Hello,

Silly question but I can’t figure it out right now after a busy day.

I would like to introduce in a strategy the high and low of the previous day for an index such as the dowjones, but only during the cash market hours… It’s pretty easy to do it for an indicator, but I don’t know why this isn’t working in proorder.

if time >=153000 and time<=220000 and date=yesterday then

myHigh=max(myHigh , high)

myLow= min(myLow , low)

endif

Any idea why myHigh/myLow are undefined?

DATE can never equal YESTERDAY.

This might help:

Customized Trading session

Thx Vonasi, always quick on the ball!

investigating a new strat based on the the open, close, and the interaction of price with vwap intraday

Vonasi, as you helped me, here is MAYBE your reward…

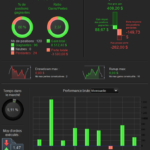

this was not the idea I had in mind a few hours back, but the results are not bad. Tested on Dow Jones 1min, on 200k. Unfortunately, not enough history to really know if this is profitable strategy. Maybe someone who has already access to V11 with millions of bars of history?

DEFPARAM FlatAfter = 215900

DEFPARAM cumulateorders=false

ONCE positionsize=1

// The 24th and 31th days of December will not be traded because market close before 7h45 PM

IF (Month = 5 AND Day = 1) OR (Month = 12 AND (Day = 24 OR Day = 25 OR Day = 26 OR Day = 30 OR Day = 31)) THEN

TradingDay = 0

ELSE

TradingDay = 1

ENDIF

if intradaybarindex=0 then

Longtradecounter = 0

Shorttradecounter = 0

long=0

short=0

endif

//to account for daylight hour change (to update every year)

if (month=3 and day<31 and day>10) then

starttime=143000

endtime=210000

else

starttime=153000

endtime=220000

endif

tradetime=time >=starttime+1500 and time < endtime and dayofweek<>0 and tradingday

if time = starttime then

op = open

lo = low

hi = high

endif

if time = endtime then

//lastop = op

lasthi = hi

lastlo = lo

lastcl = close

endif

if time >= starttime+100 and time < endtime then

hi = max(hi,high)

lo = min(lo,low)

endif

maxi=max(max(op,lastcl),lasthi)

mini=min(min(op,lastcl),lastlo)

if close crosses over maxi and time >= starttime+1500 and time < endtime then

long=1

endif

if close crosses under mini and time >= starttime+1500 and time < endtime then

short=1

endif

myMA7=average[7](close)

if tradetime and not onmarket then

if long=1 and myMA7[1]<myMA7[2] and myMA7>myMA7[1] and Longtradecounter < 1 then

buy positionSize contracts at highest[5](high)+3*pointsize STOP

endif

if short=1 and myMA7[1]>myMA7[2] and myMA7<myMA7[1] and Shorttradecounter < 1 then

sellshort positionSize contracts at lowest[5](low)-3*pointsize STOP

endif

endif

graph longtradecounter

if longonmarket then

Longtradecounter=Longtradecounter+1

endif

if shortonmarket then

Shorttradecounter=Shorttradecounter+1

endif

//if longonmarket and low=lastlo then

//sell at low-3*pointsize STOP

//endif

//

//if shortonmarket and high=lasthi then

//exitshort at high+3*pointsize STOP

//endif

//graphonprice lastcl

//graphonprice op

//graphonprice lasthi

enablets=1 // mettre à 1 pour activer le trailing stop, sinon 0

ts1=0.15 //trailing stop qui commence une fois que ts1% est atteint, puis quand la perf atteint ts2+ts3, diminué à ts2, puis quand la perf=ts1+ts2, placé à ts3

ts2=0.125

ts3=0.10

if enablets then

switch =ts2+ts3

switch2=ts1+ts2

underlaying=100

// underlaying security / index / forex

// profittargets and stoploss have to match the lines

// not to be optimized

// 0.01 forex [i.e. gbpusd=0.01]

// 1.00 securities [i.e. aapl=1 ;

// 100.00 indexes [i.e. dax=100]

// 100=xauusd

// 100=cl us crude

trailingstop1 = (tradeprice(1)/100)*ts1

trailingstop2 = (tradeprice(1)/100)*ts2

trailingstop3 = (tradeprice(1)/100)*ts3

if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then

maxprice1=0

minprice1=close

priceexit1=0

maxprice2=0

minprice2=close

priceexit2=0

maxprice3=0

minprice3=close

priceexit3=0

a1=0

a2=0

a3=0

pp=0

endif

if onmarket then

pp=(positionperf*100)

if pp>=ts1 then

a1=1

endif

if pp>=switch then

a2=1

endif

if pp>=switch2 then

a3=1

endif

endif

// setup long

if longonmarket then

maxprice1=max(maxprice1,high)

maxprice2=max(maxprice2,high)

maxprice3=max(maxprice3,high)

if a1 then

if maxprice1-tradeprice(1)>=(trailingstop1)*pointsize then

priceexit1=maxprice1-(trailingstop1/(underlaying/100))*pointsize

endif

endif

if a2 then

if maxprice2-tradeprice(1)>=(trailingstop2)*pointsize then

priceexit2=maxprice2-(trailingstop2/(underlaying/100))*pointsize

endif

endif

if a3 then

if maxprice3-tradeprice(1)>=(trailingstop3)*pointsize then

priceexit3=maxprice3-(trailingstop3/(underlaying/100))*pointsize

endif

endif

endif

// setup short

if shortonmarket then

minprice1=min(minprice1,close)

minprice2=min(minprice2,low)

minprice3=min(minprice3,low)

if a1 then

if tradeprice(1)-minprice1>=(trailingstop1)*pointsize then

priceexit1=minprice1+(trailingstop1/(underlaying/100))*pointsize

endif

endif

if a2 then

if tradeprice(1)-minprice2>=(trailingstop2)*pointsize then

priceexit2=minprice2+(trailingstop2/(underlaying/100))*pointsize

endif

endif

if a3 then

if tradeprice(1)-minprice3>=(trailingstop3)*pointsize then

priceexit3=minprice3+(trailingstop3/(underlaying/100))*pointsize

endif

endif

endif

// exit long

if longonmarket then

if priceexit1>0 then

sell at priceexit1 stop

endif

if priceexit2>0 then

sell at priceexit2 stop

endif

if priceexit3>0 then

sell at priceexit3 stop

endif

endif

// exit short

if shortonmarket then

if priceexit1>0 then

exitshort at priceexit1 stop

endif

if priceexit2>0 then

exitshort at priceexit2 stop

endif

if priceexit3>0 then

exitshort at priceexit3 stop

endif

endif

endif

//displayts=0

//

//if displayts and priceexit1<>0 then

//graphonprice priceexit1 coloured(0,0,255,255) as "trailingstop1"

//endif

//if displayts and priceexit2<>0 then

//graphonprice priceexit2 coloured(0,0,255,255) as "trailingstop2"

//endif

//if displayts and priceexit3<>0 then

//graphonprice priceexit3 coloured(0,0,255,255) as "trailingstop3"

//endif

//SET TARGET %profit 0.12

SET STOP %loss 0.5

@stefou102

Why not make a quick test on 1M bars with PRT v11? (Dow Jones index).

Would love to, but I have prt via IG, so no access to v11, and in demo I see only data with TF>day…