1) What this simulator does (and when to use it)

This indicator projects multiple possible future price paths from the latest bar, using the asset’s historical return statistics. It’s designed to answer: “Where could price plausibly go over the next N candles, given recent volatility and drift?”

It’s not a full trade backtester. Instead, it’s a path simulator: it draws NbSimu independent scenarios forward by CandleForward candles and returns the running maximum and minimum reached across all simulated paths.

2) How the engine works (high level)

-

At each bar, the script computes log-like simple returns over

NbCandlebars:v = Close / Close[NbCandle] − 1. -

Over a lookback of length

p, it estimates:-

Mean = Average[p](v)(drift) -

StandardDev = STD[p](v)(volatility)

-

-

On the last bar only (

IsLastBarUpdate), it generatesNbSimuscenarios. Each scenario evolves in steps ofNbCandlebars:-

Draw a uniform random

x ∈ (0,1)with high Precision. -

Transform

xinto a normally distributed shock (NDRV) via a rational transform (a fast inverse-CDF approximation). -

Scale and shift:

NDRV = Mean + NDRV * StandardDev. -

Update price multiplicatively:

DestPrice = OriginPrice * (1 + NDRV). -

Draw a colored segment from the previous point to the new point.

-

-

While simulating, the script tracks the highest (

mx) and lowest (mini) prices touched across all paths and returns them so you can plot bands if desired.

3) Parameters you can tune

Set these as indicator variables (they appear in the indicator’s settings):

-

NbSimu(integer): number of simulated paths to draw. More paths = smoother distribution insight, heavier workload. -

CandleForward(integer): horizon length (in candles) for each scenario. -

per(integer): lookback size used for drift/vol estimates.-

If

per = 0orper > BarIndex, the script automatically uses all available history up to the last bar.

-

-

NbCandle(integer): step size for return sampling.-

1means simulate each candle;5means jump in 5-bar blocks (useful to smooth noise).

-

Advanced internal:

-

Precisioncontrols the granularity of the uniform RNG → smoother normal transform. The default100000is already fine.

4) How to set it up in ProRealTime (step-by-step)

-

Create a new indicator in ProBuilder and paste the full code.

-

Keep the code as-is; parameters are meant to be changed via the indicator settings.

-

Apply the indicator to your chart.

-

Adjust:

-

Start with

NbSimu = 25–50,CandleForward = 50,per = 0(full history),NbCandle = 1. -

If it feels noisy, try

NbCandle = 3–5. -

For regime sensitivity (e.g., recent volatility only), set

perto a fixed window like250.

