Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Money Managment ideas

-

AuthorPosts

-

Hi Justisan

Thanks for the insight…

I only use IB and futures and my basic premise is that markets are random 70-80% of the time and in a trend 20-30% of the time.

My system is based entirely on the “random” part (the 70-80%).

My MM is simple and based on the margin of the future used:

PositionSize=Floor(Capital+StrategyProfit)/Margin // PositionSize based on Margin

If PositionSize<=MinPositionSize then //Minimum Position Size

PositionSize=MinPositionSize

ElsIf PositionSize>=MaxPositionSize then //Maximum Position Size

PositionSize=MaxPositionSize

EndIf

hi JS, thanks for your input, very interesting and to me unique appraoch – to relate position directly to the margin, intuitivey it makes sense. few questions still, if I may ask:- regarding “capital”: is it your total capital used for trading, or is it certain fraction of the total capital which you “allocate” to particular strategy (in case you trade multiple systems)? if it is a fraction, do you allocate equal fraction of total for each strategy, and if not equal, based on what do you decide the fraction size?

- based on what you define minimum and maximum position size? or ar these simply the “physical” limitations like minimum = 1, and maximum = capital devided by margin?

Hi Justisan,

Currently I trade with 1 system on the Dow Jones and my corresponding starting capital was equal to 3x the margin of the future in question…

I always start with the minimum number of contracts (the physical limit) because I think it’s important to build up capital with the system first so that the inevitable “DrawDown” is not fatal…

I determine the maximum number of contracts from an optimisation of the system (see screenshot) where I select the number of contracts where the (optimisation) line does not bend too much, in this case 20, but that is a bit arbitrary…

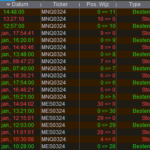

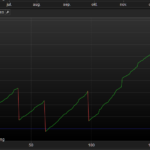

Regards Jaapjustisan, all, In my opinion it is more complicated than what meets the eye. And I am not sure I even can explain it with some sense. But I’ll try. Say that for the purpose I have a small account. N.b.: This is really the case. Envision that more than one instrument autotrades there, make that two of them for the example. Next up is the luxury problem of your autotrading doing very well. It wins and wins and wins. Therefore this post is not about DrawDown at all (read on). I too incorporate the margin, which can be regarded 10% for IB’s Futures. And, if one e.g. Micro NQ costs 35000 then the lowest investment is 35000 (no fractions possible with IB’s financial Futures). Now : Because it does not make sense to let grow your portfolio (for the Instrument) in steps of 100% (double the position), you must start with larger amounts. Side note : of course we can internally apply fractions, until it rounds up (or down from 2.xx) and then hop over to 2 contracts for real. But that does not work because nothing grows really for a long time, while your profits depicted it should. I found (my backtesting showed) that for most instruments in the realm of 1 contract costing 25K – 35K, 130K starts to work nicely. Thus say that I now start with 5 contracts, then if 1 is added, it adds 20% (initially). This is a. doable and b. works nicely. As an intermezzo I must now tell you that a position size of 130K, implies a margin of 13K and thus also a portfolio of 13K at least – maybe add some for overnight stuff when the margins may get a little worse. So we make that 15K of portfolio. Please notice that because I am not talking about possible DD, this 15K will be on the low side. Hence, lose a few and the 15K will shrink and nothing works any more. This thus virtually requires the portfolio to be larger. But I do NOT take DD into account. Because my example is about two Instruments autotrading at the same time, my portfolio needs to be 30K at least, right ? So far so good … Now the unavoidable will happen that I run out of funds. How does this work ? look at the first picture (try to avoid looking at the others for now); You see happening what I described (rounding down caused my mentioned initial 130K to end up as 3 contracts). I did not show the gains, but each green line is obviously an exit with profit. This is from one of the instruments only – the MNQ (Micro Nasdaq). For fun let’s envision that these 14 trades gain 350 per trade. My calculator tells that this is 4900. This means that I can (including margin) spend additionally 49000. Hmm … but one contract is 35000. That does not end well soon. 🙁 I was allowed to have one more contract only … Obviously I let grow the lot too fast. In no-time, like in the 6 days including a weekend, I blow up the lot to the luxury side. 🙂 Because I use 2 instruments things are more or less out of control – this is what every PRT autotrader-user knows (can’t look at the total account portfolio). The one Instrument may cause extra profit so the other can do more, but it will also do more for itself in that case, so that won’t help much (it gets worse). And because people like me tend to have some manual trading in there too, and like a good Dutch-man will have some ASML, things get more and more out of control. Yesterday morning I decided for a new “strategy” regarding this (more about that more below), but late last night I was too late with implementing it. The MNQ system was thrown out for a lack of funds. Yes, I saw that coming. A few issues in parallel, making the situation less manageable :- You may not be there to stop a system yourself. In my situation yesterday I was out all day, and it went too well. Thus, you must be there in between two trades in order to nicely stop a system. N.b.: I requested PRT to have a system stopped in a controlled fashion (in a sequence of ProOrder improvements).

