Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Conditions on number of trades, reversing trade direction

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Conditions on number of trades, reversing trade direction

-

AuthorPosts

-

Good day, all! Hope all are doing well. Kindly ask community help on the coding some backtest example for the strategy.

So, long story short:

- I enter with a buy stop to go long, or a sell stop to go short.

- I enter with 3 contracts.

- Position size: 3 contracts, with profit targets of 1R, 2R, and 3R. Once my first target is hit, my stop loss becomes breakeven.

- If I get stopped out on my first signal, I can stop out and reverse (Go long, get stopped, go short or Go short, get stopped, go long) – only 3 attempts per day.

What I did so far: I can track multitimeframe, open and close positions, but can’t realize how to reverse trade if it fails with one direction, how to count correctly number of attempts, in which timeframe? and how to partially close trade.

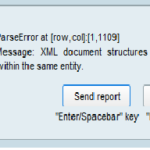

DEFPARAM CumulateOrders = False DEFPARAM PreLoadBars = 0 TIMEFRAME(30 seconds, UPDATEONCLOSE) // No new position is taken after the candlestick that closes 9:45 a.m. FinishTime = 143000 // The market analysis strats at the 30-sec candlestick which closes at 9:00:30 a.m. StartTime = 120000 PositionSize = 3 TickScale = TICKSIZE ScaleReward = 1 PartialCloseCoeff = 3 CloseQuantity = PositionSize/PartialCloseCoeff // Some holidays such as the 24th and 31st of December are excluded IF (Month = 5 AND Day = 1) OR (Month = 12 AND (Day = 24 OR Day = 25 OR Day = 26 OR Day = 30 OR Day = 31)) OR (Month = 1 AND Day = 1) OR (DayOfWeek = 0 OR DayOfWeek = 6) OR (Time < StartTime OR Time >= FinishTime) THEN TradingDay = 0 ELSE TradingDay = 1 ENDIF // We initialize this variable once at the beginning of the trading system. //ONCE StartTradingDay = -1 // We initialize this variable once at the beginning of the trading system. ONCE StartTradingDay = -1 IF (Time < StartTime AND StartTradingDay <> 0) THEN CloseO = 0 HighO = 0 LowO = 0 SellPosition = 0 StartTradingDay = 0 ELSIF Time = StartTime AND TradingDay = 1 THEN //ELSIF Time >= StartTime AND StartTradingDay = 0 AND TradingDay = 1 THEN // We store the index of the first bar of the trading day IndexStartDay = IntradayBarIndex StartTradingDay = 1 CloseO = Close HighO = High LowO = Low RangeOpen = HighO - LowO BuyLevel = HighO + TickScale SellLevel = LowO - TickScale StopLong = LowO - TickScale StopShort = HighO + TickScale ENDIF TIMEFRAME(1 seconds, UPDATEONCLOSE) If IntraDayBarIndex = 0 Then TradeONLong = 1 TradeONShort = 1 CntLong = 0 CntShort = 0 LastTrade = 0 count = 0 Endif IF Time > StartTime AND TradingDay = 1 THEN //GRAPH CloseO as "CloseO" GRAPH HighO as "HighO" GRAPH LowO as "LowO" GRAPH RangeOpen as "RangeOpen" //GRAPH DayOfWeek as "DayOfWeek" //GRAPH StopShort as "StopShort" //GRAPH StopLong as "StopLong" //GRAPH TickScale as "TickScale" // //GRAPH Time as "Time" //GRAPH DayOfWeek as "DayOfWeek" //GRAPH UpperLevel as "UpperLevel" //GRAPH LowerLevel as "LowerLevel" IF Close > HighO AND Not LongOnMarket AND CntLong = 0 AND CntShort = 0 THEN BUY PositionSize CONTRACTS AT BuyLevel STOP //SELLSHORT PositionSize CONTRACTS AT BuyLevel STOP // Definition of the maximum amount to risk per position in case // price goes in an unfavorable direction //LastTrade = 1 CntLong = CntLong + 1 TradeONLong = 0 count = count + 1 //GRAPH CntLong as "CntLong" ELSIF Close < LowO AND Not SHORTONMARKET AND CntLong = 0 AND CntShort = 0 THEN SELLSHORT PositionSize CONTRACTS AT SellLevel STOP //BUY PositionSize CONTRACTS AT SellLevel STOP // Definition of the maximum amount to risk per position in case // price goes in an unfavorable direction TradeONShort = 0 //LastTrade = 2 CntShort = CntShort + 1 count = count + 1 //GRAPH CntShort as "CntShort" ENDIF SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen ENDIFI’ve been trying to code futher and debug, but when I put GRAPH I received an error. I don’t have any problem with internet, with software, but still receiveng this when added such lines in the code and adding Graph.

