Will keep you all posted.

Feel free to share as far as you have got … others may think of improvements you may not think of … then we all benefit? 🙂

//-------------------------------------------------------------------------

// Codice principale : 1secondo

//-------------------------------------------------------------------------

//-------------------------------------------------------------------------

// Code principal : CANDLE

//-------------------------------------------------------------------------

Defparam cumulateorders = false

n = 10

//Conditions to enter long positions

TIMEFRAME(24 minutes,updateonclose)

Period= 22 //optimize

inner = 2*weightedaverage[round( Period/2)](typicalprice)-weightedaverage[Period](typicalprice)

HULLa = weightedaverage[round(sqrt(Period))](inner)

tc1 = HULLa > HULLa[1]

//tc2 = HULLa < HULLa[1]

indicator101 = SuperTrend[4,4] //optimize

tc3 = (close > indicator101)

//tc4 = (close < indicator101)

ma = average[40,4](close) //optimize

tc11 = ma > ma[1]

//tc12 = ma < ma[1]

timeframe(10 minute,updateonclose)

c160m = open > open[1] and close > close[1] and close > open

timeframe(2 minute,updateonclose)

c11m = open > open[1] and close > close[1]

c21m = abs(close-open) >= 17

c31m = abs(close[1]-open[1])

c41m = c31m > c21m

timeframe(default)

c1def = open > open[1] and close > close[1]

c2def = abs(close-open) >= 1

IF not longonmarket and c1def and c11m and c21m and c41m and c2def and c1def and c160m AND tc1 AND tc3 AND tc11 then

BUY N contracts at market

set stop ploss 300

ENDIF

//if longonmarket and close crosses under st then

//sell at market

//endif

//************************************************************************

//trailing stop function

trailingstart = 19 //trailing will start @trailinstart points profit

trailingstep = 7 //trailing step to move the "stoploss"

//reset the stoploss value

IF NOT ONMARKET THEN

newSL=0

ENDIF

//manage long positions

IF LONGONMARKET THEN

//first move (breakeven)

IF newSL=0 AND close-tradeprice(1)>=trailingstart*pipsize THEN

newSL = tradeprice(1)+trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND close-newSL>=trailingstep*pipsize THEN

newSL = newSL+trailingstep*pipsize

ENDIF

ENDIF

//manage short positions

IF SHORTONMARKET THEN

//first move (breakeven)

IF newSL=0 AND tradeprice(1)-close>=trailingstart*pipsize THEN

newSL = tradeprice(1)-trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND newSL-close>=trailingstep*pipsize THEN

newSL = newSL-trailingstep*pipsize

ENDIF

ENDIF

//stop order to exit the positions

IF newSL>0 THEN

SELL AT newSL STOP

EXITSHORT AT newSL STOP

ENDIF

//***

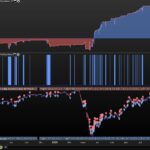

This code yields the following results

This is a combination of ideas posted by various helpful people (nonetheless, GraHal, Nicolas to name but a few)

That looks highly optimized to me, anyway i think it’s a MAKSIDE code idea.

You tell us – it’s your code just with a higher time frame filter added…

Attached is the 200 k backtest

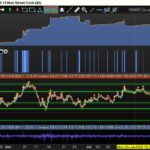

Out of interest I changed TF’s to M25, M10 and M5 and ran it on DJI on M1 TF with spread = 4.

Attached are results over 100K bars.

I have reservations about the MAE … on nearly every winning trade the MAE is Losing X multiples times the eventual Gain.

The MFE spends a lot of time way in excess of the eventual gain.

Maybe above means there is plenty of scope for improvement?

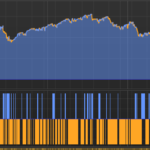

As you can see from the equity curve (gaps in positions) … the strategy (Long only) does stay out of the market during extended down periods … so that is good!

To save any confusion …

My results on DJI are with position Size = 1.

samsampop results on DAX are with position size = 10.

thanked this post

Apologies Francesco, thanks for clarifying

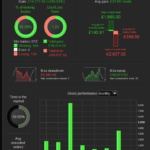

Morning – I have added a short entry criteria as well and re-ran the back test on 100k, to include the down turn in Feb-Mar of this year.

//-------------------------------------------------------------------------

// Codice principale : 1secondo

//-------------------------------------------------------------------------

//-------------------------------------------------------------------------

// Code principal : CANDLE

//-------------------------------------------------------------------------

Defparam cumulateorders = false

n =5

timeframe(10 minute,updateonclose)

c160m = open > open[1] and close > close[1] and close > open

sc1 = open < open[1] and close < close[1] and close < open

timeframe(2 minute,updateonclose)

c11m = open > open[1] and close > close[1]

c21m = abs(close-open) >= 17

c31m = abs(close[1]-open[1])

c41m = c31m > c21m

sc2 = open < open[1] and close < close[1]

sc3 = abs(close-open) <= 17 //see below

sc4 = abs(close[1]-open[1]) //these may need to be same as bove, and sc5 stays <

sc5 = sc3 < sc4

timeframe(default)

c1def = open > open[1] and close > close[1]

c2def = abs(close-open) >= 1

sc6 = open < open[1] and close < close[1]

sc7 = abs(open-close) <= 1

IF not longonmarket and c1def and c11m and c21m and c41m and c2def and c1def and c160m then

BUY N contracts at market

set stop ploss 300

ENDIF

//manage long positions

IF LONGONMARKET THEN

//first move (breakeven)

IF newSL=0 AND close-tradeprice(1)>=trailingstart*pipsize THEN

newSL = tradeprice(1)+trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND close-newSL>=trailingstep*pipsize THEN

newSL = newSL+trailingstep*pipsize

ENDIF

ENDIF

IF not shortonmarket and sc1 and sc2 and sc3 and sc4 and sc5 and sc6 and sc7 then

SELLSHORT N contracts at market

set stop ploss 300

ENDIF

//manage short positions

IF SHORTONMARKET THEN

//first move (breakeven)

IF newSL=0 AND tradeprice(1)-close>=trailingstart*pipsize THEN

newSL = tradeprice(1)-trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND newSL-close>=trailingstep*pipsize THEN

newSL = newSL-trailingstep*pipsize

ENDIF

ENDIF

//if longonmarket and close crosses under st then

//sell at market

//endif

//************************************************************************

//trailing stop function

trailingstart = 19 //trailing will start @trailinstart points profit

trailingstep = 7 //trailing step to move the "stoploss"

//reset the stoploss value

IF NOT ONMARKET THEN

newSL=0

ENDIF

//stop order to exit the positions

IF newSL>0 THEN

SELL AT newSL STOP

EXITSHORT AT newSL STOP

ENDIF

//***

I’m running this on the DAX on a 2 min time frame. Initial Capital of 5,000 and trading 5 per point. I am using a Spread of 2, but may need to increase this as it trades around the clock.

I would still add a VDAX filter for this strategy, so that it didn’t trade if volatility on the DAX > than say 40. Anyone know how this can be achieved?