Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

New to PRT and PBC, so be firm and fair…

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- New to PRT and PBC, so be firm and fair…

-

AuthorPosts

-

Okey Dokey….

So, code runs 👍and here come the questions….

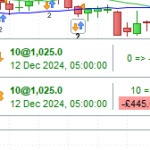

See attached image…

1.It looks like I have two live trades, I think ?

2.The orange and blue arrows – I cant find the legend to understand what they represent, or how to change the colours ?

3.My code isn’t performing correctly, as aligning the range period with the test output (best period = chart period), my code is entering and exiting trades days after or days before !Any guidance, is very much appreciated during these very early days of PRT and the use of PBC (ProBuilderCode) 👍👍

NTOne of those defrost moments 😕

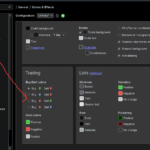

It’s much easier to show positions as in attached.

Click on your System / Algo title top left of equity curve > Configure > enable Positions Indicator.

NeoTrader thanked this postIt’s much easier to show positions as in attached.

Click on your System / Algo title top left of equity curve > Configure > enable Positions Indicator.

Got that…

But the positions graph for trade entry / exit, do not line up with the indicator and the crossover/under entry trigger (As coded)Also, how do I change the orange and blue colours, still not finding that one. <<< SOLVED 👍

And what do the numbers mean 2 or 4 by the arrows?

(It looks like I am entering two trades or even four trades at a time)If you put the positions Indicator (as my screenshot) on your Chart you will see clearer. I’m so used to seeing the Positions Indicator.

Your colours don’t seem logical? It looks like you have closed a Long at a loss of 445 and then also opened a Short ?I take it this is on a Demo Account with virtual money … as you are testing code and getting used to the Platform etc?

NeoTrader thanked this postYep. My coding is useless, it is opening a trade, and the closing it, at the same time… which is pointless….

The code is supposed to do the following…

Trade entry logic (as a test)

——————————–

Long: DM+ cross over DM-Short: DM- cross over DM+

Trade Exit Logic

——————–

1. stop loss hit

2. opposite signal triggered. Where the open trade is closed and the opposite signal trade is entered.Looking at the output, that isn’t the case 😱

I could really do with code correction advice….

Attached shows where colours for trading icons are setThis is your working code:

Are you using the Roberto provided code? Also, are you incorporating Roberto suggestion re MyMACD etc.

Roberto will help I’m sure. Asking 1 or 2 specific questions / problems at a time is best.NeoTrader thanked this postAttached shows where colours for trading icons are setThis is your working code:

Are you using the Roberto provided code? Also, are you incorporating Roberto suggestion re MyMACD etc.

Roberto will help I’m sure. Asking 1 or 2 specific questions / problems at a time is best.

Got that… thank you…

Yes, using Roberto’s code and the my* code handling, which is now amended… well, it is working better, but not resolved as per the entry and exit logic…

Trade entry logic (as a test)

——————————–

Long: DM+ cross over DM-Short: DM- cross over DM+

Trade Exit Logic

——————–

1. stop loss hit (OR)

2. opposite signal triggered. Where the open trade is closed and the opposite signal trade is entered.Here is the revised code, any assistance to rectify the process is very much appreciated.

// ========================================================================

// STRATEGY: DMI-ADX Crossover with Stop Loss + Opposite Signal Exit + Delayed Re-entry

// ========================================================================// === INPUTS ===

DMIperiod = DMIPeriod // optimize from 1 to 20

ATRperiod = 14

ATRmultiplier = 2.5

PositionSize = 10// === INDICATORS ===

myDIplus = DIPLUS[DMIperiod]

myDIminus = DIMINUS[DMIperiod]

ATR = ATR[ATRperiod]// === SIGNALS ===

LongSignal = myDIplus CROSSES OVER myDIminus

ShortSignal = myDIminus CROSSES OVER myDIplus// === STOP LOSS DISTANCE ===

StopLossDistance = ATR * ATRmultiplier// === STATE FLAGS ===

reverseToLong = 0

reverseToShort = 0// === POSITION MANAGEMENT ===

IF LongOnMarket THEN

// 1. Check stop loss

IF low <= (tradeprice(1) – StopLossDistance) THEN

SELL AT MARKET

// 2. Check for reversal

ELSIF ShortSignal THEN

SELL AT MARKET

reverseToShort = 1

ENDIF

ENDIFIF ShortOnMarket THEN

// 1. Check stop loss

IF high >= (tradeprice(1) + StopLossDistance) THEN

EXITSHORT AT MARKET

// 2. Check for reversal

ELSIF LongSignal THEN

EXITSHORT AT MARKET

reverseToLong = 1

ENDIF

ENDIF// === ENTRY WHEN FLAT ===

IF NOT LongOnMarket AND NOT ShortOnMarket THEN

IF reverseToLong THEN

BUY PositionSize SHARES AT MARKET

reverseToLong = 0

ELSIF reverseToShort THEN

SELLSHORT PositionSize SHARES AT MARKET

reverseToShort = 0

ELSE

IF LongSignal THEN

BUY PositionSize SHARES AT MARKET

ELSIF ShortSignal THEN

SELLSHORT PositionSize SHARES AT MARKET

ENDIF

ENDIF

ENDIFsummary output…

“Date” “Type” “Price” “Qty” “Value”