myCurrentProfit = STRATEGYPROFIT If myCurrentProfit < 0 then GRAPH myCurrentProfit as "myCurrentProfit" IF LongOnMarket[1] AND NOT OnMarket THEN SELLSHORT PositionSize CONTRACTS AT MARKET count = count + 1 ELSIF ShortOnMarket[1] AND NOT OnMarket THEN BUY PositionSize CONTRACTS AT MARKET count = count + 1 ENDIF SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen endifTry this as Line 12 to 14 …

Endif SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpenSo, thank you for the reply, I didn’t put all code. Here we go, with what I ended up right now

DEFPARAM CumulateOrders = False DEFPARAM PreLoadBars = 0 TIMEFRAME(45 seconds, UPDATEONCLOSE) // No new position is taken after the candlestick that closes 9:45 a.m. FinishTime = 103000 // The market analysis strats at the 30-sec candlestick which closes at 9:00:30 a.m. StartTime = 100030 PositionSize = 3 TickScale = TICKSIZE ScaleReward = 1 PartialCloseCoeff = 3 CloseQuantity = PositionSize/PartialCloseCoeff // Some holidays such as the 24th and 31st of December are excluded IF (Month = 5 AND Day = 1) OR (Month = 12 AND (Day = 24 OR Day = 25 OR Day = 26 OR Day = 30 OR Day = 31)) OR (Month = 1 AND Day = 1) OR (DayOfWeek = 0 OR DayOfWeek = 6) OR (Time < StartTime OR Time >= FinishTime) THEN TradingDay = 0 ELSE TradingDay = 1 ENDIF // We initialize this variable once at the beginning of the trading system. //ONCE StartTradingDay = -1 // We initialize this variable once at the beginning of the trading system. ONCE StartTradingDay = -1 IF (Time < StartTime AND StartTradingDay <> 0) THEN CloseO = 0 HighO = 0 LowO = 0 SellPosition = 0 StartTradingDay = 0 ELSIF Time = StartTime AND TradingDay = 1 THEN //ELSIF Time >= StartTime AND StartTradingDay = 0 AND TradingDay = 1 THEN // We store the index of the first bar of the trading day IndexStartDay = IntradayBarIndex StartTradingDay = 1 //ELSIF StartTradingDay = 1 AND Time >= StartTime AND Time <= LimitEntryTime THEN //HighClose = Close[1](High) CloseO = Close HighO = High LowO = Low RangeOpen = HighO - LowO BuyLevel = HighO + TickScale SellLevel = LowO - TickScale StopLong = LowO - TickScale StopShort = HighO + TickScale ENDIF TIMEFRAME(1 seconds, UPDATEONCLOSE) If IntraDayBarIndex = 0 Then TradeONLong = 1 TradeONShort = 1 CntLong = 0 CntShort = 0 LastTrade = 0 TradeON = 1 count = 0 Endif IF Time > StartTime AND TradingDay = 1 AND TradeON = 1 AND count <3 THEN //GRAPH CloseO as "CloseO" //GRAPH HighO as "HighO" //GRAPH LowO as "LowO" //GRAPH RangeOpen as "RangeOpen" //GRAPH DayOfWeek as "DayOfWeek" //GRAPH StopShort as "StopShort" //GRAPH StopLong as "StopLong" //GRAPH TickScale as "TickScale" IF Close > HighO AND Not LongOnMarket AND Not SHORTONMARKET THEN BUY PositionSize CONTRACTS AT BuyLevel STOP SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen //SELLSHORT PositionSize CONTRACTS AT BuyLevel STOP // Definition of the maximum amount to risk per position in case // price goes in an unfavorable direction //LastTrade = 1 CntLong = CntLong + 1 TradeONLong = 0 count = count + 1 //GRAPH CntLong as "CntLong" ELSIF Close < LowO AND Not LongOnMarket AND Not SHORTONMARKET THEN SELLSHORT PositionSize CONTRACTS AT SellLevel STOP SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen //BUY PositionSize CONTRACTS AT SellLevel STOP // Definition of the maximum amount to risk per position in case // price goes in an unfavorable direction TradeONShort = 0 //LastTrade = 2 CntShort = CntShort + 1 count = count + 1 //GRAPH CntShort as "CntShort" ENDIF // myCurrentProfit = STRATEGYPROFIT // If myCurrentProfit < 0 then //GRAPH myCurrentProfit as "myCurrentProfit" IF LongOnMarket[1] AND NOT OnMarket THEN SELLSHORT PositionSize CONTRACTS AT MARKET count = count + 1 ELSIF ShortOnMarket[1] AND NOT OnMarket THEN BUY PositionSize CONTRACTS AT MARKET count = count + 1 ENDIF SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen endif ENDIFWhat I still don’t get:

