Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

SCALPING INDICATOR

-

AuthorPosts

-

Hello guys We can discuss about the strategy here, we can help together to develop strategies on the Indicator ” SCALPING INDICATOR”. This is the indicator posted in the Library there :https://www.prorealcode.com/prorealtime-indicators/scalping-indicator-2/

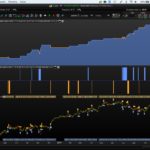

Here below some example of the operation of the indicator.

Hello Here below a new version of Scalping Indicator

// SCALPING DAX INIDCATOR, USABLE ON ANY TOOL, SET UP TIME FRAME 1 MINUTE. // PRC CONTRIBUTE_ ALE_15/12/2017 DEFPARAM CALCULATEONLASTBARS=50000 //WHB=6 //WHS=6 //BIB=6 //BIS=6 //PPKKS=0.994 //PPKKB=0.994 //RES=3 //SUP=3 //FUP=1000 //FDW=2000 //P01=1/0 //P02=1/0 //P03=1/0 //P04=1/0 //P05=1/0 //P06=1/0 //CLO= 1/0 // GRAPHIC VARIABLES PIP = 1*Pipsize //ARROW DISTANCE LIN = 10 //LENGTH OF SEGMENT OF SUPPORT OR RESISTENCE RESISTENCE = RES*Pipsize //DISTANCE OF THE SEGMENT OF THE RESISTENCE SUPPORT = SUP*Pipsize //DISTANCE OF THE SEGMENT OF THE SUPPORT // ENABLED PATTERN 1-0 / ON-OFF ONCE PrEnabled01 = P01 // SWITCH INDICATOR P01,P02 ETC .. ONCE PrEnabled02 = P02 ONCE PrEnabled03 = P03 ONCE PrEnabled04 = P04 ONCE PrEnabled05 = P05 ONCE PrEnabled06 = P06 ONCE TimeEnabled = CLO // FOR DAILY TIMEFRAME DISABLE TIMEWINDOW ////////////////////////////////////////////////////////////////////// // MODIFIED UNIVERSAL OSCILLATOR 1 whitenoiseB= (Close - Close[WHB]) if barindex>BIB then a11= exp(-1.414 * 3.14159 / BIB) b11= 2*a11 * Cos(1.414*180 /BIB) c22= b11 c33= -a11 * a11 c11= 1 - c22 - c33 filtB= c11 * (whitenoiseB + whitenoiseB[1])/2+ c22*filtB[1] + c33*filtB[1] filt11 = filtB if ABS(filt11)>pkB[1] then pkB = ABS(filt11) else pkB = PPKKS * pkB[1] endif if pkB=0 then denomB = -1 else denomB = pkB endif if denomB = -1 then resultB = resultB[1] else resultB = filt11/pkB endif endif // MODIFIED UNIVERSAL OSCILLATOR 2 whitenoise= (Close - Close[WHS]) if barindex>BIS then // super smoother filter a1= (-1.414 * 3.14159 / BIS) b1= 2*a1 * Cos(1.414*180 /BIS) c2= b1 c3= -a1 * a1 c1= 1 - c2 - c3 filt= c1 * (whitenoise + whitenoise[1])/2+ c2*filt[1] + c3*filt[1] filt1 = filt if ABS(filt1)>pk[1] then pk = ABS(filt1) else pk = PPKKB * pk[1] endif if pk=0 then denom = -1 else denom = pk endif if denom = -1 then resultS = resultS[1] else resultS = filt1/pk endif endif IF BARINDEX>50 THEN //FORCEINDEX INDICATOR FILTER Fi=FORCEINDEX(close) // TIME WINDOW TimeWindow= (TIME >=80000 and time <=210000) FilTime=(TimeWindow or not TimeEnabled) ////////////////////////////////////////////////////////////////////// //PATTERN UP 1 PrUp01 = RESULTS[3]>RESULTS[2] PrUp01 = PrUp01 and RESULTS[2]< RESULTS[1] PrUp01 = PrUp01 and RESULTS[2]<=-1 PrUp01 = (PrUp01 and PrEnabled01) //PATTERN DOWN 1 PrDW01 = RESULTS[3]<RESULTS[2] PrDw01 = PrDw01 and RESULTS[2]> RESULTS[1] PrDw01 = PrDw01 and