DEIO

DEIOParticipant

Veteran

hi all,

about the strategy I’m trying to apply Nicolas code (logic MFE).

I don’t understand why it seems that doesn’t exit at priceexit.

The code seems to be ok.

Anyone can test and let me know if I’m wrong and where ?

Here the code (this code is on TF 5 minutes):

//-----------------------------------------------------------------------------------------------

//-----------------------------------------------------------------------------------------------

//WALL STREET

// 5 MIN.

DEFPARAM cumulateorders = FALSE

CONDAVG = 1

AVG = Average[S](close)

FOR C = 1 TO F

IF AVG[C-1] > AVG[C] THEN

IF CONDAVG = 1 THEN

CONDAVG = 1

ENDIF

ELSE

CONDAVG = 0

ENDIF

NEXT

TIMEWORK = 000000

TIMESTOP = 240000

F = 20

S = 200

MFIFAST = MoneyFlowIndex[F]

MFISLOW = MoneyFlowIndex[S]

BASEMFI = MFISLOW[0] > MFISLOW[F] AND MFISLOW[0] > MFISLOW[ROUND(F/2)] AND MFISLOW[0] > MFISLOW[ROUND(F/F)]

CONDMFIL = MFIFAST[0] CROSSES OVER MFISLOW[0]

//trailingstop = ROUND(CLOSE/800) * PIPSIZE

trailingstop = 30

SIZEBUY = 1

IF CURRENTTIME >= TIMEWORK AND TIME <= TIMESTOP THEN

if not onmarket THEN

IF CONDMFIL AND BASEMFI AND CONDAVG THEN

BUY sizebuy SHARES AT highest[F](HIGH) STOP

endif

ENDIF

endif

if not onmarket then

MAXPRICE = 0

priceexit = 0

endif

if longonmarket then

MAXPRICE = MAX(MAXPRICE,close) //saving the MFE of the current trade

if MAXPRICE-tradeprice(1)>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexit = MAXPRICE-trailingstop*pointsize //set the exit price at the MFE - trailing stop price level

endif

endif

if longonmarket and priceexit>0 then

SELL AT priceexit STOP

endif

thx

Moderator’s edit: code edited to apply the correct PRT code format, please use “insert PRT code” button for future occurences (last one at end of first line of tools in message editor), thanks

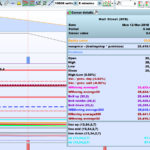

Have you tried GRAPH the Trailing Stop and use the Cursor Details (right click, Display, bottom of list) as attached … it does look like it exited at the TS ??

I haven’t studied it as I am giving you an idea so you can monitor / look into it further?

Cheers

GraHal

DEIO

DEIOParticipant

Veteran

hi GraHal,

I did al lot of test and I catch a issue that in my opinion is very important to me.

I ask Nicolas a question but I have no response at the moment.

I posted the question here:

https://www.prorealcode.com/blog/learning/trailing-stop-max-favorable-excursion-mfe/

Let me know your opinion and waiting for the Nicolas one.

thx a lot

bye

Ah yes the MFE Trail will not get you out of Trade like a Trailing Stop … you need a stop loss or a Trailing Stop also.

The MFE Trail follows / trails the Max Favourable Excursion / MFE so that a Trade that was in profit does not end up a losing Trade having not reached it’s Profit Target (as we all have had happen to us and it’s maddening! ).

So yeah you need an MFE Trail and a normal PRT Stop Loss or PRT Trailing Stop.

Even Nicolas other Trailing Stop (link below) will not act as a Stop Loss in the first period after Trade opens because it needs at least one full period to become operational (I think?).

https://www.prorealcode.com/blog/trading/complete-trailing-stop-code-function/

Hope that Helps?

GraHal

DEIO

DEIOParticipant

Veteran

Ok clear

Just I would suggest to explain this aspect in the link of MFE explanation, especially for the less expert.

Soon I am going to provide the new code of the strategy on WS 6min, with this fix on the first stop loss.

Thx for your cooperation.

Bye

Yes I agree it is confusing DEIO, it would be better if it is called Trailing Gain with the Max Favorable Excursion (MFE)

And better if the term Trailinggain is used in the code instead of Trailingstop?

I look forward to your latest code

GraHal

Jan

JanParticipant

Veteran

Hi GraHal,

thanks for sharing the strategy, sounds promising.

How do you practically deal with the fact that often in optimizing with lots of bars (like 100k bars) the equity shows choppy results at the beginning ? Just ignore or ?

