Drawdowns – Have you got the Stomach??

Forums › ProRealTime English forum › General trading discussions › Drawdowns – Have you got the Stomach??

- This topic has 19 replies, 8 voices, and was last updated 7 years ago by

Vonasi.

-

-

03/27/2018 at 10:22 AM #66523

GraHal wrote: Big overall drawdowns make me feel so shite

It is an ironic fact of life that if you start with a lot of money then making a lot of money is easier. Anyone could have made a lot of money over the years if they can cope with massive draw downs. Just keep holding and buying more as the market collapses and ignore the number of negative zeros on your account balance and wait for things to start going up again. However for those with a smaller bank balance finding a strategy that fits their needs is far harder . Lots of big profits with hardly any draw down is what they need and that is a very challenging strategy to come up with.

Thought it would be a good Topic for this Forum to occupy us while waiting for trades to set up!? 🙂

03/27/2018 at 10:55 AM #6652603/27/2018 at 11:32 AM #66527Thing is, I’ve always been very careful with money, but when a trade goes into drawdown I feel like I am throwing good money after bad and it goes against my rationale / brain profile re money.

I’ve done shares trading (Long only for days / weeks) since early 80’s, but when I go to a lot of effort trading via PRT Platform either manually or via a coded System and it goes to a big drawdown it knocks my psyche and I have thought a few times … why am I bothering!?

I know why though! I have never given up on anything in my life, but the goal posts seem to change so often with intraday trading?

The massive change since volatility of early Feb makes loads of (previously good) Systems not good anymore without rework?

GraHal

03/27/2018 at 11:38 AM #66529A persons ability to deal with large draw downs is directly related to the size of their bank balance and the length of time they have been trading a strategy. Money and confidence are the things needed to get through draw downs. If you have a lot of confidence from a long time trading a strategy successfully then you need less bank balance to deal with a big draw down. You can eat away at almost all your capital knowing that all should turn out OK in the end. However if your confidence in your strategy is lower then you will need a big bank balance to ride out a draw down without panic or heart attack. IMHO

Patience, back testing, forward testing and plenty of analysis are our confidence builders.

03/27/2018 at 11:44 AM #66530The massive change since volatility of early Feb makes loads of (previously good) Systems not good anymore without rework?

Then switch them off and rework them. A strategy that worked great in the 80’s does not work now so we should not expect our winning strategies to work forever.

A good filter if only going long on indexes is to set a lookback period. If for example today’s price is less than the price one year ago then we do not trade. We patiently wait until the market sorts itself out and then get back in. Yes there will be long periods not in the market but there will also be long periods not buying in a falling market.

03/27/2018 at 1:59 PM #66546Drawdowns can be very tricky to handle. Or better put, when to shut down a system in a DD period and when to let it run hoping for recovery, is hard to decide.

In my first half year of automatic trading I had read so often that one mustn’t turn off strategies after some losing trades, you have to give them a chance. Alright I thought and acted up to it (I thought) with the result that I almost never turned off a system even after several weeks of DD. This didn’t get me anywhere. I had profitable systems but the losers where always eating up all profits and after all I was losing. Not much but still.

At the end of 2017 I said to myself, that this can’t be the way to go and tried a new approach. I turned off all my losing systems and just kept the ones I had a good feeling about. This was a quite big step, I reduced the number of active strategies by about 40%. But so far I did not regret it. The strategies I kept performed very well even during the turmoil of the last months and I’m up for the year by more than 100%.

So the lesson is, yes you have to give strategies a real chance but at some point you have to turn them off. 🙂 But I’m still pretty unsure when this point is reached. For the time being I’m working with a test period of 6 months. If after 6 month of live trading the result does not approximately match what one would expect from the backtest performance, I turn it off.

This seems to work quite OK for strategies running on daily bars. Strategies that run intraday and trade much more often maybe need shorter time for evaluation but I’m not sure about it.

1 user thanked author for this post.

