Paul

PaulParticipant

Master

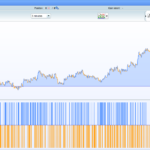

I have this running on us100 nasdaq 5 min tf. Was a few times about to close it, but let it run. Had the feeling live (demo) did a bit better then what I saw in the (bad) backtest.

So there’s a good 2 months of data. (ignore that it mentions dax).

//-------------------------------------------------------------------------

// Hoofd code : MLV DAX v3p 24h hull #2

//-------------------------------------------------------------------------

defparam cumulateorders = false

defparam preloadbars = 10000

TIMEFRAME (default)

once enablesl = 1 // stoploss

once enablept = 1 // profit target

once enablets = 1 // trailing stop atr

once displaysl = 0 // stop loss

once displaypt = 0 // profit target

once displayts = 0 // trailing stop atr

once positionweekend = 1 // weekend position then ignore time

once fridayclosetime = 225500

once tds=4

// settings

once positionsize = 1

once sl = 0.5

once pt = 2.0

// general

underlaying=100

// strategy

TIMEFRAME (15 minutes,updateonclose)

// MID-LEVEL 1

ml1 = (High[i] + Low[i]) / 2

// MID-LEVEL 2

Newhigh = 0

For i = 1 to 13 do

IF high[i] > Newhigh THEN

Newhigh = high[i]

ENDIF

NEXT

Newlow = 1000000000000

For i = 1 to 13 do

IF low[i] < Newlow THEN

Newlow= low[i]

ENDIF

NEXT

ml2 = (Newhigh + Newlow) /2

// MID-LEVEL 3

Newhigh = 0

For i = 1 to 4 do

IF high[i] > Newhigh THEN

Newhigh = high[i]

ENDIF

NEXT

Newlow = 1000000000000

For i = 1 to 4 do

IF low[i] < Newlow THEN

Newlow= low[i]

ENDIF

NEXT

TIMEFRAME (default)

// trend detection system

if tds=0 then

trendup=1

trenddown=1

else

if tds=1 then // 1 hour

trendup=(average[7](totalprice)>average[7](totalprice)[1])

trenddown=(average[1](totalprice)<average[1](totalprice)[1])

else

if tds=2 then

trendup=(Average[20](close)>Average[20](close)[1])

trenddown=(Average[35](close)<Average[35](close)[1])

else

if tds=3 then

period= 14

inner = 2*weightedaverage[round( period/2)](typicalprice)-weightedaverage[period](typicalprice)

hull = weightedaverage[round(sqrt(period))](inner)

trendup = hull > hull[1]

trenddown = hull < hull[1]

else

if tds=4 then

period= 14

inner = 2*weightedaverage[round( period/2)](totalprice)-weightedaverage[period](totalprice)

hull = weightedaverage[round(sqrt(period))](inner)

trendup = hull > hull[1]

trenddown = hull < hull[1]

endif

endif

endif

endif

endif

//

condbuy = ml1 crosses over ml2

condbuy = condbuy and close<close[1] and open<open[1]

condbuy = condbuy and trendup

condsell= ml1 crosses under ml2

condsell= condsell and close>close[1] and open>open[1]

condsell= condsell and trenddown

//

if condbuy then

buy positionsize contract at market

endif

if condsell then

sellshort positionsize contract at market

endif

// close position on friday

if positionweekend=0 then

if onmarket then

if currentdayofweek=5 and time>=fridayclosetime then

sell at market

exitshort at market

endif

endif

endif

//

if enablets then

//

once steps=0.05 // set to 0 to ignore steps

once minatrdist=3

once atrtrailingperiod = 14 // atr parameter

once minstop = 10 // minimum trailing stop distance

if barindex=tradeindex then

trailingstoplong = 4 // trailing stop atr distance

trailingstopshort = 4 // trailing stop atr distance

else

if longonmarket then

if newsl>0 then

if trailingstoplong>minatrdist then

if newsl>newsl[1] then

trailingstoplong=trailingstoplong

else

trailingstoplong=trailingstoplong-steps

endif

else

trailingstoplong=minatrdist

endif

endif

endif

if shortonmarket then

if newsl>0 then

if trailingstopshort>minatrdist then

if newsl<newsl[1] then

trailingstopshort=trailingstopshort

else

trailingstopshort=trailingstopshort-steps

endif

else

trailingstopshort=minatrdist

endif

endif

endif

endif

//

atrtrail=averagetruerange[atrtrailingperiod]((close/10)*pipsize)/1000

trailingstartl=round(atrtrail*trailingstoplong)

trailingstarts=round(atrtrail*trailingstopshort)

tgl=trailingstartl

tgs=trailingstarts

if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then

maxprice=0

minprice=close

newsl=0

endif

//

if longonmarket then

maxprice=max(maxprice,close)

if maxprice-tradeprice(1)>=tgl*pointsize then

if maxprice-tradeprice(1)>=minstop then

newsl=maxprice-tgl*pointsize

else

newsl=maxprice-minstop*pointsize

endif

endif

endif

//

if shortonmarket then

minprice=min(minprice,close)