- You are in principle not under control of the gain a trade makes. Obviously this depends on the system (your program code), but the one trade could be doing 10 times more than the average other.

- The most crucial one is that PRT lags for calculating how large your next order is allowed to be. A few years ago I tried to find the rules on this, but it is quite random when this is refreshed, plus it relates to all sorts of miscalculations throughout the day. Example : After 17:30 Eurex futures are calculated as profit (if they make profit after 17:30) but the next morning that is again calculated as profit (which now is correct) but the portfolio now does not contain the gains of the previous day any more. Thus what was fine at 22:00, breaks at 01:15 (reopen of DAX / ESTOXX) or else at 08:00 (reopen of other Eurex). For those who don’t know yet : At ;east for PRT-IB it is ProRealTime which checks in advance whether an order is still allowed for its $ amount – not the broker. You can see this happening when an orange triangle pops up in the main menu somewhere, telling you that you ran out of margin. You can make 20K in an hour, but PRT does not know that you gained that, and won’t allow new positions. Another issue here is that when you’d invert a position in one go (say from 10K long to 20K short), PRT deems that a trade of 20K and may reject your order because it thinks you don’t have sufficient funds.

- Because I can just restart the System – I will not give it parameters of where it was with its MM, and which takes a LOT of time otherwise, not speaking of the mistakes you can make (I do) – it is a matter of just stopping and restarting the System, when I deem the unheimishness getting too large.

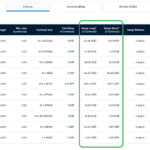

- What I easily see is that it is now impossible to run into a super DD because my position had become 1M or more, and the DD causing a loss of say 200K. And oh, the strategy as such can bear it, but who wants to lose 200K (I may not talk about a smaller account any more). On a side note, when I start the System all over, I will never know what I could have gained if I had not done that. All I would see is a slope in the curve which went less steep. See under the mouse pointer in the 4th attachment.

- If, like last night, a system can’t add a new position because the account is out of funds for the luxury reason, the system will be thrown out, and I am happy with that (for once). I take it that this will be the instrument/system now doing too much (this will not necessarily be so, but alas). Anyway I will happily restart it within minutes after I find the situation. No (typing) errors possible.

- It can well be that I stop the system(s) with higher position sizes when I foresee possibly badness. But I will restart them immediately as well. It is actually the locking in of profit, in a strangest way.

ashehzi thanked this postThe (overnight) margin for 1 Micro NQ is 2105 USD

So, the lowest investment for me is: 2105 USD

Hi Peter, Thanks for your post! Amazing to read how you work, intensive and passionate. Reading and re-reading your words I get the impression that several of issues you mention you are possibly facing because you operate close to upper limits of number of contracts which you can afford to trade. Is that the case or is my impression wrong? I mean, to me it never happens that my systems are stopped automatically due to lack of funds. I am operating with cfds definitely quite far away from those limits, trading significantly smaller than potential maximum. That of course limits equity growth, but also very significantly the risks, and aside from that it gives my psychological comfort in this severe (and fascinating) challenge of trading. To me money/risk management contains below 3 topics (welcome everybody to add some more if considering something else as well):- How much to bet/risk per trade, which is basically position sizing and mainly original topic started here by ZeroCafeine But this is for me by far not the only one part of money management, so I would definitely expand it by following:

- How to allocate capital within portfolio of strategies, so overall risk fits to what one can afford a) psychologically and b) financially

- How to avoid catastrophic losses, I mean those which are not so much related to trading strategies, but to things like plain crashing into very world-famous skyscraper, power outages, exchange stopping working, broker suddenly failing, and all sorts of other “black swans”

