Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Screener breakout swing tie highs and lows in 1 min

- Forums

- ProRealTime English Forum

- ProScreener: Market Scanners & Detection

- Screener breakout swing tie highs and lows in 1 min

-

AuthorPosts

-

the below version checks if there is at least 1 bar between 2 points.

defparam drawonlastbaronly=false if day<>day[1] or intradaybarindex=0 then unset($peak) unset($peakbar) unset($trough) unset($troughbar) i=0 j=0 endif Peak1 = (high[3] >= high[4]) AND (high[3] > high[5]) AND (high[3] > high[6]) Peak2 = (high[3] >= high[2]) AND (high[3] > high[1]) AND (high[3] > high[0]) Peak = Peak1 AND Peak2 if peak then // drawpoint(barindex[3],high[3],2) coloured("cyan") $peak[i]=high[3] $peakbar[i]=barindex[3] i=i+1 endif Trough1 = (low[3] <= low[4]) AND (low[3] < low[5]) AND (low[3] < low[6]) Trough2 = (low[3] <= low[2]) AND (low[3] < low[1]) AND (low[3] < low[0]) Trough = Trough1 AND Trough2 if Trough then //drawpoint(barindex[3],low[3],2) coloured("crimson") $trough[j]=low[3] $troughbar[j]=barindex[3] j=j+1 endif if islastbarupdate then if i>0 then hhcount=0 for k = 0 to i-1 do drawpoint($peakbar[k], $peak[k],2) coloured("cyan") for l = 0 to i-1 do if $peakbar[l]<>$peakbar[k] and abs($peakbar[l]-$peakbar[k])>1 then diff = abs(round($peak[l],2) - round($peak[k],2)) if diff = 0 then //equal price //find breakout period = max(2,max($peakbar[l],$peakbar[k]) - min($peakbar[l],$peakbar[k])) decay = max(1,barindex-max($peakbar[l],$peakbar[k])) hh = highest[period](high)[decay] if hh<=max($peak[l],$peak[k]) then //no breakout at that time drawsegment($peakbar[l],$peak[l], $peakbar[k], $peak[k]) coloured("cyan") currPeriod = max(2,barindex-max($peakbar[l],$peakbar[k])) currHH = highest[max(1,currPeriod)](high) //test if no broken since (real time) if currHH<=max($peak[l],$peak[k]) then //no breakout since drawsegment($peakbar[l],$peak[l], barindex, $peak[l]) coloured("cyan") style(dottedline4) //drawtext("!",$peakbar[l],$peak[l]+averagetruerange[14], dialog,bold, 22) hhcount=hhcount+1 endif endif endif endif next next endif if j>0 then llcount=0 for k = 0 to j-1 do drawpoint($troughbar[k], $trough[k],2) coloured("crimson") for l = 0 to i-1 do if $troughbar[l]<>$troughbar[k] and abs($troughbar[l]-$troughbar[k])>1 then diff = abs(round($trough[l],2) - round($trough[k],2)) if diff = 0 then //equal price //find breakout period = max(2,max($troughbar[l],$troughbar[k]) - min($troughbar[l],$troughbar[k])) decay = max(1,barindex-max($troughbar[l],$troughbar[k])) ll = lowest[period](low)[decay] if ll>=min($trough[l],$trough[k]) then //no breakout at that time drawsegment($troughbar[l],$trough[l], $troughbar[k], $trough[k]) coloured("crimson") currPeriod = max(2,barindex-max($peakbar[l],$peakbar[k])) currLL = lowest[currPeriod](low) //test if no broken since (real time) if currLL>=min($trough[l],$trough[k]) then //no breakout since drawsegment($troughbar[l],$trough[l], barindex, $trough[l]) coloured("crimson") style(dottedline4) llcount=llcount+1 endif endif endif endif next next endif endif return hhcount as "unbroken highs count", llcount as "unbroken lows count"yes, it work perfectly

on some stock i have noticed the same eror appeas. I have attached screenshot

Besides that, I think there is nothing to add more

This is an internal platform error I can’t get rid off. I made a ticket for this, waiting for reply.

Thanks for this work

Yea, that is rare, and i have noticed that it’s on ticker with lov volume, where charts choppy

Hi Nicolas,

I have a question about turning indicator into a ProScreener

The problem I ran into:

- indicator implementation relies on arrays like

$peak[],$peakbar[],$trough[],$troughbar[]and nested loops over all stored swings to find all equal‑price pairs and check whether they were broken or not. but ProScreener does not seem to accept array variables with$or theUNSETinstruction at all. - When I try to adapt the indicator code directly (with

$peak,$trough, etc.) into a ProScreener, the editor throws syntax errors (“unauthorized character / missing parenthesis”) exactly on the lines where$arrays orUNSET $peakare used. So I cannot reproduce the same “store all swings and compare every swing with every other swing” logic inside ProScreener. - I tried to rewrite the logic without arrays (only simple variables), but then I can only work with the last one or two swings, not with all swings of the day, so the screener no longer matches the indicator’s behaviour and misses many valid equal‑high/low levels.