1. How to determine that previous trade had a loss or profit after the close? Strategyprofit and Positionperformance don’t help me, I tried, but failed.

2. Still have the error with Graph and XML, don’t know why, discoveringthank you for the reply

My suggestion was in relation to the screenshot of the error you posted above.

I just ran the code you posted in your last post above and I get no errors at all.

How to determine that previous trade had a loss or profit after the close?

Anybody please feel free to help mrbolt on above?

So, the last version, which still doesn’t work properly 🙁

DEFPARAM CumulateOrders = False DEFPARAM PreLoadBars = 0 TIMEFRAME(30 seconds, UPDATEONCLOSE) // No new position is taken after the candlestick FinishTime = 103000 // The market analysis strats at the 30-sec candlestick which closes at 9:00:30 a.m. StartTime = 100000 PositionSize = 3 TickScale = TICKSIZE ScaleReward = 1 PartialCloseCoeff = 3 CloseQuantity = PositionSize/PartialCloseCoeff // Some holidays such as the 24th and 31st of December are excluded IF (Month = 5 AND Day = 1) OR (Month = 12 AND (Day = 24 OR Day = 25 OR Day = 26 OR Day = 30 OR Day = 31)) OR (Month = 1 AND Day = 1) OR (DayOfWeek = 0 OR DayOfWeek = 6) OR (Time < StartTime OR Time >= FinishTime) THEN TradingDay = 0 ELSE TradingDay = 1 ENDIF // We initialize this variable once at the beginning of the trading system. //ONCE StartTradingDay = -1 // We initialize this variable once at the beginning of the trading system. ONCE StartTradingDay = -1 IF (Time < StartTime AND StartTradingDay <> 0) THEN CloseO = 0 HighO = 0 LowO = 0 SellPosition = 0 StartTradingDay = 0 ELSIF Time = StartTime AND TradingDay = 1 THEN //ELSIF Time >= StartTime AND StartTradingDay = 0 AND TradingDay = 1 THEN // We store the index of the first bar of the trading day IndexStartDay = IntradayBarIndex StartTradingDay = 1 //ELSIF StartTradingDay = 1 AND Time >= StartTime AND Time <= LimitEntryTime THEN //HighClose = Close[1](High) CloseO = Close HighO = High LowO = Low RangeOpen = HighO - LowO BuyLevel = HighO + TickScale SellLevel = LowO - TickScale StopLong = LowO - TickScale StopShort = HighO + TickScale ENDIF TIMEFRAME(1 seconds, UPDATEONCLOSE) If IntraDayBarIndex = 0 Then TradeONLong = 1 TradeONShort = 1 CntLong = 0 CntShort = 0 LastTrade = 0 count = 0 Endif //GRAPH IntraDayBarIndex as "IntraDayBarIndex" IF Time > StartTime AND TradingDay = 1 AND count <= 3 THEN IF Close > HighO AND count = 0 THEN BUY PositionSize CONTRACTS AT BuyLevel STOP SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen //GRAPH LongOnMarket as "LongOnMarket" //GRAPH SHORTONMARKET[1] as "SHORTONMARKET[1]" //GRAPH LongOnMarket as "LongOnMarket" // Definition of the maximum amount to risk per position in case // price goes in an unfavorable direction //LastTrade = 1 CntLong = CntLong + 1 count = count + 1 //GRAPH CntLong as "CntLong" ELSIF Close < LowO AND count = 0 THEN SELLSHORT PositionSize CONTRACTS AT SellLevel STOP SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen //GRAPH SHORTONMARKET as "SHORTONMARKET" // Definition of the maximum amount to risk per position in case // price goes in an unfavorable direction //LastTrade = 2 CntShort = CntShort + 1 count = count + 1 ELSIF POSITIONPERF(1) < 0 AND count >= 1 THEN //GRAPH count as "count" LongPrev = LongOnMarket[1] ShortPrev = SHORTONMARKET[1] IF LongPrev THEN //GRAPH LongPrev as "LongOnMarket[1]" //GRAPH 1 as "1" //SELLSHORT PositionSize CONTRACTS AT MARKET BUY PositionSize CONTRACTS AT MARKET SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen count = count + 1 ELSIF ShortPrev THEN //GRAPH ShortPrev as "SHORTONMARKET[1]" //BUY PositionSize CONTRACTS AT MARKET SELLSHORT PositionSize CONTRACTS AT MARKET SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen count = count + 1 ENDIF ENDIF ENDIFAfter closing in loss, new trade wasn’t opened.

