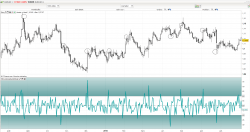

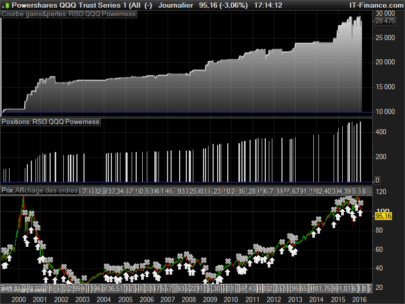

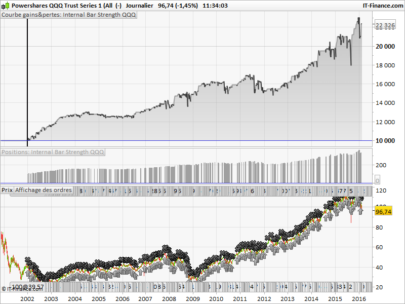

This indicator creates two equity curves of the last twenty long and last 20 short trades. It is based on the simple mean reversal theory of buying if the candle is a red candle and selling if the candle is a green candle and then closing the trade one candle later.

A weighted average of the equity curves is also plotted to assist with analysis.

Each equity curve gives us an indication of recent market conditions.

For example if looking for long trades:

- If the green equity curve is below zero then the last twenty trades would have resulted in an overall loss and this indicates that buying on dips has not worked well recently.

- If the green equity curve is rising or is above the green weighted average then this indicates that buying on dips has worked better than average recently.

- If the green equity curve is above the red equity curve then this shows that going long on dips has been working better than going short on rises recently.

- If the green equity curve crosses over the red equity curve it may be an indication that market direction is changing.

Obviously when looking for short trades apply the same rules to the red equity curve and red average.

As the simulated trades are only one candle long this indicator works better on longer time frames such as daily or weekly to give an overall feel of market sentimentality. When used on weekly time frames it can be used as an overall filter to decide whether you should be putting your trading efforts into going short or into going long or as an indicator of a changing market structure.

As the equity curves are based on the last 20 trades there is the usual expected lag that you inevitably get with this type of indicator.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 |

//Floating Mean Reversal Indicator //Created by Vonasi //19 September 2018 lastlongtradestotal = longtrade1 + longtrade2 + longtrade3 + longtrade4 + longtrade5 + longtrade6 + longtrade7 + longtrade8 + longtrade9 + longtrade10 + longtrade11 + longtrade12 + longtrade13 + longtrade14 + longtrade15 + longtrade16 + longtrade17 + longtrade18 + longtrade19 + longtrade20 lastshorttradestotal = shorttrade1 + shorttrade2 + shorttrade3 + shorttrade4 + shorttrade5 + shorttrade6 + shorttrade7 + shorttrade8 + shorttrade9 + shorttrade10 + shorttrade11 + shorttrade12 + shorttrade13 + shorttrade14 + shorttrade15 + shorttrade16 + shorttrade17 + shorttrade18 + shorttrade19 + shorttrade20 if close[1] < open[1] then longtrade1 = longtrade2 longtrade2 = longtrade3 longtrade3 = longtrade4 longtrade4 = longtrade5 longtrade5 = longtrade6 longtrade6 = longtrade7 longtrade7 = longtrade8 longtrade8 = longtrade9 longtrade9 = longtrade10 longtrade10 = longtrade11 longtrade11 = longtrade12 longtrade12 = longtrade13 longtrade13 = longtrade14 longtrade14 = longtrade15 longtrade15 = longtrade16 longtrade16 = longtrade17 longtrade17 = longtrade18 longtrade18 = longtrade19 longtrade19 = longtrade20 longtrade20 = (close - open) endif if close[1] > open[1] then shorttrade1 = shorttrade2 shorttrade2 = shorttrade3 shorttrade3 = shorttrade4 shorttrade4 = shorttrade5 shorttrade5 = shorttrade6 shorttrade6 = shorttrade7 shorttrade7 = shorttrade8 shorttrade8 = shorttrade9 shorttrade9 = shorttrade10 shorttrade10 = shorttrade11 shorttrade11 = shorttrade12 shorttrade12 = shorttrade13 shorttrade13 = shorttrade14 shorttrade14 = shorttrade15 shorttrade15 = shorttrade16 shorttrade16 = shorttrade17 shorttrade17 = shorttrade18 shorttrade18 = shorttrade19 shorttrade19 = shorttrade20 shorttrade20 = (open - close) endif longave = weightedaverage[20](lastlongtradestotal) shortave = weightedaverage[20](lastshorttradestotal) return 0, longave coloured(0,128,0) style(line,2) as "Long Average", shortave coloured(128,0,0) style(line,2) as "Short Average" , lastlongtradestotal[0] coloured(0,128,0) style(line,1) as "Long",lastshorttradestotal[0] coloured(128,0,0) style(line,1) as "Short" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

@Vonasi I saw that you did some work on seasonality, I wondered if you wanted to go here and tell me what you think https://www.prorealcode.com/topic/seasonality-average/

Sorry – my understanding of Italian is zero so if I watch the video I won’t understand it I’m afraid. Robertogozzi says the code is protected so not possible to recreate.