- minimum capital per contract = 1x margin + 2x historical max drawdown of particular strategy. why 2x dd: it gives me some psychological and financial buffer…

- when ever strategy makes profit equaling 2x historical dd I am transferring cash = 1x margin from cfd account to futures account and add 1 futures contract to the strategy. So it is still quite slow process, but by this I move with some confidence at least

Hello again justisan, Yes, trading against the limits of the portfolio. And as I told “for the purpose” hence deliberately. One of the means behind it is indeed counteracting on the black swans you talked about. Thus, what I described in my previous post, allows me to take out funds regularly, which I could very rigidly do at the same moments as resetting the AutoTrading System (which I thus reset to their initial investment value). I must add : Taking into account the broker disappearing (with our money) all together, is a bit difficult to think of. But losing about all your money in one go (could happen when no exchanges are operational for many days), is something which should be taken into account. This means that no too large positions should be active at any time. And thus part of the luxury problem : all my backtests show crazy growth, but in practice I should not let this happen. Of course, we / I will get used to the larger amounts, but I guess then we must have first larger amounts to spare. Or from a different angle : time may prove that a lost amount by black swan accident, is relatively rapidly earned back (and preferable by not paying much effort to it).That of course limits equity growth, but also very significantly the risks,

The odd thing is that this is not necessarily true; Just some theory : when my last trade implies e.g. 20 contracts, then suppose that this trade is not rejected because the portfolio can bear 20 contracts. With that one trade I make a profit of 2000. The next trade – too much put forward by me at 21 contracts – is rejected because it is too much indeed, also taken into account the possibility that PRT did not accumulate the latest profit of 2000 in my account. I see no risk anywhere in this. Plus, when the System is reset, the deepest SL will be nowhere close to that 2000 I just earned. However … You must of course anticipate that the trade wins. Or at least that all can bear the expected profit/loss ratio you took into account from the start. This is so normal for our thinking, that we might forget to really apply that. In other words, why would my trade lose if my System is so good and robust to the future (your thing !!) that it just won’t bear that risk you now talk about ? Mind you, we are not talking about the black swans now; we are talking about how good our AutoTrading systems are, and maybe how much trust we have in them. This should not be about “risk”. It should all be pre-calculated towards something in which we have 100% trust. Make that 99 and it is still fine. Make it 95 and in my view it is not okay any more. Coincidentally it is you who inspired me for a radical change in the not-overfitting stuff. Not that it was not clear to me that it should be avoided, but it made me eager to actually do it, with indeed leads as “don’t have variables to change”. Thus, sit back and think how to avoid those and have a system which gains some after all. Prove to yourself that it keeps on working back towards the infinite past. Know that it thus also won’t change towards the future. … And now our thinking about MM will change drastically as well; Now I know I will have sheer infinite growth, to the size my backtests told me. It will just happen. MM changes from protection of portfolio, to a guardian against too much money to deal with, or more money than the broker will allow for one position. Like IG will deal with you manually when you have more trades off 4M per hour. Or how you must make special arrangements with IB when you cross a threshold of 6M per trade. And thus how you not let *that* happen, and stay under the radar – also under your radar. 🙂 So you see, for a couple or years already, I am working on this kind of “protection”. But it was always without real application, because backtests were no guarantee for the future. Unless you make them 100% robust to the future … your story – and actually nothing less than we all eagerly want. I think I saw the light and have nailed this. And that’s why this kind of upside down MM driven protection. … And how we must always taken into account the black swans, like the happening this morning with the IB outage of 75 minutes. I started out with a response telling about that. But it is not much interesting (except for it being a clear example of a black swan) plus my posts are too long already – so I did not post it. I still have the text though. Best regards, PeterHow much to bet/risk per trade, which is basically position sizing

I don’t care, as long as I have already earned it.You are absolutely right – one is in very much better situation when one can afford to trade several more, but what if I can afford really only 1 contract in the very beginning?

