Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

PP Fractals // Error message

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- PP Fractals // Error message

-

AuthorPosts

-

Peter, As i mentioned above (#189007) the original code generates a profit VS the code modified by Nicolas generates a loss. So, there is something in this PP Fractals code that plays a role of filter beyond the graphing.

what @Nicolas is saying. So to me it now seems that he (from his own code ever back ?) tells that the arrays were only there for graphing, while you don’t graph anything. So just eliminate the code concerned (?).

Which is exactly what he has done for you (I checked and understand it now). So the challenge is : why is the result not the same.

Probably because the approach with the array failed ? or the arrays themselves fail ? (it really is too easy to make mistakes, the way PRT set them up).I’m not putting in doubt what Nicolas has done. However, I see (as you see it in your backtest) there is a big difference between with and without.

Do you mean that there might be something wrong in the calculation of the Arrays that generates “fake” Profits? It’s very likely. May be the solution/answer is with Vonasi the author of the original code 🙂

May be the solution/answer is with Vonasi the author of the original code

For info … we’ve not seen Vonasi hereabouts for 9 months or so!

Khaled thanked this postI think the problem lies in this part :

LongConso = long=1 and close > $resistancevalue[z] ShortConso = short=-1 and close < $supportvalue[z]My “coder hunch” tells me that z is eliminated from the new code, while z is (was) necessary for this part. So it is not about a and b, but this z. I can’t see quickly how to change that – hopefully @Nicolas can.

And maybe I am wrong. But both codes really are 100% the same, except for the part which is commented out (and the new usage of resistancevalue ans supportvalue).Khaled thanked this postFor info … we’ve not seen Vonasi hereabouts for 9 months or so!

umd followed him. If you know what I mean … (and if not then too bad).

Something else (not), we should not forget that something *is* wrong somewhere with the arrays approach. And avoiding their purpose (the graphing) is not really the very best idea.

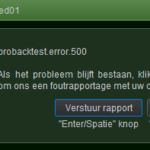

Without the arrays, this error still occurs for the 1M backtest. I will report it, then together with nontheless’s report (elsewhere) they may see commonalities.

Problem is that the array can increment 12 times per hour, so the 1 million column of the array could be reach pretty fast, please try the new version below:

DEFPARAM CUMULATEORDERS = FALSE TIMEFRAME(60 minutes,updateonclose) a=a+1 b=b+1 TIMEFRAME(60 minutes) LongConso=0 ShortConso= 0 Long=0 Short=0 //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //PRC_SwingLine Ron Black | indicator by Nicolas if upsw=1 then if high>hH then hH=high endif if low>hL then hL=low endif if high<hL then upsw=0 lL=low lH=high endif endif if upsw=0 then if low<lL then lL=low endif if high<lH then lH=high endif if low>lH then upsw=1 hH=high hL=low endif endif if upsw=1 then swingline=hL else swingline=lH endif if close>open then iRange = abs(close-open) elsif close<open then iRange = abs(open-close) endif if close>open then UpWick = high - close LoWick = open-low elsif close<open then UpWick = high-open LoWick = close-low endif // LONG if close>open then if close[1]>open[1] then if close>close[1] then long1=1 endif endif endif if close>open then if close[1]<open[1] then if close>open[1] then long2=1 endif endif endif if iRange>UpWick or LoWick>UpWick then long3 = 1 endif //if close>close[1] and close[2]>close[1] then //long4 = 1 //endif if high>high[1] or low>low[1] then long5=1 endif if (long1 or long2) and long3 and long5 and close>swingline then Long=1 endif // SHORT if close<open then if close[1]>open[1] then if close<open[1] then short1=1 endif endif endif if close<open then if close[1]<open[1] then if close<close[1] then short2=1 endif endif endif if iRange>LoWick or LoWick<UpWick then short3 = 1 endif //if close<close[1] and close[2]<close[1] then //short4 = 1 //endif if high<high[1] or low<low[1] then short5=1 endif if (Short1 or short2) and short3 and short5 and close<swingline then Short=-1 endif //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// // SR PP Fractal Lines by Vonasi //BarsBefore = 1 //BarsAfter = 1 Support = 1 Resistance = 1 Points = 1 //Make sure all settings are valid ones BarsBefore = max(BarsBefore,1) BarsAfter = max(BarsAfter,1) StartBack = max(0,startback) if barindex >= barsbefore + barsafter then //Look for a low fractal BarLookBack = BarsAfter + 1 if low[BarsAfter] < lowest[BarsBefore](low)[BarLookBack] THEN if low[BarsAfter] = lowest[BarLookBack](low) THEN //if barindex[barsafter]<>$supportbar[a] then//a<99999 then //a = a + 1 //endif $supportbar[a] = barindex[barsafter] $supportvalue[a] = low[barsafter] endif endif //Look for a high fractal if high[BarsAfter] > highest[BarsBefore](high)[BarLookBack] THEN if high[BarsAfter] = highest[BarLookBack](high) THEN //if barindex[barsafter]<>$resistancebar[b] then //b = b + 1 //endif $resistancebar[b] = barindex[barsafter] $resistancevalue[b] = high[barsafter] endif endif if islastbarupdate then //support line if a >= 2 then if support then flag = 0 zz = 0 for z = a-zz downto 1 for xx = 1 to a if z-xx < 1 then break endif if $supportvalue[z] > $supportvalue[z-xx] then if points then endif flag = 1 break endif if zz<99999 then zz = zz + 1 endif next if flag = 1 then break endif zz = 0 next endif endif //resistance line if b >= 2 then if resistance then flag = 0 zz = 0 for z = b-zz downto 1 for xx = 1 to b if z-xx < 1 then break endif if $resistancevalue[z] < $resistancevalue[z-xx] then if points then endif flag = 1 break endif if zz<99999 then zz = zz + 1 endif next if flag = 1 then break endif zz = 0 next endif endif endif endif //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// LongConso = long=1 and close > $resistancevalue[z] ShortConso = short=-1 and close < $supportvalue[z] //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// TIMEFRAME(5 minutes, UPDATEONCLOSE) nLots = min(10,round((2000+STRATEGYPROFIT)/(close*.5*.1),1)) IF NOT LongOnMarket AND LongConso THEN BUY nLots CONTRACTS AT MARKET ENDIF IF NOT ShortOnMarket AND ShortConso THEN SELLSHORT nLots CONTRACTS AT MARKET ENDIF //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// If LongOnMarket AND ShortConso THEN SELL AT MARKET SELLSHORT nLots CONTRACTS AT MARKET ENDIF IF ShortOnMarket AND LongConso THEN EXITSHORT AT MARKET BUY nLots CONTRACTS AT MARKET ENDIF //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// TIMEFRAME(1 minute) SET STOP %LOSS .3 //SL SET TARGET %PROFIT 1.6 //TPThank you very much Nicolas!!! I left home, so I’ve no access to my PRT now. I’ll test it later today and let you know.