“9 Jan 2020, 05:00:00” “Sell (entry)” “3,972.3” “-10” “39,723.00”

“14 Jan 2020, 05:00:00” “Buy (exit)” “4,013.8” “10” “40,138.00”

“26 Feb 2020, 05:00:00” “Sell (entry)” “4,241.9” “-10” “42,419.00”

“18 Mar 2020, 04:00:00” “Buy (exit)” “4,053.6” “10” “40,536.00”

“23 Mar 2020, 04:00:00” “Sell (entry)” “3,451.0” “-10” “34,510.00”

“31 Mar 2020, 05:00:00” “Buy (exit)” “3,843.0” “10” “38,430.00”

“2 Apr 2020, 05:00:00” “Sell (entry)” “3,522.3” “-10” “35,223.00”

“7 Apr 2020, 05:00:00” “Buy (exit)” “3,839.0” “10” “38,390.00”

“9 Apr 2020, 05:00:00” “Sell (entry)” “3,838.1” “-10” “38,381.00”

“13 Apr 2020, 05:00:00” “Buy (exit)” “4,000.4” “10” “40,004.00”

“16 Apr 2020, 05:00:00” “Sell (entry)” “3,635.8” “-10” “36,358.00”

“21 May 2020, 05:00:00” “Buy (exit)” “3,359.1” “10” “33,591.00”

“26 May 2020, 05:00:00” “Sell (entry)” “3,351.1” “-10” “33,511.00”

“27 May 2020, 05:00:00” “Buy (exit)” “3,441.2” “10” “34,412.00”

“12 Jun 2020, 05:00:00” “Sell (entry)” “3,283.2” “-10” “32,832.00”

“6 Jul 2020, 05:00:00” “Buy (exit)” “3,204.3” “10” “32,043.00”Try this one (I am also attaching the ITF file):

DEFPARAM FlatAfter = 160000 /* DETrade entry logic (as a test) ——————————- Long: DM+ cross over DM- Short: DM- cross over DM+ Trade Exit Logic ——————- 1. stop loss hit (OR) 2. opposite signal triggered. Where the open trade is closed and the opposite signal trade is entered. Here is the revised code, any assistance to rectify the process is very much appreciated. */ // ======================================================================== // STRATEGY: DMI-ADX Crossover with Stop Loss + Opposite Signal Exit + Delayed Re-entry // ======================================================================== // === INPUTS === DMIperiod = 14 // optimize from 1 to 20 ATRperiod = 14 ATRmultiplier = 2.5 PositionSize = 1//10 // === INDICATORS === myDIplus = DIPLUS[DMIperiod] myDIminus = DIMINUS[DMIperiod] ATR = AverageTrueRange[ATRperiod] // === SIGNALS === LongSignal = myDIplus CROSSES OVER myDIminus ShortSignal = myDIminus CROSSES OVER myDIplus // === STOP LOSS DISTANCE === StopLossDistance = ATR * ATRmultiplier // === STATE FLAGS === reverseToLong = 0 reverseToShort = 0 // === POSITION MANAGEMENT === IF LongOnMarket THEN // 1. Check stop loss AND reverse IF low <= (tradeprice(1) - StopLossDistance) THEN // SHORT reversal SELLSHORT PositionSize SHARES AT MARKET ENDIF ELSIF ShortOnMarket THEN // 1. Check stop loss AND reverse IF high >= (tradeprice(1) + StopLossDistance) THEN // LONG reversal BUY PositionSize SHARES AT MARKET ENDIF ELSE // === ENTRY WHEN FLAT === IF LongSignal THEN BUY PositionSize SHARES AT MARKET ELSIF ShortSignal THEN SELLSHORT PositionSize SHARES AT MARKET ENDIF ENDIF // debugging data graph myDIplus CROSSES OVER myDIminus AS "LongSignal" coloured("Green") graph myDIminus CROSSES OVER myDIplus AS "ShortSignal" coloured("Red") graphonprice TradePrice(1) - StopLossDistance AS "LONG sl" coloured("Red") graphonprice TradePrice(1) + StopLossDistance AS "SHORT sl" coloured("Blue")open trade is closed and the opposite signal trade is entered.