if tradeprice(1)-minprice>=tgs*pointsize then

if tradeprice(1)-minprice>=minstop then

newsl=minprice+tgs*pointsize

else

newsl=minprice+minstop*pointsize

endif

endif

endif

//

if longonmarket then

if newsl>0 then

sell at newsl stop

endif

endif

if shortonmarket then

if newsl>0 then

exitshort at newsl stop

endif

endif

//

if displayts then

//graphonprice newsl coloured(0,0,255,255) as "trailingstop atr"

endif

endif

// display profittarget

if enablept then

if not onmarket then

ptarget=0

elsif longonmarket then

ptarget=tradeprice(1) +((tradeprice(1) *pt)/underlaying)*pointsize

elsif shortonmarket then

ptarget=tradeprice(1) -((tradeprice(1) *pt)/underlaying)*pointsize

endif

set target %profit pt

if displaypt then

//graphonprice ptarget coloured(121,141,35,255) as "profittarget"

ptarget=ptarget

endif

endif

// set stoploss

if enablesl then

if not onmarket then

sloss=0

elsif longonmarket then

sloss=tradeprice(1) -((tradeprice(1) *sl)/underlaying)*pointsize

elsif shortonmarket then

sloss=tradeprice(1) +((tradeprice(1) *sl)/underlaying)*pointsize

endif

set stop %loss sl

if displaysl then

//graphonprice sloss coloured(255,0,0,255) as "stoploss"

sloss=sloss

endif

endif

indeed, before april 2019, it’s not good..

but if it’s in production, you believe in it

Paul

PaulParticipant

Master

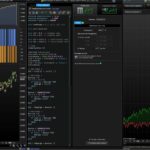

quick look at this old one, on the dow 1m.

Added part of nonetheless setup and changed entry criteria.

Optimised roughly on 200k from july ’20 & compared to 1m and of-course data before 200k is poor with exception the months april-mei-june ’20

results atm are with no trailingstop or breakeven, no overnight/weekend, a relatively small stoploss & a slightly bigger profittarget.

defparam cumulateorders = false

defparam preloadbars = 2000

defparam flatbefore = 080000

once tradetype = 1 // [1]ls [2]l [3]s

once positionsize=1

once sll = 0.6 // stoploss long

once sls = 0.6 // stoploss short

once ptl = sll*1.4 // profittarget long

once pts = sls*1.4 // profittarget short

// time

ctime=openhour<21

TIMEFRAME (15 minutes)

indicator1 = SuperTrend[2,10]

indicator1a = SAR[0.015,0.015,0.02]

cnd1 = (close > indicator1) or (close > indicator1a)

cnd2 = (close < indicator1) or (close < indicator1a)

// MID-LEVEL 1

ml1 = (High[i] + Low[i]) / 2

// MID-LEVEL 2

Newhigh = 0

For i = 1 to 2 do

IF high[i] > Newhigh THEN

Newhigh = high[i]

ENDIF

NEXT

Newlow = 1000000000000

For i = 1 to 2 do

IF low[i] < Newlow THEN

Newlow= low[i]

ENDIF

NEXT

ml2 = (Newhigh + Newlow) /2

// MID-LEVEL 3

Newhigh = 0

For i = 1 to 7 do

IF high[i] > Newhigh THEN

Newhigh = high[i]

ENDIF

NEXT

Newlow = 1000000000000

For i = 1 to 5 do

IF low[i] < Newlow THEN

Newlow= low[i]

ENDIF

NEXT

ml3 = (Newhigh + Newlow) /2

TIMEFRAME (default)

max1=max(ml1,ml2)

max2=max(max1,ml3)

min1=min(ml1,ml2)

min2=min(min1,ml3)

// conditions

condbuy = ml1 > ml3 and ml1 crosses under ml2

condbuy = condbuy or (ml1 > ml2 and ml1 crosses under ml3) and cnd1

condbuy = condbuy and (max2-min2)>8

condsell= ml1 < ml3 and ml1 crosses over ml2

condsell= condsell or (ml1 < ml2 and ml1 crosses over ml3) and cnd2

condsell = condsell and (max2-min2)>2

// entry criteria

if ctime then

if tradetype=1 then

if not longonmarket and condbuy then

buy positionsize contract at market

set stop %loss sll

set target %profit ptl

endif

if not shortonmarket and condsell then

sellshort positionsize contract at market

set stop %loss sls

set target %profit pts

endif

elsif tradetype=2 then

if not longonmarket and condbuy then

buy positionsize contract at market

set stop %loss sll

set target %profit ptl

endif

elsif tradetype=3 then

if not shortonmarket and condsell then

sellshort positionsize contract at market

set stop %loss sls

set target %profit pts

endif

endif

endif

if dayofweek=5 and time>=215500 then

sell at market

exitshort at market

endif

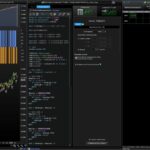

Paul

PaulParticipant

Master

found this old one and used it for testing, dow 5m, 150k