Hello, I’ve created a code for scalping the DAX based on the 50-period Simple Moving Average (SMA) on the 50-second timeframe. The signal triggers when the 7-period SMA crosses above the 20-period SMA, but we’re above the 50-period SMA, and vice versa.

Here’s the code. Do you have any ideas for improving it? I’ve experienced significant losses at times.

mm7=average[7]

mm20=average[20]

mm50=average[50]

mm80=average[80]

mm200=average[200]

mm7up= mm7>mm7[1]

mm7Down=mm7<mm7[1]

once sens=0

//flèche pour debut tendance MM7

if mm7 CROSSES OVER mm20 and close > mm50 then

buy 1 contract at market

set target profit 30

set stop loss 20

if LONGONMARKET and TRADEPRICE + 10 then

set stop loss TRADEPRICE

endif

endif

if mm7 CROSSES UNDER mm20 and close<mm50 then

sellshort 1 contract at market

set target profit 30

set stop loss 20

if SHORTONMARKET and tradeprice + 10 then

set stop loss TRADEPRICE

endif

endif

Post your topic in the correct forum: ProOrder: only strategy topics.

I moved it from ProBuilder support.

Thank you 🙂

Strategies based on moving averages are known to look great on backtest, but the real live performance then turns out to be very different.

It is so easy to get the optimiser to find MA crosses etc over a long backtest period, but these same MA crosses etc do not appear again in quite the same combination during Live running.

I suggest you re-optimise over 10K bars only and also re-optimise every day!

Let us know if losses reduce?

Wim

WimParticipant

Junior

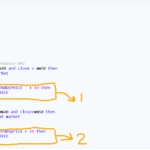

Hello. I think your code needs a little revision. On the screen capture I indicated 2 IF-THEN-ENDIF blocks that need to be extracted from the IF where you test for the presence of a signal. I guess you expect from these 2 indicated IF-THEN-ENDIF blocks that they put your position to BreakEven. But currently these blocks will only be executed when a valid entry signal is present, and not during the position itself.

Next, the condition for BE needs a correction too. Currently you state “longonmarket and tradeprice + 10”. I think I understand what you mean, but PRT will not. Try this: “longonmarket and close > tradeprice+10”. You could also use high instead of close, whatever you prefer. The other one will be “shortonmarket and close < tradeprice -10”. Good luck. And if 50S doesn’t work, try M5, you could be surprised.

Hello, I’ve made some modifications to my code, and now we need to use it on the DAX with a 5-minute timeframe. Could you try it in simulation from September 30th to October 19th and let me know if you have any ideas for improvement? I’ve resolved my break-even issue.

I would like to add conditions for a second buying condition for a shorter take profit, especially at the end of bullish movements with a MACD reversal or by taking advantage of price elasticity relative to its moving average (close > 100 pips).

The problem is that I don’t know how to manage differentiating positions. How can I limit the first buying condition to 1 lot and the second buying condition to 2 lots, for example?

defparam CUMULATEORDERS = true

mm7=average[7]

mm20=average[20]

mm50=average[50]

mm80=average[80]

mm200=average[200]

MM600=average[600]

mm7up= mm7>mm7[1]

mm7Down=mm7<mm7[1]

signalUp =mm7 CROSSES OVER mm20

signalDown= mm7 CROSSES UNDER mm20

signalUp1 =mm20 CROSSES OVER mm50

signalDown1= mm20 CROSSES UNDER mm50

once sens=0

trailingstart = 20

//reglage BE achat Long

startBreakeven = 50

PointsToKeep = 30

if not longonmarket and mm50 CROSSES OVER mm600 and close > mm600 then

buy 1 contract at market

SET TARGET pPROFIT 100

set stop loss 35

endif

IF NOT ONMARKET THEN

breakevenLevel=0

ELsIF LONGONMARKET AND close-tradeprice(1)>=startBreakeven*pipsize THEN

breakevenLevel = tradeprice(1)+PointsToKeep*pipsize

ENDIF

IF breakevenLevel>0 THEN

SELL AT breakevenLevel STOP

ENDIF

if shortonmarket and ( tradeprice-close)>=(startBreakeven1 *pointsize) then

breakevenLevel = tradeprice(1)-Pointstokeep1*pipsize

endif

if breakevenLevel then

EXITSHORT aT breakevenLevel stop

endif

////

startBreakeven1 = 50

PointsToKeep1 = 10

if not shortonmarket and signalDown and close <mm200 then

sellshort 1 contract at market

set target profit 70

set stop loss 30

endif