While out sailing today I got to thinking about the relationship between holding on to a trade in the hope that it returns to profit, draw down and overnight fees – particularly in relation to buying indices. Obviously the longer you hold a trade the greater probability of it returning to profit but the greater chance of larger draw down – but what about the effect of overnight fees? I wanted to see if their was a turning point where overnight fees made continuing to hold pointless as they just ate into any profit that you would eventually get.

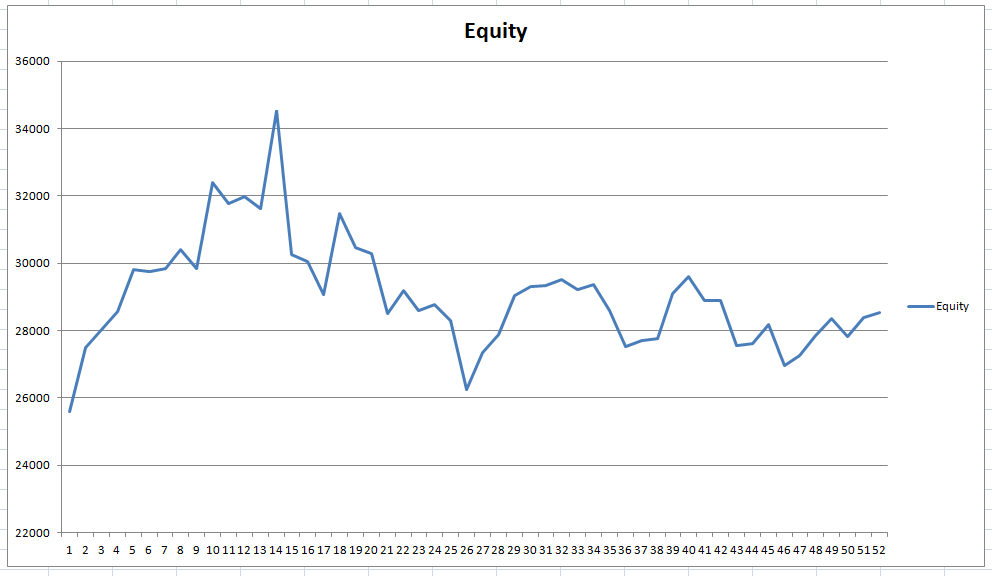

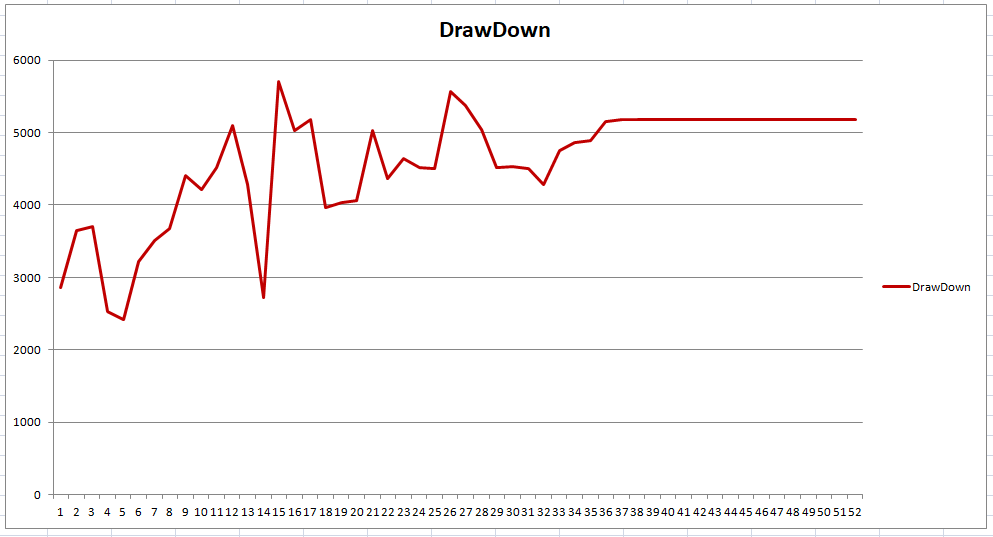

So I wrote a simple strategy that bought the Dow Jones Index on dips on a weekly chart and held a position until it either returned to profit or had been held for a certain number of weeks. No filters. All trades were done at close of bar. I tested holding for anything from 1 to 52 weeks.

I added into the strategy my code for subtracting overnight fees to give a more true equity curve. Obviously this is still inaccurate as LIBOR rates have changed over the years and I had to choose one – so I chose the latest rate. Also spreads may have changed over the years so I had to fix that at 3.8 as well.

Here are the results:

It is quite clear that holding for too long is pointless. Equity increases up to about 14 weeks and then starts to decline as fees eat into the profits. Draw down also increases up to a similar holding length of time. It seems clear that for this strategy at least holding for an absolute maximum of 14 weeks is the most cost effective – holding beyond that is a waste of time as you will make less money and more likely have higher draw down.

Sometimes it is nice to see these things in a graph.