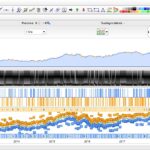

Last update with your adjustments @paul on nikkei. Tested on 200K, spread on 8.

Paul

PaulParticipant

Master

Every year positive on the Nikkei! I’ve seen a lot worse tests. Can you post your changed settings so I can have a look?

On the south african 40.

I increased the spread to 20. As with the nikkei I want to take a different approach to handle that, but that’s for later.

So it’s basically the file you got, activated trailing stop, stoploss 2, profittarget 2

break=20 & only one bar is analysed for long & short in range to 23

once steps=0.1

once minatrdist=4

once atrtrailingperiod = 14 // atr parameter

once minstop = 10 // minimum distance

if barindex=tradeindex then

trailingstoplong = 8 // trailing stop atr distance

trailingstopshort = 8 // trailing stop atr distance

It looks good without WF and it still looks good with WF. (often it breaks down completely) A lot of time the 3 bar is the one, with very few exceptions.

Ofcourse could be better, but for 1 variable in range to 23 and with this simplicity its great base!

edit;WF

1e bar 11

2e bar 3

3e bar 3

4e bar 1

all others; barnumber 3

So it’s pretty consistent

Paul

PaulParticipant

Master

couldn’t resist, the difference to WF other method.

I’ll take a look later to the last update of South Africa, the results looks amazing!

Here you have the .its of NIKKEI 1H, i’m not an expert in coding, not even remotely; so probably my attempts to diversify the strategy are futile, but I’m just trying to do something productive to stimulate development 😀

Any of you guys got attached Reject at 4:00 am this morning on the V1p version on the DAX?

Or at any time, any version, any Market?

What is the fix please? How to code it into the Strategy?

Would 2 x different min distances be best … 1 x for Market Hours and 1 x for Out of Market Hours?

Thank You

Hi Grahal,

I will test also this strategy asap

but i think the ddmax is too important..

I changed below to 12 (from 10) to see if it makes any difference?

For info: I set below temporarily to 100 (to test the boundaries) but the Long trade was still executed at 4:00 am on backtest.

once minstop = 12 //10 // minimum distance

i think the ddmax is too important..

Are you referring to Maximum Drawdown?

Too much / large at around £1k (for lot size =1) over 100k bars over around 4 Trades?

Yes,.. for me, everyone manages their risk. In general, I try to have the smallest drawdown even if it is to have less performance. PRT is not good for backtesting by drawdown result.. maybe one day..

and.. for me, the perfect system is to have a drawdown as little as possible and to be very very little on the market. But nothing is perfect 😉

@makside Gotta risk it for the biscuit 🙂

Paul

PaulParticipant

Master

@GraHal Your are quick in testing! It’s a good find but not so good in terms of results at first glance.

As I understand it, the error occurs when the stop is getting placed but is too near to the current high/low.

you can try this. If it still gives an error, increase the minstopdistance slightly.

if longtrading or (longtrading and shorttrading) then

minstopdistance=10 //minimum stop distance between stop and current price

if intradaybarindex=barnumberlong then

breakvaluelong=high //experiment!

if high-close<minstopdistance then

breakvaluelong=close+minstopdistance

else

breakvaluelong=breakvaluelong

endif

endif

endif

if shorttrading or (longtrading and shorttrading) then

if intradaybarindex=barnumbershort then

breakvalueshort=low //experiment!

if close-low<minstopdistance then

breakvalueshort=close-minstopdistance

else

breakvalueshort=breakvalueshort

endif

endif

endif

Hello – I’m just trying to test this but I keep getting error ‘backtest exceeds limit of repetitions for Walk Forward optimization’ – but I haven’t got WF selected??

Thanks

Paul

PaulParticipant

Master

@grimweasel47 Hi, Adjust the repetitions to 3, even if you don’t use them. That should fixes it.

As I understand it, the error occurs when the stop is getting placed but is too near to the current high/low.

Yes above is the reason for the Reject error.

I have added the code-fix you kindly and quickly provided and I will run a version without the fix and with the fix to validate the settings etc.

Many Thanks