Sadly for myself I got used to not being disturbed about the initial contract amount ($ size). This implies that I am used to sheer infinite growth in backtests. I don’t even dare to show pictures of that, because they are completely ridiculous. And so my problem : All which grows by normal nature, like having a linear amount of position/$, will never grow as fast as I can do manually. And I don’t like that prospectus; a. manual trading is a kind of sad as a hobby (not for a living, I suppose) and b. I like the conquering aspect of getting this money just because I can write a bit of software. But really, try to make some serious $ with AutoTrading and beat the Buy and Hold which is even far less than manual trading (me thinks). If you look at the current situation over here then Buy and Hold would work out superbly – actively manual trading probably much better again, but the autotrading gains twice what the Buy and Hold at this moment does. And I am not even taken into account the huge DD for Buy and Hold from last week. So just this week and beat that. Now incorporate my last post. This post actually tells again that you can work with money you don’t have. BUT make the trades win !!! Yes PeterSt, sure … So there is this other secret : For many years I worked towards autotrading, and the more money I would have in the base, the more AutoTrading would gain. So logical … But not the past 18 or so months. I changed all, to begin with almost nothing and end with very much. This is my first post of the last two. A little rephrased now : “Begin with almost nothing for the purpose“. If it won’t work, I will blow up those accounts to the hell-side. I would care, but I would also know how not to do it.minimum capital per contract = 1x margin + 2x historical max drawdown of particular strategy. why 2x dd: it gives me some psychological and financial buffer…

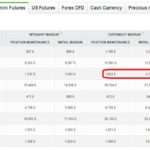

Small question if I may : what means “1x margin” in this case ? I myself started out vague on this subject (I saw later) and what JS made of it, looks like what you now say but I can’t understand it. So if you’d say -like Jaap- that the margin is (at) 2105 and the margin is stated as 10%, you can trade 21050. But it doesn’t work like that when the instrument of concern costs 35000 for 1 contract. All it would tell that if you’d loose 14000 on a trade of that, or 28000 on two contracts, you will be thrown out because of a margin call. … I would say that you mean : 35000 (which luckily is above 10x 2105 in this example) and you could lose some. That would be 14000, but since you incorporate 2x max DD, that would be 7000 each. If I still understand it all a little, I would never do that. You would loose 14000 indeed where you started out with – what ? 2105 ?The (overnight) margin for 1 Micro NQ is 2105 USD So, the lowest investment for me is: 2105 USD

That is impossible, because the 1 contract costs ~35000, unless I am mistaken on that. In other words, you have a DD of 100 (not K) and are thrown out. It is a separate discussion I think, but if one wants to have the MM right, the basics must also be right. And maybe I have it wrong ? But otherwise I understand this all right :when ever strategy makes profit equaling 2x historical dd I am transferring cash = 1x margin from cfd account to futures account and add 1 futures contract to the strategy. So it is still quite slow process, but by this I move with some confidence at least

… but you should stay at the CFDs – despite the downsides there (IG). When I saw PRT-IB Autotrading popping out, the first I said to PRT is that this would never work for anyone. But you said it yourself :I think I would need significantly higher min.capital for others, so those strategies therefore are still running on cfds…

