Here is another strategy I converted from TV.

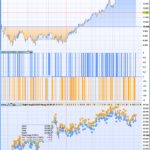

Results attached.

Can I request a 200k results for this please?

Even if looks a bit curve fitted, its could be because of trailing stop function there.

The entries are decent most of the times so might need an expert’s optimisation.

Please run, feedback and improve.

//Converted from TV strategy

// Converted by boonet

defparam cumulateorders = false

Timeframe(1 hour)

stmult = 2

stperiod = 9

atr = max(max((high-low),abs(high-close[1])),abs(low-close[1]))

uplev= low - (stmult * atr[stperiod])

dnlev= high + (stmult * atr[stperiod])

uptrend=0.0

if close[1] > uptrend[1] then

uptrend = max(uplev,uptrend[1])

else

uptrend = uplev

endif

downtrend = 0.0

if close[1] < downtrend[1] then

downtrend = min(dnlev,downtrend[1])

else

downtrend = dnlev

endif

trend = 0

if close > downtrend[1] then

trend = 1

elsif close < uptrend[1] then

trend = -1

endif

if trend=1 then

stline = uptrend

elsif trend =-1 then

stline = downtrend

endif

bullish = close crosses over stline

bearish = close crosses under stline

Timeframe(default)

// Conditions to enter long positions

IF NOT LongOnMarket AND bullish THEN

BUY 1 CONTRACTS AT MARKET

ENDIF

// Conditions to enter short positions

IF NOT ShortOnMarket AND bearish THEN

SELLSHORT 1 CONTRACTS AT MARKET

ENDIF

//

SET STOP loss 500

//Break even

breakevenPercent = 0.13

PointsToKeep = 20

startBreakeven = tradeprice(1)*(breakevenpercent/100)

once breakeven = 0//1 on - 0 off

//reset the breakevenLevel when no trade are on market

if breakeven>0 then

IF NOT ONMARKET THEN

breakevenLevel=0

ENDIF

// --- BUY SIDE ---

//test if the price have moved favourably of "startBreakeven" points already

IF LONGONMARKET AND close-tradeprice(1)>=startBreakeven*pipsize THEN

//calculate the breakevenLevel

breakevenLevel = tradeprice(1)+PointsToKeep*pipsize

ENDIF

//place the new stop orders on market at breakevenLevel

IF breakevenLevel>0 THEN

SELL AT breakevenLevel STOP

ENDIF

// --- end of BUY SIDE ---

IF SHORTONMARKET AND tradeprice(1)-close>startBreakeven*pipsize THEN

//calculate the breakevenLevel

breakevenLevel = tradeprice(1)-PointsToKeep*pipsize

ENDIF

//place the new stop orders on market at breakevenLevel

IF breakevenLevel>0 THEN

EXITSHORT AT breakevenLevel STOP

ENDIF

endif

// trailing atr stop

once trailingstoptype = 1 // trailing stop - 0 off, 1 on

once tsincrements = .01 // set to 0 to ignore tsincrements

once tsminatrdist = 1//3

once tsatrperiod = 14 // ts atr parameter

once tsminstop = 12 // ts minimum stop distance

once tssensitivity = 1 // [0]close;[1]high/low

if trailingstoptype then

if barindex=tradeindex then

trailingstoplong = 2//4 // ts atr distance

trailingstopshort = 2//4 // ts atr distance

else

if longonmarket then

if tsnewsl>0 then

if trailingstoplong>tsminatrdist then

if tsnewsl>tsnewsl[1] then

trailingstoplong=trailingstoplong

else

trailingstoplong=trailingstoplong-tsincrements

endif

else

trailingstoplong=tsminatrdist

endif

endif

endif

if shortonmarket then

if tsnewsl>0 then

if trailingstopshort>tsminatrdist then

if tsnewsl<tsnewsl[1] then

trailingstopshort=trailingstopshort

else

trailingstopshort=trailingstopshort-tsincrements

endif

else

trailingstopshort=tsminatrdist

endif

endif

endif

endif

tsatr=averagetruerange[tsatrperiod]((close/10)*pipsize)/1000

//tsatr=averagetruerange[tsatrperiod]((close/1)*pipsize) // (forex)

tgl=round(tsatr*trailingstoplong)

tgs=round(tsatr*trailingstopshort)

if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then

tsmaxprice=0

tsminprice=close

tsnewsl=0

endif

if tssensitivity then

tssensitivitylong=high

tssensitivityshort=low

else

tssensitivitylong=close

tssensitivityshort=close

endif

if longonmarket then

tsmaxprice=max(tsmaxprice,tssensitivitylong)

if tsmaxprice-tradeprice(1)>=tgl*pointsize then

if tsmaxprice-tradeprice(1)>=tsminstop then

tsnewsl=tsmaxprice-tgl*pointsize

else

tsnewsl=tsmaxprice-tsminstop*pointsize

endif

endif

endif

if shortonmarket then

tsminprice=min(tsminprice,tssensitivityshort)

if tradeprice(1)-tsminprice>=tgs*pointsize then

if tradeprice(1)-tsminprice>=tsminstop then

tsnewsl=tsminprice+tgs*pointsize

else

tsnewsl=tsminprice+tsminstop*pointsize

endif

endif

endif

if longonmarket then

if tsnewsl>0 then

sell at tsnewsl stop

endif

if tsnewsl>0 then

if low crosses under tsnewsl then

sell at market // when stop is rejected

endif

endif

endif

if shortonmarket then

if tsnewsl>0 then

exitshort at tsnewsl stop

endif

if tsnewsl>0 then

if high crosses over tsnewsl then

exitshort at market // when stop is rejected

endif

endif

endif

endif

Thanks @Paul

Yeah as said seems a bit fitted, but win rate is good.

Can you do your magic on this Paul? 🙂

Paul

PaulParticipant

Master

Hi Boonet,

I poured your code in the the layout of vectorial. This is a good example to test retry.

One pic is similar to yours with retry off. I didn’t match be/ts/sl though. (here sl2%,ts1%) (no rsi stochastic or something else, but with mri)

the second pic, I activated retry and the problem became visible. Too many signals in one area, which means big problems & low quality.

The bigger the Stoploss, trailing stop, the less meaning have a signal, as they don’t get out and keep stuck to the position and curvetting will show nice graph.

I can post the code now, but maybe I can improve a bit.

Paul

PaulParticipant

Master

Spend some time on this, but not getting the results I seek. Attached is the code. The retry method is an approach, but maybe it’s not suited to be used for every strategy.

Thanks @Paul.

I will take a look and comeback to you.

Attached 200k backtest of “version 0”.