Hell0,

I am working on my backtest code for EUR/USD. To makes things easy I only talk about LONG positions!

My buy is when the average[20] crosses over average[50]. I work with a fixed target of 10 pips and original stoploss at the lowest of the last 5 bars. BUT after a high has reached the 4 pips, I want to move the stoploss to neutral, which means the buy price. That last thing doesn’t work.

How do need to describe this?

Thanks a lot, Marc

defparam cumulateorders = false

//conditions for long

mashort = average[20] (close)

malong = average[30] (close)

c1= (mashort crosses over malong)

if c1 then

BUY 1 contract at market

stoploss = lowest[5] (low)

endif

// Conditions to put the stoploss to neutral after the high has been above the buy plus 4 pips

if LongOnMarket and high => positionprice + 4 then

stoploss = positionprice

endif

// Stops and Targets

SET TARGET pPROFIT 10

SET STOP ploss stoploss

nb = barindex - tradeindex

highesthigh = highest[nb+1](high)

If longonmarket and (not c1) and highesthigh >= positionprice + 4 then

sell at positionprice stop

endif

You are mixing prices with pips.

StopLoss is a price, while SET STOP PLOSS requires pips, with Dax your SL would become 13700 pips, with Eur/Usd just a little more than 1 pip.

Try replacing line 15 with:

stoploss = abs(positionprice - high) / PipSize

But I think the new stoploss would be set from PositionPrice, not high, so it wouldn’t be a breakeven.

Using a pending Stop order might be a better solution.

Let me know if the above doesn’t work.

Thanks Xorandnot,

It looks logical, though, when I backtest, it doesn’t do what I expect it will do. I changed the original SL to a fixed numberof 4 pips, because I see that it didn’t take the stoploss at the lowest low from the last 5 candles as descibed befor. But even then, it doesn’t move the SL to neutral after the price has reached 4 pips.

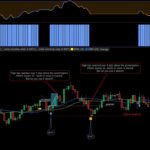

See the image.

I know it has to do with the order in my programming.

// defenition of code parameters

defparam cumulateorders = false

//conditions for long

mashort = average[20] (close)

malong = average[30] (close)

c1= (mashort crosses over malong)

if c1 then

BUY 1 contract at market

endif

// Conditions to put the stoploss to neutral after the high has been above the positionprice of 4 pips

nb = barindex - tradeindex

highesthigh = highest[nb+1](high)

If longonmarket and (not c1) and highesthigh >= positionprice + 4 then

sell at positionprice stop

endif

// Stops and Targets

SET TARGET pPROFIT 10

SET STOP ploss 4

Thanks Roberto,

Yes of course, I mix pips and price. Not good 🙂 I use EUR/USD, 600 ticks

But still… 2 things don’t work in my coding.

1. When BUY then I want the stoploss below the lowest low form the previous 5 candles. The code like down here doesn’t work like that.

if c1 then

BUY 1 contract at market

stoploss = lowest[5] (low)

endif

2. When after BUY the price has reached 4 pips above the BUY, then I want the SL moved to neutral.

I have changed my line 15 the way you suggested, but that doesn’t seem to work.

defparam cumulateorders = false

//conditions for long

mashort = average[20] (close)

malong = average[30] (close)

c1= (mashort crosses over malong)

if c1 then

BUY 1 contract at market

stoploss = lowest[5] (low)

endif

// Conditions to put the stoploss to neutral after the high has been above the buy plus 4 pips

if LongOnMarket and high => positionprice + 0.0004 then

stoploss = abs(positionprice - high) / PipSize

endif

// Stops and Targets

SET TARGET pPROFIT 10

SET STOP ploss stoploss

4 pips might be too few, check with IG what’s the minimum required.

At line 9 you should add AND Not OnMarket to your conditions, so that your calculation is not made after entering a trade since this makes your SL to move each candle.

A pending stop order, similar to the one suggested by XorAndNot might be useful.