Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Why did ALL my active Algo Trading strategies stopped on Christmas Day, at 00:55

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Why did ALL my active Algo Trading strategies stopped on Christmas Day, at 00:55

-

AuthorPosts

-

I do not think they would have lifted margin with 7X

Check IG info pages, if I recall correctly, IG can lift margin by 10x for professional clients over holiday weekends?

Anybody corroborate?

Not for me …

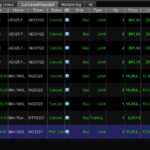

Now this is odd … Attached is the bottom of my list. It starts at December 15 ?

The 2nd attachment shows my manual trading “cancelled” list. It is all what is in there. The top 4 was implied (just minutes ago) by moving a limit order plus changing a quantity. The other ones I don’t know any more. But if these kind of things compose this list, then 1000+ are missing if this should be from of December 7.So indeed things can be in there, but what it is and what not ? …

beats me.May the difference be due to you being IB and I am IG?

Attached is the Version I am using.

Check IG info pages, if I recall correctly, IG can lift margin by 10x for professional clients over holiday weekends? Anybody corroborate?

I think even worse. But normally they warn for that – not this time that I could see. But I was just reading an email from IG with the text below, from December 23, which, btw, is about warning for December 28 and interest rates increasing more than 15 times. But as I noticed the low volatility myself on the 24th, I regard it the same situation – though apparently not expected by IG. Please notice the extreme (?) rare situation that on the 24th ALL was closed, except some Euronext stuff until 2pm my time (1pm your time). So for more regular stuff this was only CAC, IBEX, FTMIB and AEX. No German, no USA (and maybe LSE).

So I myself had the hunch that it was bad to let it running, and actually for the very first time I threw something “overnight” out. I did read the email below, but never paid attention to it or acted upon it.You can translate it via Google if you want. The main message is that IG herself won’t be able to tell what will be happening with all the interest rates, and 15 times higher seems a lot to me. So much so that you could be killed from paying interest. Btw, being short on USD is explicitly mentioned and involvement of the JPY is also explicitly mentioned. And another thing : if you’d have both (our situation at hand) AND you have PortFolio Margin (@Absolute, do you know about this ? hence was this granted to you ?), I would throw all out if I were IG. It would be the opposite of being good and allowing better margin.

So … ??

@GraHal, I was not specific enough. The first attachment in that previous post is IG. The one denoted “manual trading” is from IB.

Below the IG version from you and from me.GraHal thanked this postForgot that text :

(please use Google Translate)

Verwachte volatiliteit in FX financieringspercentages aan het eind van het jaar

In de aanloop naar het nieuwe jaar worden er voor de meeste valutaparen aanzienlijke schrommelingen in de onderliggende financieringspercentages verwacht. Dit heeft te maken met eindejaars marktfactoren, zoals financiële instellingen die hun boekhouding op orde brengen, wat weerslag kan hebben op sommige valuta’s.

We hebben het effect op de gehele forexmarkt waargenomen, hoewel sommige valuta’s waarschijnlijk meer negatief worden beïnvloed dan andere. Dit merkt u vooral als u een short positie heeft in de Amerikaanse dollar.

Als alle overige zaken gelijk blijven, zouden de bied- en laatprijs van forexparen met deze percentages mee moeten veranderen, maar hier hebben wij geen controle over. Het is belangrijk om op te merken dat de administratiekosten van IG niet worden beïnvloed. De financieringspercentages die op het platform staan, zijn slechts indicatief en aan verandering onderhevig.

Wat dit voor u betekent

Financieringspercentages voor valutaparen kunnen extreem volatiel zijn, dit leidt ertoe dat de dagelijkse aanpassingen op uw posities veel hoger zijn dan normaal. Voor zover ons bekend zal dit invloed hebben op:

• Crossparen met JPY die op 28 december na 23.00 uur (Nederlandse tijd) worden aangehouden • De meeste andere paren, alsook goud en zilver, die op 29 december na 23.00 uur (Nederlandse tijd) worden aangehouden • Posities op USD/CAD en USD/TRY die op 30 december na 23.00 uur (Nederlandse tijd) worden aangehouden Bijvoorbeeld, de normale kosten van een rollover voor drie dagen op EUR/USD, zijn 0,61 punt voor een long/short positie (+/- administratiekosten van IG). Volgens de huidige percentages betaalt of ontvangt u meer dan vijftien keer zoveel wanneer u uw posities aanhoudt tijdens de jaarafsluiting. Houd er rekening mee dat deze percentages kunnen

Maybe the liquidity providers took early off beacuse of christmas and UK holiday 27 and 28?

and the system stopped as they usally do when they cant buy or sell (at a resonable price)

I suggest a filter not to trade certain times

Posities op USD/CAD en USD/TRY die op 30 december na 23.00 uur

Maybe this is exacerbated :

I don’t know what’s up with the CAD, but from the TRY I know accidentally that it is undoable to trade with it for hedging (I am not a professional trader, so other’s words for mine). You can’t short it because of 19% interest (this was a beginning of this year – maybe now it is even worse) and you can’t ditch it overnight because of unbelievable spread. Btw, Erdogan tells that he knows what he is doing. 🙁

Now, if someone (IG) warns for a. over 15 times higher interest (like 15 x 19 = ahem 285%) and b. mentions the USD/TRY pair (undoable to begin with), then all red flags should be up.

