaxIncrement2 = 7 //Limit of no of increments either up or down Reps2 = 3 //Number of trades to use for analysis MinValue2 = 14 //Minimum allowed value MaxValue2 = 28 //Maximum allowed value If monthinit2 = 1 or monthinit2 = 3 or monthinit2 = 5 or monthinit2 = 7 or monthinit2 = 8 or monthinit2 = 10 or monthinit2 = 12 Then MonthDays2 = 31 ElsIf monthinit2 = 4 or monthinit2 = 6 or monthinit2 = 9 or monthinit2 = 11 Then MonthDays2 = 30 ElsIf monthinit2 = 2 Then If (yearinit2/4 = round(yearinit2/4)) or (yearinit2/400 = round(yearinit2/400)) Then //haha not sure how exactly to do this MonthDays2 = 29 //leap year Else MonthDays2 = 28 EndIf EndIf If (month = monthinit2 and day = dayinit2 + ResetPeriod2) or (month = monthinit2 + 1 and (day + (MonthDays2 - dayinit2)) >= ResetPeriod2) Then ValueY = StartingValue2 WinCountB2 = 0 StratAvgB2 = 0 BestA2 = 0 BestB2 = 0 dayinit2 = day monthinit2 = month yearinit2 = year EndIf once ValueY = StartingValue2 once PIncPos2 = 1 //Positive Increment Position once NIncPos2 = 1 //Neative Increment Position once Optimize2 = 0 ////Initialize Heuristicks Engine Counter (Must be Incremented at Position Start or Exit) once Mode2 = 1 //Switches between negative and positive increments //once WinCountB2 = 3 //Initialize Best Win Count //GRAPH WinCountB2 coloured (0,0,0) AS "WinCountB2" //once StratAvgB2 = 4353 //Initialize Best Avg Strategy Profit //GRAPH StratAvgB2 coloured (0,0,0) AS "StratAvgB2" If Optimize2 = Reps2 Then WinCountA2 = 0 //Initialize current Win Count StratAvgA2 = 0 //Initialize current Avg Strategy Profit HeuristicsCycle = HeuristicsCycle + 1 For i2 = 1 to Reps2 Do If positionperf(i) > 0 Then WinCountA2 = WinCountA2 + 1 //Increment Current WinCount EndIf StratAvgA2 = StratAvgA2 + (((PositionPerf(i)*countofposition[i]*100000)*-1)*-1) Next StratAvgA2 = StratAvgA2/Reps2 //Calculate Current Avg Strategy Profit //Graph (PositionPerf(1)*countofposition[1]*100000)*-1 as "PosPerf1-2" //Graph (PositionPerf(2)*countofposition[2]*100000)*-1 as "PosPerf2-2" //Graph StratAvgA2*-1 as "StratAvgA2" //once BestA2 = 300 //GRAPH BestA2 coloured (0,0,0) AS "BestA2" If StratAvgA2 >= StratAvgB2 Then StratAvgB2 = StratAvgA2 //Update Best Strategy Profit BestA2 = ValueY EndIf //once BestB2 = 300 //GRAPH BestB2 coloured (0,0,0) AS "BestB2" If WinCountA2 >= WinCountB2 Then WinCountB2 = WinCountA2 //Update Best Win Count BestB2 = ValueY EndIf If WinCountA2 > WinCountB2 and StratAvgA2 > StratAvgB2 Then Mode = 0 ElsIf WinCountA2 < WinCountB2 and StratAvgA2 < StratAvgB2 and Mode2 = 1 Then ValueY = ValueY - (Increment2*NIncPos2) NIncPos2 = NIncPos2 + 1 Mode2 = 2 ElsIf WinCountA2 >= WinCountB2 or StratAvgA2 >= StratAvgB2 and Mode2 = 1 Then ValueY = ValueY + (Increment2*PIncPos2) PIncPos2 = PIncPos2 + 1 Mode = 1 ElsIf WinCountA2 < WinCountB2 and StratAvgA2 < StratAvgB2 and Mode2 = 2 Then ValueY = ValueY + (Increment2*PIncPos2) PIncPos2 = PIncPos2 + 1 Mode2 = 1 ElsIf WinCountA2 >= WinCountB2 or StratAvgA2 >= StratAvgB2 and Mode2 = 2 Then ValueY = ValueY - (Increment2*NIncPos2) NIncPos2 = NIncPos2 + 1 Mode2 = 2 EndIf If NIncPos2 > MaxIncrement2 or PIncPos2 > MaxIncrement2 Then If BestA2 = BestB2 Then ValueY = BestA Else If reps2 >= 10 Then WeightedScore2 = 10 Else WeightedScore2 = round((reps2/100)*100) EndIf ValueY = round(((BestA2*(20-WeightedScore2)) + (BestB2*WeightedScore2))/20) //Lower Reps = Less weight assigned to Win% EndIf NIncPos2 = 1 PIncPos2 = 1 ElsIf ValueY > MaxValue2 Then ValueY = MaxValue2 ElsIf ValueY < MinValue2 Then ValueY = MinValue2 EndIF Optimize2 = 0 EndIf // Heuristics Algorithm 2 End //EndIf c1=average[valuex](close) c2=average[valuey](close) // condbuy =c1 crosses over c2 and rsi[14](close)<70 condsell=c1 crosses under c2 and rsi[14](close)>30 // if condbuy then buy at market endif if condsell then sellshort at market endif pp=positionperf(0)*100 if pp<-0.125 then sell at market exitshort at market endif set stop %loss 0.5 // exit sooner on performance criteria above set target %profit 0.25 graph valuex coloured(121,141,35,255) as "fastperiod1" graph valuey coloured(255,0,0,255) as "slowperiod" //endif //endif GRAPH HeuristicsAlgo1 coloured(121,141,35,255) //GRAPH HeuristicsAlgo2 coloured(255,0,0,255)Paul thanked this postAnd here is Paul’s code with the HeuristicsCycle all Rem’d out … results on the top equity curve.