Do you have anny sugestions? thanks in advance

Try the attached screener, it uses CALL instruction of the indicator. Not tested.

I didn’t know that was possible, but it seems to work great.

Thank you very much

Great to know. Is it possible to post some examples of successful found of the screener?

Also, how do you use those detection in trading? Waiting for breakouts? Only in stocks market? Thanks for sharing.

Sure.

For now, it’s only for stocks — I plan to try it on crypto later. The logic will need to be adjusted since some coins can have very low prices (for example, 0.00032).

Previously, the screener was returning too many results, mostly from choppy charts. So, I added filters to exclude stocks with a small 1‑minute range, less than 1M volume, or a price under $1.

I also changed the alert condition — now it triggers only when the current price actually touches equal swing highs or lows.

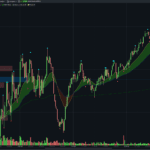

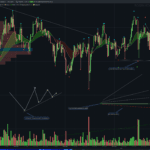

Today’s NFLX example after hours is when it triggered and i dont have more screenshot as market is closed.

I use this for breakouts when the right chart pattern is here.

One good example of such breakout today also was on NFLX

( atached both screensshots)

Thanks, that’s very interesting. I found an error in the swing detection on neighboring candles. I’ll post the fix soon. It would be great if you could share the screener code with the filters you mentioned; thanks for the feedback. Have a good weekend.

yea, i believe it wil not detect 100% correct all the time, but at least 9/10 is still would be great.

Have a great weekend too!

Code for screener:

// === Equal Swings Touch Screener with Range Filter (4 return values) === // 1) Call indicator (returns 4 values) hcount, lcount, hhprice, llprice = CALL "PRC_equal swings Hi&Lo" // 2) Price touching equal-high or equal-low level tolerance = close * 0.001 // 0.1% of price, adjust if needed touchHigh = (hcount > 0) AND (ABS(close - hhprice) <= tolerance) touchLow = (lcount > 0) AND (ABS(close - llprice) <= tolerance) // 3) Basic filters: price and volume priceFilter = close > 1 todayVol = 0 IF day = day[1] THEN FOR i = 0 TO intradaybarindex DO todayVol = todayVol + volume[i] NEXT ENDIF volumeFilter = todayVol > 1000000 // > 1M shares today // 4) Range filter to avoid messy low-range charts avgRange = 0 maxRange = 0 IF day = day[1] THEN FOR i = 0 TO intradaybarindex DO r = high[i] - low[i] avgRange = avgRange + r IF r > maxRange THEN maxRange = r ENDIF NEXT IF intradaybarindex >= 0 THEN avgRange = avgRange / (intradaybarindex + 1) ENDIF ENDIF minAvgRange = 0.03 // average 1-min range at least 3 cents minMaxRange = 0.10 // at least one 1-min candle with >= 10 cents range rangeFilter = (avgRange >= minAvgRange) AND (maxRange >= minMaxRange) // 5) Final condition cond = (touchHigh OR touchLow) AND priceFilter AND volumeFilter AND rangeFilter SCREENER[cond](hcount AS "EqHighs", lcount AS "EqLows")Nicolas thanked this postThanks for the screener code, but it will not work without your modifications of the indicator. I see you added the swings high and low. But, is it the nearest ones? Because there can be many unbroken swings given by the indicator and the last one found by the loop could no be that nearest, but the last found.

I’m not sure if this the nearest one or not. because i have finished at friday just before market close, and not testet this on a lot of charts. will need to figure this out, when market open.