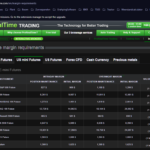

And really the most important is that we understand our environment. That takes years alone … What you do, justisan, is at least good for exploring the rentability of your strategy(s). To me that would be more valuable as investment, than making more money right now. If it only is a hobby (IMO the prerequisite to make something of this to begin with). Thanks, PeterHmm … I sat down this morning to work out a mere detailed example on the growth and margin subject, but it seems that Backtesting is broken so I can’t do it. I did not write it in that topic behind the link, but miraculously the growing of the positions does not work any more. I take it that in Live it still works, though the program code in there is exactly the same (but it will be a different “compile” or such). I can only check that when trades (Entries) start to occur. But it is quiet on that front for me, today.Hi Peter, I would love to have that mega-strong confidence in my systems which you have in yours 😃 But I don’t trust too much, even after making them painfully simple – and hopefully robust enough to be profitable in the future, not just in the backtest. I think there is still something I don’t know, never saw, so did not consider, but it might happen… markets are full of small and big black swans. So that “forces” me to trade much smaller than I could afford. Well, for me what I am doing is still not “investing”, and I do not compare my results to “buy and hold”: I think/feel that in the comparison of trading results with buy&hold/investing is something fundamentally wrong. On other hand I have the impression that your – I would call it “trading style” is very different from mine. Mines is probably much more conservative in terms of risk taking and profit expectations. The other possibility is that I am misunderstanding something in your statements (or a lot). Still I am glad to hear that I was inspiring you with something 😀 And regarding the misunderstandings, let me come back to your “1x margin” question: By 1x margin I mean – and I assume Jaap means same – is one time the margin amount which broker needs from me to have in my futures account in order to allow me to open position with one contract. So, like Jaap was indicating, for micro e-mini nasdaq it is approx. 2.000 USD (overnight), like indicated in PRT website, see attached pic. Of course it makes no sense to start trading with only 1x margin on the account, one has to have some buffer for losses/drawdawn, so the absolute minimum I personally would add is 1x historical max drawdaw of the particular strategy I want to trade. Assume it’s 500 USD per contract, so minimum capital would be 2000(margin)+500(dd) = 2500 per contract. But I decided for some comfort to add 2x dd, so in total I would run the strategy with 3000 USD in the account/per contract. Even that for my personal “risk appetite” is much too little of capital per contract. Since I am running multiple strategies, I don’t want max dd of each strategy being larger than let’s say 5% of my total equity. So roughly, if my max dd of one strategy is above mentioned 500 USD I would rather want to allocate 10k USD per contract. Ok, I don’t need to keep all this money in the futures account – but at least I want to have it “somewhere”, e.g. on private bank account, and transfer to futures account only those 1x margin + 2x dd. Please tell us what you precisely mean by 35.000 “cost” for micro e-mini nasdaq. The only thing which comes into my mind is that you possibly mean contract’s “value” – which is Nasdaq-level multiplied by point-value, which is currently with index flying at around 17.500 and 2 USD per point value in fact around 35k USD. I kind of “can’t” lose in one trade your indicated 14k when trading 1 micro nasdaq. Okay, possibly I can – but for that to happen Nasdaq has to drop “instantly” 7000 points! Then I am definitely “dead” 😃 But then I possibly don’t care about it any more, because I am not the only one dead: I assume in order Nasdaq to drop that large instantly it would need certain very big country north/east from our location to start nuclear war. You tell me kindly to stay with CFDs… yet I have at very least one very irresistible reason not to do so, and that is the fact – which me and you and others were mentioning multiple times – that IG quite frequently implements temporarily those (huge) “minimum distances” for entries via stop order. That drives me crazy. I operate with strategies having low/very low hit rates, lowest being at levels of 15% only. So those strategies’ performance very much depend of every “signal” being traded. Every. Not just some which IG “allows” me to trade. Well still I might stay with CFDs for a while. Maybe due to IB’s limitations on number of sub-accounts which I would need to run all my strategies. Maybe I will run only short strategies on CFDs – shorts (on indices) at least do not create cost for holding positions overnight 😃 Those overnight costs for long strategies make me mad as well: last year they reduced my profits by 6% and I would not say it’s peanuts. Ok, enough for today, whish all great weekend soon! justisanHello justisan, (loving the discussion) On the margin stuff, let’s say that I am wrong. That gives me a better feeling than hanging out the teacher pose. But what I do, however, is talking from experience. And this goes like this : First off, I won’t easily take a not-yet-updated margin amount as a base for trading. That is, when I don’t want to be kicked out at an attempted Entry, or receive a margin call (which is not the same). So when it is known that it is 10% for certain futures, it is just that and not less because IBKR today likes it to be less. This won’t help you tomorrow when they make it even 20% (or at least on par with their own rules) when a pandemic is in order. Secondly, nothing is as bad about either as people tend to tell us. One thing though – it is very inconvenient if your AutoTrading System is kicked out (unless you want that to happen, like I more or less suggested in my earlier post – not forgetting the context in order). Certainly the Margin Call is no big deal at all, although it may be difficult to understand afterwards what happened (a position at the will of IBKR is closed for a part they deem fit) – and all you see is a red cross somewhere when you wake up. I say : hooray for the Margin Call because it protects you. Not letting in a position because for actually the same reason (lack of sufficient funds) is also actually more than very convenient. And : The fact that it happens, usually means too much at hand to deal with reasonably (which is the protection again), but then for literally doing too much. Thus, if I want to trade 100K while my account portfolio is 5000 (at a Margin of 10%), this is not possible. The math : 100K * 10% = 10000 (again, I take 10% for the Margin and thus not something like 6,25 which IB currently expresses). Side note : the practice is somewhat different again, for that see the 3rd attachment. There you see even better margins – certainly when we look at the difference between Day and Overnight. [ it is a shame that today I can’t show it with backtesting examples – hopefully it works again soon ]Please tell us what you precisely mean by 35.000 “cost” for micro e-mini nasdaq. The only thing which comes into my mind is that you possibly mean contract’s “value” – which is Nasdaq-level multiplied by point-value, which is currently with index flying at around 17.500 and 2 USD per point value in fact around 35k USD.

