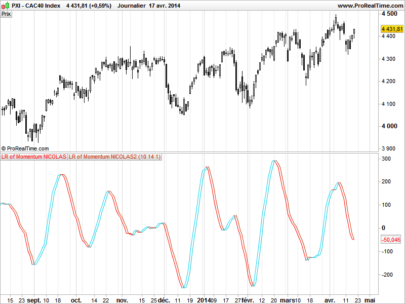

The Efficiency Ratio (ER) was first presented by Perry Kaufman in his 1995 book ‘Smarter Trading‘. It is calculated by dividing the price change over a period by the absolute sum of the price movements that occurred to achieve that change. The resulting ratio ranges between 0 and 1 with higher values representing a more efficient or trending market.

The Kaufman Eifficiency Ratio is also know as Fractal Efficiency. It can be used as a filter to differentiate between trending conditions and sideways markets.

|

1 2 3 4 5 6 7 8 9 10 11 12 |

// parameter // n = 10 Change = ABS(close - close[n]) calc = ABS(close-close[1]) volat = summation[n](calc) ER = Change / volat RETURN ER as "Kaufman's Efficiency Ratio" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thank you!