Code for indicator

defparam drawonlastbaronly = false IF day <> day[1] OR intradaybarindex = 0 THEN UNSET($peak) UNSET($peakbar) UNSET($trough) UNSET($troughbar) i = 0 j = 0 hhprice = 0 llprice = 0 ENDIF Peak1 = (high[3] >= high[4]) AND (high[3] > high[5]) AND (high[3] > high[6]) Peak2 = (high[3] >= high[2]) AND (high[3] > high[1]) AND (high[3] > high[0]) Peak = Peak1 AND Peak2 IF Peak THEN $peak[i] = high[3] $peakbar[i] = barindex[3] i = i + 1 ENDIF Trough1 = (low[3] <= low[4]) AND (low[3] < low[5]) AND (low[3] < low[6]) Trough2 = (low[3] <= low[2]) AND (low[3] < low[1]) AND (low[3] < low[0]) Trough = Trough1 AND Trough2 IF Trough THEN $trough[j] = low[3] $troughbar[j] = barindex[3] j = j + 1 ENDIF IF islastbarupdate THEN // ------- HIGHS ------- IF i > 0 THEN hhcount = 0 FOR k = 0 TO i - 1 DO drawpoint($peakbar[k], $peak[k], 2) coloured("cyan") FOR l = 0 TO i - 1 DO IF $peakbar[l] <> $peakbar[k] AND ABS($peakbar[l] - $peakbar[k]) > 1 THEN diff = ABS(ROUND($peak[l], 2) - ROUND($peak[k], 2)) IF diff = 0 THEN // equal price // find breakout period = MAX(2, MAX($peakbar[l], $peakbar[k]) - MIN($peakbar[l], $peakbar[k])) decay = MAX(1, barindex - MAX($peakbar[l], $peakbar[k])) hh = highest[period](high)[decay] IF hh <= MAX($peak[l], $peak[k]) THEN // no breakout at that time drawsegment($peakbar[l], $peak[l], $peakbar[k], $peak[k]) coloured("cyan") currPeriod = MAX(2, barindex - MAX($peakbar[l], $peakbar[k])) currHH = highest[MAX(1, currPeriod)](high) // test if no broken since (real time) IF currHH <= MAX($peak[l], $peak[k]) THEN // no breakout since drawsegment($peakbar[l], $peak[l], barindex, $peak[l]) coloured("cyan") style(dottedline4) hhcount = hhcount + 1 // store price of this unbroken equal high level hhprice = MAX($peak[l], $peak[k]) ENDIF ENDIF ENDIF ENDIF NEXT NEXT ENDIF // ------- LOWS ------- IF j > 0 THEN llcount = 0 FOR k = 0 TO j - 1 DO drawpoint($troughbar[k], $trough[k], 2) coloured("crimson") FOR l = 0 TO j - 1 DO IF $troughbar[l] <> $troughbar[k] AND ABS($troughbar[l] - $troughbar[k]) > 1 THEN diff = ABS(ROUND($trough[l], 2) - ROUND($trough[k], 2)) IF diff = 0 THEN // equal price // find breakout period = MAX(2, MAX($troughbar[l], $troughbar[k]) - MIN($troughbar[l], $troughbar[k])) decay = MAX(1, barindex - MAX($troughbar[l], $troughbar[k])) ll = lowest[period](low)[decay] IF ll >= MIN($trough[l], $trough[k]) THEN // no breakout at that time drawsegment($troughbar[l], $trough[l], $troughbar[k], $trough[k]) coloured("crimson") currPeriod = MAX(2, barindex - MAX($troughbar[l], $troughbar[k])) currLL = lowest[currPeriod](low) // test if no broken since (real time) IF currLL >= MIN($trough[l], $trough[k]) THEN // no breakout since drawsegment($troughbar[l], $trough[l], barindex, $trough[l]) coloured("crimson") style(dottedline4) llcount = llcount + 1 // store price of this unbroken equal low level llprice = MIN($trough[l], $trough[k]) ENDIF ENDIF ENDIF ENDIF NEXT NEXT ENDIF ENDIF RETURN hhcount AS "unbroken highs count", llcount AS "unbroken lows count", hhprice AS "high level", llprice AS "low level"That’s what I thought. hhprice and llprice are the last unbroken levels tested in the loop, it takes the swings one by one to build the levels, It means that they can be far away from the current price and you will miss some breakout. Just add a test in the loop to return the nearest ones found from the current price, so that your screener condition that test only this given levels is more accurate.

I had no idea, possilbly would have noticed it a lot later. Thank you again. I would want to ask you about a little new screener is that possible to create here or not. it’s like breakout screener that we made, but a little more nuanced I believe

So goal is : to find with screener which stock have linear 3 and more swing lows.

– Identify low swings (which we can already do with current indicator)

- identify 3 swings low betweeen which it’s possible to draw trendline that will group them ( so bassicaly draw trendline)

- the lows must not be ideally touch trendline – (there can be some threshold (more likely in % terms)

- trend line must from horizontal or upward ( not decline) so in other words, 1 swung low from which trendline starts must be the lowest point.

- 3 swing must be formed below 50ema (on my chart is blue line) ( so I hope this will exclude this almost vertical upward trendline)

Give stocks on which there are such trendline.

Will send screenshots

- indicator implementation relies on arrays like

-

AuthorPosts

- You must be logged in to reply to this topic.

Screener breakout swing tie highs and lows in 1 min

ProScreener: Market Scanners & Detection

Summary

This topic contains 30 replies,

has 3 voices, and was last updated by ![]() Nicolas

Nicolas

9 hours, 20 minutes ago.

Topic Details

| Forum: | ProScreener: Market Scanners & Detection |

| Language: | English |

| Started: | 10/15/2025 |

| Status: | Active |

| Attachments: | 38 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.