🏁 StratSENTINEL Signal 🏁

🟢 We are going LIVE with this version of Timehunter

strategy BarHunter DAX v1p

👉 If you want to know more about StratSENTINEL and why we launch this ** stars strategy now

https://market.prorealcode.com/product/stratsentinel-daily-licence/

https://best-trading-algos.com/

reb

rebParticipant

Master

with some modifications, but still without stoploss

Hello @reb,

I’ve added the following code to the input condition

and open>low and high>close and (open[2]<close or close[3]<close or open[1]<indicator5[1] or indicator5[10]<indicator5 or high[2]<high or low[2]<low or dopen(0)<close or dopen(1)<dopen(0)or dclose(1)>dopen(0))

Hi @fifi743 @reb

This is great; thanks guys for your inputs; this hereunder strategy modified which is better than the first one will be added and monitored on best-trading-algos.com

The backtest is just impressive ^^^; never seen a 99% ratio of win ^^^^

Please continue to post here all the stategies that you want me to monitor scatered in all the threads;

@reb

thanks for your feed abck on our work ^^^^;

FYI, this hereunder strategy is already listed:-) it’s a * star (one star) performer unfortunetly

https://www.prorealcode.com/prorealtime-trading-strategies/heiken-ashi-trading-system-with-rsi-dax-mini-nasdaq-mini-ita40-min on Dax

//==========================================================================================================

// Code: TEST Bollinger Band Engulfing (Long Only)

// Source: Inspired by all things trading related

// Author: samsampop

// Version 1

// 1.4 fifi743 : adding these conditions in the input

// and open>low and high>close and (open[2]<close or close[3]<close or open[1]<indicator5[1] or indicator5[10]<indicator5 or high[2]<high or low[2]<low or dopen(0)<close or dopen(1)<dopen(0)or dclose(1)>dopen(0))

// Index: DJI

// TF: 15 min

// TZ: EU

// Spread: 3

//

// Next Needs stop loss

// Add shorting strategy

//==========================================================================================================

DEFPARAM CumulateOrders = False // Cumulating positions deactivated

Defparam Preloadbars = 1000

//stp = 2000

//Risk Management

PositionSize=1

tp = abs(close-average[20,1](open))

//StopLoss=stp

//=== Entry Filter ===

//Only go long when close is above the close of 1 week prior

priorweekclose=close[480]

bubba = close[480]-close //points

diff = bubba/priorweekclose //as percentage

//graph bubba

//graph diff

//Identify an up trend in the market on same timeframe

indicator3=average[55,7] //71

indicator4=average[145,7] //174

F1 = indicator3>indicator4

// Conditions to enter long positions

Headroom = average[20,1] - 5

indicator5 = BollingerDown[20](close)

c1 = (close[1] < indicator5)

c2 = open < close

c3 = (close > open[1])

c4 = close[1] <= open[1]

c5 = close < Headroom

IF F1 and c1 AND c2 AND c3 AND c4 AND c5 AND bubba > 0 and open>low and high>close and (open[2]<close or close[3]<close or open[1]<indicator5[1] or indicator5[10]<indicator5 or high[2]<high or low[2]<low or dopen(0)<close or dopen(1)<dopen(0)or dclose(1)>dopen(0)) THEN

BUY PositionSize CONTRACT AT MARKET

set target profit tp

//set stop $loss StopLoss

ENDIF

// Exit Zombie Trade

EZT = 1

if EZT then

IF longonmarket and (barindex-tradeindex(1)>= 200 and positionperf>0) or (barindex-tradeindex(1)>= 500 and positionperf<0) then

sell at market

endif

endif

The backtest is just impressive ^^^; never seen a 99% ratio of win ^^^^

Less than one star from me. 😉 And still subtract one star for the lacking SL.

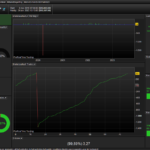

The trades/revenue you see in the 1st attachment could be of any substance. But spread over 1,5 years ? forget it. You can’t even by bread from it. But this is okay of course and to each his own. However, the fun really fades if you see what you need to do for it. That shows in attachment #2.

I post this, not to rain on someone’s parade, but to show to people how to interpret Systems which look to good to be true.

A kind of positive (though subjective) remark : This System is super decent and it doesn’t even require a SL. But on the other hand, that’s exactly where the tradeoff is hidden : it is so decent that it trades so few times that nothing can be made of it.

🙂

reb

rebParticipant

Master

Just one thing to add

I am using it from beginning 2022, and no discrepancy between Backtest and real account

At this stage 2 494 points won, 100% W, 134 trades

Thks @samsampop, the creator who unfortunately is no longer on this website

100% W, 134 trades

Wait, so why do I have 9 trades only then (in Backtest but that should not matter if all is right) ?

Do you use another TimeFrame ?

OK, I am doing this on IB. I wouldn’t think this matters for this System ?

OK, again :

The backtest is just impressive ^^^; never seen a 99% ratio of win ^^^^

Right !

Now on to the why of the difference. I hope I used the correct instrument on IB ?

Btw, I used the $2 cash here (could not find the $1 quickly).

Hello,

You can’t compare IG to IB, they don’t have the same flow.

The algorithm was designed for IG

IB and IG are totally incomparable. See the first picture for about the same time span. IB starts at 15:30 (Amsterdam) and ends at 22:00. IG starts at 00:00 and ends at 23:00.

In this DJI case there’s even sufficient volatility outside trading hours.

So … Peter should have taken the IB DJI Future because IB’s DJI Index is only active during RTH.

This DJI Future coincidentally does not work out for the best because it runs into the “Zombie” protection (500 bars) once – and in bad shape of the trade. The IG Index also runs into that protection but with a coincidental very low loss.

So a SL or other measure is still needed and that will make the win rate lower. Of course you can also make the zombie protection more weak (like 1000 bars) but hey …

I did that in the 4th attachment and we see that it is not quite for the better. So it is still a bit of too good to be true, but you must run unlucky in order to be bothered by that. 😉

reb

rebParticipant

Master

100% W, 134 trades

Wait, so why do I have 9 trades only then (in Backtest but that should not matter if all is right) ?

Do you use another TimeFrame ?

OK, I am doing this on IB. I wouldn’t think this matters for this System ?

My mistake, it isn’t 134 but 45 trades (I read the wrong line on my xls file)

Sorry if i’m wrong, but the only way to exit an order in loss is located here:

// Exit Zombie Trade

EZT = 1

if EZT then

IF longonmarket and (barindex-tradeindex(1)>= 200 and positionperf>0) or (barindex-tradeindex(1)>= 500 and positionperf<0) then

sell at market

endif

endif

Allow an order to exit in loss ONLY if it has last for at least 500 bars of 15-minutes: 96 days!

So it’s not the entries that generate a positive result, it is the way the losses are handled: bet on price will go up someday! Which is most of the time with indices as DOW, but what about the drawdown during bear market?

JS

JSParticipant

Senior

Hi,

500 bars of 15 minutes = 7500 minutes = 125 hours = 5,2 days (not 96 days?)