RESULTS[2]>=1 PrDw01 = (PrDw01 and PrEnabled01) //PATTERN UP 2 PrUp02 = resultS<=-0.95 PrUp02 = PrUp02 and resultS[1]<=-1 PrUp02 = (PrUp02 and PrEnabled02) //PATTERN DOWN 2 PrDw02 = resultS>=0.95 PrDw02 = PrDw02 and resultS[1]>=1 PrDw02 = (PrDw02 and PrEnabled02) //PATTERN UP 3 PrUp03 = close < open PrUp03 = PrUp03 and low < low[1] PrUp03 = PrUp03 and resultS<=-1 PrUp03 = PrUp03 and Fi<-FDw PrUp03 = (PrUp03 and PrEnabled03) //PATTERN DOWN 3 PrDW03 = close > open PrDw03 = PrDw03 and high > high[1] PrDw03 = PrDw03 and resultS>=1 PrDw03 = PrDw03 and Fi>FUp PrDw03 = (PrDw03 and PrEnabled03) //PATTERN UP 4 PrUp04 = resultS<=-0.95 PrUp04 = PrUp04 and resultS[1]<=-1 PrUp04 = PrUp04 and Fi<-FDw PrUp04 = (PrUp04 and PrEnabled04) //PATTERN DOWN 4 PrDw04 = resultS>=0.95 PrDw04 = PrDw04 and resultS[1]>=1 PrDw04 = PrDw04 and Fi>FUp PrDw04 = (PrDw04 and PrEnabled04) //PATTERN UP 5 PrUp05 = resultS<=-0.95 PrUp05 = PrUp05 and Fi[1]<Fi PrUp05 = PrUp05 and Fi[1]<-FDw PrUp05 = (PrUp05 and PrEnabled05) //PATTERN DOWN 5 PrDw05 = resultS>=0.95 PrDw05 = PrDw05 and Fi[1]>Fi PrDw05 = PrDw05 and Fi[1]>FUp PrDw05 = (PrDw05 and PrEnabled05) //PATTERN UP 6 PrUp06 = results <-0.5 PrUp06 = PrUp06 and results crosses over resultb PrUp06 = (PrUp06 and PrEnabled06) //PATTERN DOWN 6 PrDw06 = results >0.5 PrDw06 = PrDw06 and results crosses under resultb PrDw06 = (PrDw06 and PrEnabled06) ////////////////////////////////////////////////////////////////////// // COLORS OF THE ARROW AND SEGMENT IF PrUp01 THEN R=0 G=128 B=255 ELSIF PrUp02 THEN R=0 G=255 B=128 ELSIF PrUp03 THEN R=255 G=255 B=102 ELSIF PrUp04 THEN R=255 G=153 B=255 ELSIF PrUp05 THEN R=242 G=90 B=161 ELSIF PrDw01 THEN R=0 G=128 B=255 ELSIF PrDw02 THEN R=0 G=255 B=128 ELSIF PrDw03 THEN R=255 G=255 B=102 ELSIF PrDw04 THEN R=255 G=153 B=255 ELSIF PrDw05 THEN R=242 G=90 B=161 ELSIF PrDw06 THEN R=200 G=0 B=161 ENDIF If Filtime then if PrUp01 OR PrUp02 OR PrUp03 OR PrUp04 OR PrUp05 OR PrUp06 then DRAWARROWUP(barindex,LOW-PIP)coloured(R,G,B) DRAWSEGMENT(barindex,LOW-SUPPORT,barindex-LIN, LOW-SUPPORT )coloured(R,G,B) elsif PrDw01 OR PrDw02 OR PrDw03 OR PrDw04 OR PrDw05 OR PrDw06 then DRAWARROWDOWN(barindex,HIGH+PIP)coloured(R,G,B) DRAWSEGMENT(barindex,HIGH+RESISTENCE,barindex-LIN, HIGH+RESISTENCE)coloured(R,G,B) endif endif ENDIF RETURNHi Ale,

The V3 looks great too, but I need some help to understand the meaning of the colors. Could you explain a little please?

Thanks

ALE thanked this postNot wanting to seem a little picky but is this discussion about an indicator not posted in the wrong forum? ProBuilder Support is surely the better place for it?

On a separate note are you able to give a little summary of the principles behind the indicator so others can more understand the logic behind the coding? There are an awful lot of variables!

Hello,

Colors are fantasy nothing else. To differentiate the signals between them.