(in my opinion the loisy results are caused as the optimalisation of parameters is based on getting the best END results. An optimalisation given 4.000 profit with a loss of 3.000 in the beginning is more favorable for the optimize-machine then a 3.000 profit with 1.000 euro profit in the beginning. However the latter I would like more)

Kind regards,

Jan

Hi Jan, it’s not my Strategy, it’s DEIO’s … he’s doing all the work.

Yes I agree, ignore the early in period poor performance. Often anyway it just looks worse as it shows a below zero equity curve, but there can be just as much drawdown later on but it’s not so obvious as it’s hidden amongst profits above the zero line?

I usually click on several variable values in the Table of Results and compare equity curves … you can get surprising differences, some more as you describe with less of an early in period drawdown.

Cheers

GraHal

Your full explanation was so good Manel, I raised it on the Platform Support Forum under your Quote … hope you don’t mid?!

Hey Grahal – Of course not. Thanks for raising it. Anything to help make this platform better for all users is always appreciated.

And yes, I am a bit of a perfectionist so cannot sit on stuff if it’s not right however I have learnt that also sometimes you have to work with the limitations you are under and not get unduly frustrated :-). It’s a fine balancing act but being constructive is probably the only way to keep sane !

DEIO

DEIOParticipant

Veteran

hi all,

I am happy to read your considerations about the strategy on WS.

My basic intention anyway is to obtain a strategy that keep me out of the market during negative phase (it could seem to be a stupid idea

but I have seen too strategies make tons of trade which could be avoided…. 🙂

So with this strategy I wait until the market is good to go long… nothing else.

I don’t like strategies with endless code etc..)

Moreover I have inserted in the codea full managing of the MFE criteria (comprhending the first stop loss too).

here the code:

//-----------------------------------------------------------------------------------------------

//-----------------------------------------------------------------------------------------------

//WALL STREET

// 6 MIN.

DEFPARAM cumulateorders = FALSE

CONDAVG = 1

AVG = Average[S](close)

FOR C = 1 TO F

IF AVG[C-1] > AVG[C] THEN

IF CONDAVG = 1 THEN

CONDAVG = 1

ENDIF

ELSE

CONDAVG = 0

ENDIF

NEXT

TIMEWORK = 000000

TIMESTOP = 240000

F = 20

S = 200

MFIFAST = MoneyFlowIndex[F]

MFISLOW = MoneyFlowIndex[S]

BASEMFI = MFISLOW[0] > MFISLOW[F] AND MFISLOW[0] > MFISLOW[ROUND(F/2)] AND MFISLOW[0] > MFISLOW[ROUND(F/F)]

CONDMFIL = MFIFAST[0] CROSSES OVER MFISLOW[0]

trail = ROUND(CLOSE/300) * PIPSIZE

firstpriceexit = tradeprice(1) - trail

trailingstop = round(trail / 3)

SIZEBUY = 1

if not onmarket then

MAXPRICE = 0

priceexit = 0

firststop = 0

endif

IF CURRENTTIME >= TIMEWORK AND TIME <= TIMESTOP THEN

if not onmarket THEN

IF CONDMFIL AND BASEMFI AND CONDAVG THEN

BUY sizebuy SHARES AT highest[F](HIGH) STOP

endif

ENDIF

endif

if longonmarket then

if firststop = 0 then

priceexit = firstpriceexit

firststop = 1

endif

MAXPRICE = MAX(MAXPRICE,close) //saving the MFE of the current trade

if MAXPRICE-tradeprice(1)>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexit = MAXPRICE-trailingstop*pointsize //set the exit price at the MFE - trailing stop price level

endif

endif

//GRAPH TRADEPRICE(1)

if longonmarket and priceexit>0 then

//graph priceexit AS "PRICEEXIT"

SELL AT priceexit stop

endif

EDIT: post edited – please use the ‘Insert PRT Code’ button when posting code.

Hey results look well good DEIO … good work!!!

Might you consider a Short version?

PS You forgot to use the Insert PRT Code button again; Nicolas was enjoying his Sunday up to this point! 🙂 🙂

Might you consider a Short version?

And here is the LONG / SHORT version!

//———————————————————————————————-

//———————————————————————————————-

//WALL STREET BUY/SELL v1.0

// 6 MIN.

