Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

R. Gozzi- trail

-

AuthorPosts

-

Is there av version of R. Gozzi- trail with % and diffrent values for short and long?

//-------------------------------------------------------------------------------------------- DirectionSwitch = (LongOnMarket AND ShortOnMarket[1]) OR (LongOnMarket[1] AND ShortOnMarket) //TrP Exit (Gozzi IF Not OnMarket OR DirectionSwitch THEN TrailStart = TS//40 // Start trailing profits PointToKeep = PK//0.2 // 20% Profit percentage to keep when setting BreakEven StepSize = SS//5 // Point to increase Percentage PerCentInc = PC//0.2 // 20% PerCent increment after each StepSize Chunk RoundTO = -0.5 //-0.5 rounds always to Lower integer, 0 defaults PRT behaviour PriceDistance = 10* pipsize //6minimun distance from current price maxProfitL = 0 //0 eller 2050 maxProfitS = 0 ProfitPerCent = PointToKeep //reset to desired default value SellPriceX = 0 SellPrice = 0 ExitPriceX = 9999999 ExitPrice = 9999999 ELSE IF PositionPrice <> PositionPrice[1] AND (ExitPrice + SellPrice) <> 9999999 THEN //go on only if Trailing Stop had already started trailing IF LongOnMarket THEN newSlL = PositionPrice + ((close - PositionPrice) * ProfitPerCent) //calculate new SL SellPriceX = max(max(SellPriceX,SellPrice),newSlL) SellPrice = max(max(SellPriceX,SellPrice),PositionPrice + (maxProfitL * pipsize)) //set exit price to whatever grants greater profits, comopared to the previous one ELSIF ShortOnMarket THEN newSlS = PositionPrice - ((PositionPrice - close) * ProfitPerCent) ExitPriceX = min(min(ExitPriceX,ExitPrice),newSlS) ExitPrice = min(min(ExitPriceX,ExitPrice),PositionPrice - (maxProfitS * pipsize)) ENDIF ENDIF ENDIF //--------------------------------------------------------------------------------------------------------------------------------------------------- IF LongOnMarket AND close > (PositionPrice + (maxProfitL * pipsize)) THEN //LONG positions // compute the value of the Percentage of profits, if any, to lock in for LONG trades profitL = (close - PositionPrice) / pipsize //convert price to pips IF profitL >= TrailStart THEN // go ahead only if N+ pips Diff1 = abs(TrailStart - profitL) //difference from current profit and TrailStart Chunks1 = max(0,round((Diff1 / StepSize) + RoundTO)) //number of STEPSIZE chunks ProfitPerCent = PointToKeep + (PointToKeep * (Chunks1 * PerCentInc)) //compute new size of ProfitPerCent ProfitPerCent = max(ProfitPerCent[1],min(100,ProfitPerCent)) //make sure ProfitPerCent doess not exceed 100% maxProfitL = max(profitL * ProfitPerCent, maxProfitL) ENDIF ELSIF ShortOnMarket AND close < (PositionPrice - (maxProfitS * pipsize)) THEN //SHORT positions profitS = (PositionPrice - close) / pipsize IF profitS >= TrailStart THEN Diff2 = abs(TrailStart - profitS) Chunks2 = max(0,round((Diff2 / StepSize) + RoundTO)) ProfitPerCent = PointToKeep + (PointToKeep * (Chunks2 * PerCentInc)) ProfitPerCent = max(ProfitPerCent[1],min(100,ProfitPerCent)) maxProfitS = max(profitS * ProfitPerCent, maxProfitL) ENDIF ENDIF //-------------------------------------------------------------------------------------------------------------------------------------------------------------- IF maxProfitL THEN //LONG positions - Place pending STOP order when maxProftiL > 0 (LONG positions) SellPrice = max(SellPrice,PositionPrice + (maxProfitL * pipsize)) //convert pips to price IF abs(close - SellPrice) > PriceDistance THEN IF close >= SellPrice THEN SELL AT SellPrice STOP ELSE SELL AT SellPrice LIMIT ENDIF ELSE SELL AT Market ENDIF ENDIF IF maxProfitS THEN ExitPrice = min(ExitPrice,PositionPrice - (maxProfitS * pipsize)) //SHORT positions IF abs(close - ExitPrice) > PriceDistance THEN IF close <= ExitPrice THEN EXITSHORT AT ExitPrice STOP ELSE EXITSHORT AT ExitPrice LIMIT ENDIF ELSE EXITSHORT AT Market ENDIF ENDIFThere you go:

