Hi, Can someone advise me on how to use the limit and stop order in prt. I want to automate a simple order eg, go short when the price reaches the value 22$ and then 23$. Should I use Limit or Stop order?

SELLSHORT 10 CONTRACTS AT 22 LIMIT

SELLSHORT 10 CONTRACTS AT 23 LIMIT

or

SELLSHORT 10 CONTRACTS AT 22 STOP

SELLSHORT 10 CONTRACTS AT 23 STOP

When the VIX price (IG quotes) reached 22$ and 23$ today it did not trigger the LIMIT order. Simple test strategy source code below.

DEFPARAM CumulateOrders = True

x1 = 50

// Enter short positions

IF CLOSE > 18 AND CLOSE < 26 THEN

SELLSHORT x1 CONTRACTS AT 22.00 LIMIT

SELLSHORT x1 CONTRACTS AT 23.00 LIMIT

SET TARGET PROFIT 1 // 1 = $1

SET STOP pTRAILING 10 // Use this one

ENDIF

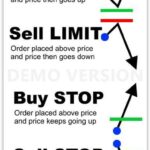

I guess you read up on Stop and Limit Orders?

https://www.investopedia.com/ask/answers/04/022704.asp

Our code needs to check where price level is relative to a Stop or Limit Order (i.e. above or below) else we may end buying or selling straight off (at a bad price) if we dont code the correct Order.

I take it you are testing your code on Demo / Virtual Account, best to be safe until we are certain of our code?

Try …

If Close > 22 Then

SellShort 1 Contract at 22 Stop

Endif

OR

If Close < 22 Then

SellShort 1 Contract at 22 Limit

Endif

Yes, GraHal is right, as you can see from attached pic.

Ye I did read up on LIMIT and STOP order. However, the purpose of the automation is to replicate my manual process where I set up a limit order in IG for $22 so this order get executed when the VIX price touches $22. The PRT document shows that the LIMIT order could be used but as it failed during the test hence I asked for your input. I will try your suggestion above and update you.

Grahal and Robert,

So I had simply did an in depth step through your suggestion / code. There is very little difference between you code suggestion and my code, please advise?

If Close < 22 Then

SellShort 1 Contract at 22 Limit

Endif

x1 = 50

IF CLOSE > 21.5 AND CLOSE < 23.5 THEN // the loop condition is tighter

SELLSHORT x1 CONTRACTS AT 22.00 LIMIT // set up a short order

SELLSHORT x1 CONTRACTS AT 23.00 LIMIT // set up the next short order

ENDIF

Try this …

If Close < 22 Then

SellShort 1 Contract at 22 Limit

Endif

x1 = 50

IF CLOSE < 22 OR CLOSE < 23.5 THEN // the loop condition is tighter

SELLSHORT 1 CONTRACTS AT 22.00 LIMIT // set up a short order

SELLSHORT 1 CONTRACTS AT 23.00 LIMIT // set up the next short order

ENDIF

The difference appears mainly live, not just backtesting, as the broker will reject your orders, or they may be entered at a wrong price.

STOP has a meaning, LIMIT a different one, they can’t be exchanged without knowing the position of the entry compared to the current price.

Then you will have to account for the distance required by the broker.

Pending orders require quite some coding effort to be dealt with.

Robert, I know it sounds simple but the coding can require more effort. Can you provide any example from previous code that you have came across to illustrate what you said “Pending orders require quite some coding effort to be dealt with”. Thanks.

For each pending order you place you need to check both if the entry price is above/below the current price (CLOSE) and if there’s enough distance to meet the broker’s requirements:

Distance = 10 //10 pips required by the broker (it's just an example)

If Close < 22 Then

IF (close + Distance) < 22 THEN

SellShort 1 Contract at 22 Limit//Pending order if within the broker's requirements

ELSE

SellShort 1 Contract at Market //comment out this line to skip at market, bu you

ENDIF //may lose a trade to wait for the next bar

Endif

x1 = 50

IF CLOSE < 22 OR CLOSE < 23.5 THEN // the loop condition is tighter

IF (close + Distance) < 22 THEN

SELLSHORT 1 CONTRACTS AT 22.00 LIMIT // set up a short order

ELSIF (close - Distance) > 22 THEN

SELLSHORT 1 CONTRACTS AT 22.00 STOP // set up a short order

ELSE

SellShort 1 Contract at Market //comment out this line to skip at market, bu you

ENDIF //may lose a trade to wait for the next bar

//

IF (close + Distance) < 23 THEN

SELLSHORT 1 CONTRACTS AT 23.00 LIMIT // set up a short order

ELSIF (close - Distance) > 23 THEN

SELLSHORT 1 CONTRACTS AT 23.00 STOP // set up a short order

ELSE

SellShort 1 Contract at Market //comment out this line to skip at market, bu you

ENDIF

ENDIF

distance is usually 6 pips on DAX, 1 on S&P500, etc… you can find it out on the broker’s website.

