Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Grid orders with one combined stop loss and limit, can it be done?

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Grid orders with one combined stop loss and limit, can it be done?

-

AuthorPosts

-

HA indicator incoming

//Heikin-Ashi xClose = (Open+High+Low+Close)/4 if(barindex>2) then xOpen = (xOpen[1] + xClose[1])/2 endif changeToGreencandle = xClose>xOpen AND xClose[1]<xOpen[1] ChangeToRedcandle = xClose<xOpen AND xClose[1]>xOpen[1] Greencandle=xclose>xopen redcandle=xclose<xopen If changeToGreencandle then Indicator1=1 elsif greencandle then indicator1=0.5 Else Indicator1=0 Endif If ChangeToRedcandle then Indicator22=-1 elsif redcandle then indicator22=-0.5 Else Indicator22=0 Endif Return indicator1 COLOURED(0,255,0) as "Buy", indicator22 COLOURED(255,0,0) as "Sell"🙂

Raul Vg thanked this postGood afternoon, I’m a beginner.

Could someone put the final system? It seems interesting. Thank youHi Iramirez and welcome to the thread 🙂

There is no final version yet since the system is still under developement but the current verions is on the previous page;

Grid orders with one combined stop loss and limit, can it be done?

I don’t recommend this system for beginners but everyone is free to use it but make sure you do your homework on it and pay attention to if cumulative orders are allowed or not.

For all other followers I’m currently working on an alternate entry method and possibly another CTFTA indicator to facilitate setting alerts for setups.

Hey fellows,

It’s been quite a while since the last update here. I have been working on an alternate entry and exit version of the strategy which is better suited for the low volatility and slow markets we have been seeing for the most part of the last few months. This version is aiming at getting 25-100 pips per trade so we still need to catch a decent move but often we will get out quickly with a very small loss, since the entry signal is Heiken Ashi changing color we need to run it on a higher TF than the other verions of the system, I have focused on M15 mainly but it can be run on M5 or H1 as well. The entry filter is directional movement (25) and ADX (25), these values are discretionary depending on the TF.

However I only run it when I can keep an eye on the markets the market can travel many pips the wrong way in 15 mins, hence I also recommend turning off cumulative orders or set a low amount of maximum entries to 3 or 5.

In order for it to work you will need the below HA Change indicator (a modified version of the one Kasper provided);

//Heikin-Ashi xClose = (Open+High+Low+Close)/4 if(barindex>2) then xOpen = (xOpen[1] + xClose[1])/2 endif changeToGreencandle = xClose>xOpen AND xClose[1]<xOpen[1] ChangeToRedcandle = xClose<xOpen AND xClose[1]>xOpen[1] Greencandle=xclose>xopen redcandle=xclose<xopen If changeToGreencandle then Indicator1=1 elsif greencandle then indicator1=0.5 elsif Changetoredcandle then indicator1=-1 elsif redcandle then indicator1=-0.5 Else Indicator1=0 Endif Return indicator1Long;

/// Definition of code parameters defparam preloadbars =10000 DEFPARAM CumulateOrders = true // Cumulating positions deactivated AAA= ADX [25] DIM= DI[25] HAC= call "HA Change" once RRreached = 0 accountbalance = 10000 //account balance in money at strategy start riskpercent = 1 //whole account risk in percent% amount = 1 //lot amount to open each trade rr = 1 //risk reward ratio (set to 0 disable this function) sd = 0.25 //standard deviation of MA floating profit //dynamic step grid minSTEP = 5 //minimal step of the grid maxSTEP = 30 //maximal step of the grid ATRcurrentPeriod = 150 //recent volatility 'instant' period ATRhistoPeriod = 3000 //historical volatility period ATR = averagetruerange[ATRcurrentPeriod] histoATR= highest[ATRhistoPeriod](ATR) resultMAX = MAX(minSTEP*pipsize,histoATR - ATR) resultMIN = MIN(resultMAX,maxSTEP*pipsize) gridstep = (resultMIN) // Conditions to enter long positions c1 = (AAA > 10) c2 = (DIM > 0) c3 = (HAC = 1) //first trade whatever condition, for one cycle only add "AND STRATEGYPROFIT=0" on line 39. if NOT ONMARKET AND (c1)=1 AND (c2)=1 AND (c3)=1 AND close>close[1] then BUY amount LOT AT MARKET endif // case BUY - add orders on the same trend if longonmarket and close-tradeprice(1)>=gridstep then BUY amount LOT AT MARKET endif //money management liveaccountbalance = accountbalance+strategyprofit moneyrisk = (liveaccountbalance*(riskpercent/100)) if onmarket then onepointvaluebasket = pointvalue*countofposition mindistancetoclose =(moneyrisk/onepointvaluebasket)*pipsize endif //floating profit floatingprofit = (((close-positionprice)*pointvalue)*countofposition)/pipsize //actual trade gains MAfloatingprofit = average[20](floatingprofit) BBfloatingprofit = MAfloatingprofit - std[20](MAfloatingprofit)*sd //floating profit risk reward check if rr>0 and floatingprofit>moneyrisk*rr then RRreached=1 endif //stoploss trigger when risk reward ratio is not met already c4 = (HAC = -1) if onmarket and (c4)=1 then SELL AT MARKET endif if onmarket and RRreached=0 then SELL AT positionprice-mindistancetoclose STOP endif //stoploss trigger when risk reward ratio has been reached if onmarket and RRreached=1 then if floatingprofit crosses under BBfloatingprofit then SELL AT MARKET endif endif //resetting the risk reward reached variable if not onmarket then RRreached = 0 endifShort

