….and how would that equity curve look if you had a big loser so stayed out of the market until the simulated equity curve went positive (so totally missed that great bit of positive equity curve) and then entered a trade and that trade was a big loser so you stayed out of the market again until the simulated equity curve went positive (so totally missed that great bit of positive equity curve)? If you don’t know the answer then it is you would go broke faster than if you had taken every trade.

The idea is great but the reality is that you can easily turn a fantastic equity curve into an average or awful equity curve. Better to have a good strategy and know that the bad trades are compensated for by the good trades than look for a way to avoid the bad trades that might actually end up with you missing all the good trades and taking all the bad trades.

Its no probable when the positive operations are 90%+-, and only 110+- operations on three years.

This is what i want it to explain.

I hope similars results with minor risk, minor drawdown, and minor time on markets.

If the win rate is 90% then don’t worry about trying to miss the 10% losers. Worry about how much each win wins compared to how much each loser loses and forget about trying to avoid some of the 1 in 10 losers with simulated trading magic.

If you only have 110 trades in 3 years in a backtest then forward test it for the next 10 years before worrying about trying to avoid the 1 in 10 losers.

I’m only trying to save you time and effort. Make a good, well tested, robustness proved strategy before trying to turn a turd into a diamond with simulated trading.

I believe that this event that I propose is different.

There is no equity curve, the results will be different, without a doubt.

It is not about average, nor about being above or below it.

Just an example:

The system reaches a maximum profit, if then it begins to lose, it would never operate again, there would be no bankruptcy.

You’re mixing pears with Vonasi crocodiles.

Fran55 – I cleaned up the mess of cut and paste HTML and also inserted your PRT code. You must know by now where to find the ‘Insert PRT Code’ button?!

Please try to be much more careful when posting future messages in the forums.

Please, help me with the code.

I think is more important to my estrategies.

And i think important to the estrategies of other persons.

No equity curve, this is different.

Your code makes no sense at all. If you turn off trading by switching ‘trading’ to zero then you will never open a trade again and so strategyprofit will never change so you will never ever switch trading back on again. That’s why you have to simulate the trades and keep a record of them – but as I said before using simulated trades to decide when to turn trading on or off just gives you one more curve fit. Fit it one way and you hit all the winners in the back test and miss all the losers but you will just as easily hit all the losers in future trading when the distribution of wins and losses is in a different order to the past.

Drawdowns safety

This is an example, and correctly function on my bots, really good and similar results.

Minor risk, minor drawdown, similar economic results.

The only difference is operate to middle of money on next operations when drawdown.

In this case is, no operate on next operations when drawdown.

My logic say when the new code the new results are good.

That topic is about money management and has nothing to do with a strategy making decisions based on simulated trades which is what this topic is about.

Try something like this example code – and stop double posting and asking the same questions in multiple places. Follow the forum rules!

defparam cumulateorders = false

positionsize = 1

spread = 1.6

entrycond = close < open and close[1] < open[1]

exitcond = (close > positionprice * 1.02) or (close < positionprice *0.95)

once tradeon = 1

if not onmarket and tradeon and entrycond then

buy positionsize contract at market

entryprice = close

endif

if not tradeon and entrycond then

entryprice = close

endif

if (onmarket or not tradeon) and exitcond then

sell at market

myprofit = myprofit + (close - entryprice - spread) * positionsize

maxprofit = max(maxprofit, myprofit)

if myprofit < maxprofit then

tradeon = 0

else

tradeon = 1

endif

endif

graph tradeon

//graph myprofit

//graph maxprofit

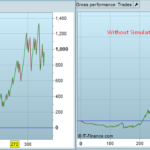

….and here are the results of that stupidly simple strategy with and without simulated trading that stops tarding if you have a loss until the simulated equity curve goes back into profit. On the left with the simulated trade filter and on the right without it.