Notice the top equity curve (rem’d out HeuristicsCycle code) results are the same bottom equity curve (included HeuristicsCycle code ). Note: included = opposite of rem’d out.

defparam cumulateorders = false defparam preloadbars = 10000 defparam flatbefore = 080000 defparam flatafter = 220000 //period1=7 //period2=14 //HeuristicsCycleLimit = 2 //once HeuristicsCycle = 0 //once HeuristicsAlgo1 = 1 //once HeuristicsAlgo2 = 0 //If HeuristicsCycle >= HeuristicsCycleLimit Then //If HeuristicsAlgo1 = 1 Then //HeuristicsAlgo2 = 1 //HeuristicsAlgo1 = 0 //ElsIf HeuristicsAlgo2 = 1 Then //HeuristicsAlgo1 = 1 //HeuristicsAlgo2 = 0 //EndIf //HeuristicsCycle = 0 //EndIf //// //If HeuristicsAlgo1 = 1 Then //Heuristics Algorithm 1 Start If (onmarket[1] = 1 and onmarket = 0) or (longonmarket[1] = 1 and longonmarket and countoflongshares < countoflongshares[1]) or (longonmarket[1] = 1 and longonmarket and countoflongshares > countoflongshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares < countofshortshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares > countofshortshares[1]) or (longonmarket[1] and shortonmarket) or (shortonmarket[1] and longonmarket) Then optimize = optimize + 1 EndIf StartingValue = 6 ResetPeriod = 3 //Specify no of months after which to reset optimization Increment = 1 MaxIncrement = 7 //Limit of no of increments either up or down Reps = 3 //Number of trades to use for analysis MinValue = 1 //Minimum allowed value MaxValue = 12 //Maximum allowed value If monthinit = 1 or monthinit = 3 or monthinit = 5 or monthinit = 7 or monthinit = 8 or monthinit = 10 or monthinit = 12 Then MonthDays = 31 ElsIf monthinit = 4 or monthinit = 6 or monthinit = 9 or monthinit = 11 Then MonthDays = 30 ElsIf monthinit = 2 Then If (yearinit/4 = round(yearinit/4)) or (yearinit/400 = round(yearinit/400)) Then //haha not sure how exactly to do this MonthDays = 29 //leap year Else MonthDays = 28 EndIf EndIf If (month = monthinit and day = dayinit + ResetPeriod) or (month = monthinit + 1 and (day + (MonthDays - dayinit)) >= ResetPeriod) Then ValueX = StartingValue WinCountB = 0 StratAvgB = 0 BestA = 0 BestB = 0 dayinit = day monthinit = month yearinit = year EndIf once ValueX = StartingValue once PIncPos = 1 //Positive Increment Position once NIncPos = 1 //Neative Increment Position once Optimize = 0 ////Initialize Heuristicks Engine Counter (Must be Incremented at Position Start or Exit) once Mode = 1 //Switches between negative and positive increments //once WinCountB = 3 //Initialize Best Win Count //GRAPH WinCountB coloured (0,0,0) AS "WinCountB" //once StratAvgB = 4353 //Initialize Best Avg Strategy Profit //GRAPH StratAvgB coloured (0,0,0) AS "StratAvgB" If Optimize = Reps Then WinCountA = 0 //Initialize current Win Count StratAvgA = 0 //Initialize current Avg Strategy Profit HeuristicsCycle = HeuristicsCycle + 1 For i = 1 to Reps Do If positionperf(i) > 0 Then WinCountA = WinCountA + 1 //Increment Current WinCount EndIf StratAvgA = StratAvgA + (((PositionPerf(i)*countofposition[i]*100000)*-1)*-1) Next StratAvgA = StratAvgA/Reps //Calculate Current Avg Strategy Profit //Graph (PositionPerf(1)*countofposition[1]*100000)*-1 as "PosPerf1" //Graph (PositionPerf(2)*countofposition[2]*100000)*-1 as "PosPerf2" //Graph StratAvgA*-1 as "StratAvgA" //once BestA = 300 //GRAPH BestA coloured (0,0,0) AS "BestA" If StratAvgA >= StratAvgB Then StratAvgB = StratAvgA //Update Best Strategy Profit BestA = ValueX EndIf //once BestB = 300 //GRAPH BestB coloured (0,0,0) AS "BestB" If WinCountA >= WinCountB Then WinCountB = WinCountA //Update Best Win Count BestB = ValueX EndIf If WinCountA > WinCountB and StratAvgA > StratAvgB Then Mode = 0 ElsIf WinCountA < WinCountB and StratAvgA < StratAvgB and Mode = 1 Then ValueX = ValueX - (Increment*NIncPos) NIncPos = NIncPos + 1 Mode = 2 ElsIf WinCountA >= WinCountB or StratAvgA >= StratAvgB and Mode = 1 Then ValueX = ValueX + (Increment*PIncPos) PIncPos = PIncPos + 1 Mode = 1 ElsIf WinCountA < WinCountB and StratAvgA < StratAvgB and Mode = 2 Then ValueX = ValueX + (Increment*PIncPos) PIncPos = PIncPos + 1 Mode = 1 ElsIf WinCountA >= WinCountB or StratAvgA >= StratAvgB and Mode = 2 Then ValueX = ValueX - (Increment*NIncPos) NIncPos = NIncPos + 1 Mode = 2 EndIf If NIncPos > MaxIncrement or PIncPos > MaxIncrement Then If BestA = BestB Then ValueX = BestA Else If reps >= 10 Then WeightedScore = 10 Else WeightedScore = round((reps/100)*100) EndIf ValueX = round(((BestA*(20-WeightedScore)) + (BestB*WeightedScore))/20) //Lower Reps = Less weight assigned to Win% EndIf NIncPos = 1 PIncPos = 1 ElsIf ValueX > MaxValue Then ValueX = MaxValue ElsIf ValueX < MinValue Then ValueX = MinValue EndIF Optimize = 0 EndIf // Heuristics Algorithm 1 End //ElsIf HeuristicsAlgo2 = 1 Then //Heuristics Algorithm 2 Start If (onmarket[1] = 1 and onmarket = 0) or (longonmarket[1] = 1 and longonmarket and countoflongshares < countoflongshares[1]) or (longonmarket[1] = 1 and longonmarket and countoflongshares > countoflongshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares < countofshortshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares > countofshortshares[1]) or (longonmarket[1] and shortonmarket) or (shortonmarket[1] and longonmarket) Then optimize2 = optimize2 + 1 EndIf StartingValue2 = 16 ResetPeriod2 = 3 //Specify no of months after which to reset optimization Increment2 = 1 MaxIncrement2 = 7 //Limit of no of increments either up or down Reps2 = 3 //Number of trades to use for analysis MinValue2 = 14 //Minimum allowed value MaxValue2 = 28 //Maximum allowed value If monthinit2 = 1 or monthinit2 = 3 or monthinit2 = 5 or monthinit2 = 7 or monthinit2 = 8 or monthinit2 = 10 or monthinit2 = 12 Then MonthDays2 = 31 ElsIf monthinit2 = 4 or monthinit2 = 6 or monthinit2 = 9 or monthinit2 = 11 Then MonthDays2 = 30 ElsIf monthinit2 = 2 Then If (yearinit2/4 = round(yearinit2/4)) or (yearinit2/400 = round(yearinit2/400)) Then //haha not sure how exactly to do this MonthDays2 = 29 //leap year Else MonthDays2 = 28 EndIf EndIf If (month = monthinit2 and day = dayinit2 + ResetPeriod2) or (month = monthinit2 + 1 and (day + (MonthDays2 - dayinit2)) >= ResetPeriod2) Then ValueY = StartingValue2 WinCountB2 = 0 StratAvgB2 = 0 BestA2 = 0 BestB2 = 0 dayinit2 = day monthinit2 = month yearinit2 = year EndIf once ValueY = StartingValue2 once PIncPos2 = 1 //Positive Increment Position once NIncPos2 = 1 //Neative Increment Position once Optimize2 = 0 ////Initialize Heuristicks Engine Counter (Must be Incremented at Position Start or Exit) once Mode2 = 1 //Switches between negative and positive increments //once WinCountB2 = 3 //Initialize Best Win Count //GRAPH WinCountB2 coloured (0,0,0) AS "WinCountB2" //once StratAvgB2 = 4353 //Initialize Best Avg Strategy Profit //GRAPH StratAvgB2 coloured (0,0,0) AS "StratAvgB2" If Optimize2 = Reps2 Then WinCountA2 = 0 //Initialize current Win Count StratAvgA2 = 0 //Initialize current Avg Strategy Profit HeuristicsCycle = HeuristicsCycle + 1 For i2 = 1 to Reps2 Do If positionperf(i) > 0 Then WinCountA2 = WinCountA2 + 1 //Increment Current WinCount EndIf StratAvgA2 = StratAvgA2 + (((PositionPerf(i)*countofposition[i]*100000)*-1)*-1) Next StratAvgA2 = StratAvgA2/Reps2 //Calculate Current Avg Strategy Profit //Graph (PositionPerf(1)*countofposition[1]*100000)*-1 as "PosPerf1-2" //Graph (PositionPerf(2)*countofposition[2]*100000)*-1 as "PosPerf2-2" //Graph StratAvgA2*-1 as "StratAvgA2" //once BestA2 = 300 //GRAPH BestA2 coloured (0,0,0) AS "BestA2" If StratAvgA2 >= StratAvgB2 Then StratAvgB2 = StratAvgA2 //Update Best Strategy Profit BestA2 = ValueY EndIf //once BestB2 = 300 //GRAPH BestB2 coloured (0,0,0) AS "BestB2" If WinCountA2 >= WinCountB2 Then WinCountB2 = WinCountA2 //Update Best Win Count BestB2 = ValueY EndIf If WinCountA2 > WinCountB2 and StratAvgA2 > StratAvgB2 Then Mode = 0 ElsIf WinCountA2 < WinCountB2 and StratAvgA2 < StratAvgB2 and Mode2 = 1 Then ValueY = ValueY - (Increment2*NIncPos2) NIncPos2 = NIncPos2 + 1 Mode2 = 2 ElsIf WinCountA2 >= WinCountB2 or StratAvgA2 >= StratAvgB2 and Mode2 = 1 Then ValueY = ValueY + (Increment2*PIncPos2) PIncPos2 = PIncPos2 + 1 Mode = 1 ElsIf WinCountA2 < WinCountB2 and StratAvgA2 < StratAvgB2 and Mode2 = 2 Then ValueY = ValueY + (Increment2*PIncPos2) PIncPos2 = PIncPos2 + 1 Mode2 = 1 ElsIf WinCountA2 >= WinCountB2 or StratAvgA2 >= StratAvgB2 and Mode2 = 2 Then ValueY = ValueY - (Increment2*NIncPos2) NIncPos2 = NIncPos2 + 1 Mode2 = 2 EndIf If NIncPos2 > MaxIncrement2 or PIncPos2 > MaxIncrement2 Then If BestA2 = BestB2 Then ValueY = BestA Else If reps2 >= 10 Then WeightedScore2 = 10 Else WeightedScore2 = round((reps2/100)*100) EndIf ValueY = round(((BestA2*(20-WeightedScore2)) + (BestB2*WeightedScore2))/20) //Lower Reps = Less weight assigned to Win% EndIf NIncPos2 = 1 PIncPos2 = 1 ElsIf ValueY > MaxValue2 Then ValueY = MaxValue2 ElsIf ValueY < MinValue2 Then ValueY = MinValue2 EndIF Optimize2 = 0 EndIf // Heuristics Algorithm 2 End //EndIf c1=average[valuex](close) c2=average[valuey](close) // condbuy =c1 crosses over c2 and rsi[14](close)<70 condsell=c1 crosses under c2 and rsi[14](close)>30 // if condbuy then buy at market endif if condsell then sellshort at market endif pp=positionperf(0)*100 if pp<-0.125 then sell at market exitshort at market endif set stop %loss 0.5 // exit sooner on performance criteria above set target %profit 0.25 graph valuex coloured(121,141,35,255) as "fastperiod1" graph valuey coloured(255,0,0,255) as "slowperiod" //endif //endif //GRAPH HeuristicsAlgo1 coloured(121,141,35,255) //GRAPH HeuristicsAlgo2 coloured(255,0,0,255) //endifPaul thanked this post -

AuthorPosts

- You must be logged in to reply to this topic.

Machine Learning in ProOrder ProRealTime

ProOrder: Automated Strategies & Backtesting

Summary

This topic contains 454 replies,

has 32 voices, and was last updated by Khaled

4 years, 1 month ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 08/06/2017 |

| Status: | Active |

| Attachments: | 207 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.