/// Definition of code parameters defparam preloadbars =10000 DEFPARAM CumulateOrders = true // Cumulating positions deactivated AAA= ADX [25] DIM= DI[25] HAC= call "HA Change" once RRreached = 0 accountbalance = 100000 //account balance in money at strategy start riskpercent = 1 //whole account risk in percent% amount = 1 //lot amount to open each trade rr = 1 //risk reward ratio (set to 0 disable this function) //sd = 0.25 //standard deviation of MA floating profit //dynamic step grid minSTEP = 5 //minimal step of the grid maxSTEP = 30 //maximal step of the grid ATRcurrentPeriod = 150 //recent volatility 'instant' period ATRhistoPeriod = 3000 //historical volatility period ATR = averagetruerange[ATRcurrentPeriod] histoATR= highest[ATRhistoPeriod](ATR) resultMAX = MAX(minSTEP*pipsize,histoATR - ATR) resultMIN = MIN(resultMAX,maxSTEP*pipsize) gridstep = (resultMIN) // Conditions to enter short positions c11 = (AAA > 10) c12 = (DIM < 0) c13 = (HAC = -1) //first trade whatever condition, for only one cycle add "AND STRATEGYPROFIT=0" on line 39. if NOT ONMARKET AND (c11)=1 AND (c12)=1 AND (c13)=1 AND close<close[1] then SELLSHORT amount LOT AT MARKET endif // case SELL - add orders on the same trend if shortonmarket and tradeprice(1)-close>=gridstep then SELLSHORT amount LOT AT MARKET endif //money management liveaccountbalance = accountbalance+strategyprofit moneyrisk = (liveaccountbalance*(riskpercent/100)) if onmarket then onepointvaluebasket = pointvalue*countofposition mindistancetoclose =(moneyrisk/onepointvaluebasket)*pipsize endif //floating profit floatingprofit = (((close-positionprice)*pointvalue)*countofposition)/pipsize //actual trade gains MAfloatingprofit = average[200](floatingprofit) BBfloatingprofit = MAfloatingprofit - std[200](MAfloatingprofit)//*sd //floating profit risk reward check if rr>0 and floatingprofit>moneyrisk*rr then RRreached=1 endif c14 = (HAC > 0) if c14 then EXITSHORT AT MARKET endif //stoploss trigger when risk reward ratio is not met already if onmarket and RRreached=0 then EXITSHORT AT positionprice-mindistancetoclose STOP endif //stoploss trigger when risk reward ratio has been reached if onmarket and RRreached=1 then if floatingprofit crosses under BBfloatingprofit then EXITSHORT AT MARKET endif endif //resetting the risk reward reached variable if not onmarket then RRreached = 0 endifI hope you will enjoy it and find room for improvements 🙂

Hello Brains

could help me with the following request:

https://www.prorealcode.com/topic/request-of-money-management-for-a-grid-strategy/

Thanks in advance

Ale

Kasper, have you tried the latest code with HA entry and exit? It seems very promising when limiting the number of entries and running it on M15 or H1 but I’m looking for a way to filter out the sideways movement but it’s tricky to find a good one, I have been experimenting with Keltner and Donchian but no major progress yet. I’m hoping you may have some suggestions 🙂

Hi. I just tried the long version on DAX 15m TF .I have made the indicator and named it “HA Change”

So it runs as an automated strategy and I can see that it continues, but it’s not profitable- properly as mentioned because of sideways marked.

I have been trying to figure out what to do the code, and I got stuck. I have no idea of what to do, other that wait until multiframe support.