Basically, what I’m trying to acheive is a Strategy that works without any time-based indicator for Entry Signals (no MA, no RSI, etc.), only price, price and price. I found the Swing Line that you shared in another post quite effective with (UPDATEONCLOSE) and TF>H1, but I need to add more filters like Breakout of Trendlines.

May be we can do that without Arrays?

Thank you for your help, @Nicolas.

The result is unchanged, but more importantly, this is not workable because of slowness and *that* tells me that something with the array-accesses is not correct (asking for an undefined element will trigger the error-trap under the hood and this is ultimately slow). The 100K takes 20 minutes to calculate. This was not so at all with the earlier version from Khaled (using arrays).I am only the messenger. 😐

Khaled thanked this postDear Trading Companions 🙂

First, please let me thank you for all the help and time you have spent trying to help. Obviously, this is more about the learning journey than the immediate end result in itself.

Second, the 2nd code reworked by Nicolas didn’t work LIVE. I had again and again the same error of 1,000,000 rows.

Third and happily, I managed to replace the PP Fractals code by another code from Vonasi called Fractals Average https://www.prorealcode.com/prorealtime-indicators/fractals-average/, where I replaced the two trigger variables with “MidAvg”. I got results not far away and it is live now as we speak. Let’s how it behaves over the afternoon.

I’ll keep you posted.

If anyone thinks of a piece of code somewhere on this forum which uses only price for Trend, Breakout, etc., please let me know. I defenitly want to build a system without any time-based indicators (MA, RSI, etc.).

Again, thank you for your support. I feel blessed.

New try (I did not compare tjhe result with initial version)