-

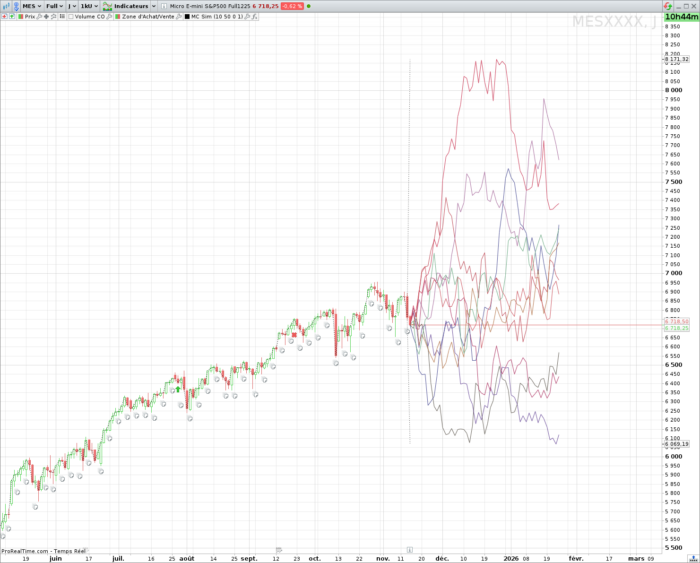

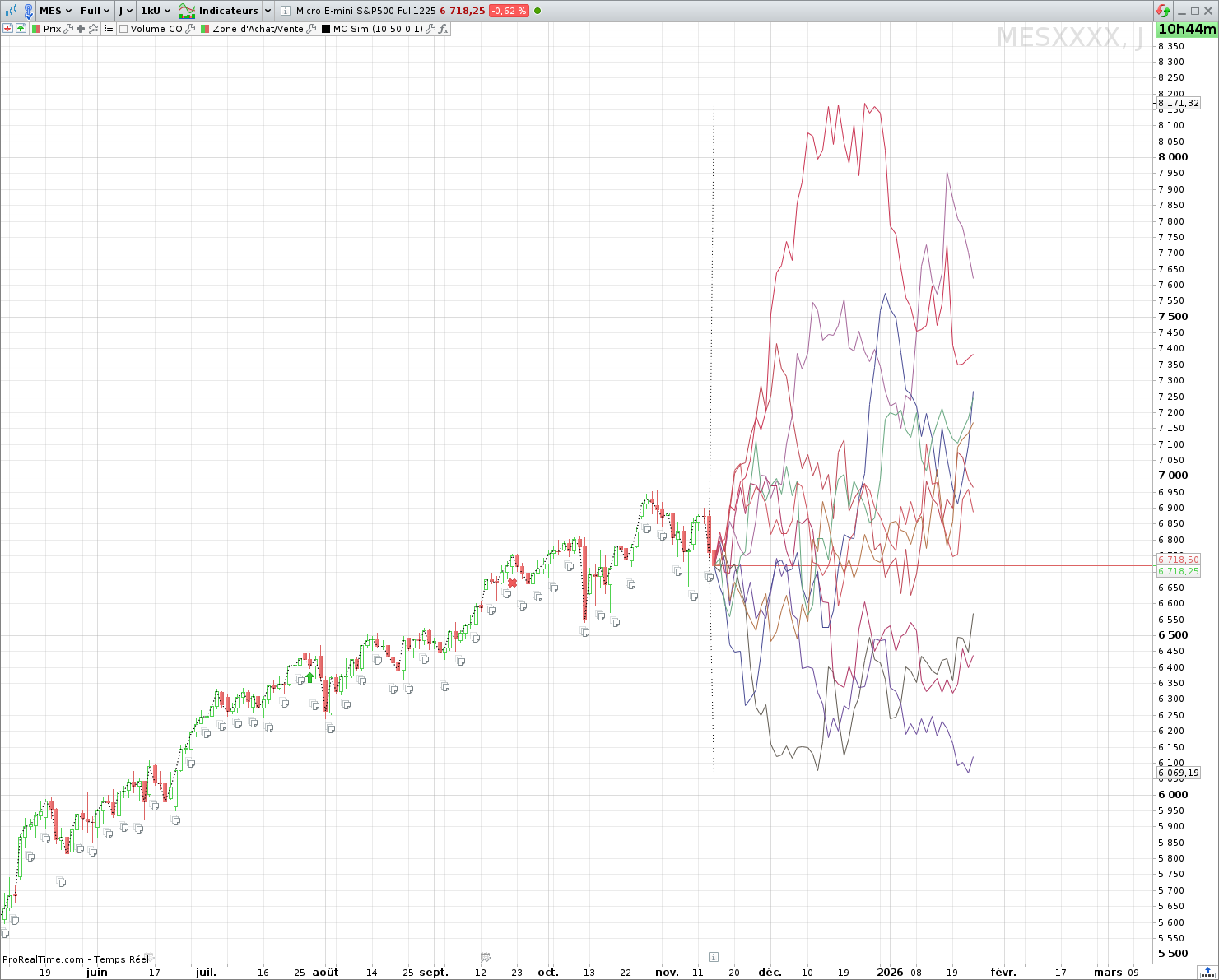

5) Reading the on-chart output

-

Colored path segments: each scenario is drawn in a random color, stepping forward from the last bar. These are possible (not predictions).