MA = 50 IF close crosses over average[MA,0] AND Not OnMarket THEN BUY at market ELSIF close crosses UNDer average[MA,0] AND Not OnMarket THEN SELLSHORT at market endif SET TARGET pPROFIT 300 SET STOP pLOSS 150 //-------------------------------------------------------------------------------------------- DirectionSwitch = (LongOnMarket AND ShortOnMarket[1]) OR (LongOnMarket[1] AND ShortOnMarket) //TrP Exit (Gozzi //-------------------------------------------------------------------------------------------- // MyEquity must be defined somewhere in your code (even to ZERO if its use is not planned) ONCE MyEquity = 10000//initial Capital (only if UseEquity = 1) ONCE UsePerCentage = 0 //0=use Pips (default), 1=use Percentages ONCE UseEquity = 0 //0=use price (default), 1=use Equity (initial Capital+StrategyProfit, defined by MyEquity) // IF Not OnMarket OR DirectionSwitch THEN StartPerCentL = 0.25 //0.25% to start triggering Trailing Stop (when UsePerCentage=1) StepPerCentL = 50 //50% (of the 0.25% above) as a Trqiling Step (when UsePerCentage=1) (set to 100 to make StepSize=TrailStart, set to 200 to make it twice TrailStart) StartPerCentS = 0.25 //0.25% to start triggering Trailing Stop (when UsePerCentage=1) StepPerCentS = 50 //50% (of the 0.25% above) as a Trqiling Step (when UsePerCentage=1) (set to 100 to make StepSize=TrailStart, set to 200 to make it twice TrailStart) // TrailStartL = TS//40 //Start trailing profits from this point (when UsePerCentage=0) TrailStartS = TS//40 //Start trailing profits from this point (when UsePerCentage=0) MinStartL = 10 //10 Minimum value for TrailStart (when UseEquity=1, to prevent TrailStart from // dropping below ZERO when Equity turns negative) MinStartS = 10 //10 Minimum value for TrailStart (when UseEquity=1, to prevent TrailStart fromMinStartL = 10 //10 Minimum value for TrailStart (when UseEquity=1, to prevent TrailStart from IF UsePerCentage THEN TrailStartL= (close / PipSize) * StartPerCentL / 100 //use current price (CLOSE) for calculations TrailStartS= (close / PipSize) * StartPerCentS / 100 //use current price (CLOSE) for calculations IF UseEquity THEN //alternative calculations using EQUITY TrailStartL= Max(MinStartL,(MyEquity / PipValue) * StartPerCentL / 100) //MyEquity is the variable (feel free to use a different name) retaining your current equity TrailStartS= Max(MinStartS,(MyEquity / PipValue) * StartPerCentS / 100) //MyEquity is the variable (feel free to use a different name) retaining your current equity ENDIF ENDIF PointToKeep = PK//0.2 // 20% Profit percentage to keep when setting BreakEven StepSizeL = SS//5 // Point to increase Percentage StepSizeS = SS//5 // Point to increase Percentage // IF UsePerCentage THEN StepSizeL = TrailStartL * StepPerCentL / 100 StepSizeS = TrailStartS * StepPerCentS / 100 ENDIF // PerCentInc = PC//0.2 // 20% PerCent increment after each StepSize Chunk RoundTO = -0.5 //-0.5 rounds always to Lower integer, 0 defaults PRT behaviour PriceDistance = 10* pipsize //6minimun distance from current price maxProfitL = 0 //0 eller 2050 maxProfitS = 0 ProfitPerCent = PointToKeep //reset to desired default value SellPriceX = 0 SellPrice = 0 ExitPriceX = 9999999 ExitPrice = 9999999 ELSE IF PositionPrice <> PositionPrice[1] AND (ExitPrice + SellPrice) <> 9999999 THEN //go on only if Trailing Stop had already started trailing IF LongOnMarket THEN newSlL = PositionPrice + ((close - PositionPrice) * ProfitPerCent) //calculate new SL SellPriceX = max(max(SellPriceX,SellPrice),newSlL) SellPrice = max(max(SellPriceX,SellPrice),PositionPrice + (maxProfitL * pipsize)) //set exit price to whatever grants greater profits, comopared to the previous one ELSIF ShortOnMarket THEN newSlS = PositionPrice - ((PositionPrice - close) * ProfitPerCent) ExitPriceX = min(min(ExitPriceX,ExitPrice),newSlS) ExitPrice = min(min(ExitPriceX,ExitPrice),PositionPrice - (maxProfitS * pipsize)) ENDIF ENDIF ENDIF //--------------------------------------------------------------------------------------------------------------------------------------------------- IF LongOnMarket AND close > (PositionPrice + (maxProfitL * pipsize)) THEN //LONG positions // compute the value of the Percentage of profits, if any, to lock in for LONG trades profitL = (close - PositionPrice) / pipsize //convert price to pips IF profitL >= TrailStartL THEN // go ahead only if N+ pips Diff1 = abs(TrailStartL - profitL) //difference from current profit and TrailStart Chunks1 = max(0,round((Diff1 / StepSizeL) + RoundTO)) //number of STEPSIZE chunks ProfitPerCent = PointToKeep + (PointToKeep * (Chunks1 * PerCentInc)) //compute new size of ProfitPerCent ProfitPerCent = max(ProfitPerCent[1],min(100,ProfitPerCent)) //make sure ProfitPerCent doess not exceed 100% maxProfitL = max(profitL * ProfitPerCent, maxProfitL) ENDIF ELSIF ShortOnMarket AND close < (PositionPrice - (maxProfitS * pipsize)) THEN //SHORT positions profitS = (PositionPrice - close) / pipsize IF profitS >= TrailStartS THEN Diff2 = abs(TrailStartS - profitS) Chunks2 = max(0,round((Diff2 / StepSizeS) + RoundTO)) ProfitPerCent = PointToKeep + (PointToKeep * (Chunks2 * PerCentInc)) ProfitPerCent = max(ProfitPerCent[1],min(100,ProfitPerCent)) maxProfitS = max(profitS * ProfitPerCent, maxProfitL) ENDIF ENDIF //-------------------------------------------------------------------------------------------------------------------------------------------------------------- IF maxProfitL THEN //LONG positions - Place pending STOP order when maxProftiL > 0 (LONG positions) SellPrice = max(SellPrice,PositionPrice + (maxProfitL * pipsize)) //convert pips to price IF abs(close - SellPrice) > PriceDistance THEN IF close >= SellPrice THEN SELL AT SellPrice STOP ELSE SELL AT SellPrice LIMIT ENDIF ELSE SELL AT Market ENDIF ENDIF IF maxProfitS THEN ExitPrice = min(ExitPrice,PositionPrice - (maxProfitS * pipsize)) //SHORT positions IF abs(close - ExitPrice) > PriceDistance THEN IF close <= ExitPrice THEN EXITSHORT AT ExitPrice STOP ELSE EXITSHORT AT ExitPrice LIMIT ENDIF ELSE EXITSHORT AT Market ENDIF ENDIFThanks alot Roberto!