DEFPARAM CUMULATEORDERS = FALSE TIMEFRAME(60 minutes) LongConso=0 ShortConso= 0 Long=0 Short=0 once $lastbarindexa[0]=barindex once $lastbarindexb[0]=barindex //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //PRC_SwingLine Ron Black | indicator by Nicolas if upsw=1 then if high>hH then hH=high endif if low>hL then hL=low endif if high<hL then upsw=0 lL=low lH=high endif endif if upsw=0 then if low<lL then lL=low endif if high<lH then lH=high endif if low>lH then upsw=1 hH=high hL=low endif endif if upsw=1 then swingline=hL else swingline=lH endif if close>open then iRange = abs(close-open) elsif close<open then iRange = abs(open-close) endif if close>open then UpWick = high - close LoWick = open-low elsif close<open then UpWick = high-open LoWick = close-low endif // LONG if close>open then if close[1]>open[1] then if close>close[1] then long1=1 endif endif endif if close>open then if close[1]<open[1] then if close>open[1] then long2=1 endif endif endif if iRange>UpWick or LoWick>UpWick then long3 = 1 endif //if close>close[1] and close[2]>close[1] then //long4 = 1 //endif if high>high[1] or low>low[1] then long5=1 endif if (long1 or long2) and long3 and long5 and close>swingline then Long=1 endif // SHORT if close<open then if close[1]>open[1] then if close<open[1] then short1=1 endif endif endif if close<open then if close[1]<open[1] then if close<close[1] then short2=1 endif endif endif if iRange>LoWick or LoWick<UpWick then short3 = 1 endif //if close<close[1] and close[2]<close[1] then //short4 = 1 //endif if high<high[1] or low<low[1] then short5=1 endif if (Short1 or short2) and short3 and short5 and close<swingline then Short=-1 endif //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// // SR PP Fractal Lines by Vonasi //BarsBefore = 1 //BarsAfter = 1 Support = 1 Resistance = 1 Points = 1 //Make sure all settings are valid ones BarsBefore = max(BarsBefore,1) BarsAfter = max(BarsAfter,1) StartBack = max(0,startback) if barindex >= barsbefore + barsafter then //Look for a low fractal BarLookBack = BarsAfter + 1 if low[BarsAfter] < lowest[BarsBefore](low)[BarLookBack] THEN if low[BarsAfter] = lowest[BarLookBack](low) THEN //if barindex[barsafter]<>$supportbar[a] then//a<99999 then //a = a + 1 //endif if barindex>$lastbarindexa[0] then a=a+1 $lastbarindexa[0]=barindex endif $supportbar[a] = barindex[barsafter] $supportvalue[a] = low[barsafter] endif endif //Look for a high fractal if high[BarsAfter] > highest[BarsBefore](high)[BarLookBack] THEN if high[BarsAfter] = highest[BarLookBack](high) THEN //if barindex[barsafter]<>$resistancebar[b] then //b = b + 1 //endif if barindex>$lastbarindexb[0] then b=b+1 $lastbarindexb[0]=barindex endif $resistancebar[b] = barindex[barsafter] $resistancevalue[b] = high[barsafter] endif endif if islastbarupdate then //support line if a >= 2 then if support then flag = 0 zz = 0 for z = a-zz downto 1 for xx = 1 to a if z-xx < 1 then break endif if $supportvalue[z] > $supportvalue[z-xx] then if points then endif flag = 1 break endif if zz<99999 then zz = zz + 1 endif next if flag = 1 then break endif zz = 0 next endif endif //resistance line if b >= 2 then if resistance then flag = 0 zz = 0 for z = b-zz downto 1 for xx = 1 to b if z-xx < 1 then break endif if $resistancevalue[z] < $resistancevalue[z-xx] then if points then endif flag = 1 break endif if zz<99999 then zz = zz + 1 endif next if flag = 1 then break endif zz = 0 next endif endif endif endif //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// LongConso = long=1 and close > $resistancevalue[z] ShortConso = short=-1 and close < $supportvalue[z] //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// TIMEFRAME(5 minutes, UPDATEONCLOSE) nLots = min(10,round((2000+STRATEGYPROFIT)/(close*.5*.1),1)) IF NOT LongOnMarket AND LongConso THEN BUY nLots CONTRACTS AT MARKET ENDIF IF NOT ShortOnMarket AND ShortConso THEN SELLSHORT nLots CONTRACTS AT MARKET ENDIF //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// If LongOnMarket AND ShortConso THEN SELL AT MARKET SELLSHORT nLots CONTRACTS AT MARKET ENDIF IF ShortOnMarket AND LongConso THEN EXITSHORT AT MARKET BUY nLots CONTRACTS AT MARKET ENDIF //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// TIMEFRAME(1 minute) SET STOP %LOSS .3 //SL SET TARGET %PROFIT 1.6 //TPKhaled thanked this postIt is normally fast again.

The results are not like the original (at all).Khaled thanked this post -

AuthorPosts

- You must be logged in to reply to this topic.

PP Fractals // Error message

ProOrder: Automated Strategies & Backtesting

Summary

This topic contains 28 replies,

has 4 voices, and was last updated by PeterSt

3 years, 11 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 02/28/2022 |

| Status: | Active |

| Attachments: | 15 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.