Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

The fall of Outperforming Long Bots

- Forums

- ProRealTime English Forum

- General Trading: Market Analysis & Manual Trading

- The fall of Outperforming Long Bots

-

AuthorPosts

-

What a time!

A month or two ago I posted on a thread ‘Does this strategy look any good?’

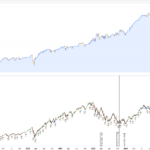

My case towards the end of the thread was basically anticipating the Mean Reversion of outperforming long bots, particularly US markets. The system I posted has had its regular draw down and cut off. A new BTD Ndq bot I started in 2025 as per annual re-balancing blew up (Monte Carlo cut-off) as per trade plan. No surprise there and a mechanical decision. My XJO portfolio has had a very expected pull back. My portfolio lacks momentum trading and is mean reversion based.

Overall, there is nothing ‘wrong’ with each area of my portfolio on an individual level. Astute traders here will be quick to point out a bit of a correlation issue, which is true as I’m not large enough to be as diversified as I’d like. I have not been working this year and as part of my ecosystem it is my manual trading hybrid systems that short the market. I log them anyway and they have out performed to the short side. At best I’d be running flat minus the blown bot so a regular DD that would be lasting for an entire quarter! That’s a whole lot of work for nothing as trading can be sometimes. Another system I have on NDQ STFR basically scalps crashes and performed beautifully but was unfortunately in incubation at the time.

Reading through the market place posts and some of the newer titles I see the theme here. Out performers have gone quiet! Known players are having their worst months of consecutive losses and it does indeed look like everything (indices) correlates in a time like this.

I would like to hear from who and what has been working for everyone here? I read some mention of decent scalp bots and see JS with something incredible but know nothing about his system. Who is nailing diversification and how?

My overall experience is that manual trading can expect reliable weekly/monthly returns off a solid system but Algos need to be considered investments and reviewed quarterly and annually. I am open to be shown differently.

…and please don’t turn this into yet another system vendor chatroom, but methods and experiences more than welcome from all!

Thanks

CC

Hi,

Thanks for your openness — it’s true, these are tough times…

As for my “incredible” system: it also went through a significant drawdown, to the point that I had to shut it down…Unfortunately, mean reversion just doesn’t work anymore in this Trump-driven market…

Looking back over the past few months, it’s only cost me money…

The high volatility caused by uncertainty is definitely a challenge…

The solution lies in incorporating that volatility (standard deviation) into your system…

GraHal and coincatcha thanked this posthi to all and to the other side of the planet in particular 😀

would also like to hear / see somebody who was doing kind of at least well during these jo-jo markets of Feb and March… and happy to read that you CC at least doing well with your manual trading. I skipped that approach of trading manually many years ago for myself – I simply have no solid idea about how/what and especially why should I trade manually. if I have an idea then it has to be very simple, and if it is simple, then I can code it and backtest over maximum data available in order to figure out if that idea is repeatable and if it is crap or cool. if I cannot code – obviously I cannot test it, so why would I trade it…

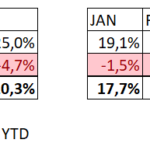

on the other hand – my algos in trading portfolio I also adjust from time to time, but does it make single algos “investement”? I do not kick single algos out of the portfolio since few years already, but adjust occasionally some things within the logic due to particular observations, not necessarily because of strategy performance (good or bad). mostly these adjustments are related to simplification of the logic, in best case I manage some reduction of parameters: my hope (and experience) being that the simplier the logic the more robust is the system. I kind of “visually” have all my major strategies in my mind and think of them a lot – and I think in terms of “how could I possibly make them simplier?!?!?”. and yes, sometimes I reduce the position size, temporarily at least. as I did it end of March this year – after max drowdown of my futures algo portfolio exceeded -15%. my max “pain” level is -20% but I started to reduce positions of few long strategies after reaching -15%. beginning of April portfolio reached the YTD max drawdown at -18% so I cannot tell what I would precisely have done if it had reached -20% but the plan was to reduce positions of few more strategies – again, not necessarily because of their poor performance but because these strategies I trade with multiple contacts so I can reduce. anyway the plan was not to kick some of them out of portfolio. the point is that with futures one can not trade fractions of contracts so I know that I am running some of the algos with “too big” size, too big compared to what I would consider “optimal”. if and when whole portfolio reaches new highs (I hope it will this year still 🙂 ) I will then increase reduced positions back to “standard”, not earlier probably.

well, diversification… I am super-strong believer that one needs it. even if it is not always very obvious. I trade futures only for dax and I am very happy to have few going-long approaches and few less but still several going-short. I know from experience and from backtests that longs and shorts sometimes all perform poorly during particular periods – as they did in my case whole March. but they also sometimes perform well in the same period – like they did in April so far. so even my shorts are still performing negatively for YTD, I stick to them. their time will come I am quite sure, they contributed to the total result positively and significantly last year and also before. in fact my shorts were doing better than longs last year until including October or mid of November, even if 2024 was overall very bullish for major equity indices and dax, too.