Here below attached strategy files as example, DAX 4H

DEFPARAM CUMULATEORDERS = FALSE // INDICATOR'S VARIABLES ONCE WHISEB = WHB //6 ONCE WHISES = WHS //6 ONCE BANDEDB = BIB //16 ONCE BANDEDS = BIS //16 ONCE PKKS = PPKKS //0.996 ONCE PKKB = PPKKB //0.993 // LONG AVERAGE FILTER ENTRY ONCE avgEnterEnabled = AVGE // 0,1 ON-OFF ONCE avgLongPeriod = AVGL // 200 // PATTERN ENTRY SELECTION ONCE PrEnabled01 = P01 // 0,1 ON-OFF ONCE PrEnabled06 = P06 // 0,1 ON-OFF // MANAGE POSITION PERFORMANCE ONCE trailingStopType = TRT // 0,1 ON-OFF ONCE trailingstoplong = TSL // 7 ONCE trailingstopshort = TSS // 2 ONCE minstop = MTP // 10 ONCE barlong = BXL // 35 ONCE barshort = BXS // 15 ONCE timeStart = TIST // 080000 ONCE timeEnd = TIEN // 220000 ONCE TimeEnabled = OCLO // FOR DAILY TIMEFRAME DISABLE TIMEWINDOW 0/1 //TAKE PROFIT AND STOP LOSS if longonmarket then takeprofit =TPL // 1.3 stoploss =SLL // 2.8 ELSIF SHORTONMARKET THEN takeprofit =TPS // 0.7 stoploss =SLS // 1.3 ENDIF // MANAGE POSITION PERFORMANCE //---------------------------------------------- atrtrail = AverageTrueRange[200]((close/10)*pipsize)/1000 trailingstartl = round(atrtrail*trailingstoplong) //trailing stop start and distance trailingstartS = round(atrtrail*trailingstopshort) if trailingStopType = TRT THEN // 1 TRAILING STOP TGL =trailingstartl TGS=trailingstarts if not onmarket then MAXPRICE = 0 MINPRICE = close PREZZOUSCITA = 0 ENDIF if longonmarket then MAXPRICE = MAX(MAXPRICE,close) if MAXPRICE-tradeprice(1)>=TGL*pointsize then if MAXPRICE-tradeprice(1)>=MINSTOP then PREZZOUSCITA = MAXPRICE-TGL*pointsize ELSE PREZZOUSCITA = MAXPRICE - MINSTOP*pointsize ENDIF ENDIF ENDIF if shortonmarket then MINPRICE = MIN(MINPRICE,close) if tradeprice(1)-MINPRICE>=TGS*pointsize then if tradeprice(1)-MINPRICE>=MINSTOP then PREZZOUSCITA = MINPRICE+TGS*pointsize ELSE PREZZOUSCITA = MINPRICE + MINSTOP*pointsize ENDIF ENDIF ENDIF if onmarket and PREZZOUSCITA>0 then EXITSHORT AT PREZZOUSCITA STOP SELL AT PREZZOUSCITA STOP ENDIF ENDIF // LONG AVERAGE FILTER ENTRY longAvg = Average[avgLongPeriod] (close) avgFilterEnterLong = (close>longAvg OR NOT avgEnterEnabled) avgFilterEnterShort = (close<longAvg OR NOT avgEnterEnabled) ////////////////////////////////////////////////////////////////////// // MODIFIED UNIVERSAL OSCILLATOR 1 whitenoiseB= (Close - Close[WHISEB]) if barindex>BANDEDS then a11= exp(-1.414 * 3.14159 / BANDEDS) b11= 2*a11 * Cos(1.414*180 /BANDEDS) c22= b11 c33= -a11 * a11 c11= 1 - c22 - c33 filtB= c11 * (whitenoiseB + whitenoiseB[1])/2+ c22*filtB[1] + c33*filtB[1] filt11 = filtB if ABS(filt11)>pkB[1] then pkB = ABS(filt11) else pkB = PKKS * pkB[1] endif if pkB=0 then denomB = -1 else denomB = pkB endif if denomB = -1 then resultB = resultB[1] else resultB = filt11/pkB endif endif // MODIFIED UNIVERSAL OSCILLATOR 2 whitenoise= (Close - Close[WHISES]) if barindex>BANDEDB then // super smoother filter a1= (-1.414 * 3.14159 / BANDEDB) b1= 2*a1 * Cos(1.414*180 /BANDEDB) c2= b1 c3= -a1 * a1 c1= 1 - c2 - c3 filt= c1 * (whitenoise + whitenoise[1])/2+ c2*filt[1] + c3*filt[1] filt1 = filt if ABS(filt1)>pk[1] then pk = ABS(filt1) else pk = PKKB * pk[1] endif if pk=0 then denom = -1 else denom = pk endif if denom = -1 then resultS = resultS[1] else resultS = filt1/pk endif endif ////////////////////////////////////////////////////////////////////// If barindex>1000 then //PATTERN UP 1 PrUp01 = RESULTS[3]>RESULTS[2] PrUp01 = PrUp01 and RESULTS[2]< RESULTS[1] PrUp01 = PrUp01 and RESULTS[2]<=-1 PrUp01 = (PrUp01 and PrEnabled01) //PATTERN DOWN 1 PrDW01 = RESULTS[3]<RESULTS[2] PrDw01 = PrDw01 and RESULTS[2]> RESULTS[1] PrDw01 = PrDw01 and RESULTS[2]>=1 PrDw01 = (PrDw01 and PrEnabled01) //PATTERN UP 6 PrUp06 = results <-0.5 PrUp06 = PrUp06 and results crosses over resultb PrUp06 = (PrUp06 and PrEnabled06) //PATTERN DOWN 6 PrDw06 = results >0.5 PrDw06 = PrDw06 and results crosses under resultb PrDw06 = (PrDw06 and PrEnabled06) endif ////////////////////////////////////////////////////////////////////// // // PATTERN ENTRY SELECTION // TIME WINDOW TimeWindow= (TIME >=TimeStart and time <=TimeEnd) FilTime=(TimeWindow or not TimeEnabled) If Filtime then IF not shortonmarket and avgFilterEnterLong AND PrUp01 or PrUp06 THEN BUY 1 CONTRACT AT MARKET ENDIF IF not longonmarket and avgFilterEnterShort AND PrDw01 or PrDw06 THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF ENDIF // MANAGE POSITION PERFORMANCE IF POSITIONPERF<0 THEN IF LongOnMarket AND BARINDEX-TRADEINDEX(1)>= barLong THEN SELL AT MARKET ENDIF ENDIF IF POSITIONPERF<0 THEN IF shortOnMarket AND BARINDEX-TRADEINDEX(1)>= barshort THEN EXITSHORT AT MARKET ENDIF ENDIF // MANAGE POSITION PERFORMANCE SET STOP %LOSS stoploss SET TARGET %PROFIT Takeprofit //ENDIF GRAPH TGLAh OK please ignore my suggestion about this being an indicator as we now have a strategy to play with!

