Does anyone know why there should be such a discrepancy between the strategy performance as reported by PRT and what actually happens in real life?

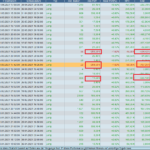

The attached image shows what PRT thinks happened on the left, and my IG history on the right (live trading).

Any trades on the DOW can only have been with this strategy. Where some of the dates and times are the same, the profit/loss amounts are way off, with PRT reporting several trades that simply never happened.

It wouldn’t surprise me to find that the two were not identical, but in this case they bear no resemblance to each other – to the extent that the data is meaningless. Has anyone else noticed this?

(apologies if this has been discussed before)

Attached is a non-exhaustive list of the elements that can impact a live trading strategy and create differences with a demo account and/or backtests:

- Spread

- Slippage

- Orders rejections due to one of the above reason, but also because of the allowed distance from current price to put pending orders (known as “minimal distance”)

- Different trading hours (ProOrder code launched in a different time zone / custom hours, by the user)

- Coding problem: division by zero error, null or negative periods for indicators, ..

- Lack of responsiveness of IG demo servers (if IG is the broker), although this has improved considerably since last year.

- Make backtests without tick-by-tick option

- “set stop trailing” instruction that give IG the total control of your stoploss, can be moved differently between accounts due to points above

- Limited risk accounts and their rules

- Guaranteed stoploss rules and fees

- Starting a strategy at a different time (1 hour or even 1 minute later): depending on the code of the strategy, the results of some calculations could be different.

- Margin required on the trading account (no demo or backtest tests are made on this subject)

- Overnight and overweekend fees

Thanks Nicolas, I am well aware of how those factors can effect the accuracy of backtests but just to be clear, this is not a backtest, it is the supposed record of live trades for that period, so most of those factors do not apply. Also, you specifically mention DEMO account, but this is with my live account; does that make a difference?

How can it record trades that never happened? Does this mean that (if I had been monitoring it) it would have shown as an active trade on the PRT platform, with nothing happening on the IG side?

How can it record trades that never happened?

A quick glance, I can see a trade on 31 March on PRT data that is not shown on the IG data.

Also for all / most trades, profit / loss difference between PRT and IG data show values of magnitude not accountable by Nicolas list.

Your findings are worrying and frustrating Nonetheless.

I know you know, but you likely will get quicker resolution by reporting to PRT using the form below.

Refer to this Thread then it be a 2 minute job to Report using the PRT WebForm.

https://www.prorealtime.com/en/contact

for all / most trades, profit / loss difference between PRT and IG data show values of magnitude not accountable by Nicolas list.

Yeah, that’s what I thought too. Obviously at the end of the proverbial day, with live trading what you get is whatever lands in your account and that’s that. I just hadn’t realized that the PRT reporting was quite so meaningless, in terms of % win, profit/loss etc. Possibly the biggest practical problem would be any coding that refers to ‘StrategyProfit’ (MM for example) when PRT is apparently incapable of measuring that with any accuracy.

Thanks for the link, I’ll send it to PRT and see what they say.

Ich have some problems with the backtest report. A lot of details are missing.

do you mean backtest, or live trading performance report?

Backtest. But after a reboot it works fine again.

Backtests are potentially inaccurate because of all the factors that Nicolas mentioned above. This I find understandable because they’re reporting imaginary trades that ‘might’ have happened in the past.

I had (wrongly) assumed that the live trading reports would be free of that because the real data would be available – either a trade happened or it didn’t, where it entered / exited etc etc.

Unfortunately this is not the case.

The backtesting reports (V11.1) are sometimes pretty strange. MAE are somtimes massiv higher than the SL. MFE is also wrong.

I’ve had some weird stuff happening earlier today!

Been getting great BT results almost as of tick by tick was disabled, but it was enabled.

Then a few hours ago it was if PRT turned tick by tick back on and the good results have now largely gone!!

Early night I think and see what shows tomorrow!

The backtesting reports (V11.1) are sometimes pretty strange. MAE are somtimes massiv higher than the SL. MFE is also wrong.

See https://www.prorealcode.com/topic/mae-and-mfe-values-in-the-detailed-report-are-wrong/.

The PRT team have reproduced the problem and are working to correct the bug.

The backtesting reports (V11.1) are sometimes pretty strange. MAE are somtimes massiv higher than the SL. MFE is also wrong.

By the way, I think it is quite normal that MAE can be higher than stop loss, because the detailed report cannot know what your stop loss is. MFE can also be higher than take profit for the same reason. MAE and MFE are simply the highest high and the lowest low of all bars since opening of a position, including the last bar.

I don´t think so. In V10 MAE & MFE worked fine. I checked it many times directly in the chart. This is definitly a bug.

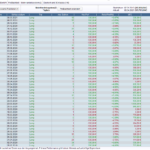

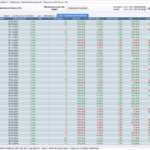

That’s strange. For me, MAE and MFE values are identical in v11 and v10.3 (see images). However, this means that MAE and MFE have always (also in v10.3) been calculated with the wrong close prices instead of low and high. But nobody has noticed.

sl and tp are both 500 in the images attached. But sometimes, MFE or MEA are higher than 500, especially for positions closed on a week-end, it seems.

Sometimes, MFE values are all = 0 in v11 when the detailed report is shown for the first time. Only when starting the report for a second time, real MFE values show up.