thank you for the reply

My suggestion was in relation to the screenshot of the error you posted above.

I just ran the code you posted in your last post above and I get no errors at all.

How to determine that previous trade had a loss or profit after the close?

Anybody please feel free to help <span class=”bbp-author-name”>mrbolt</span> on above?

So strange, to be honest 🙁 I don’t know why I’m receiving an error with XML when adding block on trying to turn trade direction as well. So, with commented block on new trade direction GRAPH works well.

DEFPARAM CumulateOrders = False DEFPARAM PreLoadBars = 0 TIMEFRAME(30 seconds, UPDATEONCLOSE) // No new position is taken after the candlestick that closes 9:45 a.m. FinishTime = 103000 // The market analysis strats at the 30-sec candlestick which closes at 10:00:30 a.m. StartTime = 100000 PositionSize = 3 TickScale = TICKSIZE ScaleReward = 1 PartialCloseCoeff = 3 CloseQuantity = PositionSize/PartialCloseCoeff // Some holidays such as the 24th and 31st of December are excluded IF (Month = 5 AND Day = 1) OR (Month = 12 AND (Day = 24 OR Day = 25 OR Day = 26 OR Day = 30 OR Day = 31)) OR (Month = 1 AND Day = 1) OR (DayOfWeek = 0 OR DayOfWeek = 6) OR (Time < StartTime OR Time >= FinishTime) THEN TradingDay = 0 ELSE TradingDay = 1 ENDIF // We initialize this variable once at the beginning of the trading system. //ONCE StartTradingDay = -1 // We initialize this variable once at the beginning of the trading system. ONCE StartTradingDay = -1 IF (Time < StartTime AND StartTradingDay <> 0) THEN CloseO = 0 HighO = 0 LowO = 0 SellPosition = 0 StartTradingDay = 0 ELSIF Time = StartTime AND TradingDay = 1 THEN //ELSIF Time >= StartTime AND StartTradingDay = 0 AND TradingDay = 1 THEN // We store the index of the first bar of the trading day IndexStartDay = IntradayBarIndex StartTradingDay = 1 //ELSIF StartTradingDay = 1 AND Time >= StartTime AND Time <= LimitEntryTime THEN //HighClose = Close[1](High) CloseO = Close HighO = High LowO = Low RangeOpen = HighO - LowO BuyLevel = HighO + TickScale SellLevel = LowO - TickScale StopLong = LowO - TickScale StopShort = HighO + TickScale ENDIF TIMEFRAME(1 seconds, UPDATEONCLOSE) If IntraDayBarIndex = 0 Then TradeONLong = 1 TradeONShort = 1 CntLong = 0 CntShort = 0 LastTrade = 0 count = 0 Endif //GRAPH IntraDayBarIndex as "IntraDayBarIndex" IF Time > StartTime AND TradingDay = 1 AND count <= 3 THEN IF Close > HighO AND count = 0 THEN BUY PositionSize CONTRACTS AT BuyLevel STOP SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen GRAPH LongOnMarket as "LongOnMarket" //GRAPH SHORTONMARKET[1] as "SHORTONMARKET[1]" //GRAPH LongOnMarket as "LongOnMarket" // Definition of the maximum amount to risk per position in case // price goes in an unfavorable direction //LastTrade = 1 CntLong = CntLong + 1 count = count + 1 //GRAPH CntLong as "CntLong" ELSIF Close < LowO AND count = 0 THEN SELLSHORT PositionSize CONTRACTS AT SellLevel STOP SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen //GRAPH SHORTONMARKET as "SHORTONMARKET" // Definition of the maximum amount to risk per position in case // price goes in an unfavorable direction //LastTrade = 2 CntShort = CntShort + 1 count = count + 1 //ELSIF POSITIONPERF(1) < 0 AND count >= 1 THEN ////GRAPH count as "count" //LongPrev = LongOnMarket[1] //ShortPrev = SHORTONMARKET[1] //IF LongPrev THEN ////GRAPH LongPrev as "LongOnMarket[1]" ////GRAPH 1 as "1" ////SELLSHORT PositionSize CONTRACTS AT MARKET //BUY PositionSize CONTRACTS AT MARKET //SET TARGET pPROFIT RangeOpen*ScaleReward //SET STOP PLOSS RangeOpen //count = count + 1 //ELSIF ShortPrev THEN ////GRAPH ShortPrev as "SHORTONMARKET[1]" ////BUY PositionSize CONTRACTS AT MARKET //SELLSHORT PositionSize CONTRACTS AT MARKET //SET TARGET pPROFIT RangeOpen*ScaleReward //SET STOP PLOSS RangeOpen //count = count + 1 //ENDIF ENDIF ENDIFSo are you all good now?

If not, make a brief clear statement on what parts / function in the code you need help / a solution?

Thanks for the asking, much appreciated. So, almost all, I’d say.

Just have two qestions:

