Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Pivots Points – Buy and sell short strategy

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Pivots Points – Buy and sell short strategy

-

AuthorPosts

-

Hello,

Just looking for an automated strategy that involves Pivots Points (Free or with a small fee).

Conditions:

Buy if PP is support

Sell if PP is resistance

TF to be determined manually.

TP to be determined manually.

Thank you

Thank you

Damien

Any help and code posted on this forum is ALWAYS for free.

There you go:

DEFPARAM CumulateOrders = False SL = 200 * PipSize TP = SL * 3 N = 5 PP = (DHigh(1) + DLow(1) + DClose(1))/3 //PP calculation // Res1 = summation[N](close <= PP) = N Res2 = summation[N](high >= PP) Res = Res1 AND Res2 // Sup1 = summation[N](close >= PP) = N Sup2 = summation[N](low <= PP) Sup = Sup1 AND Sup2 // IF Sup AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF Res AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF // SET TARGET pPROFIT TP SET STOP pLOSS SL // GraphOnPrice PP AS "Pivot" coloured("Fuchsia",255) GraphOnPrice TradePrice AS "TradePrice" coloured("Cyan",255)Midlanddave, Inertia, Nicolas and KumoNoJuzza thanked this postHi Roberto, Big thanks to you and very long life to this forum!

Nice approach by Roberto!

Other code related to avoid take positions near pivot points: https://www.prorealcode.com/topic/prevent-entry-near-pivot-points/#post-202658

could be easily reverted to take positions on them.

robertogozzi and Inertia thanked this postDEFPARAM CumulateOrders = False SL = 40 TP = 10 N = 5 Ht = DHigh(1) Bs = DLow(1) C = DClose(1) Pivot = (Ht + Bs + C) / 3 // Res1 = summation[N](close <= Pivot) = N Res2 = (high[1] >= Pivot) Res = Res1 AND Res2 // Sup1 = summation[N](close >= Pivot) = N Sup2 = (low[1] <= Pivot) Sup = Sup1 AND Sup2 // IF Sup AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF Res AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF // SET TARGET pPROFIT TP SET STOP pLOSS SLGood morning Roberto,

Thank you for this strategy.

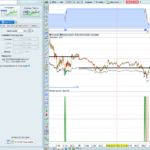

I am scratching my head wondering why this strategy did not take a short position at 1030am this morning (NASDAQ – 1 mn UT) ?

Point pivot was a “Res” for the close, 5 previous close were below Point Pivot and high was over point pivot.

Thank you.

Damien

Because it was already ShortOnMarket AND condition Sup1 was false.

Using GRAPH extensively to monitor your conditions and other data will help you.

Inertia thanked this postThank you Roberto for your swift answer. Appreciated.

If I am not mistaken, the strategy was flat. I added the Graph as you said. I have ignored the Sup1 // …

According to the chart, the strategy should have taken postions at 9:44am & 9:54am and 10:31am? What do you think?

These types of entries are the one I am looking for. I am a dummy in coding 😉

Append these lines to your code:

graphonprice Pivot coloured("Fuchsia") graph Res coloured("Red") graph Sup coloured("Green")you will see that NO condition was true and that the price was quite far from the pivot line.

Find it why, thank you Roberto.

1 – The code uses the previous PP (1) so of course there were no trade taken in the mentioned levels today (0). Sorry 😉

2 – But when i change the PP with (0) instead of (1) it gives a funny PP… How can i have it straight like the PRT one please?

Thank you.

Damien

Ht = DHigh(1) Bs = DLow(1) C = DClose(1) Pivot = (Ht + Bs + C) / 3 Res3 = Res1 + (Ht - Bs) Res2 = Pivot + Ht - Bs Res1 = (2 * Pivot) - Bs Sup1 = (2 * Pivot) - Ht Sup2 = Pivot - (Ht - Bs) Sup3 = Sup1 - (Ht - Bs) Return Res1 AS "Res1" coloured("green"), Res2 AS "Res2" coloured("green"), Res3 AS "Res3" coloured("green"), Pivot AS "Pivot" coloured("black"), Sup1 AS "Sup1" coloured("red"), Sup2 AS "Sup2" coloured("red"), Sup3 AS "Sup3" coloured("red")Strangely, the indicator PP Daily gives a straight line for the PP Pivot like the PRT PP even with the (1)… Please help. Thank you Roberto.