DEFPARAM cumulateorders = FALSE

CONDAVGbull = 1

CONDAVGbear = 1

AVG = Average[S](close)

FOR C = 1 TO F

IF AVG[C-1] > AVG[C] THEN

IF CONDAVGbull = 1 THEN

CONDAVGbull = 1

ENDIF

ELSE

CONDAVGbull = 0

ENDIF

NEXT

FOR C = 1 TO F

IF AVG[C-1] < AVG[C] THEN

IF CONDAVGbear = 1 THEN

CONDAVGbear = 1

ENDIF

ELSE

CONDAVGbear = 0

ENDIF

NEXT

TIMEWORK = 000000

TIMESTOP = 240000

F = 20

S = 200

MFIFAST = MoneyFlowIndex[F]

MFISLOW = MoneyFlowIndex[S]

BASEMFIbull = MFISLOW[0] > MFISLOW[F] AND MFISLOW[0] > MFISLOW[ROUND(F/2)] AND MFISLOW[0] > MFISLOW[ROUND(F/F)]

CONDMFILbull = MFIFAST[0] CROSSES OVER MFISLOW[0]

BASEMFIbear = MFISLOW[9] < MFISLOW[F] AND MFISLOW[7] < MFISLOW[ROUND(F/2)] AND MFISLOW[0] < MFISLOW[ROUND(F/F)]

CONDMFILbear = MFIFAST[1] CROSSES UNDER MFISLOW[1]

trail = ROUND(CLOSE/300) * PIPSIZE

firstpriceexitbull = tradeprice(1) - trail

firstpriceexitbear = tradeprice(1) + trail

trailingstop = round(trail / 3)

SIZEBUY = 1

SIZESELL = 1

if not onmarket then

MAXPRICE = 0

MINPRICE = 0

priceexitbull = 0

priceexitbear = 0

firststopbull = 0

firststopbear = 0

endif

IF CURRENTTIME >= TIMEWORK AND TIME <= TIMESTOP THEN

if not onmarket THEN

IF CONDMFILbull AND BASEMFIbull AND CONDAVGbull THEN

BUY sizebuy SHARES AT highest[F](HIGH) STOP

endif

ENDIF

endif

IF CURRENTTIME >= TIMEWORK AND TIME <= TIMESTOP THEN

if not onmarket THEN

IF CONDMFILbear AND BASEMFIbear AND CONDAVGbear THEN

SELLSHORT sizesell SHARES AT lowest[F](LOW) STOP

endif

ENDIF

endif

if longonmarket then

if firststopbull = 0 then

priceexitbull = firstpriceexitbull

firststopbull = 1

endif

MAXPRICE = MAX(MAXPRICE,close) //saving the MFE of the current trade

if MAXPRICE-tradeprice(1)>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexitbull = MAXPRICE-trailingstop*pointsize //set the exit price at the MFE - trailing stop price level

endif

endif

if shortonmarket then

if firststopbear = 0 then

priceexitbear = firstpriceexitbear

firststopbear = 1

endif

MINPRICE = MIN(MINPRICE,close) //saving the MFE of the current trade

if tradeprice(1)-MINPRICE>=trailingstop*pointsize then //if the MFE is lower than the trailingstop then

priceexitbear = MINPRICE+trailingstop*pointsize //set the exit price at the MFE + trailing stop price level

endif

endif

//GRAPH TRADEPRICE(1)

if longonmarket and priceexitbull>0 then

//graph priceexit AS "PRICEEXIT"

SELL AT priceexitbull stop

endif

if shortonmarket and priceexitbear>0 then

//graph priceexit AS "PRICEEXIT"

EXITSHORT AT priceexitbear stop

endif

Good trades!

Gertrade

Jan

JanParticipant

Veteran

Deio,

with the code below, the CONDAVG is only set to 1 if during the complete fast average period (F) the slow average always increases, to my understanding.

Why did you add this code ?

CONDAVG = 1

AVG = Average[S](close)

FOR C = 1 TO F

IF AVG[C–1] > AVG[C] THEN

IF CONDAVG = 1 THEN

CONDAVG = 1

ENDIF

ELSE

CONDAVG = 0

ENDIF

NEXT

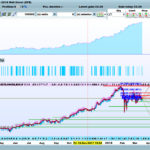

Hey thanks Gertrade, I’ve set both DEIO Long only and your Long & Short going Live @ 0.5 Lot size on both … I’ll monitor each trade as it develops and report back.

The Short trades do give a useful boost to profits on backtest, see attached.

Cheers

GraHal

DEIO

DEIOParticipant

Veteran

HI JanWd,

I set such conditions just because I wanted that tha BASE AVG (the slow one) be always increasing in the last F periods.

If I used the last S periods the condition would be too restrictive and trades would be very few.

you can test it substituting in the loop … FOR C= 1 TO F WITH FOR C = 1 TO s

thx

bye