Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

System stopped [defparam] by this code

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- System stopped [defparam] by this code

-

AuthorPosts

-

Hi

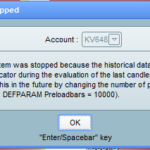

Who can explain the meaning the following code? because I had run some, but sometimes was stopped by systems. It said I need to amend this. Many thanks.

defparam cumulateorders = true / false ??? defparam preloadbars = 10000Try below …

defparam cumulateorders = True //or False, but not both :)It’s also a problem with preloadbars instruction. Try to increase the number.. There is a problem with history data of an indicator inside

I tried it “True” and “False”, system still reject it immediately.

What happens if you delete defparam cumulateorders altogether?

If Algo still gets rejected then something else is causing Rejection?

Try testing on a reduced number of bars until the Algo does not get Rejected.

Let us know how you get on please?

I have deleted the “defparam cumulateorders”, ran 3 hours, then also was stopped. 🙁

This system has also run in other instruments, no this issue.

p.s., I am using Vectorial, and Mother of Dragon also have this problem.

You should post the code and tell us the instrument you are trading, in order to try to replicate the issue.

ran 3 hours

Try it on 3 hour timeframe and on 100 bars and let us know how you get on?

defparam cumulateorders = true defparam preloadbars = 10000 once tradetype = 1 // [1]long/short [2]long [3]short once reenter = 1 // [1]on [0]off (off ignores positionperftype/value below) once positionperftype = 0 // [0]loss/gain [1]loss [2]gain once positionperfvalue = 0.1 // % (0 or higher) once stochasticrsi = 1 once sll = 1.6 // stoploss long once sls = 1.8 // stoploss short once ptl = undefined // profit target long once pts = undefined // profit target short once overnightposition = 1 once weekendposition = 1 // money management MM = 0 // = 0 for optimization if MM = 0 then positionsize=1 // ENDIF if MM = 1 then ENDIF ENDIF if overnightposition=1 and weekendposition=1 then ctime = (time>=14000 and time=<240000 or time>=000000 and time<3500) and not (time>=120000 and time<130000 or time>=50000 and time<60000) elsif overnightposition=0 then ctime = (time>=044500 and time<220000) //and not (time>=153000 and time<163300) elsif overnightposition=1 and weekendposition=0 then ctime = ((dayofweek<5 and time>=044500 and time<230000) or (dayofweek=5 and time>=044500 and time<220000)) //and not (time>=153000 and time<163300) endif once periodea = 33 //14 once nbchandeliera = 14 //20 once periodeb = 32 //29 once nbchandelierb = 48 //41 mma = exponentialaverage[periodea](close) adjasuroppo = (mma-mma[nbchandeliera]*pipsize) / nbchandeliera angle = (atan(adjasuroppo)) mmb = exponentialaverage[periodeb](close) pente = (mmb-mmb[nbchandelierb]*pipsize) / nbchandelierb trigger = exponentialaverage[periodeb](pente) cb1 = angle >= 34 cs1 = angle <= -28 cb2 = (pente crosses over trigger) and (pente >-6 and pente < 1) cs2 = (pente crosses under trigger) and (pente >-11 and pente < 9) //entrees en position condbuy = cb1 and cb2 //and low<>dlow(0) //and close<>low condsell = cs1 and cs2 //and high<>dhigh(0) //and close<>high //stochastic rsi | indicator if stochasticrsi then lengthrsi = 11 // 2 rsi period lengthstoch = 2 // 6 stochastic period smoothk = 4 // 4 smooth signal of stochastic rsi smoothd = 10 // 8 smooth signal of smoothed stochastic rsi myrsi = rsi[lengthrsi](totalprice) minrsi = lowest[lengthstoch](myrsi) maxrsi = highest[lengthstoch](myrsi) stochrsi = (myrsi-minrsi) / (maxrsi-minrsi) k = average[smoothk](stochrsi)*100 d = average[smoothd](k) c13 = k>d c14 = k<d condbuy = condbuy and c13 condsell= condsell and c14 else c13=c13 c14=c14 endif // entry criteria if ctime then if (tradetype=1 or tradetype=2) then if condbuy and not longonmarket then buy positionsize contract at market if tradetype=1 then set stop %loss sll set target %profit ptl elsif tradetype=2 then set stop %loss sll set target %profit ptl endif endif endif if (tradetype=1 or tradetype=3) then if condsell and not shortonmarket then sellshort positionsize contract at market if tradetype=1 then set stop %loss sls set target %profit pts elsif tradetype=3 then set stop %loss sls set target %profit pts endif endif endif if reenter then if positionperftype=1 then positionperformance=positionperf(0)*100<-positionperfvalue elsif positionperftype=2 then positionperformance=positionperf(0)*100>positionperfvalue else positionperformance=((positionperf(0)*100)<-positionperfvalue or (positionperf(0)*100)>positionperfvalue) endif if (tradetype=1 or tradetype=2) then if condbuy and longonmarket and positionperformance then sell at market endif if condbuy[1] and not longonmarket then buy positionsize contract at market if tradetype=1 then set stop %loss sll set target %profit ptl elsif tradetype=2 then set stop %loss sll set target %profit ptl endif endif endif if (tradetype=1 or tradetype=3) then if condsell and shortonmarket and positionperformance then exitshort at market endif if condsell[1] and not shortonmarket then sellshort positionsize contract at market if tradetype=1 then set stop %loss sls set target %profit pts elsif tradetype=3 then set stop %loss sls set target %profit pts endif endif endif endif else if longonmarket and condsell then //sell at market endif if shortonmarket and condbuy then //exitshort at market endif endif // break even stop once enablebe = 1 if enablebe then once besg = 0.89//0.25 //% break even stop gain once besl = -0.001//0.75 //% break even stop level (+ or -) if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then benewsl=0 endif if longonmarket then if high-tradeprice(1)>=((tradeprice(1)/100)*besg)*pointsize then benewsl=tradeprice(1)+((tradeprice(1)/100)*besl)*pointsize endif endif if shortonmarket then if tradeprice(1)-low>=((tradeprice(1)/100)*besg)*pointsize then benewsl=tradeprice(1)-((tradeprice(1)/100)*besl)*pointsize endif endif if barindex-tradeindex>1 then if longonmarket then if benewsl>0 then sell at benewsl stop endif if benewsl>0 then if low crosses under benewsl then sell at market endif endif endif if shortonmarket then if benewsl>0 then exitshort at benewsl stop endif if benewsl>0 then if high crosses over benewsl then exitshort at market endif endif endif endif endif // trailing atr stop once trailingstoptype1 = 1 // trailing stop - 0 off, 1 on if trailingstoptype1 then once tsincrements = 0.11 // set to 0 to ignore tsincrements once tsminatrdist = 1 once tsatrperiod = 9 // ts atr parameter once tsminstop = 20 // ts minimum stop distance once tssensitivity = 1 // [0]close;[1]high/low if barindex=tradeindex then trailingstoplong = 10 // ts atr distance trailingstopshort = 8 // ts atr distance else if longonmarket then if tsnewsl>0 then if trailingstoplong>tsminatrdist then if tsnewsl>tsnewsl[1] then trailingstoplong=trailingstoplong else trailingstoplong=trailingstoplong-tsincrements endif else trailingstoplong=tsminatrdist endif endif endif if shortonmarket then if tsnewsl>0 then if trailingstopshort>tsminatrdist then if tsnewsl<tsnewsl[1] then trailingstopshort=trailingstopshort else trailingstopshort=trailingstopshort-tsincrements endif else trailingstopshort=tsminatrdist endif endif endif endif tsatr=averagetruerange[tsatrperiod]((close/10)*pipsize)/1000 //tsatr=averagetruerange[tsatrperiod]((close/1)*pipsize) // (forex) tgl=round(tsatr*trailingstoplong) tgs=round(tsatr*trailingstopshort) if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then tsmaxprice=0 tsminprice=close tsnewsl=0 endif if tssensitivity then tssensitivitylong=high tssensitivityshort=low else tssensitivitylong=close tssensitivityshort=close endif if longonmarket then tsmaxprice=max(tsmaxprice,tssensitivitylong) if tsmaxprice-tradeprice(1)>=tgl*pointsize then if tsmaxprice-tradeprice(1)>=tsminstop then tsnewsl=tsmaxprice-tgl*pointsize else tsnewsl=tsmaxprice-tsminstop*pointsize endif endif endif if shortonmarket then tsminprice=min(tsminprice,tssensitivityshort) if tradeprice(1)-tsminprice>=tgs*pointsize then if tradeprice(1)-tsminprice>=tsminstop then tsnewsl=tsminprice+tgs*pointsize else tsnewsl=tsminprice+tsminstop*pointsize endif endif endif if barindex-tradeindex>1 then if longonmarket then if tsnewsl>0 then sell at tsnewsl stop endif if tsnewsl>0 then if low crosses under tsnewsl then sell at market endif endif endif if shortonmarket then if tsnewsl>0 then exitshort at tsnewsl stop endif if tsnewsl>0 then if high crosses over tsnewsl then exitshort at market endif endif endif endif endif // trailing stop percentage once trailingstoptype2=1 if trailingstoptype2 then once trailingpercent = 1 once steppercent = (trailingpercent/10)*1 if onmarket then trailingstart = tradeprice(1)*(trailingpercent/100) trailingstep = tradeprice(1)*(steppercent/100) endif if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then newsl=0 endif if longonmarket then if newsl=0 and high-tradeprice(1)>=trailingstart then newsl = tradeprice(1)+trailingstep endif if newsl>0 and high-newsl>trailingstep then newsl = newsl+trailingstep endif endif if shortonmarket then if newsl=0 and tradeprice(1)-low>=trailingstart then newsl = tradeprice(1)-trailingstep endif if newsl>0 and newsl-low>trailingstep then newsl = newsl-trailingstep endif endif if barindex-tradeindex>1 then if longonmarket then if newsl>0 then sell at newsl stop endif if newsl>0 then if low crosses under newsl then sell at market endif endif endif if shortonmarket then if newsl>0 then exitshort at newsl stop endif if newsl>0 then if high crosses over newsl then exitshort at market endif endif endif endif endif // market resilience once mr=1 if mr then starttime = 0 // 08h00 Pré Market EU (Cac, Dax, Footsie, ect...) endtime = 140000 // 09h00 Ouverture session européenne if intradaybarindex = 0 then hh = 0 ll = 0 endif if time >= starttime and time < endtime then if high > hh then hh = high endif if low < ll or ll = 0 then ll = low endif endif fib38 = hh fib0 = ll fibobull200 = (fib38-fib0)*2.19+fib0 fibobull162 = (fib38-fib0)*1.59+fib0 fibobull124 = (fib38-fib0)*0.73+fib0 fibobull100 = (fib38-fib0)*0.07+fib38 fibobull76 = (fib38-fib0)+fib38 fibobull62 = (fib38-fib0)*1.87+fib0 fibobear62 = (fib0-fib38)*0.29+fib0 fibobear76 = (fib0-fib38)+fib0 fibobear100 = (fib0-fib38)*0.45+fib0 fibobear124 = (fib0-fib38)*0.99+fib0 fibobear162 = (fib0-fib38)*0.67+fib0 fibobear200 = (fib0-fib38)*0.08+fib0 fibobull200=fibobull200 fibobull162=fibobull162 fibobull124=fibobull124 fibobull100=fibobull100 fibobull76=fibobull76 fibobull62=fibobull62 fibobear62=fibobear62 fibobear76=fibobear76 fibobear100=fibobear100 fibobear124=fibobear124 fibobear162=fibobear162 fibobear200=fibobear200 if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then flag1=0 flag2=0 flag3=0 flag4=0 flag5=0 flag6=0 flag7=0 flag8=0 flag9=0 flag10=0 flag11=0 flag12=0 endif if time>=0 then if longonmarket then if close crosses over fibobull62 then flag1=1 endif if flag1=1 then if close crosses under (ll+fibobull62)/2 