Hi @Paul

Thanks for your work !

Instead of MFE and MAE on which I work a lot (And don’t use them actually), why don’t you simply use 2 variable a and b with set targt pprofit a and set stop ploss b or with trailing stop ?

Because the problem with MAE and MFE is that some winning trades with MAE can be cut too soon and some other winning trades can be cut too soon too ? Hope I’m clear

With these 2 “simple” variables the system calculate the best compromise

Have a nice day Paul

That is splendido, MM works perfick now, new version attached.

I revised the stops and targets as it seemed they might be over-optimized for such a short backtest, still does well with more generalized values.

Could be a winner! 😁

well done!

how much is this optimized nonetheless? 70/30?

@ullle73, this also fixes the .2 problem

how much is this optimized

The indicators I added are optimized at 70/30, stops and targets were done with 100% of data

Five minutes to explain what I said before, on a picture, and why for me it’s better to use variables a and b, or sometimes only a

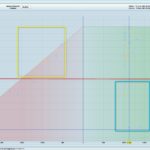

When we use MAE (same thing with MFE), as you see on the picture if we put a cutoff at -1500 USD for example, we lose all winning trades in the blue rectangle and we still have losing trades in the yellow rectangle

And if we use a cutoff at -3000 USD you have effectively all winning trades, but all losing trades too

That’s why, for me, it’s better to use a variable, to do a backtest, and choose the best compromise

MAE/MFE works ONLY when it can separate quite all winning/losing trades who is very very rare

And finally, the more complex is the code, the more curvefitting we will have

Have a nice day @Paul

Paul

PaulParticipant

Master

Hi @Zilliq, So you also work the other way around? Doing a backtest without or large stoploss then determine the cutoff /compromise point visually and you use that as stoploss? This with limited variables.

It’s need to sink in a bit more & I will do some experiments with less variables.

Thnx for your explanation & have a nice evening!

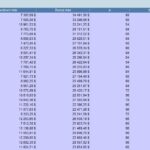

No @Paul I use one variable to determine the better compromise in the backtest as you can see on the picture (Stop at 26, 28, 30, pip and so on..)

The backtest determine the better stop not me and not visual

Never more than 3 variables in all the algo and the more simple it is the less curvefit we will have

We need always remember that it is like a polynomial regression on gain (More variable=more curvefit=bad OOS results on mid/long term and more often on small term)

Have a nice evening Paul

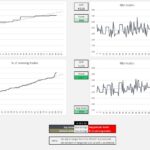

Hi Paul, here’s a v11 update – optimized 75/25 so about 8 months OOS. I tried both ATR and % TS (4MM pc), not a huge difference but I think the ATR gives a better curve. VRT is uncommonly good, so that’s encouraging.

Best regards and thanks again for sharing this.

Paul

PaulParticipant

Master

Hi nonetheless, great work, it looks really good with lots of trades!

Only thing I see, don’t know what difference it would make yet, you defined n (5) as parameter for the supertrend, but n is also used a bit below and assigned to value 4 in the mfe&mae section.

It’s no big deal, the performance is as it is but maybe there’s a bit more room to optimise.

Thnx for putting it online & investing time in this concept!

you defined n (5) as parameter for the supertrend, but n is also used a bit below

Hey, well spotted – explains why I got a different result when I tried to clear the opt box and insert the values in the code. It was bending my brain trying to find the discrepancy so I just left it. I don’t normally post the itf like that but if I hadn’t I’d have never found out.

So here’s the correct version — Supertrend (2.5,6) — gives a nice 5% bump to overall performance.

I just arrived here I don’t know how bu I’d like to say congrtas to you guys! This strat looks very promising 🙂

I´m on UTC+01.00 Sweden

I´ve changed “closetime = 235500” (was 225500, row 55)

But what should I have here below? Don´t understand the “0” (row 59)

ctime=time>=0 and time<230000//UK time

Hi oboe, this is how I would check for the best Ctime settings:

Ctime = time >=t1 and time <t2

then enter a range of times, for example 0 to 150000 for t1 and 180000 to 230000 for t2

both with steps of 10000

Thanks nonetheless!

Yes I´m familiar to the way to optimize. I just want to use the same settings as you to replicate and look at your result. If “0” is the same as “000000” I guess it will be

ctime=time>=010000 and time<000000 in my timezone.