Good morning, in case I miss something that I have not taken into account, why don’t you use version 4.2? For me it is the one that gives the best results with a very tight DD. At the end of July I put in real and I am getting very good results, attached screenshot.

According to my back test, V5 is better with less DD.

In addition, it has performed really well since it was made in April

I use size 0.5.

Even with 1 contract, V5 has lower DD..

But does V2 make a bigger profit?

@Stefanb what settings are you running? usetimecriteria etc?

I’ve just finished reading this thread – looks like a great strategy.

I’m still finding my way around PRT and IG and would like to confirm something. Regarding the backtesting done by various people above, is that on the Germany 30 ‘CFD’ account or ‘Spreadbet’ account (and is there a way to tell from the posted results)?

Thanks.

@nfulcher

CFD Germany30 with IG Markets.

Good, when I wrote I could not study version 5 quietly, but this is better, having a drowdown less than laitad that 4.2 is preferable to activate version 5.0 with 2 contracts to activate 4.2, since it would take less money and earn plus. Thanks for putting backtest with 200,000 candles.

@Nacho

Backtest with 200k candles / PositionSize = 1 / Spread = 1 with these variables :

once tradeschedule = 0 //[0]=full; [1]=morning; [2]=lunch; [3]=afternoon

once resetcounter = 1 //[0]=default; [1]=experiment (both connected by position criteria)once enablesl = 1 // stoploss

once enablept = 0 // profit target

once enablets = 1 // trailing stop

once enablebb = 0 // bollingerband exit (add bb as indicator to have it visually) (all can be combined)

AE

AEParticipant

Senior

Hi @Balmora74

Thanks you for this fantastic strategy. Two questions:

- Which variables do you recomend to check in order to fit to the market (maybe the angle? the MAs?)

- How many ofen do you recomend check this variables?

Thanks again!

Thanks @AE

QUESTION 1

You can play with :

ONCE PeriodeA = 10

ONCE nbChandelierA= 15

ONCE PeriodeB = 20

ONCE nbChandelierB= 35

ONCE lag = 1.5

and also the variable “pente”

In order to help you in this work you can had these 2 indicators

PeriodeA = 10 //Période de la MM

nbChandelierA= 20 // Nombre de chandeliers sur lesquels on évalue la pente

MM = Exponentialaverage[PeriodeA](close)

//pente = (MM-MM[nbchandelierA])/nbchandelierA

//trigger = Exponentialaverage[Periode](pente)

ADJASUROPPO = (MM-MM[nbchandelierA]*pipsize) / nbChandelierA

ANGLE = (ATAN(ADJASUROPPO))

RETURN angle as "Angle"

PeriodeB = 30 //Période de la MM

nbChandelierB = 40 // Nombre de chandeliers sur lesquels on évalue la pente

lag = -10

MM = Exponentialaverage[PeriodeB](close)

pente = (MM-MM[nbchandelierB]*pointsize)/nbchandelierB

trigger = Exponentialaverage[Periodeb + lag](pente)

//ADJASUROPPO = (ABS(MM-MM[nbchandelierB]*pointsize)) / nbChandelierB

//ANGLE = (ATAN(ADJASUROPPO))

RETURN Pente as "Pente", trigger as "Trigger"

See attached piece for the graphical configuration of these indicators.

For your question number 2 = It’s a good question 🙂

@nacho

Backtest with 200k candles / PositionSize = 1 / Spread = 1 with these variables :

once tradeschedule = 0 //[0]=full; [1]=morning; [2]=lunch; [3]=afternoon

once resetcounter = 1 //[0]=default; [1]=experiment (both connected by position criteria)once enablesl = 1 // stoploss

once enablept = 0 // profit target

once enablets = 1 // trailing stop

once enablebb = 0 // bollingerband exit (add bb as indicator to have it visually) (all can be combined)

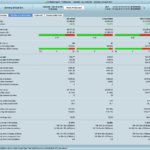

I’ve backtested this tonight using 100,000 and got the following results. This is nowhere near the 95% gain you got above. Is this due to the backtest period.

I’ve used the following variables:

//strategy

once periodea = 10

once nbchandeliera= 15

once periodeb = 25 //20

once nbchandelierb= 35

once lag = 1.5

Google traduction :

Hello Balmora74,

thank you again for your strategy and the idea of giving the corresponding indicators helps to better understand it.

I test this strategy in real and demo, actually I also find some trade differences if the trailing stop is affected at the same time or not.

Moreover, I was able to test strategies in M1 and the problem can be very important with SL affected in real while demo we did a TP.

In demo there are also overnight and overweek charges that are not taken into account.

Regarding the stop follower, I noticed that often the gain realized is well below the maximum gain possible on a position (in the table MFE).

Is there the possibility to modify the variables of this trailing stop which is based on the ATR?

Have a good day.

@tba69

Only english speaking in english forums sections of the website please.

I have had different versions of this code live but now I am considering increasing size of contracts.

Have some € 100 in profit on this code and might as well bet the “profit”

Now I use v5.

Will start with 3 contracts.

Do you have the code live or on demo?

@Stefanb … might be better to wait until you are £1000 in profit and then bet £100 of the free money?

That way you will still be happy even if it goes wrong?? 🙂

I am still in Demo with Vectorials, but I will be going Live as soon as PRT v11 is provided by IG.

If anybody wants to enter performance in the Log below for any version – Forward Test on Demo or Live using live data – then we may all help each other?

Forward Test – Sys Perf