then sell at market endif endif if close crosses over fibobull76 then flag2=1 endif if flag2=1 then if close crosses under (hh+fibobull76)/2 then sell at market endif endif if close crosses over fibobull100 then flag3=1 endif if flag3=1 then if close crosses under (fibobull62+fibobull100)/2 then sell at market endif endif if close crosses over fibobull124 then flag4=1 endif if flag4=1 then if close crosses under (fibobull76+fibobull124)/2 then sell at market endif endif if close crosses over fibobull162 then flag5=1 endif if flag5=1 then if close crosses under (fibobull100+fibobull162)/2 then sell at market endif endif if close crosses over fibobull200 then flag6=1 endif if flag6=1 then if close crosses under (fibobull124+fibobull200)/2 then sell at market endif endif endif if shortonmarket then if close crosses under fibobear62 then flag7=1 endif if flag7=1 then if close crosses over (hh+fibobear62)/2 then exitshort at market endif endif if close crosses under fibobear76 then flag8=1 endif if flag8=1 then if close crosses over (ll+fibobear76)/2 then exitshort at market endif endif if close crosses under fibobear100 then flag9=1 endif if flag9=1 then if close crosses over (fibobear62+fibobear100)/2 then exitshort at market endif endif if close crosses under fibobear124 then flag10=1 endif if flag10=1 then if close crosses over (fibobear76+fibobear124)/2 then exitshort at market endif endif if close crosses under fibobear162 then flag11=1 endif if flag11=1 then if close crosses over (fibobear100+fibobear162)/2 then exitshort at market endif endif if close crosses under fibobear200 then flag12=1 endif if flag12=1 then if close crosses over (fibobear124+fibobear200)/2 then exitshort at market endif endif endif endif endif // display days in market once displaydim =0 // displays the number of days in market (activated graph) once maxdim =99 // maximum days in market if displaydim then if not onmarket then dim=0 else if onmarket and not onmarket[1] or (longonmarket and shortonmarket[1]) or (shortonmarket and longonmarket[1]) then dim=1 endif endif if not opendayofweek=0 then if onmarket then if openday <> openday[1] then dim = dim + 1 endif endif endif if onmarket and dim>=maxdim then sell at market exitshort at market endif //graph dim // display days in market endif if not overnightposition then if time>=215400 then sell at market exitshort at market endif endif if not weekendposition then if (dayofweek=5 and time>=215400) then exitshort at market sell at market endifHi Robertogozzi

This is the code and running in Hong Kong instrument with HK time.

It is based on Vectorial strategy and only adjusted the figures for HK. I have also ran in DJI, DAX, no such issue.

Sometimes, I used the strategy “Mother of Dragon” in Japan and Singapore instruments, also have this issue.

Thanks.

running in Hong Kong instrument

Which Hong Kong instrument?

Do you mean the Hang Seng Index?

Runs okay for me (no error message etc) on 10k bars on 3 H TF on the Hang Seng … see attached.

When you confirm what Instrument and TF and No of bars and Timezone you are having Issues with then I will run same on my Platform for you.

Yes, Hang Seng index

What Timeframe and No of bars and would that be UTC +8?

yes, UTC +8 and 3 min. & 100,000 bar

-

AuthorPosts

- You must be logged in to reply to this topic.

System stopped [defparam] by this code

ProOrder: Automated Strategies & Backtesting

Author

Summary

This topic contains 20 replies,

has 4 voices, and was last updated by GraHal

5 years, 5 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 09/17/2020 |

| Status: | Active |

| Attachments: | 1 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.