Some time ago I dealt a little with opening strategies and now I’ve pulled out some again … and was surprised how well it seems to work. Without any magic indicator … I updated this one and it looks pretty good. Timeframe M2 because SL / TP can be scaled better in shorter times.

I am particularly proud of the trend filter, this simplicity leaves no room for over-optimization. Also works great in other indices or in the commodities market.

I would like to have known your opinion. What do you think about that? Does anyone have an idea for improvement as well?

Looks like it has been optimized in 2020 and 2021 ? But generally, it is a good idea to work without time-based indicators and to look at price changes only. Japanese charts such as Renko or Kagi do that. There may be yet less room for over-optimization then.

With 1000000 Candles I would have liked to work. 😉

It was built on 200,000 Candles WF80 / 20. But principle also works on higher Timeframes. Unfortunately, I do not know about Renko. What do you basically say something?

I think robust for 1-2 months and then re-optimize TP / SL.

I wanted to say that Renko or Kagi charts use no time-based indicators such as moving averages that allow nice curve fits for everything. They look only at changes in price, just as you did. There are a few threads on Renko charts in the forum, I think.

Several topics with Renko I have already followed here. Unfortunately, it looks like even the great masters can not work well. So as a small light certainly not. So I have to stay with the more common things.

here’s the 1m bar backtest, run at 08:00 in the UK.

I’ve also played around with this kind of “opening bell” strategy, in my experience the biggest killer is the slippage – can easily be 10-15 points away from the opening value, so the backtest is fairly meaningless.

How do I get 1,000,000 candles? Well, as I said, I had to work on 200,000 candles. I once put the system in a demo and see how it develops.

How do I get 1,000,000 candles?

You have to open a Premium IG account via PRT

I have a normal IG account. Is Premium = Commercial?

@Robertogozzi

I think I just discovered a bug. If the 2nd position opens at 4:30 p.m. … could it be that the SL / TP of the current position changes to the value of the 2nd position? It shouldn’t be like that. What do I have to change?

Is Premium = Commercial?

no, you just have to open it through PRT (so they get a % of the IG fees)

it works exactly the same as any PRT platform except you get 1m bar backtests.

here’s the 1m bar backtest, run at 08:00 in the UK.

I’ve also played around with this kind of “opening bell” strategy, in my experience the biggest killer is the slippage – can easily be 10-15 points away from the opening value, so the backtest is fairly meaningless.

What you can do, is a correction for slippage. You do all calculations in your live system with the open price of the trade candle instead of the real positionprice. That is, if a long position should in theory (without slippage) open at a price of 10.000, with sl and tp both 50 points, but in reality it opens at 10.010 due to slippage, you set the stop nevertheless at 9950 and the limit at 10.050. Slippage can go one way or the other, but most of the time it cancels out over time, because sometimes it is bad, sometimes good.

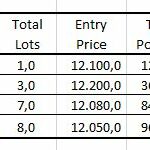

If you accumulate positions, SL and TP are calculated on an average price named POSITIONPRICE (as per attached pic).

Oh good to know Then I will close the first position before the 2nd. Let’s see what that looks like. Thank you Roberto.