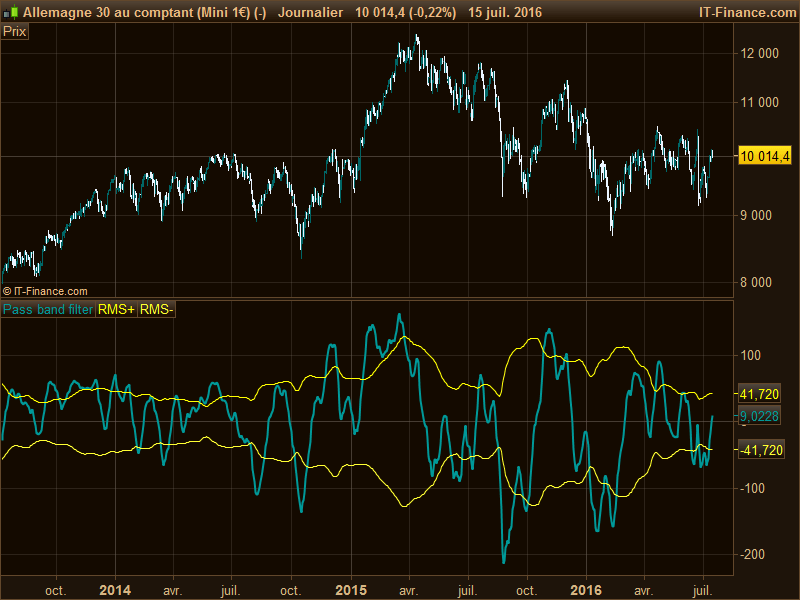

Here is the newest indicator by John Ehlers described in the new traders’tips of July 2016, like his other indicators this one is also a nearly-zero lag filter which is another attempt to filter out noises from high and low frequencies of market data.

John Ehlers describe the trading rules of this new indicator as this:

- Buy on the filter crossing above its -RMS line

- Short on the filter crossing below its RMS line

- Exit long when the filter either crosses below its RMS or crosses below -RMS (which signifies a false entry signal)

- Cover short when the filter either crosses above its -RMS or crosses above RMS (which signifies a false entry signal)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 |

// parameters flen = 40 //fast length slen = 60 //slow length if barindex>slen then a1= 5/flen a2= 5/slen PB = (a1 - a2) * close + (a2*(1 - a1) - a1 * (1 - a2))* close[1] + ((1 - a1) + (1 - a2))*(PB[1])- (1 - a1)* (1 - a2)*(PB[2]) RMSa = summation[50](PB*PB) RMSplus = sqrt(RMSa/50) RMSminus = -RMSplus endif RETURN PB as "Pass band filter", RMSplus as "RMS+", RMSminus as "RMS-" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

For intraday purpose I tried to modify the parameters

Rules are different. It works like a stop and reverse

Long on the filter crossing above its RMS line. Stay Long until the filter is crossing below the lower line (band), then reverse the position from Long to Short

Short on the filter crossing below its RMS line. Stay Short until the filter is crossing above the higher line (band), then reverse the position from Short to Long

It works well on Germany 30 5 min

// parameters

flen = 20//fast length

slen = 30 //slow length

if barindex>slen then

a1= 5/flen

a2= 5/slen

PB = (a1 - a2) * close + (a2*(1 - a1) - a1 * (1 - a2))* close[1] + ((1 - a1) + (1 - a2))*(PB[1])- (1 - a1)* (1 - a2)*(PB[2])

RMSa = summation[25](PB*PB)

RMSplus = sqrt(RMSa/25)

RMSminus = -RMSplus

endif

RETURN PB as \"Pass band filter\", RMSplus as \"RMS+\", RMSminus as \"RMS-\"

Nice, thanks for sharing. How much profitability lookback do you have with this indicator modification?

Well, I am a discretionary trader, so I don’t trade all the signals given by a system or by indicators

All I can say is that this indicator give you good entry points.

…and that’s clever, thanks again for your feed back and your sharing.