Try adding below at Line 39 in Roberto code posted above.

reverseToLong = 1 reverseToShort = 1 If ShortonMarket and LongSignal and reversetolong = 1 Then ExitShort at Market Endif If LongonMarket and ShortSignal and reversetoShort = 1 Then Sell at Market Endifrobertogozzi and NeoTrader thanked this postTip for Neo / Anybody … if you pres Ctrl + F5 BEFORE starting to type then you will / should see the blue ‘Insert PRT Code’ as shown at red arrowhead in attached.

Click the blue ‘Insert PRT Code’ when you are ready to enter code (use only for code) and then your code will appear formatted as shown in my post above … so much easier to read and understand as code.

robertogozzi thanked this postTry adding below at Line 39 in Roberto code posted above.

123456789reverseToLong = 1reverseToShort = 1If ShortonMarket and LongSignal and reversetolong = 1 ThenExitShort at MarketEndifIf LongonMarket and ShortSignal and reversetoShort = 1 ThenSell at MarketEndifI actually forgot to remove lines 39 and 40, as those two variables are no longer set and used.

If you add those lines, though, the two variables will ALWAYS be true and the following instructions executed no matter what! So you have to clear them initially, then decide when they are to be set to TRUE. But, if I coded the TS correctly as planned, your suggested lines shouldn’t be needed.

Try this one (I am also attaching the ITF file):

Press CTRL+C to Copy, CTRL+V to Paste123456789101112131415161718192021222324252627282930313233343536373839404142434445464748495051525354555657585960616263646566DEFPARAM FlatAfter = 160000/*DETrade entry logic (as a test)——————————-Long: DM+ cross over DM-Short: DM- cross over DM+Trade Exit Logic——————-1. stop loss hit (OR)2. opposite signal triggered. Where the open trade is closed and the opposite signal trade is entered.Here is the revised code, any assistance to rectify the process is very much appreciated.*/// ========================================================================// STRATEGY: DMI-ADX Crossover with Stop Loss + Opposite Signal Exit + Delayed Re-entry// ========================================================================// === INPUTS ===DMIperiod = 14 // optimize from 1 to 20ATRperiod = 14ATRmultiplier = 2.5PositionSize = 1//10// === INDICATORS ===myDIplus = DIPLUS[DMIperiod]myDIminus = DIMINUS[DMIperiod]ATR = AverageTrueRange[ATRperiod]// === SIGNALS ===LongSignal = myDIplus CROSSES OVER myDIminusShortSignal = myDIminus CROSSES OVER myDIplus// === STOP LOSS DISTANCE ===StopLossDistance = ATR * ATRmultiplier// === STATE FLAGS ===reverseToLong = 0reverseToShort = 0// === POSITION MANAGEMENT ===IF LongOnMarket THEN// 1. Check stop loss AND reverseIF low <= (tradeprice(1) – StopLossDistance) THEN// SHORT reversalSELLSHORT PositionSize SHARES AT MARKETENDIFELSIF ShortOnMarket THEN// 1. Check stop loss AND reverseIF high >= (tradeprice(1) + StopLossDistance) THEN// LONG reversalBUY PositionSize SHARES AT MARKETENDIFELSE// === ENTRY WHEN FLAT ===IF LongSignal THENBUY PositionSize SHARES AT MARKETELSIF ShortSignal THENSELLSHORT PositionSize SHARES AT MARKETENDIFENDIF// debugging datagraph myDIplus CROSSES OVER myDIminus AS “LongSignal” coloured(“Green”)graph myDIminus CROSSES OVER myDIplus AS “ShortSignal” coloured(“Red”)graphonprice TradePrice(1) – StopLossDistance AS “LONG sl” coloured(“Red”)graphonprice TradePrice(1) + StopLossDistance AS “SHORT sl” coloured(“Blue”)Hi there Roberto.

Sorry, I’ve been away the weekend…

Thank you for the code update, just putting it through a test…I have amended this bit…

DMIperiod = DMIperiod // 14 optimize from 1 to 20 [Which was // DMIperiod = 14 // optimize from 1 to 20]

Amended as the optimisation wont run!NT

Just tested the file….

The output is blank, not sure why.I’ll have a go at solving now…

And any guidance you/anyone can give is much appreciated.NT

-

AuthorPosts

- You must be logged in to reply to this topic.

New to PRT and PBC, so be firm and fair…

ProOrder: Automated Strategies & Backtesting

Author

Summary

This topic contains 44 replies,

has 6 voices, and was last updated by NeoTrader

9 months, 2 weeks ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 05/01/2025 |

| Status: | Active |

| Attachments: | 9 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.