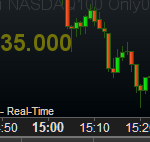

Precisely that. Each of my Futures charts shows the value (cost of one contract) in capitals and in real time (rounded at 1000, see 1st picture), so that I know what I am actually buying/selling when I like the figure 7 (for example). It would mean 245K in this case. If I apparently don’t know how it works, just tell me – I am not the teacher. The Live example I am seeing – and we all know the figures by now (only the gains are still hidden) is 11x35K for the MNQ in that, remember, “smaller” account. This gives 385K. This means my portfolio in there should be 38,5K when the Margin would be 10%. This is there, so no worries for me yet. Would I apply the literal figure IBKR currently presents, it would be (6,25%) 24K what my portfolio should carry at this moment. This is of course also there. But as we know it is a bit more complex, because I (currently) trade 2 Future Instruments in there – also the MES. Now, see the 2nd picture : The last time both were in at the same time was Jan 24, 14:04:02. MES was at 30 contracts, MNQ coincidentally at 4 (see entry on 24 Jan. 09:21). This gives 30 x 25000 = 750000 and a Margin requirement of (~5% now, look in the 3rd attachment for the S&P500 Micro – justisan, you showed the same) = 37500 plus 4 x 35000 = 140000 and a Margin requirement of (still using 6,25%) = 8750. Total for Margin requirement = 37500 + 8750 = 46250. This is again sufficiently there and again no worries; I know – and we can see that the reality is even much better because the MES looks to be ~ 4,8% (~1200 on ~25000) and for MNQ it is ~4% (~1800 on ~35000). Hocus-pocus and again it has become a confusing post; Think of IB being able to turn the <5% into 10% easily and it is good to commonly calculate with 10%. Now you can loose some as well. Small correction of what I told in a previous post : it is IB who rejects the order which crosses the threshold. PRT just passes that on to you via ProOrder and throwing out your system. At ProRealTime they currently can’t tell what will actually happen when IB throws out 1 contract after you’re in and lose a bit too much in order to still comply to the Margin rules. This is really how IB does it, trust me. Probably something will go bad again because Pro-Order won’t understand (and my program code most certainly won’t). Usually I am the first to know – haha. Petershorts (on indices) at least do not create cost for holding positions overnight 😃

Are you getting some preferential treatment off the ‘old boys network’ then or what?? 😉 See attached from my IG Statement relating to £1 per point short on Dow Jones Index. To see … click in ‘white space’ above screenshot title.It has been a long day GraHal … above extract from Statement shows £9.21 received against the overnight short!

…it’s rather a special “tax” for strategies going short when dow is making all time highs? yet jokes aside, I was referring to my trading, so short/long stratgies which I run on dax. it was sure not my intention to tell (and confuse somebody) that “IG will never ever charge any cost for holding overnight short positions on any of the indices available for trading”. they might charge… under certain conditions. and talking about transaprancy – probably I am blind, but I was not able to find the currently applied cost for holding positions overnight (long and short) with IG on IG’s webise – something like in the pic attached (not IG…). my message was anyway that overnight “financing” accumulates to substantial amounts over time, while for futures trading there are no such additional costs. in the end GraHal, any inputs on the actual topic – money management??shorts (on indices) at least do not create cost for holding positions overnight 😃

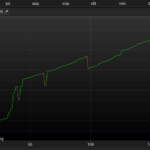

Are you getting some preferential treatment off the ‘old boys network’ then or what?? 😉 See attached from my IG Statement relating to £1 per point short on Dow Jones Index. To see … click in ‘white space’ above screenshot title.This is a bit of a neutral post – not addressing anyone. N.b.: I prepared a couple of responses to justisan, but my browser gave up on me and I lost them. So I’ll be back later on those responses. Now taking into account the PRT discrepancy between Backtesting and Live regarding StrategyProfit as described in here I could finally make a showcase of what Money Management can accomplish. First a few prerequisites for understanding :- In all the examples I have or may have later (e.g. upon questions), the algorithmic code is 100% the same. This means : no matter how MM has been set up, or how I change it now, the number of trades is exactly the same and the trades themselves always have the same times of entry and exit.