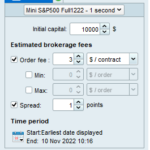

1. What does it mean closing trade like Buy(exit) or Sell(exit)?

2. Position size: 3 contracts, with profit targets of 1R, 2R, and 3R. Once my first target is hit, my stop loss becomes breakeven. – may you suggest about that, how to tackle it?DEFPARAM CumulateOrders = False DEFPARAM PreLoadBars = 0 TIMEFRAME(30 seconds, UPDATEONCLOSE) // No new position is taken after the candlestick that closes 9:45 a.m. FinishTime = 103000 // The market analysis strats at the 30-sec candlestick which closes at 9:00:30 a.m. StartTime = 093030 PositionSize = 3 TickScale = TICKSIZE ScaleReward = 1 PartialCloseCoeff = 3 CloseQuantity = PositionSize/PartialCloseCoeff // Some holidays such as the 24th and 31st of December are excluded IF (Month = 5 AND Day = 1) OR (Month = 12 AND (Day = 24 OR Day = 25 OR Day = 26 OR Day = 30 OR Day = 31)) OR (Month = 1 AND Day = 1) OR (DayOfWeek = 0 OR DayOfWeek = 6) OR (Time < StartTime OR Time >= FinishTime) THEN TradingDay = 0 ELSE TradingDay = 1 ENDIF // We initialize this variable once at the beginning of the trading system. //ONCE StartTradingDay = -1 // We initialize this variable once at the beginning of the trading system. ONCE StartTradingDay = -1 IF (Time < StartTime AND StartTradingDay <> 0) THEN CloseO = 0 HighO = 0 LowO = 0 SellPosition = 0 StartTradingDay = 0 ELSIF Time = StartTime AND TradingDay = 1 THEN //ELSIF Time >= StartTime AND StartTradingDay = 0 AND TradingDay = 1 THEN // We store the index of the first bar of the trading day IndexStartDay = IntradayBarIndex StartTradingDay = 1 //ELSIF StartTradingDay = 1 AND Time >= StartTime AND Time <= LimitEntryTime THEN //HighClose = Close[1](High) CloseO = Close HighO = High LowO = Low RangeOpen = HighO - LowO BuyLevel = HighO + TickScale SellLevel = LowO - TickScale StopLong = LowO - TickScale StopShort = HighO + TickScale ENDIF TIMEFRAME(1 seconds, UPDATEONCLOSE) If IntraDayBarIndex = 0 Then TradeONLong = 1 TradeONShort = 1 CntLong = 0 CntShort = 0 LastTrade = 0 count = 0 CntLongExtra = 0 CntShortExtra = 0 Endif //GRAPH CntLong as "CntLong" //GRAPH CntShort as "CntShort" //GRAPH count as "count" //GRAPH CntShortExtra as "CntShortExtra" //GRAPH CntLongExtra as "CntLongExtra" //GRAPH IntraDayBarIndex as "IntraDayBarIndex" IF Time > StartTime AND TradingDay = 1 AND count < 3 THEN IF Close > HighO AND count = 0 THEN BUY PositionSize CONTRACTS AT BuyLevel STOP SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen CntLong = CntLong + 1 count = count + 1 ELSIF Close < LowO AND count = 0 THEN SELLSHORT PositionSize CONTRACTS