I cannot tell anything about “mean reverse” approaches currently doing bad or good, nor about – possibly opposite – “trend following” approaches, since I don’t know in which exactly to put my systems 🙂

for your fun I attach YTD performance of my dax futures algo portfolio. still faaaar away from “doubling my account every week” ;-D

cheers

justisan

GraHal, Snålänningen, coincatcha and JS thanked this postJust to add my two cents… my mean reversal systems are either trading nothing or at least in the black this year. Even simple things like Tuesday turnarounds have worked so far this year. Trend followers that are only long are sometimes in the red, but there are also systems that are only long that have a small profit for me. I’ll have to sort out what works better… with a small drawdown. My day trading things, long and short in small time frames, are working really well, though. I’m now convinced that this might yield more profit in the long run.

GraHal, coincatcha and JS thanked this postHello everyone,

I agree that many “fancy” indicator‑based systems with complex parameter setups have gone quiet during periods of high volatility—especially throughout these recent “Trump‑driven” market swings. What I’ve found to work consistently before, during, and after such turbulent times is pure candlestick patterns and price‑action algorithms, with no traditional technical indicators at all.

coincatcha and JS thanked this postThanks everybody for some replies. I’ve had a day to think about these and come up with some more ideas for my next coding bubble which I do about 2-3mths per year then await results. @justisan “I don’t know in which exactly to put my systems” You raise a fair point here. I say mean reversion but are they really? Everything in essence is catching a trend albeit 10sec or 3 weeks. If I enter on an impulse move to the upside but from an area where data demonstrates mean reversion is probable, then I trail that until it kicks itself out…..then do I have a Breakout system, Mean Reversion or a Trend following system? Or all 3? Often these systems I write that have worked combine all three. In the case of the bots I posted above, they literally buy/sell a 2-20 bar price break and reverse it. The only ‘indicator’ I tend to use regularly are forms of EMAs and this is to determine location of transactions (ie Filter). But I don’t just fiddle and find, I conduct deep testing of multiple impulse signals with a count test, 1:1, 1:2…all straight out of K.Davey’s workbook and has given me my most robust work to date. Anyway all this has me thinking some more. Certainly my Volatility based systems have held up fine (thanks JS) I suppose because they are very selective. Also funny you say MR systems don’t work in Trump2.0 because back in early Feb I heard another trader say Trump has killed swing trading! This thinking always seems to lead me back to Less is More. 2-3 rule systems divided by time. Case in point below, 2 other system versions I could have chosen to the BTD I ran. My plan was to scale them up and I guess I got greedy wanting more action to help bide time during my year off of doing school runs for 3, so it was a trading decision based off the bear market performance in 2022. It seems catching every major bull run on the Nasdaq was not enough for me! No biggie, I’ve blown up so many systems yet I always make more. My diversification was coming from my manual trading so I will address that. Obviously this must be the continuous lure of faster systems..to be doing something. That’s a psychological issue, exactly what we are trying to avoid! Thanks crew@coincatchaI just wanted to let you know that I was able to adapt my system to the volatility, by integrating the standard deviation, and started it up again this week…

If I am to believe the “backtest”, the system now performs even better in volatile times…

coincatcha thanked this postOops, I see that my daughter was still logged in…

Brief explanation of the system used:

This is a somewhat unconventional approach compared to what’s typically discussed here. I’ve written about it on this forum before — I apply concepts from Digital Signal Processing (DSP).

I treat the price data as an input signal and perform a decomposition on it. Essentially, this means breaking down the input signal into simpler, more fundamental components. You can think of it similarly to the numerical decomposition of a value — for instance, the number 4351 can be decomposed into 4000 + 300 + 50 + 1. When these components are summed (superposition), they reconstruct the original value (signal).

The goal of signal decomposition is to reduce a single complex signal into simpler, analyzable parts, enabling individual processing of each component. These components can then be used to extract the underlying characteristics or structure of the signal. Once the key signal features are identified, it’s possible to determine what kind of strategy or response is most appropriate.

