Hi,

I have optimised the timing of trading of this interesting strategy from @juanj (thanks to him) for the DAX H1;

Universal Strategy

Enjoy safely ^^

————————————–

📍 http://best-trading-algos.com :

✅ 250+ strats ranked by perf

#algotrading #trading #tradingstrategy

👉 Visualize and anticipate when your strategy goes out off track, so you can cut it

👉 Relauch it when it is back on track

📍 StratSENTINEL – Lifetime licence

https://market.prorealcode.com/product/stratsentinel/

📍 StratSENTINEL – Daily Licence

https://market.prorealcode.com/product/stratsentinel-daily-licence

Hello,

long-long-long term backtesting (2006) is nice, but doing a medium-term backtesting (just latest 12 motnhs), we get the following equity curve:

which doesn’t look appetizing to try it at real. Note a psicological effect: even having an smart equity curve on the long term, you won’t be able to hold this algo on real if after 12 months, it is loosing money as we can apretiate on this screenshot. IMHO, this is key. Also appliable to best-trading-algos.

Perhaps if you calibrate it to have a better performance in 12 or 6months, it could be a good option 🙂

@alfredocuaresma

please do not embed pics and other files in your post, as this slows down the loading of the pages. Use the “Select File” button to attach files, instead.

Thanks 🙂

@alfredocuaresma I perfectly agree; this is where StratSENTINEL comes in the picture: to distinguish the proper moment to launch the strat;

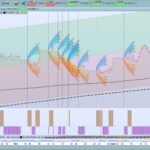

As you can see on the upper part of the chart, StratSENTINEL gives you clearly a red flag signal that the strat is going of track which is coherent with your own chart;

However, the global profile of this strat is not bad to me with a slope that has absorbed all the big drawdowns of the market;

🙌 BACKTESTS UPDATE 🙌 Actualy since January ^^

Hi,

Thanks for your interest in this project.

Our mission is to ease the PRC algo-trader’s life by giving him a simple tool that ranks in a click the best free and paid algos running on ProRealTime.

We have many news about this project :

👉 The +280 algos of the ProRealCode site are now updated

👉 EscoTrading and Squared2 and ProfitAlgos are listed on our independent and transparent site so that you can check their value

👉 We have added the positions of the strategies in order to compare on an equal basis all strategies and reduced to 1 contract the contract size (except for Martingales for which the increase of risk is part of the core concept)

👉 We have created a new tool to help you launch the algo at the right moment: StratSENTINEL

✅ We give a 30% discount to anybody that brings us a strategy that

- we don’t already have (oh really ?? 😉

- that is a potential 2 stars = initial capital x 2 after 200 000 units backtest

At your disposal to help you find your way in algo-trading,

Chris

MetaSignalsPro

—————————————–

📍 http://best-trading-algos.com :

✅ 250+ strats ranked by perf

#algotrading #trading #tradingstrategy

📍 StratSENTINEL

👉 Visualize and anticipate when your strategy goes out off track, so you can cut it

👉 Relauch it when it is back on track

📍 StratSENTINEL – Lifetime licence

https://market.prorealcode.com/product/stratsentinel/

📍 StratSENTINEL – Daily Licence

https://market.prorealcode.com/product/stratsentinel-daily-licence

Sounds good, looks good!

I flashed over the links above, but it didn’t leap out at me … how, in a few words, do we use StratSENTINEL?

Would we …

- Run StratSENTINEL as an Indicator alongside a backtest of MyAlgo-1 while at same time MyAlgo-1 is running under ProOrder?

OR

2. StratSENTINEL runs as an integral part of MyAlgo-1 and we keep an eye on the profits equity curve while MyAlgo-1 runs under ProOrder?

OR

3. Neither 1. or 2. above, you would use StratSENTINEL like this … ???

I flashed over the links again a tad slower this time, I can see that it can be 2. above as you say …Contact us by mail if you want to implement these 2 indicators inside your strategy.

I will look and read again, but do you anywhere show results with and without StratSENTINEL?

So if StratSENTINEL is run as described in item 1. (in my post 2 above) then I would need to keep close eye on a backtest /StratSENTINEL Indicator.

Above is obvious I know. but I just wanted to ‘close the loop‘ on my post.

implement these 2 indicators inside your strategy.

I guess to run as above then I would need to provide you with my Algo code and you then hide your StratSENTINEL code within my Algo code and post the full code back to me?

So if StratSENTINEL is run as described in item 1. (in my post 2 above) then I would need to keep close eye on a backtest /StratSENTINEL Indicator.

Above is obvious I know. but I just wanted to ‘close the loop‘ on my post.

implement these 2 indicators inside your strategy.

I guess to run as above then I would need to provide you with my Algo code and you then hide your StratSENTINEL code within my Algo code and post the full code back to me?

Hi Grahal,

I love when you answer yourself all the legitimate questions one can ask ;-))

To be honnest, the offer was on the subscription 😉 and I haven’t stopped hopping that you will give me a hand one day on the best-trading-algos project; never knows ^^^;-)

At your disposal,

Chris

So if StratSENTINEL is run as described in item 1. (in my post 2 above) then I would need to keep close eye on a backtest /StratSENTINEL Indicator.

Above is obvious I know. but I just wanted to ‘close the loop‘ on my post.

Hi @Grahal,

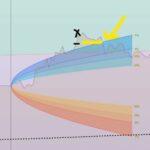

To answer you more concretey, here for example thanks to StratSENTINEL #2 (the probability cone) , you know that you need to get out, as your performance is among the 1% of the best Trades of this strategy;

While StratSENTINEL #1 (the dotted and the plain line) tells you that the strategy is still on the right track;

This is the way you can handle at your advantage a good timing for launching the algo AND maximising the equity.

At your disposal,

Chris

@grahal

Just to complete you will find enclosed with this algo the evolution of the price and the proof of the relevance of such a method as the price is now receding: our profits have been optimised.

=> f you want you can post here a reliable public algo that you have in production and if it looks ok I could launch it live to have more cases?

@grahal

and this is how the trade finished from this algo;

So thanks to this statistical tool of StratSENTINEL

- we have closed a trade when it was in the 1% of the best deals

- avoiding a final trade being in the average

Do you mean IF you had closed the trade at X?

I still can’t get my head around how StratSENTINEL helps as one still has to judge the ‘top’ … which is easy to do with hindsight … as you you have and then marked an X on the Chart.

The equity curve crossed under the 1% StratSENTINEL curve line twice, but you decided to mark x at a ‘top’ for which the StratSENTINEL would have been no help in identifying??

Maybe I am missing something?

Do you mean IF you had closed the trade at X?

I still can’t get my head around how StratSENTINEL helps as one still has to judge the ‘top’ … which is easy to do with hindsight … as you you have and then marked an X on the Chart.

The equity curve crossed under the 1% StratSENTINEL curve line twice, but you decided to mark x at a ‘top’ for which the StratSENTINEL would have been no help in identifying??

Maybe I am missing something?

Hi Grahal,

Thanks for your legitimate question; in this case what guided me is the average duration of the trades which is indicated by the length of the Probability Cone;

You are right; you could have rationaly cut at the first breakout of the 1% line; but it was little early in the duration, so I took the risk and waited for a new higher high.

At your disposal,

Chris