Hello!

I was missing an easy-to-use Monte Carlo tool and Portfolio Analyzer for ProRealTime. So I decided to build my own! They’re now available on the Marketplace.

I’m especially excited about releasing the Portfolio Analyzer, because as we all know, the holy grail in algorithmic trading is a diversified algo portfolio. 🙂

Here’s a quick overview:

Monte Carlo for Algorithmic Trading

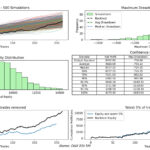

Run Monte Carlo simulations on your trading algorithms to test their robustness. It’s a great addition to your robustness testing process.

Read more about it here: https://market.prorealcode.com/product/monte-carlo-for-algorithmic-trading/

Portfolio Analyzer for Algorithmic Trading

A powerful tool to analyze the correlation between all algos in your portfolio, as well as finding the best subset of your algos based on metrics like lowest max drawdown

- View your combined equity curve and max drawdown and the correlation between your algorithms.

- Optimize your portfolio by selecting the best subset of algos based on metrics like lowest max drawdown, Net Profit / Max Drawdown, or Sharpe ratio. For example, if you have 10 strategies, the best risk-adjusted return might come from trading only 8 of them.

Read more about it here: https://market.prorealcode.com/product/portfolio-analyzer-for-algorithmic-trading/

If you are interested to get them in a bundle, you can do it here: https://market.prorealcode.com/product/bundle-monte-carlo-and-portfolio-analyzer/

I hope you find these tools helpful! Feel free to reach out if you have any questions or feature requests.

Sorry for double post, PRC crashed when trying to upload screen shots, so here I try again!

Finally managed to add the screenshots! 🙂

Hey! I just recorded Youtube demos for both softwares to easier show how they work and the benefits of them. See links below:

Youtube Demo Montecarlo: https://www.youtube.com/watch?v=-RQrHPZPGcI

Youtube Demo Portfolio Analyzer: https://youtu.be/JN0Rs84pb_Q

I have now actually made the Monte Carlo tool as a FREE (for a limited time) webapp as well. You can try it out here: https://www.snalanningen.com/monte-carlo-for-algorithmic-trading/

Please let me know if you have any feedback!

JS

JSParticipant

Senior

Hi,

I tried but get an error message…

Hi,

I tried but get an error message…

Thanks for the report, it should be fixed now. Was an issue with the different ProRealTime languages, as the CSV export differs. Every language should work now!

I have now also converted my Portfolio/Correlation analyzer to a FREE webapp. It´s a powerful tool, as the holy grail in trading is a diversified basket of algorithms. This tool is developed for plug n play with CSV files exported from ProRealTime. You will get a detailed analysis for your complete portfolio. See attached screenshots. Let me know your thoughts!

LINK:

https://www.snalanningen.com/portfolio-analyzer-for-algorithmic-trading/

hello I do not know perfectly the use of your tool, while hovering over the topics I did not find any information related to the ratio risk rewards (R/R) per trade. it’s crucial information, did I miss something?

The use of the tool is to get insights of your portfolio of algorithms. To see how they correlate. If two algorithms are higly correlated, is it worth trading both? You can also see the optimal portfolio of the algos you trade to get the most diversified portfolio. Sometimes a portfolio of 4 algorithms is more stable than a portfolio of 6 algorithms. This is something that is missing from inside PRT, hence this separate tool!

Hi!

I have now updated the Portfolio Analyzer to also contain a Position Size optimizer. See attached screenshot. You can find the full Portfolio Analyzer here:

https://www.snalanningen.com/portfolio-analyzer-for-algorithmic-trading/

And the Monte Carlo tool here:

https://www.snalanningen.com/monte-carlo-for-algorithmic-trading/

Let me know if you have any more feedback on the tools!

Hi again!

To get more people, that didnt had the chance earlier, to try these awesome tools I have now added a free trial for the last week of November. Use the code “FREENOV” to get free access on the tools until 2025-11-30.

Portfolio Analyzer(Correlation, Position Size Optimizer etc):

https://www.snalanningen.com/portfolio-analyzer-for-algorithmic-trading-2/

Monte Carlo(Robustness test):

https://www.snalanningen.com/monte-carlo-for-algorithmic-trading-2/

As always, let me know if you have any feature request or feedback on the tools! 🙂

Hi again!

I have just updated the softwares with a more user friendly dashboard, to easier get a quick info on how the results are. See attached screenshots! 🙂

You can find the tools here:

Portfolio Analyzer(Correlation, Position Size Optimizer etc):

https://www.snalanningen.com/portfolio-analyzer-for-algorithmic-trading-2/

Monte Carlo(Robustness test):

https://www.snalanningen.com/monte-carlo-for-algorithmic-trading-2/

Cheers!