Hello Guys,

I have been using Pro Realtime for over a year now and the only thing that happens is that I loose Money.

I have used 1 min timeframe the most, perhaps that´s wrong and a difficult choise?

Best timeframe for a newbie?

Breakout or cross over strategy?

I have used top-bottom = amplitude as stop loss/target profit. Used the “Greedy row” you can see in the code but it doesn´t work.

I have used the trailing code by Nicolas but it´s doesn´t matter….I Always loose.

Pro Realtime seems to have it´s limitations, I get the “Tick by Tick limit reached” a bit to often. :/

The code below is a DAX 1Min Long 0930 Breakout strategy, looks fairly good in backtest but not in reality, any advice would be nice. (Warning! Don´t use the code below)

//-------------------------------------------------------------------------

Defparam cumulateorders = False

DEFPARAM PreLoadBars = 5000

TradingHour = Time >= 093000 AND Time <= 173000

n = 1

IF Time = 093000 THEN

top = highest[30](high)

ENDIF

//Trend direction

indicator70 = Average[1](close)

indicator71 = Average[3](close)

indicator72 = Average[7](close)

indicator73 = Average[8](close)

indicator74 = Average[41](close)

indicator75 = Average[51](close)

indicator76 = Average[64](close)

//Remove wrong setups before position at c10

indicator100 = Average[5](close)

indicator101 = Average[3](close)

indicator102 = Average[4](close)

indicator103 = Average[1](close)

indicator104 = Average[28](close)

indicator105 = Average[4](close)

indicator106 = Average[34](close)

indicator107 = Average[6](close)

//Distance not to big

MADist = (indicator75-indicator76)<=6.2

c10 = (indicator100>indicator101) or (indicator102>indicator103) or (indicator104>indicator105) or (indicator106>indicator107)

//Trend direction

c1 = (indicator70>indicator71) and (indicator71>indicator72) and (indicator72>indicator73) and (indicator73>indicator74) and (indicator74>indicator75) and (indicator75>indicator76)

//Direction

c2 = (indicator70>indicator70[1]) and (indicator71>indicator71[1]) and (indicator72>indicator72[1]) and (indicator73>indicator73[1]) and (indicator74>indicator74[1]) and (indicator75>indicator75[1]) and (indicator76>indicator76[1])

indicator1 = RSI[14](close)

c3 = (indicator1>=54.7) and (indicator1<=66.95)

indicator2 = Volume

c4 = (indicator2>=60) and (indicator2<=315)

indicator3 = MACDline[12,26,9](close)

c5 = (indicator3 >=1.21) and (indicator3<=4.77)

//Not to much movement before position

R1 = Range[3]<=9 and Range[5]<=13 and Range[6]<=9

//Limit length of upper tail

HTail = (open<close) and abs(high-close)<=5.7

IF MADist and HTail and R1 and c1 and c2 and c3 and c4 and c5 and not c10 and TradingHour THEN

buy n contract at top stop

ENDIF

//Added Greedy Row

//IF LONGONMARKET AND (BarIndex-TradeIndex(1))>=0 AND (close-tradeprice(1))>=1.01 THEN

//SELL AT MARKET

//ENDIF

IF LONGONMARKET AND (TIME>=225500) THEN

SELL AT MARKET

ENDIF

set stop ploss 9.01

set target pprofit 9.91

After demoing several 1-minute stategies on different instruments I have dropped them and now I am only testing strategies on TFs no less than 30 minutes and they seem to work better.

Before running them on a real account I want to successfully demo it for 6-12 months.

I can only suggest to demo your strategy for a longer period before going real!

Hi ! I think bigger timeframes are best to begin with (but that’s my opinion).

I don’t see any trailing stop in your code…

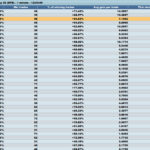

Did you really backtested your code ? Cause I tested it and it’s not good… see attached.

What can’t we use the code below ? Could you give us the code you actually use ?

surely below won’t work (from your code) it has to be a whole number of points?

set stop ploss 9.01

set target pprofit 9.91

Looks loads better with this

set stop ploss 45

set target pprofit 10

I think I’ll give it a go Live! 🙂 but I will watch it’s every move … as always!