Sorry, but I can’t understand what you want to do, why are you comparing yestarday’s (1) data with today’s (0)?

Please post exactly the code you want to use and tell me when it doesn’t work according to you (on Nasdaq, 1-minute TF) ?

Inertia thanked this postBonjour Nicolas,J’ai envoyé une demande mercredi via la messagerie “Trading Programming Service” afin de faire construire la Ferrari des points Pivots 😉 dans votre garage. C’est possible, n’est-ce pas ?Excellente journée.DamienHello Nicolas, I sent a request on Wednesday via the “Trading Programming Service” messaging service to have the Pivot Points Ferrari built 😉 in your garage. It’s possible, isn’t it? Excellent day.

Damien

Sorry Roberto. Thank you. Cheers. Thank you for your help.

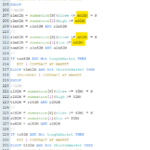

//------------------------------------------------------------------------- // Main code : DAX OCTOBRE //------------------------------------------------------------------------- DEFPARAM CumulateOrders = TRUE // Cumulating positions deactivated //monthly values // MONTHLY mR1M = 15828 R1M = 16016 mR2M = 16283 R2M = 16550 mR3M = 16738 R3M = 16926 mR4M = 17381 R4M = 17836 PivotM = 15640 mS1M = 15373 S1M = 15106 mS2M = 14918 S2M = 14730 mS3M = 14663 S3M = 14196 mS4M = 13741 S4M = 13286 //WEEKLY VALUES R4W = 16331 R3W = 15791 R2W = 15598 R1W = 15251 PivotW = 15058 S1W = 14711 S2W = 14518 S3W = 14171 S4W = 13631 //TITAN HigWPrev = 15683 HigMPrev = 16175 LowWPrev = 15188 LowMPrev = 15265 //ROUNDNUMBER VALUES c1 = 15000 c2 = 14500 c3 = 14000 c4 = 15500 c5 = 16000 //N periodes to look back N = 5 //Position taker //mR1M r1mR1M = summation[N](close <= mR1M) = N r2mR1M = summation[1](high >= mR1M) tlmR1M = r1mR1M AND r2mR1M // s1mR1M = summation[N](close >= mR1M) = N s2mR1M = summation[1](low <= mR1M) tsmR1M = s1mR1M AND s2mR1M // IF tsmR1M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlmR1M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //R1M r1R1M = summation[N](close <= R1M) = N r2R1M = summation[1](high >= R1M) tlR1M = r1R1M AND r2R1M // s1R1M = summation[N](close >= R1M) = N s2R1M = summation[1](low <= R1M) tsR1M = s1R1M AND s2R1M // IF tsR1M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlR1M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //mR2M r1mR2M = summation[N](close <= mR2M) = N r2mR2M = summation[1](high >= mR2M) tlmR2M = r1mR2M AND r2mR2M // s1mR2M = summation[N](close >= mR2M) = N s2mR2M = summation[1](low <= mR2M) tsmR2M = s1mR2M AND s2mR2M // IF tsmR2M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlmR2M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //M2M r1R2M = summation[N](close <= R2M) = N r2R2M = summation[1](high >= R2M) tlR2M = r1R2M AND r2R2M // s1R2M = summation[N](close >= R2M) = N s2R2M = summation[1](low <= R2M) tsR2M = s1R2M AND s2R2M // IF tsR2M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlR2M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //m3RM r1mR3M = summation[N](close <= mR3M) = N r2mR3M = summation[1](high >= mR3M) tlmR3M = r1mR3M AND r2mR3M // s1mR3M = summation[N](close >= mR3M) = N s2mR3M = summation[1](low <= mR3M) tsmR3M = s1mR3M AND s2mR3M // IF tsmR3M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlmR3M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //3RM r1R3M = summation[N](close <= R3M) = N r2R3M = summation[1](high >= R3M) tlR3M = r1R3M AND r2R3M // s1R3M = summation[N](close >= R3M) = N s2R3M = summation[1](low <= R3M) tsR3M = s1R3M AND s2R3M // IF tsR3M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlR3M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF // //m4RM r1mR4M = summation[N](close <= mR4M) = N r2mR4M = summation[1](high >= mR4M) tlmR4M = r1mR4M AND r2mR4M // s1mR4M = summation[N](close >= mR4M) = N s2mR4M = summation[1](low <= mR4M) tsmR4M = s1mR4M AND s2mR4M // IF tsmR4M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlmR4M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //4RM r1R4M = summation[N](close <= R4M) = N r2R4M = summation[1](high >= R4M) tlR4M = r1R4M AND r2R4M // s1R4M = summation[N](close >= R4M) = N s2R4M = summation[1](low <= R4M) tsR4M = s1R4M AND s2R4M // IF tsR4M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlR4M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF // //PIVOT M r1PivotM = summation[N](close <= PivotM) = N r2PivotM = summation[1](high >= PivotM) tlPivotM = r1PivotM AND r2PivotM // s1PivotM = summation[N](close >= PivotM) = N s2PivotM = summation[1](low <= PivotM) tsPivotM = s1PivotM AND s2PivotM // IF tsPivotM AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlPivotM AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //mS1MV r1mS1M = summation[N](close <= mS1M) = N r2mS1M = summation[1](high >= mS1M) tlmS1M = r1mS1M AND r2mS1M // s1mS1M = summation[N](close >= mS1M) = N s2mS1M = summation[1](low <= mS1M) ssmS1M = s1mS1M AND s2mS1M // IF ssmS1M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlmS1M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //S1MV r1S1M = summation[N](close <= S1M) = N r2S1M = summation[1](high >= S1M) tlS1M = r1S1M AND r2S1M // s1S1M = summation[N](close >= S1M) = N s2S1M = summation[1](low <= S1M) tsS1M = s2S1M AND s1S1M // IF tsS1M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlS1M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //mS2M r1mS2M = summation[N](close <= mS2M) = N r2mS2M = summation[1](high >= mS2M) tlmS2M = r1mS2M AND r2mS2M // s1mS2M = summation[N](close >= mS2M) = N s2mS2M = summation[1](low <= mS2M) tsmS2M = s1mS2M AND s2mS2M // IF tsmS2M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlmS2M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //S2M r1S2M = summation[N](close <= S2M) = N r2S2M = summation[1](high >= S2M) tlS2M = r1S2M AND r2S2M // s1S2M = summation[N](close >= S2M) = N s2S2M = summation[1](low <= S2M) tsS2M = s1S2M AND s2S2M // IF tsS2M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlS2M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //mS3M r1SmS3M = summation[N](close <= mS3M) = N r2SmS3M = summation[1](high >= mS3M) tlSmS3M = r1SmS3M AND r2SmS3M // s1SmS3M = summation[N](close >= mS3M) = N s2SmS3M = summation[1](low <= mS3M) tsSmS3M = s1SmS3M AND s2SmS3M // IF tsSmS3M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlSmS3M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //S3M r1S3M = summation[N](close <= S3M) = N r2S3M = summation[1](high >= S3M) tlS3M = r1S3M AND r2S3M // s1S3M = summation[N](close >= S3M) = N s2S3M = summation[1](low <= S3M) tsS3M = s1S3M AND s2S3M // IF tsS3M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlS3M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //mS4MV r1SmS4M = summation[N](close <= mS4M) = N r2SmS4M = summation[1](high >= mS4M) tlSmS4M = r1SmS4M AND r2SmS4M // s1SmS4M = summation[N](close >= mS4M) = N s2SmS4M = summation[1](low <= mS4M) tsSmS4M = s1SmS4M AND s2SmS4M // IF tsSmS4M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlSmS4M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //S4MV r1S4M = summation[N](close <= S4M) = N r2S4M = summation[1](high >= S4M) tlS4M = r1S4M AND r2S4M // s1S4M = summation[N](close >= S4M) = N s2S4M = summation[1](low <= S4M) tsS4M = s1S4M AND s2S4M // IF tsS4M AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlS4M AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //R1W r1R1W = summation[N](close <= R1W) = N r2R1W = summation[1](high >= R1W) tlR1W = r1R1W AND r2R1W // s1R1W = summation[N](close >= R1W) = N s2R1W= summation[1](low <= R1W) tsR1W = s1R1W AND s2R1W // IF tsR1W AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlR1W AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //R2W r1R2W = summation[N](close <= R2W) = N r2R2W = summation[1](high >= R2W) tlR21W = r1R2W AND r2R2W // s1R2W = summation[N](close >= R2W) = N s2R2W= summation[1](low <= R2W) tsR21W = s1R2W AND s2R2W // IF tsR21W AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlR21W AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //R3W r1R3W = summation[N](close <= R3W) = N r2R3W = summation[1](high >= R3W) tlR3W = r1R3W AND r2R3W // s1R3W = summation[N](close >= R3W) = N s2R3W= summation[1](low <= R3W) tsR31W = s1R3W AND s2R3W // IF tsR31W AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlR3W AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //R4W r1R4W = summation[N](close <= R4W) = N r2R4W = summation[1](high >= R4W) tlR4W = r1R4W AND r2R4W // s1R4W = summation[N](close >= R4W) = N s2R4W= summation[1](low <= R4W) tsR41W = s1R4W AND s2R4W // IF tsR41W AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlR4W AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //PivotW r1PivotW = summation[N](close <= PivotW) = N r2PivotW = summation[1](high >= PivotW) tlPivotW = r1PivotW AND r2PivotW // s1PivotW = summation[N](close >= PivotW) = N s2PivotW= summation[1](low <= PivotW) tsPivotW = s1PivotW AND s2PivotW // IF tsPivotW AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlPivotW AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //S1W r1S1W = summation[N](close <= S1W) = N r2S1W = summation[1](high >= S1W) tlS1W = r1S1W AND r2S1W // s1S1W = summation[N](close >= S1W) = N s2S1W = summation[1](low <= S1W) tsS1W = s1S1W AND s2S1W // IF tsS1W AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlS1W AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //S2W r1S2W = summation[N](close <= S2W) = N r2S2W = summation[1](high >= S2W) tlS2W = r1S2W AND r2S2W // s1S2W = summation[N](close >= S2W) = N s2S2W = summation[1](low <= S2W) tsS2W = s1S2W AND s2S2W // IF tsS2W AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlS2W AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //S3W r1S3W = summation[N](close <= S3W) = N r2S3W = summation[1](high >= S3W) tlS3W = r1S3W AND r2S3W // s1S3W = summation[N](close >= S3W) = N s2S3W = summation[1](low <= S3W ) tsS3W = s1S3W AND s2S3W // IF tsS3W AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlS3W AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //S3W r1S4W = summation[N](close <= S4W) = N r2S4W = summation[1](high >= S4W) tlS4W = r1S4W AND r2S4W // s1S4W = summation[N](close >= S4W) = N s2S4W = summation[1](low <= S4W ) tsS4W = s1S4W AND s2S4W // IF tsS4W AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlS4W AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //S4W r1S4W = summation[N](close <= S4W) = N r2S4W = summation[1](high >= S4W) tlS4W = r1S4W AND r2S4W // s1S4W = summation[N](close >= S4W) = N s2S4W = summation[1](low <= S4W ) tsS4W = s1S4W AND s2S4W // IF tsS4W AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlS4W AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //HigWPrev r1HigWPrev = summation[N](close <= HigWPrev) = N r2HigWPrev = summation[1](high >= HigWPrev) tlHigWPrev = r1HigWPrev AND r2HigWPrev // s1HigWPrev = summation[N](close >= HigWPrev) = N s2HigWPrev = summation[1](low <= HigWPrev ) tsHigWPrev = s1HigWPrev AND s2HigWPrev // IF tsHigWPrev AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlHigWPrev AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //HigMPrev r1HigMPrev = summation[N](close <= HigMPrev) = N r2HigMPrev = summation[1](high >= HigMPrev) tlHigMPrev = r1HigMPrev AND r2HigMPrev // s1HigMPrev = summation[N](close >= HigMPrev) = N s2HigMPrev = summation[1](low <= HigMPrev ) tsHigMPrev = s1HigMPrev AND s2HigMPrev // IF tsHigMPrev AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlHigMPrev AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //LowWPrev r1LowWPrev = summation[N](close <= LowWPrev) = N r2LowWPrev = summation[1](high >= LowWPrev) tlLowWPrev = r1LowWPrev AND r2LowWPrev // s1LowWPrev = summation[N](close >= LowWPrev) = N s2LowWPrev = summation[1](low <= LowWPrev ) tsLowWPrev = s1LowWPrev AND s2LowWPrev // IF tsLowWPrev AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlLowWPrev AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //LowMPrev r1LowMPrev = summation[N](close <= LowMPrev) = N r2LowMPrev = summation[1](high >= LowMPrev) tlLowMPrev = r1LowWPrev AND r2LowMPrev // s1LowMPrev = summation[N](close >= LowMPrev) = N s2LowMPrev = summation[1](low <= LowMPrev ) tsLowMPrev = s1LowMPrev AND s2LowMPrev // IF tsLowMPrev AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlLowMPrev AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //c1 r1c1 = summation[N](close <= c1) = N r2c1 = summation[1](high >= c1) tlc1 = r1c1 AND r2c1 // s1c1= summation[N](close >= c1) = N s2Lc1 = summation[1](low <= c1) tsc1 = s1c1 AND s2Lc1 // IF tsc1 AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlc1 AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //c2 r1c2 = summation[N](close <= c2) = N r2c2 = summation[1](high >= c2) tlc2 = r1c2 AND r2c2 // s12c2 = summation[N](close >= c2) = N s2Lc2 = summation[1](low <= c2) tsc2 = s12c2 AND s2Lc2 // IF tsc2 AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlc2 AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //c3 r1c3 = summation[N](close <= c3) = N r2c3 = summation[1](high >= c3) tlc3 = r1c3 AND r2c3 // s12c3 = summation[N](close >= c3) = N s2Lc3 = summation[1](low <= c3) tsc3 = s12c3 AND s2Lc3 // IF tsc3 AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlc3 AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF //c4 r1c4 = summation[N](close <= c4) = N r2c4 = summation[1](high >= c4) tlc4 = r1c4 AND r2c4 // s12c4 = summation[N](close >= c4) = N s2Lc4 = summation[1](low <= c4) tsc4 = s12c4 AND s2Lc4 // IF tsc4 AND Not LongOnMarket THEN BUY 1 CONTRACT AT MARKET ELSIF tlc4 AND Not ShortOnMarket THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF // TS = 7 // 30 trailingstop = TS//Best 30 if not onmarket then MAXPRICE = 0 priceexit = 0 endif if longonmarket then MAXPRICE = MAX(MAXPRICE,close) //saving the MFE of the current trade if MAXPRICE-tradeprice(1)>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then priceexit = MAXPRICE-trailingstop*pointsize //set the exit price at the MFE - trailing stop price level endif endif //exit on trailing stop price levels if onmarket and priceexit>0 then SELL AT priceexit STOP endif TS = 7 // 30 trailingstop = TS//Best 30 if not onmarket then MINPRICE = close priceexit = 0 endif if shortonmarket then MINPRICE = MIN(MINPRICE,close) //saving the MFE of the current trade if tradeprice(1)-MINPRICE>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then priceexit = MINPRICE+trailingstop*pointsize //set the exit price at the MFE + trailing stop price level endif endif if onmarket and priceexit>0 then EXITSHORT AT priceexit STOP SELL AT priceexit STOP endif SET STOP %LOSS 0.15 SET TARGET %PROFIT 0.07Hello Roberto,

Here is the code.

Highlighted in yellow the level to Buy OR Sellshort.

No trade were taken despite: “DEFPARAM CumulateOrders = TRUE “.

Thank you for your help.

-

AuthorPosts

- You must be logged in to reply to this topic.

Pivots Points – Buy and sell short strategy

ProOrder: Automated Strategies & Backtesting

Summary

This topic contains 16 replies,

has 4 voices, and was last updated by LaMaille

2 years, 3 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 09/06/2023 |

| Status: | Active |

| Attachments: | 11 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.