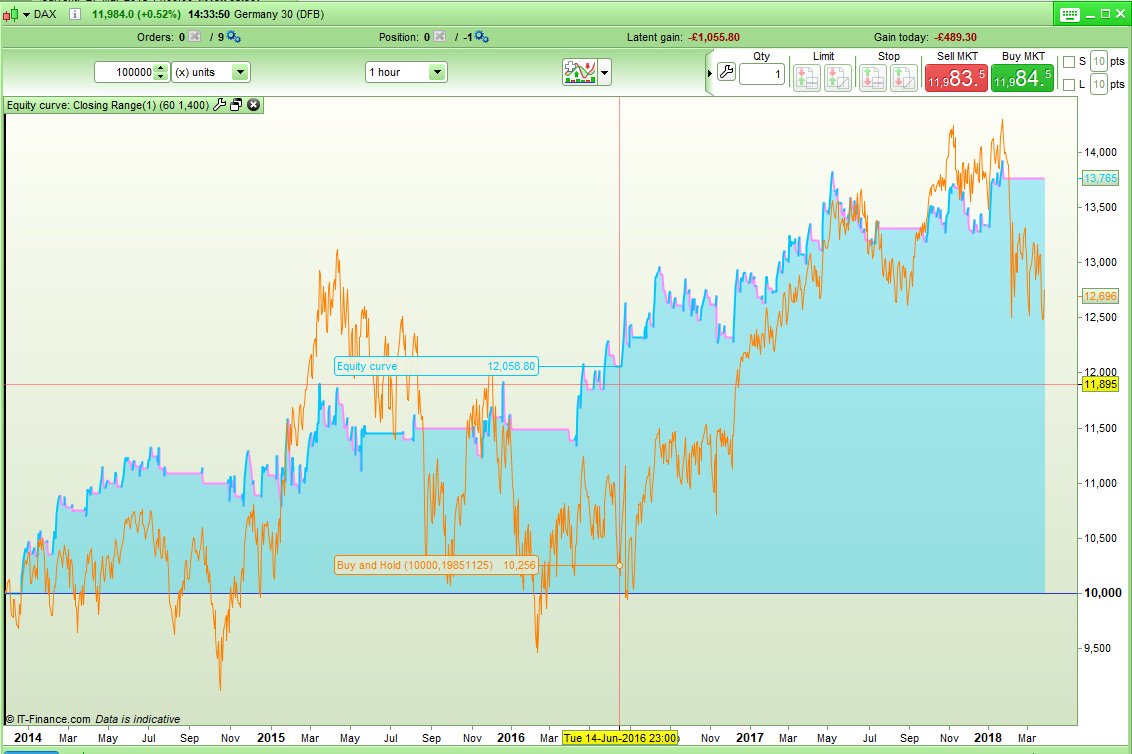

03/27/2018 at 2:46 PM #66554Here is an example of how having a simple filter that stops a strategy trading if price is below whatever price was ‘x’ periods ago can massively reduce drawdowns.

In this example the lookback period is 1400 hours or approx a quarter of a year. The orange line is buy and hold and it can be seen that there are some massive potential drawdowns if you had got into a trade at the wrong time and held on to it or carried on trading through massive market corrections. The strategy itself only does slightly better than buy and hold but it has long periods not in the market (zero risk time) and the drawdown is only around 6% with a starting balance of 10K. The filter does not close any trades, it just stops new ones being opened until price has stabilised or recovered.

It’s not exciting but it is much lower risk trading.

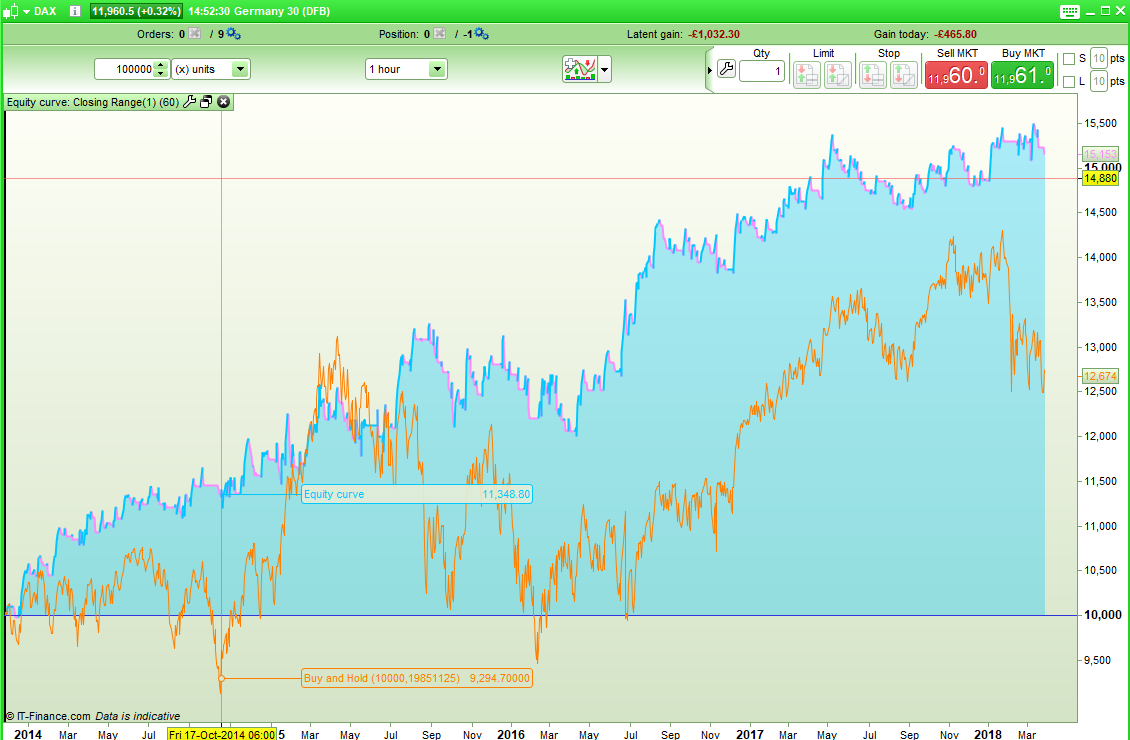

03/27/2018 at 2:58 PM #66562Here is the same strategy but with the lookback filter removed. Yes it is a little bit more profitable but the drawdown has increased to almost 10%. Although not a massive increase (maybe this was not a good example strategy to choose) it is an increase in drawdown. I guess it confirms that if you have the balance and the balls to sit through larger drawdown then you can make more money.

03/27/2018 at 3:46 PM #6656703/30/2018 at 10:35 PM #66839Funny eh? Attached are 5 Systems that have been running on my SB Demo account and made around £6,300 in total (@ £1 per point) which I would very happy to have made in Real!

The Systems have not been running as long as attached indicates as they have been switched off for 9 months since June 17 until a few weeks ago. So figures on attached are for about 12 moths running.

But I know if I set them going in my Live I’d be stressing all the time about the drawdown and are they going the wrong way against visible market structure etc etc! 🙂

If anybody wants a copy of any of the codes for a play just say?

GraHal

03/31/2018 at 10:16 AM #66855But I know if I set them going in my Live I’d be stressing all the time about the drawdown and are they going the wrong way against visible market structure etc etc!

Before putting them live you also have to consider how many bets they have placed in the test period. £2000 up looks great until you discover that there were only three bets and you were in a massive drawdown for most of the test period before suddenly having a big winner (it would be great if PRT could display the number of trades and win/loss percentage alongside the total gain/loss in this window)

Time in position also needs to be considered as overnight costs could could wipe out a lot of the gain and is not shown in the results.

You should also consider how the whole portfolio worked over the period and consider a worst case scenario – if they all had big drawdown at the same time your account might not survive to trade another day.

Please feel free to attach the itf files of the codes if you have time as it is always interesting to see how other people are thinking regarding strategy ideas and looking at strategies that have actually returned good results already is a great starting point. Thinking of new ideas to try out can be quite exhausting sometimes!

04/09/2018 at 12:01 AM #67573Hi GraHal, I cut my systems in February and have been looking for a solution to the uptick in volatility before restarting my algorithms. My systems are basic buy on support but don’t work when the market turns down very suddenly.

The solution I’m testing is a moving average ATR. I have a fast and a slow moving average and if the faster is above the slower then it doesn’t trade. It looks good on back tests and filters out the worst of the drops in February and March. I have it on demo and will let you know how things go.

1 user thanked author for this post.

04/10/2018 at 7:10 AM #67787The relation between Auto trading and Quantum physics.

The Quantum mechanics double-slit experiment…

Things happen in a certain way when you don’t look at it but it changes as soon as you look at it.

When you are not looking you know what is happening because the laws of physics(algo trading) says so and you know that is right because it has been tested and proven. Yet you still want to look again just to confirm but the second you do things changes and it does not make sense because it goes against the laws of physics(algo trading)All so true.!

Auto trading takes more guts than manual trading.

That believe in the algo and keep on having trust in the code hoping it turn before the SL kicks it. Again and again you have to have the stomach and the believe in your code…@GraHal

I will appreciate it if you can post the algo you mention that you tested.

Thank you.04/10/2018 at 1:33 PM #67903What a difference 10 days makes!?

Attached are ongoing results for the same 5 Algos … decimated! Good job they are on Demo!

If you still want them all or any particular one just say?

Or I can leave running and update again with another screenshot of results in another 10 days?

GraHal

04/10/2018 at 2:17 PM #67914@GraHal

Thank you but as you say yourself those are not doing good so no use for me to experiment with them.

Andre.

-

AuthorPosts

Find exclusive trading pro-tools on