Your strategy seems heavily optimized too, what is the purpose of using these kind of levels with a MACD? 😯

indicator3 = MACDline[12,26,9](close)

c5 = (indicator3 >=1.21) and (indicator3<=4.77)

Hi, and thanks for all your quick replies.

Robert, I Think I will try to make a strategy for higher timeframes as well, but it feels like the higer timeframe you have the more I can loose. :/

Irioton, In this code I didn´t use trailing, but i have in the passed. Very nice to set a breakeven level at some point to secure profit.

GraHal, Are you sure you want to to do this? Or do I set my stop loss/target profit the wrong way? It feels like it should be a 1:1 ratio between them but that may not be the best practical solution in the real World.

Nicolas, Yes, it is backtested very heavliy, perhaps a bit to much. It seems to me that the backtest tool makes it look good, it picks the history of trades that it wins and then when I run it live it doesn´t behave the same way. Perhaps this is why I should have a bigger stop loss?

It seems to me that the backtest tool makes it look good, it picks the history of trades that it wins and then when I run it live it doesn´t behave the same way.

Hmm I think you’d better explore discussions about equity overfitting, to understand why it fails. Optimizing is like changing the past the way you want (like a time machine), but if you break the machine, future days will never be so sweet.. (I think we might be trapped in a temporal loop here 😆 )

Well, I have looked in to this and my conclusion is that I use to low stop loss or to low volume, or both, or just to low stop loss.

My strategies seems to be fairly ok by just increasing the stop loss to let´s say twice of what I use to have it to. The problem is perhaps me, to much emotions that don´t want to loose, to much chicken in the code.

I have another strategy like the one above but for short trades. If I set the stop loss to 35 and target profit to 10 the backtest gives a 100% win on it. But it this the way to go?

According to my own amature eyes the market seems to reach a breakoutpoint, then it goes back for a while and later on it reaches the point again and even goes over it, then down, then up even more, etc, etc…….and sometimes it´s a true breakout that flies like a rocket… and…… if my thoughts are right, I will (hopefully) only loose when the market have a real trend turn from bear to bull or vice versa.

I mean, it can´t be that bad if GraHal just change the stop loss and then let it run live, or is he the Daredevil in this forum?

GraHal just change the stop loss and then let it run live, or is he the Daredevil in this forum?

Or the madman!? 🙂

The difference is that, recently, I have started to use Auto-Systems as trade entry points and then immediately (screen or on phone app) assess … would I trade this in manual? If the answer is Yes then I let the Autotrade run for while especially if in profit.

If I wouldn’t enter a manual trade at that point and it goes to a loss quickly then I exit with maybe 5 to 10 point loss.

So No, not a daredevil at all, scaredy pants actually … scared of long drawn out drawdowns!? 🙂

GraHal

So No, not a daredevil at all, scaredy pants actually … scared of long drawn out drawdowns!?  GraHal

GraHal

So, a bigger stop loss isn´t recommended then?

So, a bigger stop loss isn´t recommended then?

I would generally have manually exited / closed the AutoSystem way before it gets anywhere near a big stop loss, but it’s good to have a stop loss as a fail safe for when disaster strikes (instant big spike due to news, war etc).

Leo

LeoParticipant

Veteran

Hi,

I create an simple moving average time frame daily for intraday time frame (hopefully come multiframe capabilities soon)

for me works very well as a filter for detects the main trend. Hope it works for you as well.

https://www.prorealcode.com/prorealtime-indicators/daily-data-intraday-timeframe/

The more time you spend staring at candles going up and down and testing theories on them the more you realise that the shorter the time frame the greater the noise and the harder it is to make a profit – especially as most of the noise is within the spread difference! You also start to realise that stops do more harm than good. Give a trade some freedom to move and don’t fight the long to mid term trend and work in only longer time frames and you are far more likely to be profitable than trying to zip in and out of a noisy fast moving market for a few pips while using tight stops. Unfortunately you need a bigger starting balance to trade longer time frames with loose or no stops but at least you will be more likely to end up with more money rather than less. IMHO

this system looks not bad. you have an idea for a short version of it?

I second Vonasi on his opinion that shorter timeframes are too noisy and that the trades need some space to grow. When I started I also thought it would be “safer” on shorter timeframes with tighter stops and so on but nowadays most (if I think little closer almost all) of my successful strategies run on daily bars.

GraHal

GraHal