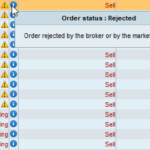

Roberto. I got this error: “stoped by broker due to many atempts to place order”

Nasdaq 1EUR

Timeframe 15MDo u know whats wrong?

See attached picture//-------------------------------------------------------------------------------------------- DirectionSwitch = (LongOnMarket AND ShortOnMarket[1]) OR (LongOnMarket[1] AND ShortOnMarket) //TrP Exit (Gozzi IF Not OnMarket OR DirectionSwitch THEN TrailStart = 0.9 // Start trailing profits PointToKeep = 0.81 // PK20% Profit percentage to keep when setting BreakEven StepSize = 1 // Point to increase Percentage PerCentInc = 0.9 // 20% PerCent increment after each StepSize Chunk RoundTO = -0.8 //-0.5 rounds always to Lower integer, 0 defaults PRT behaviour PriceDistance = 10* pipsize //6minimun distance from current price maxProfitL = 0 //0 eller 2050 maxProfitS = 0 ProfitPerCent = PointToKeep //reset to desired default value SellPriceX = 0 SellPrice = 0 ExitPriceX = 9999999 ExitPrice = 9999999 ELSE IF PositionPrice <> PositionPrice[1] AND (ExitPrice + SellPrice) <> 9999999 THEN //go on only if Trailing Stop had already started trailing IF LongOnMarket THEN newSlL = PositionPrice + ((close - PositionPrice) * ProfitPerCent) //calculate new SL SellPriceX = max(max(SellPriceX,SellPrice),newSlL) SellPrice = max(max(SellPriceX,SellPrice),PositionPrice + (maxProfitL * pipsize)) //set exit price to whatever grants greater profits, comopared to the previous one ELSIF ShortOnMarket THEN newSlS = PositionPrice - ((PositionPrice - close) * ProfitPerCent) ExitPriceX = min(min(ExitPriceX,ExitPrice),newSlS) ExitPrice = min(min(ExitPriceX,ExitPrice),PositionPrice - (maxProfitS * pipsize)) ENDIF ENDIF ENDIF //--------------------------------------------------------------------------------------------------------------------------------------------------- IF LongOnMarket AND close > (PositionPrice + (maxProfitL * pipsize)) THEN //LONG positions // compute the value of the Percentage of profits, if any, to lock in for LONG trades profitL = (close - PositionPrice) / pipsize //convert price to pips IF profitL >= TrailStart THEN // go ahead only if N+ pips Diff1 = abs(TrailStart - profitL) //difference from current profit and TrailStart Chunks1 = max(0,round((Diff1 / StepSize) + RoundTO)) //number of STEPSIZE chunks ProfitPerCent = PointToKeep + (PointToKeep * (Chunks1 * PerCentInc)) //compute new size of ProfitPerCent ProfitPerCent = max(ProfitPerCent[1],min(100,ProfitPerCent)) //make sure ProfitPerCent doess not exceed 100% maxProfitL = max(profitL * ProfitPerCent, maxProfitL) ENDIF ELSIF ShortOnMarket AND close < (PositionPrice - (maxProfitS * pipsize)) THEN //SHORT positions profitS = (PositionPrice - close) / pipsize IF profitS >= TrailStart THEN Diff2 = abs(TrailStart - profitS) Chunks2 = max(0,round((Diff2 / StepSize) + RoundTO)) ProfitPerCent = PointToKeep + (PointToKeep * (Chunks2 * PerCentInc)) ProfitPerCent = max(ProfitPerCent[1],min(100,ProfitPerCent)) maxProfitS = max(profitS * ProfitPerCent, maxProfitL) ENDIF ENDIF //-------------------------------------------------------------------------------------------------------------------------------------------------------------- IF maxProfitL THEN //LONG positions - Place pending STOP order when maxProftiL > 0 (LONG positions) SellPrice = max(SellPrice,PositionPrice + (maxProfitL * pipsize)) //convert pips to price IF abs(close - SellPrice) > PriceDistance THEN IF close >= SellPrice THEN SELL AT SellPrice STOP ELSE SELL AT SellPrice LIMIT ENDIF ELSE SELL AT Market ENDIF ENDIF IF maxProfitS THEN ExitPrice = min(ExitPrice,PositionPrice - (maxProfitS * pipsize)) //SHORT positions IF abs(close - ExitPrice) > PriceDistance THEN IF close <= ExitPrice THEN EXITSHORT AT ExitPrice STOP ELSE EXITSHORT AT ExitPrice LIMIT ENDIF ELSE EXITSHORT AT Market ENDIF ENDIFIt seems you are using a 1-second TF, so every second a pending order is placed when trailing is triggered. It seems that IG cannot process further oreders because in a single bar could not adress the prior request.

It often occurs to me, as well. But I am using a 5-minute TF, which should be a TF large enough not to make this happen, but it does, however.

So far I couldn’t get any clue how to solve it, despite some email messages.

Im using 15min timeframe

Is there a combiantion of these vakkues thats not possible to use in live-trading?

TrailStart = 0.9 // Start trailing profits PointToKeep = 0.81 // PK20% Profit percentage to keep when setting BreakEven StepSize = 1 // Point to increase Percentage PerCentInc = 0.9 // 20% PerCent increment after each StepSize Chunk RoundTO = -0.8 //-0.5 rounds always to Lower integer, 0 defaults PRT behaviour PriceDistance = 10* pipsize //6minimun distance from current priceNo, they seem all correct.

Try GRAPHing the variables involved to spot any weird value.

-

AuthorPosts

- You must be logged in to reply to this topic.

R. Gozzi- trail

ProOrder: Automated Strategies & Backtesting

Summary

This topic contains 7 replies,

has 2 voices, and was last updated by ![]() robertogozzi

robertogozzi

3 years, 10 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 04/13/2022 |

| Status: | Active |

| Attachments: | 2 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.