I have also tried to incorporate the grid code into Reiners Pathfinder, but it can not be done. it either ruins the pathfinder profit or change it so much that it’s not pathfinder anylonger. Mainly because that grid order are keeping a thight MM strategy of only trading for 1% of the account, which Pathfinder does not.

We could try and give the ALE code a shoot.

Well it is coded as an automated strategy but just as with the other versions of my strategies we need to pick and choose the period to start it when we have the right setup and stop it when we are happy with our profits or the setup has disappeared. If we expect an up move on DAX on Monday we start the strategy on Monday morning and keep an eye on it and the price action during the day.

Indeed MTF support would make a huge difference with more precise entries and a stoploss ready to kick in right away when a retrace occurs rather than at the close of each 15m candle, do think there is a chance that we can change the code in the HA Change to reflect a higher TF, for instance running it on 5m with the changes of 15m? I know I have asked the question before but perhaps we have found new answers since last time it was asked.

I will look inte Ale’s code more and give it a shot too, it has a lot of potential for the ranging markets we have been seeing lately.

Thanks for your feedback Kasper 🙂

Hey traders,

Long time no speak, I have been waiting for MTF to become available but it seem to take longer and longer.

However here is an early christmas gift. The below update is fairly useful on low-medium timframes such as M15 but when using aggregating orders (of course we can stick with single orders too) we need to run it on low TF such as M1 or lower to be able to rely on our SL or BB exit since it kicks in at close of candle and too much can happen during a M15 candle and cause much larger losses during the 15 minutes it takes for the candle too close hence I recommend setting a low maximum number of orders and monitor the system manually while it is up and running.

The update is based on Squeeze (from BB Squeeze but only the squeeze function and not the momentum) and Heiken Ashi. Squeeze need to be off (blue bar) and Heiken Ashi decide the direction of the trade either by change of color or by the current color when Squeeze changes to off (for change of color “HAC crosses over 0” and for current direction “HAC >0” for long) on line 31.

First the required indicators, HA Change;

//Heikin-Ashi xClose = (Open+High+Low+Close)/4 if(barindex>2) then xOpen = (xOpen[1] + xClose[1])/2 endif changeToGreencandle = xClose>xOpen AND xClose[1]<xOpen[1] ChangeToRedcandle = xClose<xOpen AND xClose[1]>xOpen[1] Greencandle=xclose>xopen redcandle=xclose<xopen If changeToGreencandle then Indicator1=1 elsif greencandle then indicator1=0.5 elsif Changetoredcandle then indicator1=-1 elsif redcandle then indicator1=-0.5 Else Indicator1=0 Endif Return indicator1And Squeeze;

// Bollinger bands source = close bbMa = Average[bbLength](source) dev = bbMult * STD[bbLength](source) bbUpper = bbMa + dev bbLower = bbMa - dev // Keltner channels kcMa = Average[kcLength](source) kcRange = TR(source) kcMaRange = Average[kcLength](kcRange) kcUpper = kcMa + kcMaRange * kcMult kcLower = kcMa - kcMaRange * kcMult // Squeeze indicator if bbLower > kcLower and bbUpper < kcUpper then // Squeeze on indicator1=-1 else // Squeeze off indicator1=1 endif return indicator1The strategy for longs;

/// Definition of code parameters defparam preloadbars =10000 DEFPARAM CumulateOrders = true // Cumulating positions deactivated SQ= call "Squeeze"[12, 1.5, 12, 1] HAC= call "HA Change" once RRreached = 0 accountbalance = 10000 //account balance in money at strategy start riskpercent = 1 //whole account risk in percent% amount = 1 //lot amount to open each trade rr = 1 //risk reward ratio (set to 0 disable this function) sd = 0.25 //standard deviation of MA floating profit //dynamic step grid minSTEP = 20 //minimal step of the grid maxSTEP = 50 //maximal step of the grid ATRcurrentPeriod = 150 //recent volatility 'instant' period ATRhistoPeriod = 3000 //historical volatility period ATR = averagetruerange[ATRcurrentPeriod] histoATR= highest[ATRhistoPeriod](ATR) resultMAX = MAX(minSTEP*pipsize,histoATR - ATR) resultMIN = MIN(resultMAX,maxSTEP*pipsize) gridstep = (resultMIN) // Conditions to enter long positions c1 = (SQ > 0) c2 = (HAC CROSSES OVER 0) //first trade whatever condition, for one cycle only add "AND STRATEGYPROFIT=0" on lne 34 if NOT ONMARKET AND (c1)=1 AND (c2)=1 then BUY amount LOT AT MARKET endif // case BUY - add orders on the same trend if longonmarket and close-tradeprice(1)>=gridstep then BUY amount LOT AT MARKET endif //money management liveaccountbalance = accountbalance+strategyprofit moneyrisk = (liveaccountbalance*(riskpercent/100)) if onmarket then onepointvaluebasket = pointvalue*countofposition mindistancetoclose =(moneyrisk/onepointvaluebasket)*pipsize endif //floating profit floatingprofit = (((close-positionprice)*pointvalue)*countofposition)/pipsize //actual trade gains MAfloatingprofit = average[20](floatingprofit) BBfloatingprofit = MAfloatingprofit - std[20](MAfloatingprofit)*sd //floating profit risk reward check if rr>0 and floatingprofit>moneyrisk*rr then RRreached=1 endif //stoploss trigger when risk reward ratio is not met already if onmarket and RRreached=0 then SELL AT positionprice-mindistancetoclose STOP endif //stoploss trigger when risk reward ratio has been reached if onmarket and RRreached=1 then if floatingprofit crosses under BBfloatingprofit then SELL AT MARKET endif endif //resetting the risk reward reached variable if not onmarket then RRreached = 0 endifAnd shorts;

