Good morning

I like to program my mean revision set up on 15 min TF buying outside the Bollinger Bands. However in the current Back Test system bought only on the first candle outside the BBs and not on the subsequent ones.

Most appreciate your insights.

Hi!

Could you share your code to copy/paste?

Just press the buttom “Insert PRT code”.

JS

JSParticipant

Senior

Hi,

When I look at the code you go “Long” when the “Close<Blower” and “Short” when the “Close>BUpper”…

If you want to go “short” you must use “SellShort” in your code…

So, line 20 of the code should be: “SellShort 1 Lot at Market”

Furthermore, if you want to use “cumulative orders” then the following line in your code must be used: “DefParam CumulateOrders=True”

With this, any “Close” that goes outside the BB will generate an order…

Thank you for your answer. Here the code

// Strategy 1 Mean Revision Trade

BUpper = BollingerUp[20](Close)

BLower = BollingerDown[20](Close)

//Conditions to enter a long trade

IF NOT LongOnMarket AND Low [1]< BLower THEN

BUY 1 CONTRACTS AT MARKET

ENDIF

//Conditions to close a long trade

If LongOnMarket AND High > BUpper THEN

SELL AT MARKET

ENDIF

//Conditions to enter a short trade

IF NOT ShortOnMarket AND High > BUpper THEN

SELL 1 LOT AT MARKET

ENDIF

//Conditions to close a short trade

IF ShortOnMarket AND Low > BLower THEN

EXITSHORT AT MARKET

ENDIF

SET STOP TRAILING 16

Hi, As JS indicates in his answer, in order to enter more orders you have to put the instruction

defparam cumulateorders=true on the first line. On the other hand, the entry condition must be changed so that it can accumulate positions. You have to remove

if not longonmarket . This makes the purchase only occur if it is not bought. Also the instruction to go short is

sellshort defparam cumulateorders=true

// Strategy 1 Mean Revision Trade

BUpper = BollingerUp[20](Close)

BLower = BollingerDown[20](Close)

//Conditions to enter a long trade

IF Low [1]< BLower THEN

BUY 1 CONTRACTS AT MARKET

ENDIF

//Conditions to close a long trade

If LongOnMarket AND High > BUpper THEN

SELL AT MARKET

ENDIF

//Conditions to enter a short trade

IF High > BUpper THEN

SELLshort 1 CONTRACTS AT MARKET

ENDIF

//Conditions to close a short trade

IF ShortOnMarket AND Low > BLower THEN

EXITSHORT AT MARKET

ENDIF

SET STOP TRAILING 16

Many thanks!

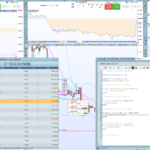

Now if I look at the trade log of the back testing with ‘defparam cumulateorders=true’

The systems doesn’t open trades where the conditions are fullfilled. Do I have to specify anything more than ‘IF Low [1]< BLower THEN’

Or is this just a bug with the backtesting on this software?

I truly appreciate your insights.

Best Regards

Sab

The system works as you designed… It opens new positions in the next bar open when conditions are met.

Look at the screenshot.

I tested the system as you did on EURUSD 1 hr, but I get some really strange back testing results, which I can not understand. I have been going through line by line what positions the system

opened and when it closed them, as I like to understand the equity curve it projects. However I am turning in circles, hence I

Just looking at Oct 2nd, the systems opens correctly a

11.00 – Sell order @ 1.10723, the candle has a total lenght of (open 1.0723, Low 1.0613) over 10 points, with a trailing stop of 16, this positions should not have created

a Loss of $762. My question is why is that possible with a trailing stop of 16? Max loss should be $160

13.00 – Sell order @ 1.10671, the candle opened however @ 1.10757, why is the system opening a position only 8 pips later? The trade was closed correctly

15.00 – System generates a buy order but doesn’t close it until October 4th

Are these problems of the backtesting with ProRealTime or do I need to write the code differently?

Thank you so much for your assistance.

As a guess, from your image, the code only allows 1 buy and 1 sell at a time, due to IF NotxxxxOnMarket.

It appears that…

On 30 sept 19:00 Buy entry @ 1.11485 is exited by 2 oct 11:00 Sell entry 1.10723 and the difference is 0.00762 ( $ 762 )

Then 2 oct 11:00 Sell exit @ 1.10723 and is exited by 2 oct 12:00 Buy exit 1.10717 and the difference is 0.00006 ( $ 6 )

However , I may have got the entry and exit transposed, but the numbers seem to correlate.

I’m still guessing, I think its a combination having buy and sell in same strategy, with the buy exit condition and sell entry condition the same along with the 1 entry of each.

So, when the buy exit is triggered, then the sell entry could also be triggered in the same bar, does one take precedence over the other!, also the entry for long and short are slightly different low[1] , high[0] .

If code line are executed in sequence this can’t happen the other way round, short exit _ long entry, it would have to wait for the next bar.

This sequence of events may be happening on other trades and maybe that’s what tripping up the trailing stop, thinking its in a buy but its in a sell or something.

To test, I would have two strategy’s one long, one short, see if correct trades are taken, and compared to current strategy results, this may show the difference.

Thank you so much for your reply.

Is it generally better to separate the short and long set ups in two different codes?

Best Regards

Good morning

I did separate the short and long trades into two codes, but still have the same problem that the system opens a short trade @ 5 pm althought the condition was met @ 3.45 when it opened correctly a short trade.

If I can eliminate this error, than the system should be working fine. I appreciate your input and assistance.

Best Regards

When defparam cumulateorders=true your code will trade even when a postion is open. If you change this to false or add “if not onmarket” to your buy conditions (if you whant to acumulate positons) this will be controlled.

I have modified the code to use a 3 Standard Deviation for the short only to reduce trades when market is trending strongly. However here I have the same issue, the system doesn’t open a trade in the right location, but only 3 bars later after the condition as met.

//Strategy 1 Mean Revision Short only

DefParam CumulateOrders = True

DefParam FLATBEFORE = 080000

DefParam FLATAFTER = 220000

BB = 20 //20 periods

BBdev = 3 //3 standard deviation

BBavg = average[BB,0](close) //BB mean (middle line)

UPboll = BBavg + ((std[BB](close)) * BBdev) //BB Upper Band

LOboll = BBavg – ((std[BB](close)) * BBdev) //BB Lower Band

//Conditions to enter a short trade

IF High [1]> UPboll THEN

SELLSHORT 1 LOT AT MARKET

ENDIF

//Conditions to close a short trade

IF ShortOnMarket AND Close < BBavg THEN

EXITSHORT AT MARKET

ENDIF

SET STOP TRAILING 25

I adjust this, however I ran into the same problem again, the system opens the trade too late, only after 2 candles. However it closes the trade correctly.

I can’t figure out what I am missing in my code.

Thanks for your assistance!