Hi i tried to code a strategy i found on the internet. Not a very good code but it makes a nice equity curve. Probably because ustech100 has been on a long uptrend.

If someone can help test with 200k units that’ll be super helpful.

UStech 100 on 2 min tf

attached the itf

Done …. I hope it will help you.

I changed the tradetiemes from 2.30 p.m to 19 p.m. (german time) and the results seems to be more comfortable. But i can´t backtestet it with 200k.

Another point is, the trailing stop ist not profitable. Take a look at MFE, some trades are loosing 90% profit.

Thats a good idea actually thanks. saves on overnight costs too. Ill look into MFE.

Long only strategy in a straight upward market since May. Ok 😉

Long only strategy in a straight upward market since May. Ok 😉

Right, that was my first thought. Nobody knew when the trend will change. It´s better to build a strategy which works on boths sides.

It´s better to build a strategy which works on boths sides.

Not on a strategy on an equity index in my humble opinion.

Trying to short those is a tough thing to do and this game is hard enough already without trying to fight the markets natural tendency. Better to be long only but ensure that your strategy is capable of being out of the market when those annoying recessions and major events cause a temporary correction…. and ensure that there are some of these in your back test. It is also essential to robustness test to ensure that you didn’t just get lucky and get out before a big drop just because of when your strategy was started. Starting the strategy a day later or even the day before a big drop might have mean’t that you bought in just before that large drop but your back test just got lucky because it started trading on the right day/time.

The problem with these strategies with low time frames is to have little data available …. indeed I would say very little.

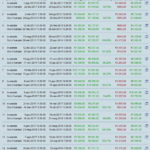

Then you should always use the Walk Forward test as often suggested by Nicolas … use it as you see fit, but using it is important …. for example, I use it this way.

In this example I have 30 test starts that are taken at random and in a time frame of 7 months it always remains positive … to me this gives me an extra certainty of not having a trading system with a lucky start as he told you above Vonasi.

Hello

Hi <span class=”bbp-author-name”>monochrome,</span>

Thank you very much for sharing, it’s been an interesting strategy to experiment with. I made the a series of minor changes, tested in a simple Walk-Forward and am just analyzing the results which I thought you’d be interested in seeing.

I have added exit methodology based on market structure (thank you <span class=”bbp-author-name”>nonetheless)</span>, optimized the Ichimoku settings slightly and added a Max Position function as changing CumulateOrders=False resulted in failiure early on. Will keep testing and keep you posted.

Best,

S

Meant to add, Sharpe ratio of 2.7 which is great, but Max DD still needs improving. Thanks once again for sharing.

Paul

PaulParticipant

Master

interesting, but a 5% stoploss & pt is pretty big for 2m timeframe.

cumulate orders is true, but if using tradeprice(1) it is only based on the last trade. What happens if your long multiple positions and also to the first position? Does the breakeven work as intended for all?

one other point. Breakeven starts when having 60 points. If pointstokeep is set bigger then zero, you have a nice winning percentage, I like it too, but it’s cheating the statistics. If you set that at 0, it wouldn’t finish wf.

it always remains positive

Did you optimise the strategy over the full period of the 30 WF Tests before you did the WF?

I agree, 5% is too wide. I have tested it with 2.5% and the results are still very respectable. Your point regarding the multiple orders is something I had overlooked, well spotted.

Regarding the setting the Points To Keep to 0, the results aren’t too far off. This issue which VinzentVega pointed out, is that the trailing stop is still not profitable. Looking at the MFE, some trades are loosing 90% profit. Trying to see how best to resolve that one.

Paul

PaulParticipant

Master

alright, looking forward to idea’s.

it’s interesting look at signals regardless of a position and if these are well placed.

IF trigger= 1 and close>spanb and c1 and c2 and cc and timeEnterBefore AND timeEnterAfter AND not daysForbiddenEntry and countofposition < 10 THEN

BUY 1 CONTRACTS AT MARKET

SET TARGET %PROFIT 5

SET STOP %loss 5

trigger = 0

test=1

else

test=0

endif

graph test