/// Definition of code parameters defparam preloadbars =10000 DEFPARAM CumulateOrders = true // Cumulating positions deactivated SQ= call "Squeeze"[12, 1.5, 12, 1] HAC= call "HA Change" once RRreached = 0 accountbalance = 10000 //account balance in money at strategy start riskpercent = 1 //whole account risk in percent% amount = 1 //lot amount to open each trade rr = 2 //risk reward ratio (set to 0 disable this function) sd = 0.25 //standard deviation of MA floating profit //dynamic step grid minSTEP = 20 //minimal step of the grid maxSTEP = 50 //maximal step of the grid ATRcurrentPeriod = 150 //recent volatility 'instant' period ATRhistoPeriod = 3000 //historical volatility period ATR = averagetruerange[ATRcurrentPeriod] histoATR= highest[ATRhistoPeriod](ATR) resultMAX = MAX(minSTEP*pipsize,histoATR - ATR) resultMIN = MIN(resultMAX,maxSTEP*pipsize) gridstep = (resultMIN) // Conditions to enter short positions c11 = (SQ > 0) c12 = (HAC CROSSES UNDER 0) //first trade whatever condition, for only one cycle add "AND STRATEGYPROFIT=0" on line 34 if NOT ONMARKET AND (c11)=1 AND (c12)=1 then SELLSHORT amount LOT AT MARKET endif // case SELL - add orders on the same trend if shortonmarket and tradeprice(1)-close>=gridstep then SELLSHORT amount LOT AT MARKET endif //money management liveaccountbalance = accountbalance+strategyprofit moneyrisk = (liveaccountbalance*(riskpercent/100)) if onmarket then onepointvaluebasket = pointvalue*countofposition mindistancetoclose =(moneyrisk/onepointvaluebasket)*pipsize endif //floating profit floatingprofit = (((close-positionprice)*pointvalue)*countofposition)/pipsize //actual trade gains MAfloatingprofit = average[20](floatingprofit) BBfloatingprofit = MAfloatingprofit - std[20](MAfloatingprofit)*sd //floating profit risk reward check if rr>0 and floatingprofit>moneyrisk*rr then RRreached=1 endif //stoploss trigger when risk reward ratio is not met already if onmarket and RRreached=0 then EXITSHORT AT positionprice-mindistancetoclose STOP endif //stoploss trigger when risk reward ratio has been reached if onmarket and RRreached=1 then if floatingprofit crosses under BBfloatingprofit then EXITSHORT AT MARKET endif endif //resetting the risk reward reached variable if not onmarket then RRreached = 0 endifRemember to be mindful of line 34 to set or avoid recurring cycles, recurring is great for testing but risky for live trading, also note to increase most parameters if using on very low TF.

