Automated trading with ProOrder and IB is now possible for everyone!

I am excited to announce that the long-awaited feature of automated trading on the Futures market is finally here! Our favorite trading software now allows users to fully automate their strategies, making it easier than ever to take advantage of market opportunities and manage their risk.

With this feature, users can now set up their trading strategies, including entry and exit points, stop-losses, and profit targets, and then let the software execute trades on their behalf on the Futures market.

I believe that this new feature will be a game-changer for many of our users and I am excited to see how it can help them achieve their trading goals. If you have any questions or feedback, please don’t hesitate to ask questions in this dedicated topic to automated trading with Interactive Broker..

What is automated trading with ProOrder?

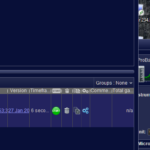

ProOrder is an automated trading feature offered by ProRealTime. With ProOrder, users can create and execute trading strategies based on their own technical analysis and codes built especially to be used with ProRealTime.

These strategies can include rules for entry and exit points, stop-losses, and profit targets. ProOrder also allows users to backtest their strategies using historical market data and optimize their parameters for better performance. Once a strategy is set up, ProOrder can automatically execute trades on the user’s behalf, allowing for more efficient and consistent trading. This can be useful for traders who wish to take advantage of market opportunities without having to constantly monitor the markets.

Where to find automated strategies for ProOrder?

There are many free codes available on ProRealCode forums (ProOrder sections) and in the Library. There are also paid strategies that can be purchased on the ProRealCode marketplace.

What is Interactive Broker and why is it different from the current automated trading feature available?

Interactive Brokers (IB) is an online brokerage firm that provides trading and investment services to individuals and institutional clients. The company was founded in 1978.

Bascially, it is a broker that provide trading on Futures market and therefore uses different fees and margin requirement. The main pros are:

Pros of Futures:

- Lower margin requirements

- Regulated by futures exchanges

- Standardized contracts

What instrument can be traded automatically with ProOrder with Interactive Broker?

Currently, as 9 October 2023, the available instruments and their costs per contract are listed below:

- M2K Micro-Mini Russel 5$/point Margin ~850€ Cost 0.62$/contract

- MES Micro-Mini ES (S&P500) 5$/point Margin ~1500€ Cost 0.62$/contract

- MNQ Micro-Mini NQ (NASDAQ100) 2$/point Margin ~2000€ Cost 0.62$/contract

- MYM Micro-Mini DJ (DOWJONES30) 0.5$/point Margin ~1000€ Cost 0.62$/contract

- DXS Micro-Dax (DAX40) 1€/point Margin ~1500€ Cost 0.38€/contract

+ cancellation fee

- SXE Micro-ESTOXX50 (EUROSTOX50) 1€/point Margin ~400€ Cost 0.34€/contract

+ cancellation fee

- All Forex pairs: Maximum 200k / Spot Gold & Silver: Maximum 80k

Margin ~€1500-2000

Cost min $2/order

- DAX DAX40 25€/point

- DXM Mini DAX 5€/point

- NQ Mini NASDAQ100 20€/point

- ES Mini S&P500 50€/point

- RTY Mini Russell 50€/point

- YM Mini DJ30 5€/point

- ESTX ESTOXX50 10€/point

- FCE CAC40 10€/point

- BUND Euro Bund 10€/point

- EURUSD, EEURUSD, MEURUSD, NG

(updated on 09 October 2023)

Where can I open a new trading account that allow automated trading with IB?

You can start by browsing the below page and fill the forms:

https://trading.prorealtime.com/en/InteractiveBrokers

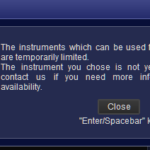

Current limitations and differences with ProOrder on CFD:

_ no trailing stop instruction (currently being developed in order to act the same on any different broker using ProOrder) – It means that: ** SET STOP TRAILING is not possible **

_ ProOrder codes are stopped on rollover of Futures contract – It means that: On each rollover of contract the strategy must be re-started.

Be aware that these are temporary and will be modified for better ease in the next upcoming weeks.

Want to know more? Questions and feedbacks are welcome below 🙂