All right. Thanks. And yes, regarding this your code thus works as advertised.

Daily reporting sounds really generous, and if you do decide to share your observations and insights, I’m sure many people would really appreciate it. I could even send you a live trade view that would run until the end of 2025, just let me know the best way to reach you. Daily reporting like that would be really helpful for lots of others too.

Oh, I am really interested and would report from day 1 (could be today). If you search a little you can find me. So, waiting for it !

Btw, I did use the CE version but probably got caught by what I see happing : exits at 22:50 which should be 21:50 ?? With this thinking, I assume overnight tariffs ;-( start at 22:00 my time (= CE, right ?). Also please note : I am not all that bogged up on overnight tariffs. But if it is supposed to work to avoid that anyway … why not.

I am apologise, I just realized something important I had overlooked, for live trading, the platform requires the code to be visible, which unfortunately means I can’t send the version as planned. I’m really sorry about this oversight. I hope you understand, this It’s not about being secretive, it’s simply to preserve the strategy’s edge.

I truly appreciate your interest and your thoughtful approach to testing, and I hope we can still find a way for you to explore it meaningfully, even if not in live mode just yet.

Oh, then I can apologise just the same, because I could have sent you that right away. I thought this was for the purpose of not being able to use it for real.

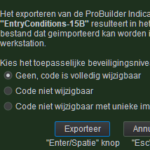

“This code can not be used for automatic trading because the code is not accessible”.

Unless you don’t care that everybody sees the code, you should use CALL to indicator code (which you then hide) that returns values to your strategy based upon which it opens/closes positions. Could be a somewhat tedious operation …

Oh, then I can apologise just the same, because I could have sent you that right away. I thought this was for the purpose of not being able to use it for real. “This code can not be used for automatic trading because the code is not accessible”. Unless you don’t care that everybody sees the code, you should use CALL to indicator code (which you then hide) that returns values to your strategy based upon which it opens/closes positions. Could be a somewhat tedious operation …

Thank you for your kind message, and no need to apologize at all. I truly appreciate your openness and your thinking around how to protect the logic while still making live trading possible.

You’re absolutely right that using CALL to a hidden indicator can be one approach. The challenge, though, is that unless the called indicator are packaged in .masteritf format, otherwise (.itf) the protection doesn’t hold, the indicator remains visible in the user’s list. So in this case, that method wouldn’t fully preserve the edge either.

It’s a bit of a trade-off. For now, I’ve leaned on the .masteritf format to keep everything wrapped and quiet, I hope that makes sense, and I really appreciate your understanding.

Thanks again for all your thoughtful input and testing, it really means a lot.

I don’t know anything about masteritf format (I which I could help). I only hope it is clear to you that I meant with “hide the indicator” – hide its code. Something along the lines of what you see below under option 2 or 3 (not 1 – that is normally readable and changeable).

What you may refer to is that you never even see the indicator in a list (of indicators) somewhere. That is, I think I have seen that Indicators can be dragged along with Strategy Code (export the Strategy and at Import at the other end the Indicator is then present as well) which would be an other subject (or dimension if you will).

Nicolas will definitely know.

Of course it is a bummer that you unexpectedly run into this, but hey, your market won’t run away. It didn’t run away for Covid, not for Trump #1, not for #2 and not for Tariffs. And now assumed that all is kosher of course and not too much over-fitted.

But eager to get going. And might I lose some, then you won’t hear me complain.

JS

JSParticipant

Senior

It’s not really difficult to reproduce the system; just the “Long” side (about 70% of the profit)…

Of course it is a bummer that you unexpectedly run into this, but hey, your market won’t run away. It didn’t run away for Covid, not for Trump #1, not for #2 and not for Tariffs. And now assumed that all is kosher of course and not too much over-fitted.

But eager to get going. And might I lose some, then you won’t hear me complain.

Thank you, I really appreciate your thoughtful reply and the positive spirit you’re bringing to all this. It’s great to hear you’re eager to get going!

Just to share a bit more context, here’s how the strategy behaved during some of the more notable Nasdaq-100 drawdowns over the past years .

- Trump Tariffs / U.S.–China Trade War (using the 15-minute version for historical perspective):

September–December 2018: It experienced a loss during this period. I’ll leave it to your judgment whether it was reasonable given how sharp and prolonged the pullbacks were, also worth noting the lower absolute market levels back then.

- COVID-19 Crash (Feb–March 2020)

It took a manageable loss, not unscathed, but it didn’t fall apart either, I’ll leave it to your judgment.

