…comming back finally with some stats and more thoughts…

please consider that results are all based on backtest, not live trading. backtest goes some 11 months back (max possible), live I was kicking off the algo mid of march approx.

so, basically when one is facing 3 options when intering market with “my” synthetic stop+limit order instead of stop or market:

- you miss the entry completely (or partially) – and that I consider biggest risk

- you enter at exactly at the limit level

- surprise suprise – you enter with positive “slippage”!

reg.1: being my biggest concern, I was very eager to see how many entries I will really miss and what is the impact.

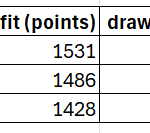

result: 4 entries missed, and impact? – as you see in the excel/printscreed attached: synthetic stop+limit trading still shows best results in terms of total profit, profit per trade and drawdown vs “stop entries” and “market entries”.

missing 4 entries from 114 (when using stop or market entries) – well, that is still a bit of headache for me despite positive “feedback” from the backtested period. this my algo (like majority of others) is “low hit-rate” system, means – its result rely on reltaviely small amount very profitable trades while majority of trades are losing, so the worse what can happen is in fact missing one or few of those big winners. I would like to see the backtest for 11 years, not 11 months… but that is unfortunately not possible with data available on 10sec TF.

reg.2: there is not so much to be told about this, but still: according tests approx 90-95% of all entries are taking place already within first 10sec bar after issueing the limit order. that’s great and that is matching my visual observation of price dynamics after markets touching my stop-level mentiond in the initial post: heavy slipping through the stop level but also very quick reversal following. and still – kind of within the 5-10% of remaining entries there are those 4 entries which are fully lost, never filled…

reg.3: what I mean here by “slippage” is following: 10sec bar which touches/crosses entry-level due quick reversal might close well above the intended entry-level, and when at the end of that 10sec bar limit order is submitted, it will be execuded “at market” then, so at better price than originally intended entry-level. and it’s not peanuts: in the backtest 59 entries out of 110 “collect” this way positive slippage, 20 of those 59 have positive slippage >= 5 index points, and max slippage being even 17 index points. in total all those 59 trades with positive slippage accumulate 254 points of positive slippage. considering that total profit of algo in the backtest is approx 1500 points, these 254 are quite a substantial “bonus”. did not expect that…

even looking at best result in backtest being with synthetic stop+limit entries, the differences of results of all 3 entry types are not really substantial I would say. even if the real results when using stop or market entries will be probably worse than in backtest, those entries have huge advantage: you can not backtest and you can’t know for the future real trading at which prices you will get your orders filled – but you for 100% know that you will be filled, you will have all the contracts you planned. that is for me crucial – to have intended volumes with each position. going for limit entries is quite the opposite: you know your price for 100% (being intended price or better), but you never know your volume, it might vary from O to intended X, and you might miss maybe exactly those big trades/moves which you are looking for, waiting for days and weeks to appear. so what is better in the end? some hope for my new approach with limit-entries gives me the live trading: I allready had 2 algos trading shorts live with synthetic stop+limit orders during trump’s world-wide-tariffs-turbulences on 4th and 7th of April: both algos did not miss any of the entries, did great job, and that was first but also so far the only live test, which these algos successfully passed. let’s what happens in the next down-phase…

cheers

justisan

nb: this uncertainty in relation to limit entries (knowing 100% price but not volumes) and market entries (knowing 100% volumes but not the price) some moment all the sudden reminded me of “uncertainty principle” in quantum physics formulated by W. Heisenberg, for those who interested: it tells basically that by nature one can not measure two complementary parameters with 100% precision at the same time, famous example being speed and position of electron: when you know where it is, you can’t know its speed, and when you know its speed – you can’t know where it precisely is located. funny, and still it does not make trading such a rocket science like quantum physics. or does it?