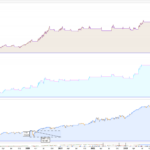

I applied this decomposition technique to the Dow Jones index and extracted nine dominant characteristics from the signal. These features have been integrated into the logic of my current trading system.

GraHal, coincatcha and Method314 thanked this postBig Thanks JS for sharing your insight … how to make ‘good out of bad‘ re Trump-driven chaos in the markets!- What Timeframe on DJIA have you found gives most consistent results?

coincatcha thanked this postThe good thing about these rough times is that you’re forced to go back to the drawing board because your “incredible” system turned out to be not so incredible after all…

The timeframe I’m using here is 1 minute, and the optimization is done over 200k bars…

P.S. The backtest results are shown above…@JS I’ve been wishing the day away to get back to here to talk to you. Then you have already beat me to it, posting exactly what I would have asked you for! Please be aware, when a true Quant comes along and casually demonstrates how this should be done it can alter the course of one’s life. Know this. I’ve read you say that “nobody is looking at price” in their data before. I wholeheartedly agree that it is far superior to bunching a few lagging indicators and finding some sort of average achievable trade management that gives at best a D grade edge, but makes some money so we call it a bot. The silly thing about it is, it is SO obvious that there is a strong tendency to want to make our algos look like manual textbook trades. I’m super guilty of it but have moved on somewhat after a 3.5 month experiment last year which altered my course forever. Without going too far into it, I proved to myself that this should be approached through mathematical edges. To create undeniable records of proof. Taking every signal to 90% compliance rate whether I wanted to or not. I was petrified every time it seemed random. Then scaled as it was working, then got paid. They didn’t all look like trades at all. The misunderstood thing is (for me), how should one dissect and process price exactly? I mean, you just told us one way… but before then it can be hard to know where to start without some sort of base in Quant Finance or Computer Science. Of course if I truly believed what I just wrote I never would try thus fail before the beginning. So I set about my first real attempt at using price and time only + one filter. That’s the NDQ STFR Tail I posted earlier. Very inspiring to see more of your work and no doubt we are all very lucky here to share the way we do. You just don’t get this on Australian forums. You’re right too, it’s the adversity that drives innovation or less elegantly put… Traders Pain! Now I have some serious homework to do. I taught my kids superposition decomposition last year when we were homeschooling them. It’s a Montessori technique for 1st grade math. We are not done with this topic by a long way, so I must stop and let others chime in. Before I do though I can briefly show how I am now approaching this (past 12months) as to price points I assign meaning to. Thank you so much.JS thanked this postYes, exactly—that’s it. You have to go through the fire…

Once you realize that everything incredible happening right now in the world of technology is built on mathematical and statistical foundations, you start seeing signals differently… that’s when you step into the real game…

I was completely lost at first too, but slowly the insights start to come. I might only understand one percent of that fascinating world, but that one percent is so important…

I hope I’ve laid down a sort of foundation to build upon, but hopefully you also understand that I can’t reveal everything…

Still, if you keep digging into decomposition and superposition, you’ll come across it eventually…

Let’s keep digging. 😊coincatcha thanked this postOk great. Sure I get it that that these enlightenments must be discovered and truly understood to form a deep belief system as a foundation. Ridding the rubbish paradigms entrenched in us in Theta state. This can only be gained through experience of discovery and grueling pain. That can’t be free. Give a man a fish for a day or teach him how to fish and all that. I want the pain. Bring it. ..still you will hear from me some more!JS thanked this postJS is your Backtest Timeframe 1 minute because you have a Trailing Stop running on M1 TF? What is the TF over which you decompose the Signal? Is it 1 Hour maybe or is it 1 Day? If 1 Hour (or whatever TF, please say?) … how many hours back from current hour are you decomposing the Signals in those Hours / Bars? This is what I meant when I asked what is the maximum value entered in Optimiser (in the min, max and step boxes)?coincatcha thanked this post -

AuthorPosts

- You must be logged in to reply to this topic.

The fall of Outperforming Long Bots

General Trading: Market Analysis & Manual Trading

Author

Summary

This topic contains 58 replies,

has 8 voices, and was last updated by coincatcha

9 months ago.

Topic Details

| Forum: | General Trading: Market Analysis & Manual Trading |

| Language: | English |

| Started: | 04/22/2025 |

| Status: | Active |

| Attachments: | 16 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.