Yes Vonasi, I thought to start with a strategy to simplify the concept.

I notice that the indicator is on a 1 minute time frame and the strategy is on a 4 hour time frame. Any reason for this as I usually assume that with scalping faster time frames are preferred.

this indicator is born for time low frame, but for the automatic strategies I dissuade him/it, because the probacktests would not be truthful. The data of IG don’t allow this.

Could be used by Scalping trader that are abled with low timeframe.

I have downloaded your ITF file for the v3 indicator and applied it to a DAX 1 minute chart but it draws nothing on the chart. I notice that your adjustable variables are set differently to those shown // in the code so tried them – but still nothing on the chart. Any ideas why I am getting nothing?

Have You Apply it on Chart? Have you Enabled P01 or P02 or … etc?

OK – so are you saying it is either P01 = TRUE or P02 = TRUE or P03 = TRUE etc etc? You exported the ITF with everything set to TRUE as a default. It has to load (very slowly) with this the first time (as it is impossible to edit an indicator before it has been added at least once) before anyone can set only one P0 to TRUE and then have to load it all again (very slowly).

I’m afraid

If you find it slow to load at first time, add this line at the beginning of the code, it will prevent the indicator to calculate on all the history but on the last X bars you want:DEFPARAM CALCULATEONLASTBARS=5000 -

AuthorPosts

- You must be logged in to reply to this topic.

SCALPING INDICATOR

ProOrder: Automated Strategies & Backtesting

Summary

This topic contains 55 replies,

has 15 voices, and was last updated by ALE

7 years, 8 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 12/16/2017 |

| Status: | Active |

| Attachments: | 21 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.