- Because the very same algorithmic code ran Live from of January 4, I can show(case) the influence of MM; thus here too the entries and exits and all are the very same. The fact that I really ran/run this Live, should tell people at least about some decency. Thus, this is really happening.

- The showcase as I intended it earlier (before I saw the flaw in StrategyProfit) was only about making more money with MM; now, when I had to revamp all the MM code, I explicitly also took into account the auto-protection against losses. N.b.: Earlier I had both as elements, now I have them in combination.

- I take it that anyone with sufficient programming skills is able to do this too, hence this is why I put forward the general means. Btw it is impossible to show any code of this because it is in the middle of a whole strategy as such, and one of the properties of this strategy is that it is close to always winning. Creating this latter – and whether it is a good thing – is completely up to yourselves. I really like you to think in terms of Strategy, because without that, in my opinion no MM can exist; please keep in mind that this is still about making more $.

- Using as much of the Margin as possible. Thus, once e.g. 1000 is earned, in this/my case the 1819 of Overnight Maintenance Margin is consumed immediately. This means that the ratio with the by IBKR given Margin against the price of the product (~35K for the Nasdaq I used) is re-invested. Would the ratio imply 4% then 25 x 1000 can be reinvested. But this can obviously only be done when the price of the product allows this investment. And with an earned 1000 this thus can not be done yet. It would require 35K / 25 = 1400 of profit. This is of course dynamic from many angles and it must all be in the software.

- Not using more new investment than the current due StopLoss allows for. This is brain-damaging in itself. This implies that initial investments better be small than large, or else the first picture will remain despite MM being active. You may earn more because of the larger investment, but you will keep on earnings less against the MM of any (??) smaller investment.

- Not going sky-high with virtually uncontrolled amounts because otherwise someone like a broker may come after you. You virtually see this (because see next bullet point) in the 2nd situation by the slope starting to be linear – never progressively rising any more after the initial super-boost …

- … which I again did not make but how it works. Because what you see in this case happening (and this is literal) is the impossibility for further growth because the SL would imply going under and the MM system does not allow for that. And so it does nothing. It is virtually deactivated until … Until sufficient funds are available and a next now really super^2 boost will happen. And for this Nasdaq Micro this did not happen yet in these 7 months of time. It could be tomorrow ? If you look at the losses (all ran into SL) you see the sheer beauty of them being totally harmless; would a next tranche occur of “boost” then you can already see that no matter the rise, it will be as harmless and as small which is absolute. I did not make this (as in SL must always be the same absolute amount) – it is how it works. It is what I call a servo system that maintains the balance automatically by means of feedback and counteracting (yes @JS, that’s for example an OpAmp). You can see between trade ~ 100 and 170 that the slope is not completely linear, and in there “it” tried a few times to expand, which worked for 1 or 2 trades. So at those moments the SL would still be bearable, but after making some more $ the SL would become too large, and the additional investments stop again. The trades really drop back to the base and you can see that by comparing the first 60 or so trades, where it is no additional investing yet because the SL would become too large (compare with the 1st situation now). You can also easily see that after the last SL shown, the curve has become completely linear again (apart from individual more and less gains per trade). You see two more of these surfaces / tranches, where additional investment is out of the question. Anyway … when putting a ruler along the slope, we may be able to predict when finally the next boost may occur, *if* no SL occurs in the mean time. And we don’t know about that part of this game. Point is : this may occur so late in time (like in next August perhaps) that the normal (algo) Strategy is at the limit I put in general – this is what the previous bullet point is about. So recap of that : when the hard-limit of investment is reached, the curve will again be linear, but not flat as you may think at first glance. It will look exactly the same, because your normal Strategy will keep on winning, just like you see here. Take this into account for when the broker may start to chase you, and set the hard limit earlier or stop the System. Thus, setting the hard limit on 6M (did I post about that ?) because IBKR will start to reject your trades, does not help. This only helps for avoiding crazy excursions to trades of e.g. 9M, but it won’t prevent further gains (which easily are 100K/month by that time).

-

AuthorPosts

- You must be logged in to reply to this topic.

Money Managment ideas

ProOrder: Automated Strategies & Backtesting

Author

Summary

This topic contains 32 replies,

has 12 voices, and was last updated by pppittpeter

1 year, 11 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 05/02/2023 |

| Status: | Active |

| Attachments: | 14 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.