I hope you will find it useful 🙂

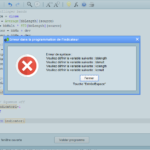

the variables of squeeze are good like this? thanksHi Cfta! have you tried to have a stop order for rrreached instead of crossover market order. Then less can happen with profit. Multitf is better but I think it will work better until we have it. regards@ Rejo the code is exactly the same as I run without any problems, the only issue I can think of is that it might be caused by running PRT in French instead of English. @ Henrik, sorry but I’m not sure what you mean, do you refer to having a stop order for taking profit? I guess we can implement that but since it is a discretionary system I prefer exiting manually to maximize profit or let the bollinger exit kick in, which in one way let us maximize profit to the extent that we stay in our position until we have retracement and ride the price movement all the way rather than exiting when it’s halfway since we rarely know when a move is done.Hi Cfta! Looked at your codes from the beginning when i was trying to make a “bombmatta” dont know what its called in english. I made some changes for the grid to buy on fixed prices and used your profit exit but changed it to be a stop order instead of sell at market. Now when i try to explain i cant find the final codes but atleast two that explains fixed grid entry and exit calculation with stop order. so i copypasted the snippets i talked about so youll understand what i mean. I just wanted to show you as your ideas made me come up with this. 🙂 Regards//BREAKOUT//////////////////////////////////////////////////////////////////////// K=highest[X](close) //IC*0.25 //FÖRVÄNTAD DAGLIG RÖRELSE (PROCENT) = INKÖP/STOP//////////////////////// DP=0.007 //AVSTÅND INKÖP MATTA / STOP//////////////////////////////////////////////// IC=((CLOSE*DP)/4) BOMHAST=IC //------------------------------------------------------------------------- //graph close as "close" //GRAPH K AS "BREAKOUT" //GRAPH START AS "START" //GRAPH IC AS "NORMALSPANN" //GRAPH floatingprofit as "floating profit" //GRAPH BBfloatingprofit as "BB Floating Profit" //------------------------------------------------------------------------- //////////////////////////////////////////////////////////////////////////////////////// // Conditions to enter long positions //////////////////////////////////////////////////////////////////////////////////////// //TREND INDI//////////////////////////////////////////////////////////////////////// TFC=1 indicator1 = dema[18*TFC](ROC[13*TFC](ExponentialAverage[1*TFC])) indicator2 = dema[18*TFC](ROC[13*TFC](ExponentialAverage[1*TFC])) c1 = (indicator1 > indicator2[1]) //SET STOP ORDER INDI//////////////////////////////////////////////////////////////////////// TFC2=15 indicator10 = dema[20*TFC2](ROC[25*TFC2](ExponentialAverage[1*TFC2])) indicator20 = dema[20*TFC2](ROC[25*TFC2](ExponentialAverage[1*TFC2])) c10 = (indicator10 > indicator20[1]) //c20 = (indicator10[1] < indicator20[2]) AND C20 IF c1 AND C10 AND NOT ONMARKET THEN START=K BUY 1 CONTRACT AT K STOP BUY 1 CONTRACT AT CLOSE+K+BOMHAST STOP BUY 2 CONTRACT AT CLOSE+K+(BOMHAST*2) STOP //BUY 4 CONTRACT AT START+(BOMHAST*3) STOP ENDIF IF c1 AND COUNTOFPOSITION=1 THEN BUY 1 CONTRACT AT START+BOMHAST STOP BUY 2 CONTRACT AT START+(BOMHAST*2) STOP //BUY 4 CONTRACT AT START+(BOMHAST*3) STOP ENDIF IF c1 AND COUNTOFPOSITION=2 THEN BUY 2 CONTRACT AT START+(BOMHAST*2) STOP //BUY 4 CONTRACT AT START+(BOMHAST*3) STOP ENDIF //IF c1 AND COUNTOFPOSITION=4 THEN //BUY 4 CONTRACT AT START+(BOMHAST*3) STOP //ENDIF //////////////////////////////////////////////////////////////////////////////////////// // SAFETY STOPS MATTA //////////////////////////////////////////////////////////////////////////////////////// // Stops and targets if countofposition=1 then SELL AT START-BOMHAST STOP ENDIF if countofposition=2 then SELL AT START STOP ENDIF if countofposition=4 then SELL AT START+BOMHAST STOP ENDIF //if countofposition=8 then //SELL AT START+(BOMHAST*2) STOP //ENDIF floatingprofit = (((close-positionprice)*pointvalue)*countofposition)/pipsize //actual trade gains MAfloatingprofit = average[20](floatingprofit) //[ONMARKET] BBfloatingprofit = MAfloatingprofit - std[20](MAfloatingprofit)*1.8//0.25 FPP= (BBfloatingprofit)/((pointvalue*countofposition/pipsize))+positionprice if onmarket then if FPP<CLOSE then SELL AT FPP STOP endif ENDIF GRAPH FPP AS "floatingprofit stop FPP" //GRAPH floatingprofit AS "floatingprofit" GRAPH CLOSE AS "Close" -

AuthorPosts

- You must be logged in to reply to this topic.

Grid orders with one combined stop loss and limit, can it be done?

ProOrder: Automated Strategies & Backtesting

Summary

This topic contains 307 replies,

has 1 voice, and was last updated by OtherAttorney

1 year, 9 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 04/14/2016 |

| Status: | Active |

| Attachments: | 106 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.