Robert, thanks in advance and I will see what I can learn and adopt. I have attached my simple grid trading script and failed snapshot from yesterday/today but it has been going on for the last 5 to 10 days since I released in to Live.

// VIX GRID TRADING SHORT STRATEGY WITH 2 HOURS TIMEFRAME

// This is a simple grid trading system to enter long and short positions when VIX is moving sideways between $18 to $20 (or $21 to $23 in IG.com).

DEFPARAM CumulateOrders = True

x1 = 50

// Enter short positions

IF CLOSE >= 21.50 AND CLOSE <= 23.00 THEN

//IF NOT SHORTONMARKET THEN

SELLSHORT x1 CONTRACTS AT 21.50 LIMIT

SELLSHORT x1 CONTRACTS AT 21.75 LIMIT

SELLSHORT x1 CONTRACTS AT 22.00 LIMIT

SELLSHORT x1 CONTRACTS AT 22.25 LIMIT

SELLSHORT x1 CONTRACTS AT 22.50 LIMIT

SELLSHORT x1 CONTRACTS AT 22.75 LIMIT

SELLSHORT x1 CONTRACTS AT 23.00 LIMIT

//SET TARGET %PROFIT 2 // 5% = $1 based on $20 price

//SET TARGET $PROFIT 1000 // 1000 = $1

SET TARGET PROFIT 1 // 1 = $1

//SET TARGET pPROFIT 1 // 1 = $1. Use this one

//SET STOP %LOSS 5 // This 25% will ensure that the stop loss will not reach but it’s a risk mgt parameter

SET STOP pTRAILING 10 // Use this one

//ENDIF

ENDIF

vix grid trading failed snapshot.

Robert, Let me know if this looks right (also AND is used instead of OR) to you but the output seems good???

DEFPARAM CumulateOrders = True

distance = 10 // 10 pips required by the broker

distancePlus = Close + distance

distanceMinus = Close – distance

x1 = 100

If Close >= 21 AND Close <= 23 Then // The loop condition is tighter

If distancePlus <= 21 Then

SellShort x1 Contracts At 21 Limit // Set up a short order

Elsif distanceMinus >= 21 Then

SellShort x1 Contracts At 21 Stop // Set up a short order

Else

SellShort x1 Contracts At Market // Comment out this line to skip At Market but you

Endif // may lose a trade to wait for the next bar

//Set Target %Profit 5 // 5% = $1 based on $20 price

Set Target Profit 1 // 1 = $1

//Set Stop %Loss 5

//Set Stop %Trailing 5

//Set Stop pTrailing 2

Endif

To use your currency for the target, you must use the $ sign:

Set Target $Profit 1 // 1 = $1

As you wrote it, it means 1 unit as a price difference, which would work with most indices (if their value per pip, PipValue, is 1), but would fail with currency pairs such as GBPUSD (what if 1 was added or subtracted to/from 1.3500!?).

A similar issue could be in

distance = 10

it should read either:

distance = 10*PipSize

or

distancePlus = Close + distance*PipSize

distanceMinus = Close – distance*PipSize

The code to place pending orders is correct.

Further tests have shown that only the ‘SellShort 1 Contract at Market’ in the If – Else loop was called so the Limit and Stop order are redundant. Therefore, your code and my modification of your code (uses MARKET ORDER) doesn’t address my original question and issue because I want to automate my manual process where I go to IG and set a LIMIT ORDER to short at $23 and take profit at $22. Any other idea ie use a while-loop or thought on this?

Original script:

DEFPARAM CumulateOrders = True

x1 = 50

// Enter short positions

IF CLOSE >= 21.50 AND CLOSE <= 23.00 THEN

SELLSHORT x1 CONTRACTS AT 21.50 LIMIT

SELLSHORT x1 CONTRACTS AT 21.75 LIMIT

SELLSHORT x1 CONTRACTS AT 22.00 LIMIT

SELLSHORT x1 CONTRACTS AT 22.25 LIMIT

SELLSHORT x1 CONTRACTS AT 22.50 LIMIT

SELLSHORT x1 CONTRACTS AT 22.75 LIMIT

SELLSHORT x1 CONTRACTS AT 23.00 LIMIT

SET TARGET PROFIT 1 // 1 = $1

SET STOP pTRAILING 10 // Use this one

ENDIF

New Script:

DEFPARAM CumulateOrders = True

distance = 10*PipSize

distancePlus = Close + distance

distanceMinus = Close – distance

x1 = 100

If Close => 21 AND Close <= 23 Then //

If distancePlus <= 21 Then

SellShort x1 Contracts At 21 Limit // Don’t need this

Elsif distanceMinus >= 21 Then

SellShort x1 Contracts At 21 Stop // Don’t need this

Else

SellShort x1 Contracts At Market // This is called 100% of the time

Endif

// Set Target %Profit 5 // 5% = $1 based on $20 price

Set Target Profit 1 // 1 = $1

//Set Stop %Loss 5

//Set Stop %Trailing 5

//Set Stop pTrailing 2

Endif