Maybe I should add (from my own experience) that what IG does with interests is quite crazy when compared with IB. I once even called IG support to ask whether what I saw was correct (I forgot the real figure, but something like charging a full 2% for converting your portfolio from EUR to USD – something which is completely for free with IB (with the additional fun that with IB you do that via a normal Forex trade so you determine the “rate” to pay)). Anyway, because IG is quite crazy with interests, they also have additional duty to warn you for that, which comes down to the warning for them closing positions. Mind you, in itself this is a good thing (it protects you from losing too much money).@GraHal – I use exactly the same version of PRT.

GraHal thanked this post@PeterSt – I received the exact same letter but did not really delved deep into it – it was only noticed….next time I would scrutinise and also interpret and try to extrapolate the detail…where the devil normally hides.

Check IG info pages, if I recall correctly, IG can lift margin by 10x for professional clients over holiday weekends?

@GraHal – this is new to me – I will go and read the terms again – this would be then the most plausible reason why they “tripped” all Algo’s. I will confirm first with IG whether it was the case.

@PeterSt –

I would throw all out if I were IG. It would be the opposite of being good and allowing better margin.

So … ??

I fully agree with your argument here…I still have a lot to learn and experience. I do start to understand why Bill Simons of Renaissance build his own infrastructure…

Which other brokers do link up with PRT similar to IG ?

I suggest a filter not to trade certain times

@Eric, thanks for your feedback. Refer to the two screenshots attached.Contrary to ones gut that tells you that when market goes to sleep ATR should decline. The truth is that ATR spikes in absence of volume when markets goes to sleep.

Do you suggest the filter must contain ATR and TimesOfDay or only one of the two or do you have any other suggestions ?

Below the reply from IG:I use an ATR based TP and SL – Are they possibly responsible for the tripping of Algo’s during times of very limited volume ?

Dear Mr. Rossouw,Thanks for your email.

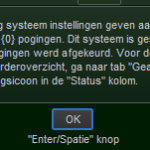

We’ve forwarded your case to Pro Real Time to double check the execution of your system.From what we can see, your system kept trying to execute trades at a price that was no longer available, which caused multiple rejections, eventually leading to your system to stop.

For your reference, the investigation number is 0012701/INC0605895

If you wish to discuss this further, feel free to contact us during business hours.

If you have any further queries, please do not hesitate to contact us. Alternatively, please visit the IG Communitywhere you can share ideas, knowledge and experience with other like-minded traders.

You can now use your domestic debit or credit card to fund your international trading account*. Find out more about international accounts.

Regards,

Trading Services

IG

T +27 10 344 0053

F 011 467 8501

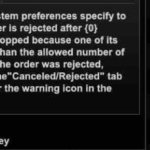

C community.ig.comThis message (below) has been discussed before. But I forgot the merits of it. I have had it myself as well, and in that case the dreaded (for you empty) tab showed like the 2nd attachment for me. Translated it tells that I put the Limit too far from the current price point. If I recall correctly, this was about me setting a TP to “infinity” because the code had a Set Target (whatever) command in there anyway, and I never wanted the system to reach that because I code my own take profit. Btw, just an example and not your case. Still it can very well be about similar but now related to a bug (?). It was also the first thing which came to my mind after reading your topic, yesterday. But, while extreme “sudden distances” can occur when Forex has been down between days (for the 20 minutes or whatever it is), I checked for this in your situation and I don’t think this can be in order.

The above is actually for reference.

Try to interpret that error message as that “your settings” imply that the positions will be cancelled when an error occurs (the system will stop anyway). And thus not that the number of retries (the {0}) is settable (it may read like that). And thus FYI, when you flip that setting, the error will still occur, the system(s) will stop, but the position(s) will remain. You may not like that for the better as your positions become a loose running train.

It could be you yourself with the best insight of what could have happened here, you knowing what your systems actually do. I suppose there will be some (very) nice trickery that makes your systems virtually not lose a thing (remember my “hats off”). That trickery (or smart moves) may now play against you.

Thus, assumed the message is plain correct (price is not available any more), what could it be in all of your systems that made PRT choke ? Or actually made the broker system choke.

Let me add that your first post has an atmosphere of “yeah, I could expect this to happen long ago, but it always went fine”. N.b.: Pure my own words but also my way of debugging IT systems (the way the user reports is often crucial for the analysis).Something else – see 4th attachment;

To me it seems that the losses in pips are way out of consistency boundaries. It will be again you who can tell something about that. Thus, how on earth can a system which tends to make a few pips per trade, lose over 100 pips in so many of these cases, which actually should be a static situation ? I won’t tell this seems fishy, but something tells me that this can’t be. And with this too, you never talked about this, which to me “speaks”. Again, you could be doing something in there which is “the big trick”, but on the 26th a situation occurred that did not dig it. … You surely should not unveil your secrets, but you should be able to answer the question whether it could be normal that these relatively large losses occur in all of your systems, once they were thrown out at any random moment. Btw, you don’t need to explain that any still running position is virtually always in a loss, until that very brief (scalping) moment. But this high ?All ‘n all, in 100% good spirit, couldn’t you expect this to happen one day ?

🙂 -

AuthorPosts

- You must be logged in to reply to this topic.

Why did ALL my active Algo Trading strategies stopped on Christmas Day, at 00:55

ProOrder: Automated Strategies & Backtesting

Summary

This topic contains 34 replies,

has 6 voices, and was last updated by Absolute

4 years ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 12/28/2021 |

| Status: | Active |

| Attachments: | 26 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.