- 2022 Tech Sell-off (Nov 2021–End of 2022)

Interestingly, the strategy held its ground and even made a gain during this extended downturn.

- Mini-Correction (July–August 2024)

It performed well here and booked a gain.

- 2025 Trump Tariff Return / Trade War Round 2 (Feb–March 2025)

It came through with a gain, despite a sharp drop and volatility.

I’m not mentioning the exact results here because I’d like everyone to explore and see the performance through their own perspective.

This isn’t to say “look how great it is”, it’s just to encourage everyone to really dig into the strategy across those periods, test it through the tough spots, and form your own view and share your view with others.

Thanks again for your openness and energy, it means a lot.

It’s not really difficult to reproduce the system; just the “Long” side (about 70% of the profit)…

Thank you for your insight! It’s great to hear you’re able to explore and replicate parts of the system. The long side does play a significant role, and your observation really shows that the

LESS is MORE strategy is working well. I appreciate your perspective and hope you continue to find value and interesting discoveries as you dig deeper into it!

Just wanted to share a quick update, I’ve uploaded a small update to the

LESS is MORE strategy that lets you switch between different leverage and time zones. This should make it easier to test and run the strategy based on your account type and region. Please note that nothing has changed in terms of logic, it’s the exact same code and strategy. Hope it’s helpful and I’m always happy to hear your thoughts or feedback! 📥

LESS is MORE download

Support Leverage: 1:20, 1:200, 1:250

Support Time Zone

- UK (GMT or BST)

- Central Europe (CET/CEST)

- Eastern Europe (EET/EEST)

- US Eastern Time (ET)

- US Central Time (CT)

- US Mountain Time (MT)

- US Pacific Time (PT)

- Gulf Standard Time (GST)

- Australia Eastern Time (AEST)

- New Zealand Time (NZST/NZDT)

boah, what a creative marketing campaign! 😀

boah, what a creative marketing campaign! 😀

Haha, thanks, trust is definitely something that has to be earned, especially so much noise out there! 😊 That’s exactly why I approached this differently. Instead of flashy promises and bold claims, I’d rather let people explore the logic and see the results for themselves than rely on big claims. It would be really appreciated if you’d give it a test and share your results and feedback, I’d genuinely love to hear how it performs for you!

Ha must be something about NASDAQ US100 on M10 TF … attached is one of mine which is

optimised on M1 on DJI over 50K bars.

Thought I’d see what it looks like on NAS M10 over 100K bars (no change to code or values) … shed load of Short Trades (AvGain of Shorts only £2.83 against £37.59 for the Longs).

Feel a bit awful posting (hijacking RW Thread) but surprised by the results … may also get me switching Instruments from DJI to NAS!!

I’ll now see what it looks like optimised for M10 on NAS over 100K bars!

https://market.prorealcode.com/product/lessismore/

That’s it. Let(s sse if the strategy will have good returns…

You wrote : “🟣 Try It, Don’t Just Take My Word for It

No screenshots. No sales talk. You test it yourself. Backtest in trial and see every result with full transparency. That’s where trust starts – from your experience.”

1st question : where are the results in real life ? (no backtests)

2nd question : The ability to backtest it in trial is certainly good for trust, but someone has done far better for trusting him…

1st question : where are the results in real life ? (no backtests) 2nd question : The ability to backtest it in trial is certainly good for trust, but someone has done far better for trusting him… Have you heard about Iridium Guarantee ?

On real-life results: I believe the strongest form of trust comes from personal experience. That’s why LESS is MORE is fully backtestable, so you can verify the result yourself, on your own terms. Many traders find this more valuable than relying on someone else’s live account, especially since it’s often hard to tell what’s real and what isn’t or is it just a selective result, particularly given that markets evolve and everyone’s setup is different.

Regarding the Iridium Guarantee – yes, I’m aware of it! It’s definitely a unique and admirable approach. What I’m offering with LESS is MORE is a different path: simple, consistent rules that speak for themselves when tested. You don’t have to take my word for it, the system is designed so its edge becomes clear when you engage with it directly.

As you can see, there are already people trying to hijack the concept, which says a lot about how interesting this LESS is MORE strategy really is. In fact, I take it as a good sign, if others are trying to replicate it, it must be worth something. There’s a reason it’s called Less Is More, and I genuinely appreciate the attention it’s getting.

If you do give it a try, I’d genuinely appreciate hearing your feedback and seeing how it performs for you.