AT SellLevel STOP SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen CntShort = CntShort + 1 count = count + 1 ENDIF IF POSITIONPERF(1) < 0 AND count >= 1 THEN // //LongPrev = LongOnMarket[1] //ShortPrev = SHORTONMARKET[1] IF (CntLong = 1 OR CntLongExtra = 1) AND NOT OnMarket THEN count = count + 1 CntShortExtra = CntShortExtra + 1 SELLSHORT PositionSize CONTRACTS AT MARKET SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen ELSIF (CntShort = 1 OR CntShortExtra = 1) AND NOT OnMarket THEN BUY PositionSize CONTRACTS AT MARKET SET TARGET pPROFIT RangeOpen*ScaleReward SET STOP PLOSS RangeOpen count = count + 1 CntLongExtra = CntLongExtra + 1 ENDIF ENDIF ENDIFWhat does it mean closing trade like Buy(exit) or Sell(exit)?

To Exit a Buy (i.e a Long trade) we use Sell.

To Exit a SellShort (i.e. a Short trade) we use ExitShort.

Position size: 3 contracts, with profit targets of 1R, 2R, and 3R. Once my first target is hit, my stop loss becomes breakeven. – may you suggest about that, how to tackle it?

Am I correct in saying that above is not (currently) in your code (posted above) in any form?

So you are looking for somebody to post a new snippet which achieves what you ask for above?

Grahal, let me comment:

1. Ok, about exiting what you mentioned, I understand, I don’t understand why I see such trades in the order list if I have stop loss all the time? I mean I see trades with label “profit” and “loss” and label “exit” appears so rare, but it appears, so, I’m trying understand what it is, may be some glitch in data or something else

2. In general, it’d be great, but at least I’m seeking some clue how to do itlabel “profit” and “loss” and label “exit” appears so rare

Where are you seeing these labels? A screenshot will help loads.

So, here you go.

1. You can find in in order list. Because of such “exit” trades I have wrong trade with another direction, you can see it for 21st October. Moreover, the difference is 1 point(?), like spread I put (?).

2. Also, may you suggest what spread I should put for ES mini futures? I didn’t find yet what does it mean 1 points for backtesting.Missed first one.

-

AuthorPosts

- You must be logged in to reply to this topic.

Conditions on number of trades, reversing trade direction

ProOrder: Automated Strategies & Backtesting

Summary

This topic contains 37 replies,

has 4 voices, and was last updated by PeterSt

3 years, 3 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 11/08/2022 |

| Status: | Active |

| Attachments: | 9 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.