-

mxandmini(returned series): the running upper and lower envelopes reached by any scenario across all steps.-

You can plot them as lines to visualize the aggregate uncertainty band.

-

-

Because simulation runs on the last bar, paths emanate from “now” and do not clutter historical sections.

6) Practical tips for realistic simulations

-

Match your sampling to your trading lens:

-

Intraday scaling? Keep

NbCandle = 1. -

Swing lens? Use

NbCandle = 5–20to reflect multi-bar steps.

-

-

Window length (

per) matters:-

per = 0(full history) blends regimes and can under/overstate current risk. -

A rolling window (e.g., 100–250 bars) adapts better to current volatility.

-

-

Horizon vs variance: increasing

CandleForwardcompounds volatility; expect a wider fan even with the sameStandardDev. -

Drift realism: the mean return is typically small; most dispersion comes from

StandardDev. If your asset trends strongly, a shorterpermay capture it. -

Reproducibility: the internal RNG is not seeded; each refresh will produce new paths. Save snapshots if you need to keep a particular simulation.

7) Performance notes & troubleshooting

-

Drawing load: many paths × long horizons = heavy rendering. If it lags:

-

Lower

NbSimu, shortenCandleForward, or increaseNbCandle.

-

-

No lines appear? Ensure you’re on the last bar and the indicator is set to update on the live bar (the simulation runs inside

IsLastBarUpdate). -

Flat bands: happens if

StandardDevis ~0 (quiet market or too smallper). Increaseperor wait for more variability. -

Spikes/overshoots: normal shocks are unbounded; in high volatility regimes, outliers are expected by construction.

8) Code placement reminder (what you may edit safely)

-

Adjust only the parameters at the top:

NbSimu,CandleForward,per,NbCandle(and optionallyPrecision). -

The simulation core (normal transform, loops, drawing,

mx/minitracking) should be left untouched to avoid breaking the math and rendering.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 |

// Parameters to be entered in the indicator variables: ONCE NbSimu = 10 // Number of simulations to display ONCE CandleForward = 50 // Simulation size (in number of candlesticks) ONCE per = 0 // number of candlesticks for calculating statistics; if 0, then the entire history is used ONCE NbCandle = 1 // number of candlesticks for variation calculation // Contenu du code : ONCE Precision=100000 if per>BarIndex or per=0 THEN p=max(BarIndex ,1) ELSE p=per ENDIF if BarIndex >= NbCandle then v=Close/Close[NbCandle]-1 if IsLastBarUpdate THEN StandardDev=STD[P](v) Mean=Average[P](v) ENDIF ENDIF mx=Close mini=close if IsLastBarUpdate THEN NbSimuInit=NbSimu while NbSimu >= 1 do r=RANDOM(50,210) g=RANDOM(50,210) b=RANDOM(50,210) for i=1 to CandleForward do // calcul de xn xn+1 & yn if i=1 THEN OriginInd=BarIndex OriginPrice=Close ELSE OriginInd=DestInd OriginPrice=DestPrice ENDIF DestInd=OriginInd+NbCandle // Calcul de yn+1 en utilisant une loi normale x = RANDOM(1,Precision)/Precision // NDRV = Normaly Distributed Random Variable if x > 1/2 THEN NDRV = 5.5556*(1-POW((1-x)/x,0.1186)) ELSif x < 1/2 THEN NDRV = - 5.5556*(1-POW((x)/(1-x),0.1186)) ELSE NDRV = 0 ENDIF NDRV = Mean + NDRV * StandardDev DestPrice=OriginPrice*(1+NDRV) mx=max(Destprice,mx) mini=min(Destprice,mini) DRAWSEGMENT(OriginInd , OriginPrice, DestInd, DestPrice) COLOURED(r,g,b) NEXT NbSimu = NbSimu - 1 WEND ENDIF RETURN mx as "max",mini as "mini" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials